Chapter 11 - Savannah State University

advertisement

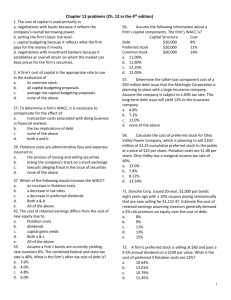

Chapter 11 The Cost of Capital 1 Learning Outcomes Chapter 11 Compute the component cost of capital for (a) debt, (b) preferred stock, (c) retained earnings, and (d) new common equity. Describe the weighted average cost of capital (WACC) and discuss the logic of using WACC to make informed financial decisions. Describe how the marginal cost of capital (MCC) is used to make capital budgeting decisions. Discuss the relationship between the firm’s weighted average cost of capital (WACC) and investor’s’ required rates of return. 2 Cost of Capital Firm’s average cost of funds, which is the average return required by firm’s investors What must be paid to attract funds 3 Required Rate of Return (Opportunity Cost Rate) The return that must be raised on invested funds to cover the cost of financing such investments 4 Basic Definitions Capital Component Types of capital used by firms to raise money • rd = before tax interest cost • rdT = rd(1-T) = after tax cost of debt • rps = cost of preferred stock • rs = cost of retained earnings • re = cost of external equity (new stock) 5 Basic Definitions WACC Weighted Average Cost of Capital Capital Structure A combination of different types of capital(debt and equity) used by a firm 6 After-Tax Cost of Debt The relevant cost of new debt Taking into account the tax deductibility of interest Used to calculate the WACC 7 Cost of Preferred Stock Rate of return investors require on the firm’s preferred stock The preferred dividend divided by the net issuing price F = percentage flotation costs as a decimal NP0 = per share net proceeds firm receives from the issue 8 Cost of Retained Earnings Rate of return investors require on the firm’s common stock rs = required rate of return RPs = risk premium for Stock S r̂s = expected rate of return g = constant growth rate P0 = current stock price rRF = risk-free rate of return D̂1 = next period’s expected dividend 9 The CAPM Approach rs rRF rM RPs βs = cost of retained earnings = risk-free rate of return = risk-free rate of return = risk premium for Stock S = beta coefficient for Stock S 10 The Discounted Cash Flow Approach (Expected Rate of Return) Price and expected rate of return on a share of common stock depends on the dividends expected on the stock. rs = cost of retained earnings P0 = current stock price r̂s = expected rate of return g = constant growth rate D̂1 = next period’s expected dividend 11 The Bond-Yield-Plus-Premium Approach Estimating a risk premium above the bond interest rate Judgmental estimate for premium “Ballpark” figure only 12 Cost of Newly Issued Common Stock External equity, re Based on the cost of retained earnings Adjusted for flotation costs (the expenses of selling new issues) re = cost of new equity g = constant growth rate D̂1 = next period’s expected dividend F = percentage flotation cost stated as a decimal P0 = current stock price 13 Target Capital Structure Optimal Capital Structure Percentage of debt, preferred stock, and common equity in the capital structure that will maximize the price of the firm’s stock 14 Weighted Average Cost of Capital, WACC A weighted average of the component costs of debt, preferred stock, and common equity wd = proportion of debt in firm’s capital structure wps = proportion of preferred stock in firm’s capital structure ws = proportion of common stock in firm’s capital structure 15 The Logic of the Weighted Average Cost of Capital The use of debt impacts the ability to use equity, and vice versa, so the weighted average cost must be used to evaluate projects, regardless of the specific financing used to fund a particular project. 16 Marginal Cost of Capital Marginal Cost of Capital Schedule A graph that relates the firm’s weighted average of each dollar of capital to the total amount of new capital raised Reflects changing costs, depending on amounts of capital raised 17 MCC Schedule for Unilate Textiles 18 Break Point (BP) The dollar value of new capital that can be raised before an increase in the firm’s weighted average cost of capital occurs 19 MCC Schedule Using Retained Earnings, New Common Stock and Higher-Cost Debt 20 Combining the MCC and Investment Opportunity Schedules Use the MCC schedule to find the cost of capital for determining projects’ net present values. Investment Opportunity Schedule (IOS) Graph of the firm’s investment opportunities ranked in order of the projects’ internal rate of return 21 Combining the MCC and Investment Opportunity Schedules 22