Form 5500 Schedules

advertisement

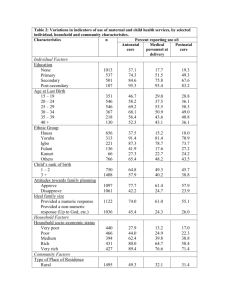

Mastering Form 5500: A to Z and everything in-between William J. Hein, CPC, QPA, QKA Senior Pension Consultant Preferred Pension Planning Corp. www.preferredpension.com Denise L. Finney, CPA Manager - Pension Services Group Amper, Politziner & Mattia, P.C. www.amper.com Mastering Form 5500: A to Z and everything in-between Brief Outline: Introduction Form 5500 and related schedules DOL Benefit Plan Audit Requirement Questions & Answers 2 Form 5500 3 William J. Hein Senior Pension Consultant Preferred Pension Planning Corp. Form 5500 Every benefit plan covered by ERISA must file annually, with a few exceptions ERISA Form 5500 and required supplemental schedules Determining number of participants Due date Changes to 2007 Form 5500 Penalties for not filing or filing late 4 Form 5500 - ERISA Employee Retirement Income Security Act of 1974 Gives the Department of Labor (“DOL”) and Internal Revenue Service (“IRS”) authority to issue regulations for: Financial records Tax returns Annual reports Audits in accordance with Generally Accepted Auditing Standards (“GAAS”) 5 Form 5500 Who is involved in administering an Employee Benefit Plan? Required Plan Information Supplemental Schedules Who signs Form 5500 6 Administration of Employee Benefit Plan’s (“EBP”) Plan Sponsor – employer, if single-employer plan Named Fiduciary – plan must designate one or more –usually an officer or employee for single-employer plan Plan Administrator – responsible for day-to-day operations and operating plan in accordance with plan documents and applicable laws Trustee – authority to manage and/or control assets Custodian – holds plan assets Record Keeper – third-party administrator who provides record keeping services – responsible for participant level data Form 5500 Preparer Plan Auditor 7 Form 5500 Schedules Schedule A – Insurance Information – If benefits provided by an insurance co. Schedule B – Actuarial Information – must be signed by actuary enrolled in the Joint Board for the Enrollment of Actuaries Schedule C – Service Provider Information – if the plan paid any individual or company > $5000 for services (accounting, auditing, brokerage, administrative fees, investment advisory fees) Schedule D – DFE/Participating Plan Information – if plan participates or invests in a common collective trust (CCT), pooled separate account (PSA), master trust (MT), or 103-12 Investment Entities (103-12 IE) 8 Form 5500 Schedules Schedule E – Employee Stock Ownership Plan (“ESOP”) Annual Information Schedule G – Financial Transaction Schedules – If plan has loans or fixed income obligations in default or determined to be uncollectible, leases in default or classified as uncollectible, or prohibited transactions. If required, auditor must report on this schedule. Schedule H – Financial Information for Large Plans – also required supplemental schedules of: Assets held at end of year Assets acquired and disposed of during year Reportable transactions – single transaction or series of transactions purchased or disposed of that exceed 5% of plan assets 9 Form 5500 Schedules Schedule I – Financial Information for Small Plans Schedule R – Retirement Plan Information – reports distributions, funding and amendments that increase the value of the plan Schedule SSA – Annual Registration Statement Identifying Separated Participants with Deferred Vested Benefits PBGC Form 1 – DB plans pay an annual premium and file this form 10 Form 5500 Who Signs Form 5500? 11 Form 5500 - Determining the Number of Participants Determined at beginning of plan year Active participants – all eligible participants Retirees or separated participants who are receiving benefits (with account balances) Retirees or separated participants who are entitled to begin receiving benefits (with account balances) Beneficiaries of deceased participants (with account balances) 12 Form 5500 Due Date: Form 5500 is due last day of 7th month after plan year-end. May be extended up to 2 ½ month from original due date. For calendar year plans, original due date is July 31 and the extended due date is October 15 13 Form 5500 Changes to 2007 Form 5500 14 Form 5500 Penalties for not filing or filing late Delinquent Filer Voluntary Compliance Program (“DFVCP”) 15 DOL Benefit Plan Audit Requirements 16 Denise L. Finney CPA Manager – Pension Services Group Amper, Politziner & Mattia DOL Employee Benefit Plan Audit Requirements What EBP’s require an audit? Types of audits required by ERISA Section 103(a)(3)(A) General components of an employee benefit plan audit Contribution Timeliness Issues Small Plan Audits (< 100 participants) Changing 403(b) Plan requirements Employee Benefit Plan Audit Quality Center 17 DOL Employee Benefit Plan Audit Requirements What types of EBP’s require an audit Defined Contribution Plans Defined Benefit Plans Health and Welfare Plans funded through the Voluntary Employee Beneficiary Association (“VEBA”) Trust What size of EBP’s require an audit An excess of 100 eligible participants at the beginning of a plan year 18 DOL Employee Benefit Plan Audit Requirements Exemptions to requirement – General rule - plans with < 100 participants Plans electing to file as “small plan” under the 80-120 participant rule – for plans that each year fluctuate around the 100 participant level – if plan has 80-120 participants in beginning of plan year, can file same way it filed previous year 19 DOL Employee Benefit Plan Audit Requirements A plan sponsor’s fiduciary responsibility as required by ERISA and scrutinized by the Department of Labor includes having a prudent process for selecting service providers. Generally, an audit is required by an independent CPA for each plan with over 100 eligible participants at the beginning of a plan year. There are two levels of audits acceptable to the DOL. Limited scope Full scope 20 DOL Employee Benefit Plan Audit Requirements (cont’d) The type (limited or full) depends on where the assets are held. Limited Scope - can be performed if held by: Bank, Trust company Insurance company Failure to supply acceptable audited financial statements is considered failure to supply a complete Form 5500 and substantial penalties apply (Generally $50,000). 21 DOL Employee Benefit Plan Audit Requirements Investments Limited scope/full scope procedures Certification Participant Accounts Contributions, fund allocations, earnings allocations, distributions, rollovers Supplemental Schedules Non exempt transactions Reviewing Form 5500 No material inconsistencies Generally focus on Schedule H Audit Report is filed along with the Annual Form 5500 filings 22 Pitfalls of Investing Contributions RULE #1: KNOW DOL 29 CFR 2510.3-102 Employee deferrals must be contributed to the plan as of the earliest date on which such contributions can reasonably be segregated from the employer’s general assets. In no event shall the deposit occur later than the 15th business day of the month following the month in which the participant contribution amounts are received/withheld by the employer. Question on Form 5500. 23 Pitfalls of Investing Contributions (cont’d) This is a very sensitive area with the DOL. Plan Sponsors must be made aware of its importance. The DOL considers infractions to be prohibited transactions and an extension of credit to the Plan Sponsor. 24 Audits of Small Plans Effective as of the first plan year beginning after April 17, 2001 (or effective January 1, 2002 for calendar year plans), employee benefit plans with fewer than 100 participants at the beginning of a plan year are no longer automatically exempt from the Department of Labor’s annual audit requirement. 25 Audits of Small Plans (cont’d) Generally, a two-part test applies. A plan must meet both 1 AND 2 below, or an audit is required: ONE: Either At least 95% of plan assets (measured at the end of the prior plan year) are “qualifying plan assets” Or If less than 95% of plan assets are held in “qualifying plan assets,” any person who “handles” assets is covered by a fidelity bond (as defined). 26 Audits of Small Plans (cont’d) TWO: Certain required disclosures are made in the plan’s Summary Annual Report regarding names of institutions holding assets, name of surety company issuing the bond if more than 5% are non-qualifying assets and various other notices to participants. 27 Audits of Small Plans (cont’d) Qualifying assets are basically assets held at: Bank Insurance company Broker-dealer Trust company Mutual Fund Company Participant loans Qualifying employer securities 28 Non-qualifying assets would include: Hedge Funds Real Estate Art Coin Collections Antique Cars etc. DOL Employee Benefit Plan Audit Requirements Changing 403(b) Plan Requirements Plan document effective January 1, 2009 Audits required, same guidelines, for the 2009 Form 5500 filing 29 Employee Benefit Plan Audit Quality Center (“EBPAQC”) The EBPAQC was opened in March 2004 The purpose of the Center is to promote the quality of employee benefit plan audits and serve as a comprehensive resource provider and provide support for the performance of employee benefit plan audits There are approximately 1,500 member firms Website: http://ebpaqc.aicpa.org/ Plan Sponsor Resources Page Helpful no matter what the plan size Can assist in finding a firm center member 30 Questions? 31 Contact Information William J. Hein, CPC, QPA, QKA Senior Pension Consultant Preferred Pension Planning Corp. 991 Route 22 West Bridgewater, NJ 08807-2956 (908) 575-7575 ext. 204 wjhein@preferredpension.com www.preferredpension.com Denise L. Finney, CPA Manager - Pension Services Group Amper, Politziner & Mattia, P.C. 750 Rt. 202, South Suite 500 Bridgewater, NJ 08807 908-218-5002 ext. 269 finney@amper.com www.amper.com “The material contained in this presentation is for general information and should not be acted upon without prior professional consultation.” 32