Recitation 11

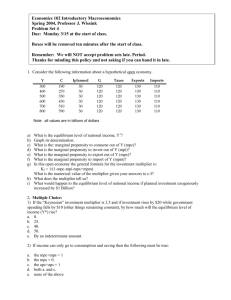

advertisement

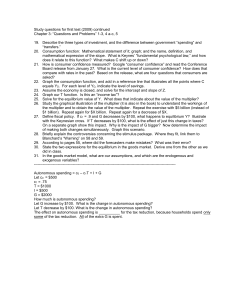

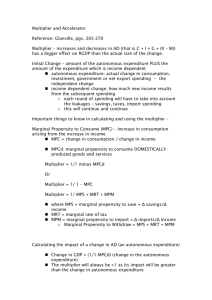

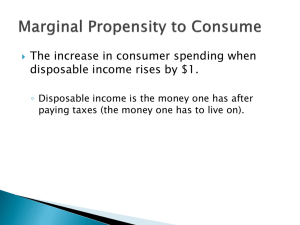

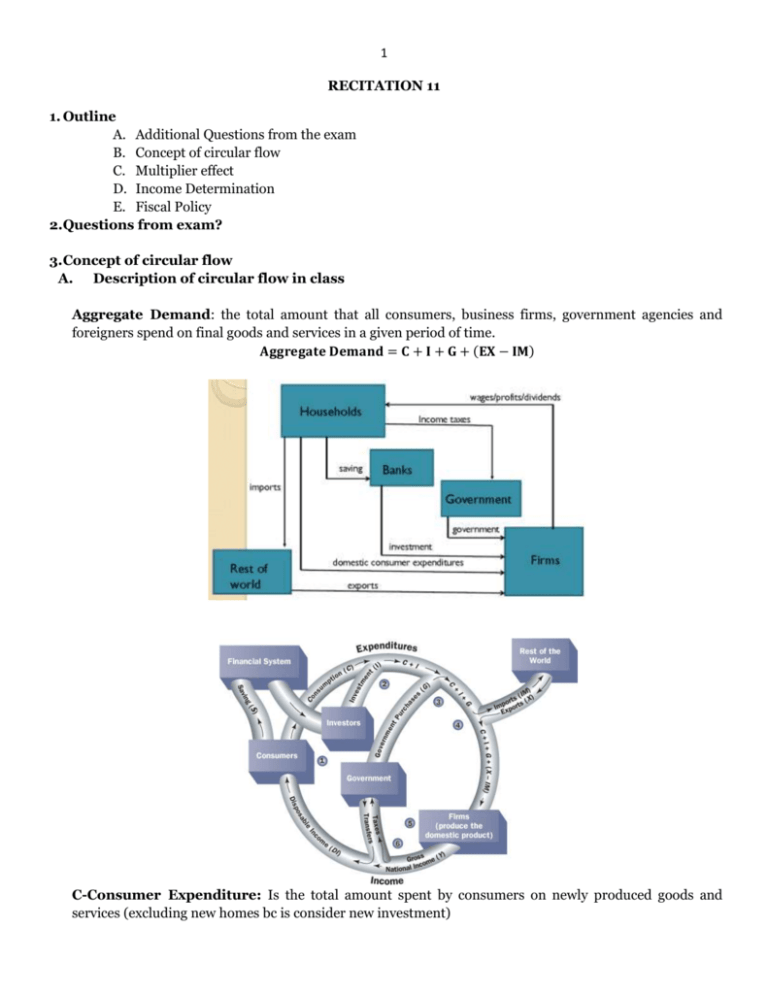

1 RECITATION 11 1. Outline A. Additional Questions from the exam B. Concept of circular flow C. Multiplier effect D. Income Determination E. Fiscal Policy 2.Questions from exam? 3. Concept of circular flow A. Description of circular flow in class Aggregate Demand: the total amount that all consumers, business firms, government agencies and foreigners spend on final goods and services in a given period of time. 𝐀𝐠𝐠𝐫𝐞𝐠𝐚𝐭𝐞 𝐃𝐞𝐦𝐚𝐧𝐝 = 𝐂 + 𝐈 + 𝐆 + (𝐄𝐗 − 𝐈𝐌) C-Consumer Expenditure: Is the total amount spent by consumers on newly produced goods and services (excluding new homes bc is consider new investment) 2 I-Investment spending: total expenditures of business firms on new plant, equipment, software and household new homes (excluding financial investment and resale of existing physical assets). G-Government Purchases: goods and services purchased by all levels of government. NET EXPORT=EXports-IMports: difference between exports (EX) and imports (IM). Difference between what we sell to foreign and what we buy from them. How does it work? 1. Consumers: IN: disposable income. OUT: consumption (C) & savings (S) . *For now leave out the financial system. So we are going to consider S as a “leak”. 2. Investment: IN: loan from the financial system OUT: Investment (I) from a group call “investors”, this includes both business firms and home buyers. 3. Government: IN: Taxes from both business firms and home buyers OUT: government purchases (G) 4. Net exports: IN: OUT: export entering the circular flow from abroad and import spending leaking out. Net exports can be either positive or negative 5. Firms IN: The circular flow diagram shows this aggregate demand for goods and services arriving at firms, which are located at point 5. OUT: Responding to this demand, firms produce the domestic product 6. NATIONAL INCOME=DOMESTIC PRODUCT (In general) NI-NATIONAL INCOME: is the sum of the incomes that all individuals in the economy earn in the forms of wages, interest rents, and profits. It excludes government transfer payments and is calculated before any deductions are taken for income taxes. GDP- GROSS DOMESTIC PRODUCT: National income and domestic product must be equal. DI-DISPOSABLE INCOME: sum of the income of all individuals in the economy after all taxes have been deducted and all transfer payments have been added. 𝐃𝐈 = 𝐆𝐃𝐏 − 𝐓𝐀𝐗𝐄𝐒 + 𝐓𝐑𝐀𝐍𝐒𝐅𝐄𝐑 𝐏𝐀𝐘𝐌𝐄𝐍𝐓𝐒 𝐃𝐈 = 𝐆𝐃𝐏 − (𝐓𝐀𝐗𝐄𝐒 − 𝐓𝐑𝐀𝐍𝐒𝐅𝐄𝐑𝐒) 𝐃𝐈 = 𝐆𝐃𝐏 − 𝐓 MPC-MARGINAL PROPENSITY TO CONSUME: is the ratio of the change in consumption relative to the change in disposable income that produces the change in consumption. 𝐂𝐡𝐚𝐧𝐠𝐞 𝐢𝐧 𝐂 𝐌𝐏𝐂 = 𝐂𝐡𝐚𝐧𝐠𝐞 𝐢𝐧 𝐃𝐈 3 CONSUMPTION FUCTION: shows the relationship between total consumer expenditures and total disposable income in the economy, holding all other determinants of consumer spending constant. Movements along the consumption function: anything that changes the real disposable income. Shifts of the consumption function: wealth, price level, the real interest rate, future income expectations. Permanent cuts in income taxes cause greater increases in consumer spending that cause temporary cuts of equal magnitude. B. Demonstration of the multiplier (Active Learning Exercise) MULTIPLIER: is the ratio of the change in equilibrium GDP (Y) divided by the original change in spending that causes the change in GDP. 𝐂𝐡𝐚𝐧𝐠𝐞 𝐢𝐧 𝐘 𝟏 𝐌𝐮𝐥𝐭𝐢𝐩𝐥𝐢𝐞𝐫 = = 𝐂𝐡𝐚𝐧𝐠𝐞 𝐢𝐧 𝐈 𝟏 − 𝑴𝑷𝑪 Every time there is an injection of new demand into the circular flow there is likely to be a multiplier effect. This is because an injection of extra income leads to more spending, which creates more income, and so on. The multiplier effect refers to the increase in final income arising from any new injection of spending. The size of the multiplier depends upon household’s marginal decisions to spend, called the marginal propensity to consume (mpc), or to save, called the marginal propensity to save (mps). How does it work? Lets look to a simplified version of the circular flow Round 1: 1. Firms decide to invest $100 dollars to upgrade office building. This money goes to construction workers and owner of construction companies as wages and profits. That is, the $100 becomes their income. TOTAL EXPENDITURE ROUND 1=$100 4 Round 2: 2. The construction firms’s owners and workers will spent $85 because MPC= 0.85. This $85 is a net addition to the nation’s demand for goods and services, just as the $100 was. TOTAL EXPENDITURE ROUND 2=$100+(100)x(0.85)=185 Round 3: 3. This $85 goes back to another worker that will spent $85x(0.85)=72.25. This $72.25 is a net addition to the nation’s demand for goods and services. TOTAL EXPENDITURE ROUND 3=$100+(100)x(0.85)+ (100)x(0.85)x(0.85)=257.25 Round “Infinity”: 4. TOTAL EXPENDITURE ROUND 3=$100+(100)x(0.85)+ (100)x(0.85)x(0.85)+….= 𝟏 𝟏 𝐌𝐮𝐥𝐭𝐢𝐩𝐥𝐢𝐞𝐫 = 𝟏𝟎𝟎 = 𝟔𝟔𝟔. 𝟔𝟔 = 𝑰 𝟏 − 𝟎. 𝟖𝟓 𝟏 − 𝑴𝑷𝑪 4.Income determination A. Autonomous vs. Induced expenditures Autonomous expenditure is independent of changes in real GDP whereas induced expenditures change with real GDP. The induced expenditures are the heart of the multiplier effect. Induced expenditure is the 5 sum of the components of aggregate expenditure that change with GDP. Autonomous expenditures is the sum of the components of aggregate expenditure that don’t change when real GDP change There are two types of change in consumer expenditure: INDUCED INCREASE IN CONSUMPTION: is an increase in consumer spending that stems from an increase in consumer incomes. It is represented on a graph as a movement along a fixed consumption function. AUTONOMOUS INCREASE IN CONSUMPTION: is an increase in consumer spending without any increase in consumer incomes. It is represented on a graph as a shift of the entire consumption function. A higher price level leads to lower real wealth and therefore to less spending at any given level of real income. Thus, a higher price level leads to a lower consumption function (such as C1 in Figure 4), and a lower price level leads to a higher consumption function (such as C2 in Figure 4). Because students are sometimes confused by this point, it is worth repeating that the depressing effect of the price level on consumer spending works through real wealth, not through real income. The consumption function displays the relationship between real consumer income and real consumer spending. Thus, if real income declines for any reason, the economy moves leftward along a fixed consumption function. By contrast, a decline in real wealth will shift the entire consumption function downward, meaning that people spend less at any given level of real income. From the slides: Autonomous consumption: the portion of consumption not dependent upon consumer income. It depends on wealth and other non-income factors (Ĉ) Induced consumption: the portion of consumption that rises and falls with consumer income. Consumption will rise as disposable income rises (MPC ● (Y-T)) MPC (marginal propensity to consume): the increase in consumption from a one unit increase in disposable income. Consumption function: C = Ĉ + MPC ● (Y-T)=autonomous consumption+Marginal Propensity to Consume x (Disposable Income) B. Planned and actual expenditures 6 https://www.khanacademy.org/economics-finance-domain/macroeconomics/income-and-expendituretopic/keynesian-cross-tutorial/v/keynesian-cross C. Equilibrium In equilibrium national income is equal to expenditures. The red line is where that is always true (i.e. all the equilibrium points where the economy is at equilibrium) If planned expenditures are above the red line, there is an excess of inventory. If planned expenditures are below, actual output is below what is demanded, so firms produce more and output will naturally go to the equilibrium point. 5. Fiscal policy What Happens when planned spending falls? One outcome of financial crisis: consumers spending less as they “unwind” their credit-card debt. This leads to less autonomous consumption, less planned expenditure, and less GDP. 1. Suppose autonomous consumption falls by 150. 7 2. New equilibrium point Y=900. Autonomous expenditure drops by 150, but Y drops by 500. What can we do as government? Fiscal policy: adjustment of government expenditures or taxes to achieve a desired equilibrium level of short-run output. Note that government expenditure and taxes are components of autonomous expenditure. Changes in government spending have a multiplier effect on changes in equilibrium output Stabilization policies: government policies that are used to affect planned aggregate expenditure, with the objective of eliminating output gaps. a. Contractionary: reduced expenditure/reduced output. b. Expansionary: increased expenditure/increased output. Two policies: 1. Stimulus. Suppose G rises by 30 (to 230). We move to a new equilibrium point where Y=1500. Because an increase in G=30 increases Y=100. 1 ) 1−0.7 From 30 ( = 100 8 2. Tax cut. Increases disposable income (Y-T), and thus is expansionary fiscal policy. This shifts the planned expenditure line up, and has a multiplier effect on equilibrium output. Suppose T falls to 162.5 (tax cut of 37.5) Which one do we choose? Note also that we needed a larger tax cut than we had stimulus spending (37.5 rather than 30). Why is that? Tax multiplier: 2.666 9