Form 5500 Reporting presentation

advertisement

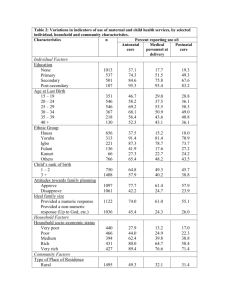

New York Metro Chapter – CEBS Filing Requirements of the 2009 Form 5500 and Related Schedules June 3, 2010 Agenda I. II. III. IV. V. VI. Introduction to the Form 5500 Forms 5500 & Schedules Including 2009 Changes Audit Requirements for Employee Benefit Plans 403(b) Plan Enhanced Reporting Filing 2009 Form 5500 Electronically in 2010 Articles 2 I. What is the Form 5500? • Annual Return/Report of employee benefit plan (generally pension & welfare) • Used to satisfy the annual reporting requirements for the DOL, IRS & PBGC • Primary source of information reported to the government about employee benefit plans • Used for enforcement, research & disclosure 3 Types of Plans Filing the Form • Large Pension Plans • Small Pension Plans (less than 100 participants) • Large Welfare Plan • Small Welfare Plan (less than 100 participants) • Direct Filing Entity (Master Trust, Pooled Separate Account, CCT, GIA, etc.) 4 Typical Plans Not Subject to Filing the Form • Fringe Benefit Plans – (Premium Only Plan (POP)), adoption assistance plan described in §127 job-related benefits are relieved from the requirement to file annual information returns. IRS Notice 2002-24 - Other types of plans not filing a Form 5500 include, non-electing church plans, non-ERISA 403(b) plans - NQDC plans who have filed a registration statement with the DOL 5 The 5500 Process Custodian Insurance Companies Plan Administrator Recordkeeper Electronically Filed with EBSA Form 5500 Auditor (satisfies reporting obligation of DOL, IRS and PBGC) Consultant Employer Plan Sponsor Data Actuary Legal 6 Trustee II. • Form 5500s and Schedules Including 2009 Changes Form 5558. Extension of Time to File Certain Employee Plan Returns. - Filed by paper to IRS Ogden Service Center - Recommend using a process to produce a receipt of filing - Form 5558 is not included in the electronic filing to EBSA 7 Form 5500-SF (Short Form) • An eligible plan may file Form 5500-SF if it meets all eligibility conditions • Two (2) page Form which contains Financial Information and Compliance Questions, • Expected to reduce filing burdens of many small employers and 403(b) plan sponsors Eligibility: • Covers fewer than 100 participants or would be eligible to file as a small plan under the 80/120 rule; (this is also applicable for 403(b) plans) • Is eligible for the small plan audit waiver (but not by reason of enhanced bonding); • Holds no employer securities at any time during the plan year; • Has 100% of its assets in investments that have a readily ascertainable fair market value; and • Is not a multiemployer plan. 8 Form 5500-EZ Annual Return • Changes made for 2009 reporting to allow additional use of this Form to satisfy filing requirement. Generally used by one-participant plans with assets at the end of the 2009 plan year which are at least $250,000, or is a final filing. • The Form 5500-EZ is a paper filing with the IRS only at the Ogden, UT Service Center. Alternative is to prepare a Form 5500-SF (not a 5500) and file electronically under EFAST2. 9 Form 5500 – Main Form & Schedules • • Needed for large pension, welfare plans and DFEs (Direct Filing Entities) Contents of this Form includes; - Identification of certain data about the ER, & plan sponsor - Basic Plan Information New for 2009 The optional, preparer information (former line 5) has been removed. Multiemployer plans are now required to provide information about the number of employers contributing to the plan on a new line 7. A one-participant plan may not file an annual return on Form 5500 for 2009. New “plan characteristics codes” have been added/changed for Defined Contribution Plans that use “automatic enrollment” – 2S and “default investment” 2I and characteristic code 3E, previously used to identify prototype pension plans, has been removed. Code 3D will be used to identify all pre-approved pension plans, (including master, prototype, and volume submitter plans) for 2009. 10 Schedule A – Insurance Information • Plans or Direct Filing Entities (DFEs) with Insurance Contract – – • Insurance Information • Separate Schedule A for each contract • Contract year reporting is permitted (not PY) • Data from insurance carriers are due to plan administrators 120 days after PY ends [ERISA Section 103(a)(2)] Exceptions • Contract is an ASO (Administrative Services Only) • Plan participates in a MT or other DFE which reported the contract data New for 2009 – – – Fee and commission information formerly reported on line 2 is now clarified and broken out on lines 2 and 3. A new Part IV has been added for plan administrators to be able to report insurance companies that fail or refuse to provide any information necessary to complete Schedule A. A reminder has been added to the Schedule A Instructions to advise plan administrators that they should notify the insurer that the plan administrator intended to identify the insurer on the Schedule A as not having provided the information needed. 11 Schedule MB – Multiemployer Defined Benefit Plan Actuarial Information • Used by Multiemployer defined benefit plan to report actuarial information • Used by money purchase pension plan (and target benefit plans) with funding waivers that are currently being amortized – – Less encompassing than Schedule SB used to report the funded status, contributions, assumptions used by the plan, reconciliations, and other miscellaneous items Line E – Check box for Type of Plan (Multiemployer or Money-Purchase) New for 2009 – – The plan administrator is required to maintain a fully executed copy of the Schedule MB with the plan records, and include with the electronic filing as an attachment (in PDF format) a scanned copy of the executed Schedule MB labeled ‘MB Actuary Signature.’ The plan actuary can sign the Schedule, or insert the actuary’s typed name in the signature line followed by the actuary’s handwritten initials 12 Schedule SB – Single Employer Defined Benefit Plan Actuarial Information • Used by Single-Employer or Multiple Employer defined benefit plan to report actuarial information. - The schedule contains 8 Parts, 40 line items to report the funded status, contributions, assumptions used by the plan, reconciliations, and other miscellaneous items - Line E – Check box for Type of Plan (Single or Multiple Employer A or B) • New for 2009 – The plan administrator is required to maintain a fully executed copy of the Schedule SB with the plan records, and include with the electronic filing as an attachment (in PDF format) a scanned copy of the executed Schedule SB labeled ‘SB Actuary Signature.’ – The plan actuary can sign the Schedule, or insert the actuary’s typed name in the signature line followed by the actuary’s handwritten initials. 13 Schedule C – Service Provider Information • • • • • Only required to be filed by large pension and welfare plans, (more than 100 participants) and DFEs (e.g., Master Trusts, 103-12 IEs, GIA) Used only when plan has a trust (funded status) Do not report insurance commissions, PBGC fees, ER paid fees Reporting threshold is $5,000 The Schedule is required to report payments made directly to service providers or compensation received for services rendered to the plan from sources other than directly from a plan or plan sponsor (indirect compensation) – Never list name or SS#s on Schedule C. Use title/position 14 Schedule C – Service Provider Information (continued) • New for 2009 – Reporting of indirect compensation – Additional service codes to identify service providers – Top 40 service providers eliminated. Must report all service providers who receive $5,000 or more in direct or indirect compensation – Do not report plan employee compensation < $25,000 – Report service providers who fail or refuse to provide information 15 Schedule C – Service Provider Information (continued) • New for 2009 (continued) • Examples of indirect compensation: • Commissions • Soft dollars • 12b-1 distribution fees • Finder’s fees • Communication expenses • Redemption • Consulting fees • Sales loads • Brokerage (securities and real estate) • Surrender/termination fees 16 Schedule D – DFE/Participating Plan Information – Plans that participated in a DFE @ any time during the plan year – Trusts, Accounts, and other Investment Arrangements that file the Form 5500 as a Direct Filing Entity must include this Schedule – The normal due date for a DFE is 9.5 months after the plan year ends Type of DFE CCT ( C) MTIA (M) PSA (P) 103-12 IE (E) Form 5500 Reporting Voluntary Required Voluntary Voluntary Audited Required No No No Yes No significant changes made to the Schedule for 2009 17 Schedule G – Financial Transaction Schedules • Large plan’s required to file if lines 4b, 4c or 4d on Schedule H are marked yes – Loans, leases or fixed income obligations due the plan in default, or classified as uncollectible at the end of the plan year. Not participant loans in 401(k)/account balance plans if loan is securitized with account balance. – Nonexempt transactions – No longer required for delinquent participant contributions/loan repayments – Schedule G should resemble amounts and description included in the financial statement Schedule of Nonexempt Transactions No significant changes made to the Schedule for 2009 18 Schedule H – Financial Information (Large Plan) • Schedule should report assets using current value • Pension and Welfare plans, and DFEs – Exceptions: • Insured, unfunded or combination of insured/unfunded welfare plans • Part I Asset and Liability Statement (Balance Sheet) – Any differences between FS reporting or assets must be reconciled in the FS footnotes – Beginning of year balances must match prior year ending balances otherwise DOL Notice generated • Part II Income and Expense Statement (Income Statement) – Assets/Expenses/investments reported elsewhere throughout return on Schedules (A, C, D) should be readily identified by similar category on the income statement 19 Schedule H – Financial Information (Large Plan) • Part III Accountants Opinion – Ensure Accountant’s Opinion issued is correctly marked • Part IV Transactions During Plan Year – This part of Schedule H (IV) requires a ‘YES’ or ‘NO’ response, ‘N/A’ is unacceptable. Amounts will be needed for any ‘YES’ response – Line 4a – Delinquent EE contributions and loan repayments. – Yes responses to line items 4a, 4b, 4c, 4d, 4i, 4j will require a DOL Schedule (AICPA Guide and Form 5500 instructions for guidance) 20 Schedule H – Reporting Delinquent Participant Contributions • Participant contributions (i.e., employee contributions including deferrals, and loan repayments) are plan assets on the earliest date they can reasonably be segregated from employer’s general assets – For pension plans – no later than 15th business day of the month following the month in which contributions are withheld or received by employer. (This is the rule an auditor of a plan uses in their test work) – For welfare plans – no later than 90 days after withheld or received by employer • An employer who is delinquent in forwarding participant contributions and who holds them commingled with its general assets has engaged in a prohibited transaction (PT) under ERISA §406 21 Schedule H – Reporting Delinquent Participant Contributions • • • Delinquent contributions are no longer reported on Schedule G, but line 4a must be treated by the auditor as a PT and a separate schedule is required in the financial statement for the plan Those corrected using VFCP and PTE 2002-51 are not considered to be PTs See instructions to line 4a, Schedule H for additional guidance on reporting 0and correction requirements, (e.g., filing Form 5330 with IRS, contributing ‘lost’ earnings to the plan, communications to participants) New for 2009 • • DOL is vigilantly contacting all plan administrator’s when line item 4a is marked ‘yes’. The DOL requests documentation to support correction. Consider DOL’s VFC program. Line 2b(2)(C) has been added for reporting dividends on registered investment company (mutual fund) shares. 22 Schedule H – Reporting Delinquent Participant Contributions (continued) New for 2009 (continued) • • • • The instructions for line 4g have been modified to make clear that insurance investment contracts for which the plan received valuation information at least annually and mutual fund shares are not reportable on line 4g. A new standardized schedule has been to report delinquent participant contributions. A line item was added regarding whether the plan failed to provide any benefit when due under the plan. Line items were added pertaining to whether there has been blackout (temporary suspension, limitation, or restrictions) lasting more than 3 consecutive business days. If yes, the plan administrator will need to respond to an additional question regarding if the required notice was provided to the plan participants, or an exception applied. 23 Schedule I – Financial Information (Small Plan) – Small pension and welfare plans – Report assets similar to large plan reporting on Schedule H – Transactions During Plan Year are reported similar to Part IV of the Schedule H New for 2009 • Line 2 has been revised to have plans separately report expenses for administrative service providers (salaries, fees, and commissions) and other expenses 24 Schedule H — Line 4a – Schedule of Delinquent Participant Contributions (If Corrected Under DOL VFC Program) Participant Total that Constitute Nonexempt Prohibited Total Fully Transactions Corrected Contributions Transferred Under VFCP Late to Plan for and PTE 2002- Plan Year 51 Contributions Contributions Contributions Not Corrected Corrected Pending Outside VFCP Correction in VFCP Check here if late participant loan repayments are included: 25 Schedule R – Retirement Plan Information • • Plans required to file ─ Defined benefit ─ Defined contribution plans which are subject to minimum funding standards ─ Defined contribution plans which paid distributions in other than cash during the plan year - Generally, the plan’s actuary may need to assist with these line items Part I – Requests information on distributions 26 Schedule R – Retirement Plan Information (continued) • Parts II & III – Funding Information & Amendments made to the plan. • Parts V & VI – Additional Information for Multiemployer and Single-Employer Defined Benefit Pension Plans New for 2009 • A new Part IV has been added for reporting certain employee stock ownership plan (ESOP) information formerly reported on Schedule E. • The instructions for Part V relating to required attachments for multiemployer defined benefit plans have been modified to take into account elections under sections 204 and 205 of WRERA. 27 Form 8955-SSA – Separated Participants With Deferred Vested Benefits (New) • Replaces Schedule SSA • Filing is required for the Internal Revenue Service only (Ogden) • Pension plans (DB or DC) who have separated participants with deferred vested benefits ─ Automatic extension of time to file the Form for 2009 calendar year plans ─ Form 5558 may be used to request an extension of time to file the Form 28 III. Audit Requirements for Employee Benefit Plans • Large Plan versus Small Plans • The 80-120 Rule • Audit requirements • Active versus inactive participants 29 30 Planning and General Audit Considerations Audit Objectives • Expression of an opinion • Auditor must obtain reasonable assurance that material misstatements are detected. Auditor Considers • Existence and valuation investments • Completeness as to EE and ER contributions • Accuracy of benefits paid and benefit obligations • Appropriateness of plan expenses 31 Determination of Audit Scope and Communications A. Initial or First Year Audits B. Full Scope Audit C. Limited Scope Audit D. Form 5500 and Required Schedules Covered by Auditor’s Report E. Engagement Letter/Communication with Those in Charge with Governance Understanding of the Plan and Information Gathering Audit Risk 32 Initial Audit Considerations • Engagement letter – Scope of services • Any client-imposed scope restrictions? – Excluded contracts per DOL FAB? – Limited scope audit under 29 CFR 2520.103-8? – Auditor responsibility for prior year (comparative) statement of net assets available for benefits? – Audit, review, compilation? 33 Initial Audit Considerations • Make inquires of the plan administrator and outside service providers, as applicable, regarding the plan’s operations during those earlier years. • Obtain relevant information (for example, trust statements, recordkeeping reports, reconciliations, minutes of meetings, and SAS No. 70 reports) for earlier years, as applicable, to determine whether any errors were noted during those years that could have a material effect on current year balances. • Gain an understanding of the accounting practices that were followed in prior years to determine that they have been consistently applied in the current year. 34 Initial Audit Considerations Comparative Statements of Net Assets • Comparative statements of net assets available for benefits required by ERISA • Apply procedures that are practicable and reasonable in the circumstances to obtain assurance that the accounting principles used by the plan in the current and the preceding year are consistent. 35 Initial Audit Considerations Risk Assessment Procedures • Planning the nature, timing, and extent of further audit procedures depends on the outcome of the auditors risk assessment procedures. • The 2010 EBP Audit Risk Alert includes a list of factors (not all inclusive) that the auditor may want to consider when performing their risk assessment procedures for an initial audit of a 403(b) plan. • General • Plan reporting and governance • Fraud 36 Initial Audit Considerations Areas of Special Consideration • Completeness of participant data and records • Participant eligibility • Amounts and types of benefits • Eligibility for benefits • Account balances • The nature, timing, and extent of auditing procedures applied by the auditor are a matter of judgment and will vary with factors such as the adequacy of past records, the significance of beginning balances, the complexity of the plan's operations, and controls covered by SAS No. 70 reports. 37 IV. 403(b) Enhanced Reporting Financial Statements and Disclosures • 403(b) plans are considered a type of defined contribution plan. • The financial statements and disclosures will be similar to those of a 401(k) plan. – Comparative Statement of Net Assets Available for Benefits (2009/2008) – Current year Statement of Changes in Net Assets Available for Benefits 38 403(b) Financial Statements and Disclosures • Consideration should be given concerning which disclosures may need to be modified or added. – For example, the general description of the plan, eligibility requirements, funding, and tax status should reflect the requirements of the 403(b) plan document. – Note: 403(b) plans do not currently have IRS determination letters 39 DOL Advisory Opinion (AO) 2010-10A • Issued March 4, 2010- Addresses Traditional Annuities issued by TIAA-CREF • Allocated vs. Unallocated insurance contracts? • DOL concluded the contracts are UNALLOCATED – For plan years beginning on or after 1/1/09 must be reported as plan assets on the Form 5500 – DOL will not reject (or require amended) Form 5500 for plan years ending in 2008 or prior which contain a modified opinion due to exclusion of these contracts from plan assets • What about similar contracts with other insurance companies? 40 DOL Advisory Opinion (AO) 2010-10AAudit/5500 Considerations • Depends on facts and circumstances – Financial Statements • Could be an error • May require restatement of financial statements • Modified opinion • Reconciliation to the 5500 • Form 5500 – Will not have to restated or amended – Treat the contracts as a transfer in for the 2009 Schedule H 41 Allocated Contracts Emerging Technical Issues • FASB Definition (FASB Codification Master Glossary)– A contract in which an insurance entity unconditionally undertakes a legal obligation to provide specified pension benefits to specific individuals in return for a fixed consideration or premium. An annuity contract is irrevocable and involves the transfer of significant risk from the employer to the insurance entity. • Allocated=not recognized as a plan asset Unallocated=recognized as a plan asset • Read insurance contracts and supporting documentation to determine appropriate classification of the contract 42 403(b) Financial Statements and Disclosures • Additional or modified disclosures of the accounting policies surrounding the accounting treatment of certain contracts may be necessary. • “Loans to participants” ─ Loans to participants are made by the vendor to the participant which are secured by the participant’s assets ─ Loans to participants are not currently on the plan’s financial statements or the Form 5500 ─ Possible need additional disclosures in the footnotes to the financial statements 43 V. • Filing 2009 Form 5500 Electronically DOL final regulations issued November 2007 ─ Eliminate paper filings ─ Applies to plan years beginning in 2009 and all prior year filings (except 2008 until 10/15/2010) ─ Internet-based methods to transmit filings 1. IFILE – Free, “no frills” web based filing application available on the DOL’s EFAST2 website, or 2. Approved third-party software ─ Signing credentials (2) need to be secured from the DOL and input on 1 st page of Form 5500 ─ Alternative filing option available if signed copy of 5500 is attached (PDF) and preparer inputs signing (and transmitter credentials) 44 2009 Form 5500 Filings – Summary of Changes • Electronic Filing • Paper filing still applicable for; Form 5558, Form 5500-EZ, Form 8955-SSA 2008 plan year amended filings until 10/15/2009 • New Form 5500-SF < 100 participants (small plans) • Schedules E and SSA (IRS filings) eliminated from DOL filing • Attachments to Form 5500 – do not include 5558, must be in PDF format, cannot exceed size limitation (or contact EFAST2) • 403(b) plans will be subject to enhance reporting and be required to be filed in the same manner as qualified retirement plans • Schedule C – fee disclosures (direct and indirect compensation) 45 2009 Form 5500 Filings – Summary of Changes (continued) • Immediate validation or rejection of filing by EBSA. If rejected the Form 5500 would not be considered filed and potentially subject to penalties • Signing credentials are needed by signer of the Form 5500 and possibly others – Schedule preparer’s, transmitter’s of the form, 46 Q&A and Contact Information Louis F. LiBrandi Tim Desmond Principal Partner 212-286-2600 914-381-8900 llibrandi@odmd.com tdesmond@odmd.com www.ODMD.com IRS Circular 230 Disclosure To ensure compliance with requirements imposed by the IRS, we inform any U.S. federal tax advice contained in this document is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding penalties under the Internal Revenue Code, or (ii) promoting, marketing, or recommending to another party any transaction or matter that is contained in this document. 47