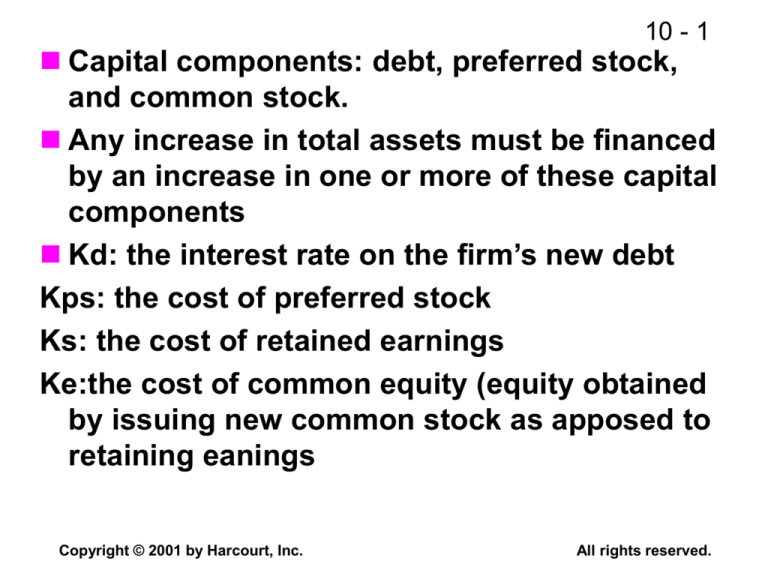

10 - 1

Capital components: debt, preferred stock,

and common stock.

Any increase in total assets must be financed

by an increase in one or more of these capital

components

Kd: the interest rate on the firm’s new debt

Kps: the cost of preferred stock

Ks: the cost of retained earnings

Ke:the cost of common equity (equity obtained

by issuing new common stock as apposed to

retaining eanings

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

10 - 2

1. The cost of debt

Kd(1-T) is the after tax cost of debt. The

relevant cost of new debt, taking into

account the tax deductibility of interest.

In effect, the government pays part of the

cost of debt because interest is

deductible.

Note that the cost of debt is the interest

rate on new debt, not the interest rate

paid on existing or old debt.

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

10 - 3

A 15-year, 12% semiannual bond sells

for $1,153.72. What’s kd?

0

1

2

30

i=?

...

60

-1,153.72

INPUTS

30

N

OUTPUT

60

-1153.72 60

I/YR

PV

PMT

60 + 1,000

1000

FV

5.0% x 2 = kd = 10%

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

10 - 4

Component Cost of Debt

Interest is tax deductible, so

kd AT = kd BT(1 – T)

= 10%(1 – 0.40) = 6%.

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

10 - 5

2. The cost of preferred stock (Kp)

The rate of return investors require on the

firm’s preferred stock.

Preferred stock is a perpetuity that pays a

fixed dividend (Dp) forever.

Kp = Preferred dividend / the current price

of the preferred stock

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

10 - 6

What’s the cost of preferred stock?

Pp = $111.10; $10 dividend/share

Use this formula:

Dp

$10

kp

0.090 9.0%.

Pp $111.10

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

10 - 7

Note:

Preferred dividends are not tax

deductible, so no tax adjustment.

Just kp.

Nominal kp is used.

Our calculation ignores flotation

costs.

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

10 - 8

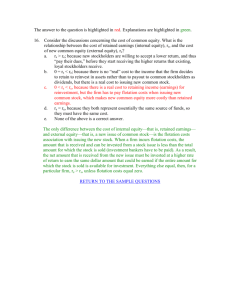

Why is there a cost for retained

earnings?

Earnings can be reinvested or paid

out as dividends.

Investors could buy other securities,

earn a return.

Thus, there is an opportunity cost if

earnings are retained.

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

10 - 9

Opportunity cost: The return

stockholders could earn on

alternative investments of equal risk.

They could buy similar stocks and

earn ks. So, ks is the cost of retained

earnings. The rate of return required by

stockholders on a firm’s common stock

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

10 - 10

Three ways to determine cost of

common equity, ks:

1. CAPM: ks = kRF + (kM – kRF)b.

2. The bond-yield plus risk-premium approach:

Ks= bond yield + firm’s risk premium

firms with risky, low-rated, and consequently

high-interest-rate debt will also have risky, highcost equity. The risk premium over a firm’s own

bond yield has generally ranged from 3 to 5

percentage.

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

10 - 11

3. Discount Cash Flow model

(Constant dividend growth model)

Ks = (D1/Po) + g

How to estimate g?

g = (1- dividend pay out ratio)*ROE

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

10 - 12

What’s the cost of common equity

based on the CAPM?

kRF = 7%, RPM = 6%, b = 1.2.

ks = kRF + (kM – kRF )b.

= 7.0% + (6.0%)1.2 = 14.2%.

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

10 - 13

What’s the DCF cost of common

equity, ks? Given: D0 = $4.19;

P0 = $50; g = 5%.

D1

D0(1 + g)

ks =

+g=

+g

P0

P0

$4.19(1.05)

=

+ 0.05

$50

= 0.088 + 0.05

= 13.8%.

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

10 - 14

Suppose the company has been

earning 15% on equity (ROE = 15%)

and retaining 35% (dividend payout =

65%), and this situation is expected to

continue.

What’s the expected future g?

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

10 - 15

Retention growth rate:

g = (1 – Payout)(ROE) = 0.35(15%)

= 5.25%.

Here (1 – Payout) = Fraction retained.

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

10 - 16

Find ks using the own-bond-yield-plusrisk-premium method.

(kd = 10%, RP = 4%.)

ks = kd + RP

= 10.0% + 4.0% = 14.0%

This RP CAPM RP.

Produces ballpark estimate of ks.

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

10 - 17

What’s a reasonable final estimate of ks?

Method

Estimate

CAPM

14.2%

DCF

13.8%

kd + RP

14.0%

Average

Copyright © 2001 by Harcourt, Inc.

14.0%

All rights reserved.

10 - 18

Why is the cost of retained earnings

(ks) cheaper than the cost of issuing

new common stock (ke)?

1. When a company issues new common

stock they also have to pay flotation costs

to the underwriter.

2. Issuing new common stock may send a

negative signal to the capital markets,

which may depress stock price.

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

10 - 19

Two approaches that can be used to

account for flotation costs:

Include the flotation costs as part of the

project’s up-front cost. This reduces the

project’s estimated return.

Adjust the cost of capital to include

flotation costs. This is most commonly

done by incorporating flotation costs in

the DCF model.

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

10 - 20

Ke = [D1/Po(1-F) ] + g

F is the percentage flotation cost incurred in

selling the new stock.

So, Po (1-F) is the net price per share

received by the company.

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

10 - 21

New common, F = 15%:

D0 (1 g)

ke

g

P0 (1 F)

$4.191.05

5 .0 %

$501 0.15

$4.40

5.0% 15.4%.

$42.50

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

10 - 22

Because of flotation costs, dollars raised by

selling new stock must “work harder” than

dollars raised by retaining earnings.

Moreover, since no flotation costs are

involved, retained earnings have a lower cost

than new stock.

Therefore, the firms should utilize retained

earnings to the extent possible to avoid the

costs of new common stock.

However, if a firm has more good investment

opportunities, issuing new common stock is

necessary.

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

10 - 23

The retained earnings breakpoint represents

the total amount of financing that can be

raised before the firm is forced to sell new

common stock.

Retained earnings breakpoint

= addition to retained earnings/equity fraction

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

10 - 24

E.g) Suppose a firm estimates its

earnings to be $100M next year and

has a payout ratio of 40%. Its capital

structure consists of 45% debt, 2%

preferred, and 53% equity.

The break point will be $60M/0.53 =

$113.2M; After the firm has raised

total capital of $113.2M, the firm will

be forced to issue new common

stock.

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

10 - 25

Comments about flotation costs:

Flotation costs depend on the risk of

the firm and the type of capital being

raised.

The flotation costs are highest for

common equity. However, since

most firms issue equity infrequently,

the per-project cost is fairly small.

We will frequently ignore flotation

costs when calculating the WACC.

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

10 - 26

5. Weighted Average Cost of Capital (WACC)

If all new equity will come from retained earnings:

WACC = Wd [Kd(1-t)] + Wp(Kps) + Wc(Ks)

Wd, Ws, Wc are the weights used for debt, preferred

stock, and common equity.

Assume that the firm has established such a target

and will finance all new investments so as to

maintain a constant target capital structure.

Weights should be based on the market value.

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

10 - 27

What’s the firm’s WACC (ignoring

flotation costs)?

WACC = wdkd(1 – T) + wpkp + wcks

= 0.3(10%)(0.6) + 0.1(9%) + 0.6(14%)

= 1.8% + 0.9% + 8.4% = 11.1%.

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

10 - 28

The company has a target capital

structure of 40 percent debt and 60

percent equity

Bonds pay 10% coupon (semiannual),

mature in 20 years and sell for $849.54

the company stock beta is 1.2

rf = 10%, market risk premium = 5%

the company is a constant growth firm

that just paid a dividend of $2, sells for

$27 per share, and a growth rate of 8%

marginal tax rate is 40%.

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

10 - 29

What factors influence a company’s

composite WACC?

Market conditions. (the level of interest

rates, tax rates…)

The firm’s capital structure and dividend

policy.

The firm’s investment policy. Firms with

riskier projects generally have a higher

WACC.

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

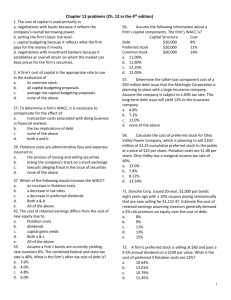

10 - 30

WACC Estimates for Some Large

U. S. Corporations, Nov. 1999

Company

Intel

General Electric

Motorola

Coca-Cola

Walt Disney

AT&T

Wal-Mart

Exxon

H. J. Heinz

BellSouth

Copyright © 2001 by Harcourt, Inc.

WACC

12.9%

11.9

11.3

11.2

10.0

9.8

9.8

8.8

8.5

8.2

All rights reserved.

10 - 31

Should the company use the

composite WACC as the hurdle rate for

each of its projects?

NO! The composite WACC reflects the

risk of an average project undertaken

by the firm. Therefore, the WACC only

represents the “hurdle rate” for a

typical project with average risk.

Different projects have different risks.

The project’s WACC should be adjusted

to reflect the project’s risk.

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

10 - 32

What procedures are used to determine

the risk-adjusted cost of capital for a

particular project or division?

Subjective adjustments to the

firm’s composite WACC.

Attempt to estimate what the cost

of capital would be if the

project/division were a stand-alone

firm. This requires estimating the

project’s beta.

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

10 - 33

Find the division’s market risk and cost

of capital based on the CAPM, given

these inputs:

Target debt ratio = 40%.

kd = 12%.

kRF = 7%.

Tax rate = 40%.

betaDivision = 1.7.

Market risk premium = 6%.

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

10 - 34

Beta = 1.7, so division has more market

risk than average.

Division’s required return on equity:

ks = kRF + (kM – kRF)bDiv.

= 7% + (6%)1.7 = 17.2%.

WACCDiv. = wdkd(1 – T) + wcks

= 0.4(12%)(0.6) + 0.6(17.2%)

= 13.2%.

Copyright © 2001 by Harcourt, Inc.

All rights reserved.

10 - 35

How does the division’s market risk

compare with the firm’s overall market

risk?

Division WACC = 13.2% versus

company WACC = 11.1%.

Indicates that the division’s market risk

is greater than firm’s average project.

“Typical” projects within this division

would be accepted if their returns are

above 13.2%.

Copyright © 2001 by Harcourt, Inc.

All rights reserved.