Financial Accounting Assignments & Problems

advertisement

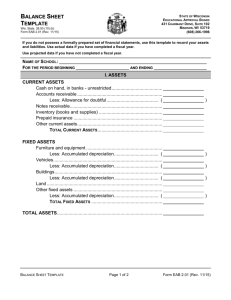

SUGGESTED ASSIGNMENTS P3-2. Financial statement account identification LG 1; Basic Account Name Accounts payable Accounts receivable Accruals Accumulated depreciation Administrative expense Buildings Cash Common stock (at par) Cost of goods sold Depreciation Equipment General expense Interest expense Inventories Land Long-term debt Machinery Marketable securities Notes payable Operating expense Paid-in capital in excess of par Preferred stock Preferred stock dividends Retained earnings Sales revenue Selling expense Taxes Vehicles * P3-6. (a) Statement (b) Type of Account BS BS BS BS IS BS BS BS IS IS BS IS IS BS BS BS BS BS BS IS BS BS IS BS IS IS IS BS CL CA CL FA* E FA CA SE E E FA E E CA FA LTD FA CA CL E SE SE E SE R E E FA This is really not a fixed asset, but a charge against a fixed asset, better known as a contra-asset. Income statement preparation LG 1; Intermediate Owen Davis Company Balance Sheet December 31, 2012 Assets Current assets: Cash Marketable securities Accounts receivable Inventories Total current assets Gross fixed assets Land and buildings Machinery and equipment Furniture and fixtures Vehicles Total gross fixed assets Less: Accumulated depreciation $ 215,000 75,000 450,000 375,000 $1,115,000 $ 325,000 560,000 170,000 25,000 $1,080,000 265,000 Net fixed assets Total assets $ 815,000 $1,930,000 Liabilities and stockholders’ equity Current liabilities: Accounts payable Notes payable Accruals Total current liabilities Long-term debt Total liabilities Stockholders’ equity Preferred stock Common stock (at par) Paid-in capital in excess of par Retained earnings Total stockholders’ equity Total liabilities and stockholders’ equity $ 220,000 475,000 55,000 $ 750,000 420,000 $1,170,000 $ 100,000 90,000 360,000 210,000 $ 760,000 $1,930,000 P3-17. Interpreting liquidity and activity ratios LG 3; Intermediate a. Bluegrass appears to be holding excess inventory relative to the industry. This fact is supported by the low inventory turnover and the low quick ratio, even though the current ratio is above the industry average. This excess inventory could be due to slow sales relative to production or possibly from carrying obsolete inventory. b. The accounts receivable of Bluegrass appears to be high due to the large number of days of sales outstanding (73 vs. the industry average of 52 days). An important question for internal management is whether the company’s credit policy is too lenient or customers are just paying slowly—or potentially not paying at all. c. Since the firm is paying its accounts payable in 31 days vs. the industry norm of 40 days, Bluegrass may not be taking full advantage of credit terms extended to them by their suppliers. By having the receivables collection period over twice as long as the payables payment period, the firm is financing a significant amount of current assets, possibly from long-term sources. d. The desire is that management will be able to curtail the level of inventory either by reducing production or encouraging additional sales through a stronger sales program or discounts. If the inventory is obsolete, then it must be written off to gain the income tax benefit. The firm must also push to try to get their customers to pay earlier. Payment timing can be increased by shortening credit terms or providing a discount for earlier payment. Slowing down the payment of accounts payable would also reduce financing costs. Carrying out these recommendations may be difficult because of the potential loss of customers due to stricter credit terms. The firm would also not want to increase their costs of purchases by delaying payment beyond any discount period given by their suppliers. P3-21. Ratio proficiency LG 6; Basic a. Gross profit sales gross profit margin Gross profit $40,000,000 0.8 $32,000,000 b. Cost of goods sold sales gross profit Cost of goods sold $40,000,000 $32,000,000 $8,000,000 c. Operating profit sales operating profit margin Operating profit $40,000,000 0.35 $14,000,000 d. Operating expenses gross profit operating profit Operating expenses $32,000,000 $14,000,000 $18,000,000 e. Earnings available for common shareholders sales net profit margin $40,000,000 0.08 $3,200,000 sales $40,000,000 $20,000,000 total asset turnover 2 earnings available for common shareholders g. Total common equity ROE $3,200,000 Total common equity $16,000,000 0.20 sales h. Accounts receivable average collection period 365 $40,000,000 Accounts receivable 62.2 days 62.2 $109,589.041 $6,816,438.36 365 Classifying inflows and outflows of cash LG 2; Basic f. P4-5. Total assets Item Change ($) Cash 100 Accounts 1,000 payable Notes payable 500 Long-term debt 2,000 Inventory 200 Fixed assets 400 I/O Item Change ($) I/O O O Accounts receivable Net profits 700 600 I I I O O O Depreciation 100 Repurchase of stock 600 Cash dividends 800 Sale of stock 1,000 I O O I Note 1: Think of cash in terms of money in a checking account. Note 2: As a non-cash charge depreciation is not really an I/O at all, but it will be reported as a positive amount on the statement of cash flows. P4-6. Finding operating and free cash flows LG 2; Intermediate a. NOPAT EBIT (1 t) NOPAT $2,700 (1 0.40) $1,620 b. OCF NOPAT depreciation OCF $1620 $1,600 OCF $3,220 c. FCF OCF net fixed asset investment* net current asset investment** FCF $3,220 $1,400 $1,400 FCF $420 Net fixed asset investment change in net fixed assets depreciation Net fixed asset investment ($14,800 $15,000) ($14,700 $13,100) Net fixed asset investment –$200 $1,600 $1,400 ** Net current asset investment change in current assets change in (accounts payable and accruals) * Net current asset investment ($8,200 $6,800) ($100 $100) Net current asset investment $1,400 0 $1,400 d. Keith Corporation has positive cash flows from operating activities. Depreciation is approximately the same size as net operating profit after tax, so the operating cash flow is about twice the NOPAT. The FCF value is very meaningful since it shows that the cash flows from operations are adequate to cover both operating expense plus investment in fixed and current assets. P4-9. Cash budget—basic LG 4; Intermediate Sales Cash sales (0.20) Lag 1 month (0.60) Lag 2 months (0.20) Other income Total cash receipts Disbursements Purchases Rent Wages & salaries Dividends Principal & interest Purchase of new equipment Taxes due Total cash disbursements Total cash receipts Total cash disbursements Net cash flow Add: Beginning cash Ending cash Minimum cash Required total financing (notes payable) Excess cash balance (marketable securities) March April May June July $50,000 $10,000 $60,000 $12,000 $70,000 $14,000 36,000 10,000 2,000 $62,000 $80,000 $16,000 42,000 12,000 2,000 $72,000 $100,000 $ 20,000 48,000 14,000 2,000 $ 84,000 $50,000 3,000 6,000 $70,000 3,000 7,000 3,000 4,000 $ 80,000 3,000 8,000 6,000 $59,000 6,000 $93,000 $97,000 $62,000 59,000 $ 3,000 5,000 $ 8,000 5,000 $72,000 93,000 ($21,000) 8,000 ($13,000) 5,000 $84,000 97,000 ($13,000) (13,000) ($26,000) 5,000 $18,000 $31,000 0 0 $ 3,000 The firm should establish a credit line of at least $31,000, but may need to secure three to four times this amount based on scenario analysis. P4-16. Pro forma income statement—scenario analysis LG 5; Challenge a. Pro Forma Income Statement Allen Products, Inc. for the Year Ended December 31, 2013 Sales Less cost of goods sold (45%) Gross profits Less operating expense (25%) Operating profits Less interest expense (3.2%) Net profit before taxes Taxes (25%) Net profits after taxes Pessimistic Most Likely Optimistic $900,000 405,000 $495,000 225,000 $270,000 28,800 $241,200 60,300 $180,900 $1,125,000 506,250 $ 618,750 281,250 $ 337,500 36,000 $ 301,500 75,375 $ 226,125 $1,280,000 576,000 $ 704,000 320,000 $ 384,000 40,960 $ 343,040 85,760 $ 257,280 b. The simple percent-of-sales method assumes that all costs are variable. In reality some of the expenses will be fixed. In the pessimistic case this assumption causes all costs to decrease with the lower level of sales when in reality the fixed portion of the costs will not decrease. The opposite occurs for the optimistic forecast since the percent-of-sales assumes all costs increase when in reality only the variable portion will increase. This pattern results in an understatement of costs in the pessimistic case and an overstatement of profits. The opposite occurs in the optimistic scenario. c. Pro Forma Income Statement Allen Products, Inc. for the Year Ended December 31, 2013 Pessimistic Most Likely Optimistic Sales $900,000 $1,125,000 $1,280,000 Less cost of goods sold: Fixed 250,000 250,000 250,000 Variable (18.3%)a 164,700 205,875 234,240 Gross profits $485,300 $ 669,125 $ 795,760 Less operating expense Fixed 180,000 180,000 180,000 Variable (5.8%)b 52,200 65,250 74,240 Operating profits $253,100 $ 423,875 $ 541,520 Less interest expense 30,000 30,000 30,000 Net profit before taxes $223,100 $ 393,875 $ 511,520 Taxes (25%) 55,775 98,469 127,880 Net profits after taxes $167,325 $ 295,406 $ 383,640 a Cost of goods sold variable percentage ($421,875 $250,000) / $937,500 b Operating expense variable percentage ($234,375 $180,000) / $937,500 d. The profits for the pessimistic case are larger in part (a) than in part (c). For the optimistic case, the profits are lower in part (a) than in part (c). This outcome confirms the results as stated in part (b). EXTRA END-OF-CHAPTER PROBLEM ANSWERS P3-10. Statement of retained earnings LG 1; Intermediate a. Cash dividends paid on common stock Net profits after taxes – preferred dividends – change in retained earnings $377,000 – $47,000 – (1,048,000 – $928,000) $210,000 Hayes Enterprises Statement of Retained Earnings for the Year Ended December 31, 2012 Retained earnings balance (January 1, 2011) Plus: Net profits after taxes (for 2012) Less: Cash dividends (paid during 2012) Preferred stock Common stock Retained earnings (December 31, 2012) b. Earnings per share $ 928,000 377,000 (47,000) (210,000) $1,048,000 Net profit after tax Preferred dividends (EACS* ) Number of common shares outstanding Earnings per share $377,000 $47,000 $2.36 140,000 * Earnings available to common stockholders c. Cash dividend per share Total cash dividend # shares Cash dividend per share $210,000 (from Part a) $1.50 140,000 P3-22. Cross-sectional ratio analysis LG 6; Intermediate a. Fox Manufacturing Company Ratio Analysis Industry Average 2012 Current ratio Quick ratio Inventory turnover Average collection period Total asset turnover Debt ratio Times interest earned Gross profit margin Operating profit margin Net profit margin Return on total assets Return on common equity Earnings per share 2.35 0.87 4.55 times 35.8 days 1.09 0.30 12.3 0.202 0.135 0.091 0.099 0.167 $3.10 Actual 2012 1.84 0.75 5.61 times 20.5 days 1.47 0.55 8.0 0.233 0.133 0.072 0.105 0.234 $2.15 Liquidity: The current and quick ratios show a weaker position relative to the industry average. Activity: All activity ratios indicate a faster turnover of assets compared to the industry. Further analysis is necessary to determine whether the firm is in a weaker or stronger position than the industry. A higher inventory turnover ratio may indicate low inventory, resulting in stockouts and lost sales. A shorter average collection period may indicate extremely efficient receivables management, an overly zealous credit department, or credit terms that prohibit growth in sales. Debt: The firm uses more debt than the average firm, resulting in higher interest obligations that could reduce its ability to meet other financial obligations. Profitability: The firm has a higher gross profit margin than the industry, indicating either a higher sales price or a lower cost of goods sold. The operating profit margin is in line with the industry, but the net profit margin is lower than industry, an indication that expenses other than cost of goods sold are higher than the industry. Most likely, the damaging factor is high interest expenses due to a greater than average amount of debt. The increased leverage, however, magnifies the return the owners receive, as evidenced by the superior ROE. b. Fox Manufacturing Company needs improvement in its liquidity ratios and possibly a reduction in its total liabilities. The firm is more highly leveraged than the average firm in its industry and therefore has more financial risk. The profitability of the firm is lower than average but is enhanced by the use of debt in the capital structure, resulting in a superior ROE. P3-24. Integrative—complete ratio analysis LG 6; Challenge Sterling Company Ratio Analysis Ratio Current ratio Actual 2010 1.40 Actual 2011 1.55 Quick ratio 1.00 0.92 Inventory turnover 9.52 9.21 Average collection period Average payment period Total asset turnover 45.6 days 36.9 days 59.3 days 0.74 61.6 days 0.80 Debt ratio 0.20 0.20 Times interest earned 8.2 7.3 Fixed payment coverage ratio Gross profit margin 4.5 0.30 4.2 0.27 Operating profit Actual 2012 1.67 Industry Average TS: Time-Series 2012 CS: Cross-Sectional 1.85 TS: CS: 0.88 1.05 TS: CS: 7.89 8.60 TS: CS: TS: 29.2 days 35.5 days CS: TS: 53.0 days 46.4 days CS: 0.83 0.74 TS: CS: 0.35 0.30 TS: CS: 6.5 8.0 TS: CS: TS: 2.3 4.2 CS: 0.25 0.25 TS: CS: TS: Improving Fair Deteriorating Poor Deteriorating Fair Improving Good Unstable Poor Improving Good Increasing Fair Deteriorating Poor Deteriorating Poor Deteriorating Average Improving margin Net profit margin Return on total assets Return on common Equity Earnings per share (EPS) Price/earnings (P/E) Market/book ratio (M/B) 0.12 0.062 0.12 0.062 0.13 0.066 0.10 0.053 0.045 0.050 0.0508 0.040 0.061 0.067 0.0782 0.066 $1.75 $2.20 $3.05 $1.50 12.0 10.5 13.0 11.2 1.20 1.05 1.16 1.10 CS: TS: CS: TS: CS: TS: CS: TS: CS: TS: CS: TS: CS: Good Stable Good Stable Good Improving Good Improving Good Unstable Good Deteriorating Fair Liquidity: Sterling Company’s overall liquidity as reflected by the current ratio and quick ratio appears to be following different trends, but is below the industry average. Activity: The activity of accounts receivable has improved, but inventory turnover has deteriorated and is currently below the industry average. The firm’s average payment period appears to have speeded up from 2010, although the firm is still paying more slowly than the average company. Debt: The firm’s debt ratios have increased from 2010 and are very close to the industry averages, indicating currently acceptable values but an undesirable trend. The firm’s fixed payment coverage has declined and is well below the industry average figure, indicating a deterioration in servicing ability. Profitability: The firm’s gross profit margin, while in line with the industry average, has declined, probably due to higher cost of goods sold. The operating and net profit margins have been stable and are also above industry averages. Both the ROA and the ROE appear to have improved slightly and are better than the industry averages. EPS made a significant increase in 2011 and 2012. The P/E ratio indicates an increasing degree of investor confidence in the firm’s future earnings potential. Market: The firm’s P/E ratio was good in 2010, fell significantly in 2011, but recovered in 2012. The ratio is now above the industry average. The market to book ratio initially showed signs of improving in 2011 and 2012. The market’s interpretation of Sterling’s earning ability indicates a lot of uncertainty. The fluctuation in the M/B ratio also shows signs of uncertainty. In summary, the firm needs to attend to inventory and accounts payable and should not incur added debts until its leverage and fixed-charge coverage ratios are improved. Other than these indicators, the firm appears to be doing wellespecially in generating return on sales. The market seems to have some lack of confidence in the stability of Sterling’s future. P4-6. Finding operating and free cash flows LG 2; Intermediate a. NOPAT EBIT (1 t) NOPAT $2,700 (1 0.40) $1,620 b. OCF NOPAT depreciation OCF $1620 $1,600 OCF $3,220 c. FCF OCF net fixed asset investment* net current asset investment** FCF $3,220 $1,400 $1,400 FCF $420 Net fixed asset investment change in net fixed assets depreciation Net fixed asset investment ($14,800 $15,000) ($14,700 $13,100) Net fixed asset investment –$200 $1,600 $1,400 ** Net current asset investment change in current assets change in (accounts payable and accruals) Net current asset investment ($8,200 $6,800) ($100 $100) Net current asset investment $1,400 0 $1,400 * d. Keith Corporation has positive cash flows from operating activities. Depreciation is approximately the same size as net operating profit after tax, so the operating cash flow is about twice the NOPAT. The FCF value is very meaningful since it shows that the cash flows from operations are adequate to cover both operating expense plus investment in fixed and current assets. P4-11. Cash budget—advanced LG 4; Challenge a. Xenocore, Inc. ($000) Sept. Forecast Sales Cash sales (0.20) Collections Lag 1 month (0.40) Lag 2 months (0.40) Other cash receipts Total cash receipts Forecast Purchases Cash purchases Payments Lag 1 month (0.50) Lag 2 months (0.40) Salaries & wages Rent Interest payments Principal payments Dividends Taxes Purchases of fixed assets Total cash disbursements Total cash receipts Less: Total cash disbursements Net cash flow Add: Beginning cash Ending cash Less: Minimum cash balance b. Required total financing (notes payable) Excess cash balance Oct. Nov. Dec. Jan. Feb. Mar. Apr. $210 $250 $170 $ 34 $160 $ 32 $140 $ 28 $180 $ 36 $200 $ 40 $250 $ 50 100 84 68 100 $218 $140 $ 14 $200 $100 $ 10 64 68 15 $175 $ 80 $ 8 56 64 27 $183 $110 $ 11 72 56 15 $183 $100 $ 10 80 72 12 $214 $ 90 $ 9 75 48 50 20 70 60 34 20 50 56 32 20 10 40 40 28 20 55 32 36 20 50 44 40 20 10 30 20 80 $120 $150 20 $207 25 $219 $196 $139 $153 $303 $218 $200 $175 $183 $183 $214 207 11 22 33 219 (19) 33 14 196 (21) 14 (7) 139 44 (7) 37 153 30 37 67 303 (89) 67 (22) 15 15 15 15 15 15 1 22 37 (marketable securities) c. 18 22 52 The line of credit should be at least $37,000 to cover the maximum borrowing needs for the month of April. P4-19. Integrative—pro forma statements LG 5; Challenge a. Pro Forma Income Statement Red Queen Restaurants for the Year Ended December 31, 2013 (percent-of-sales method) Sales Less: Cost of goods sold (0.75 sales) Gross profits Less: Operating expenses (0.125 sales) Net profits before taxes Less: Taxes (0.40 NPBT) Net profits after taxes Less: Cash dividends To Retained earnings $900,000 675,000 $225,000 112,500 $112,500 45,000 $ 67,500 35,000 $ 32,500 b. Assets Cash Marketable securities Accounts receivable Inventories Current assets Net fixed assets* Total assets Pro Forma Balance Sheet Red Queen Restaurants December 31, 2013 (Judgmental Method) Liabilities and Equity $ 30,000 Accounts payable 18,000 Taxes payable** 162,000 Other current liabilities 112,500 Current liabilities $322,500 Long-term debt 375,000 Common stock Retained earnings*** External funds required**** Total liabilities and $697,500 stockholders’ equity * Net fixed assets (January 1, 2013) Plus: New machine Less: Depreciation Ending net fixed assets (December 31, 2013) ** $350,000 42,000 (17,000) $375,000 Taxes payable = $45,000 x 0.25 = $11,250 *** Beginning retained earnings (January 1, 2013) Plus: Net profit after taxes Less: Dividends paid Ending retained earnings (December 31, 2013) **** External funds required = $697,500 - $686,250 = $11,250 $175,000 67,500 (35,000) $207,500 $112,500 11,250 5,000 $128,750 200,000 150,000 207,500 11,250 $697,500 c. Using the judgmental approach, the external funds requirement is $11,250. P4-20. Integrative—pro forma statements LG 5; Challenge a. Pro Forma Income Statement Provincial Imports, Inc. for the Year Ended December 31, 2013 (percent-of-sales method) Sales Less: Cost of goods sold (0.35 sales $1,000,000) Gross profits Less: Operating expenses (0.12 sales $250,000) Operating profits Less: Interest expense Net profits before taxes Less: Taxes (0.40 NPBT) Net profits after taxes Less: Cash dividends (0.40 NPAT) To Retained earnings $6,000,000 3,100,000 $2,900,000 970,000 $1,930,000 200,000 $1,730,000 692,000 $1,038,000 415,200 $ 622,800 b. Assets Cash Marketable securities Accounts receivable Inventories Current assets Net fixed assets Total assets Pro Forma Balance Sheet Provincial Imports, Inc. December 31, 2013 (Judgmental Method) Liabilities and Equity $ 400,000 Accounts payable 275,000 Taxes payable (same percentage as prior year) Notes payable 750,000 Other current liabilities 1,000,000 Current liabilities $2,425,000 Long-term debt 1,646,0002 Common stock Retained earnings External funds required Total liabilities and $4,071,000 stockholders’ equity $ 840,000 138,4001 200,000 6,000 $1,184,400 500,000 75,000 1,997,8003 313,800 $4,071,000 1 Taxes payable for 2012 are nearly 20% of the 2012 taxes on the income statement. The pro forma value is obtained by taking 20% of the 2013 taxes (0.2 $692,000 $138,400). 2 Net fixed assets (January 1, 2013) Plus: New computer Less: Depreciation Net fixed assets (December 31, 2013) $1,400,000 356,000 (110,000) $1,646,000 3 Beginning retained earnings (January 1, 2013) Plus: Net profit after taxes Less: Dividends paid Ending retained earnings (December 31, 2013) $1,375,000 1,038,000 (415,200) $1,997,800 c. Using the judgmental approach, the external funds requirement is $313,800.