Wages and Income Tax Notes

advertisement

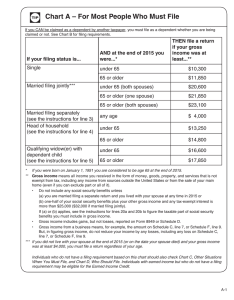

INCOME TAXES (How much will you keep?) GROSS PAY / DEDUCTIONS & NET PAY Your paycheck (stub) contains vital information which needs to be reviewed and understood GROSS PAY = Total pay before deductions Net Pay = The amount of your paycheck after deductions (“Take-home Pay”) Regular Wages or Salary + Overtime = Gross Pay Gross Pay – Deductions = Net Pay Direct Deposit Hourly vs. Salaried Employees Hourly Wages: (Rate of pay) x (# of hours worked) Overtime pay must be calculated at 1.5x rate of pay (Fair Labor Standards Act) – standard work week is 40 hours Minimum wage in IL - $8.25 (subminimum wage) Commission / Tips / Piecework Salaried Employees: Regular hours & a set amount of pay (usually stated as yearly salary & broken into equal increments) Example - $36,000 annual salary – no overtime unless negotiated Monthly Pay – ($36,000 / 12 = $3000 per month gross) Bi-weekly – ($36,000 / 26 = $1384.62 every 2 weeks) Bi-monthly – ($36,000 / 24 = $1500 twice a month) Weekly – ($36,000 / 52 = $692.30 every week) REQUIRED Deductions Amounts subtracted from gross pay (Government) Federal / State & Local Income Tax Support multiple “public goods” & “programs” (roads / schools / defense / welfare / etc.) The largest source of income for the Federal government is from Income taxes (43% of all revenue) Social Security Tax (FICA) Federal Insurance Contributions Act Government supported retirement program % of Gross Income Employer matches Medicare Tax Government supported health insurance for retirees % of Gross Income Employer matches up to certain $ amount OPTIONAL Deductions Amounts subtracted from gross pay (Personal Option) Health Insurance PPO / HMO / etc. Retirement Savings (401k / 403b / etc.) Vested Life Insurance Union Dues Employee Stock Options Plan Savings Accounts Various Others (parking / gym / etc.) Employment Classifications Full-Time Full access to benefits & better pay Part-Time Fewer hours – benefits may or may not be offered Temporary Short-term assignments (leaves / busy periods) Employment agencies may provide benefits Contract Specified time period for project completion Usually no benefits unless stated in contract Homework Review Questions - Chapter 8 (pg. 206; 1-13) (Due Wednesday) TYPES OF TAXES Progressive Taxes (Income Tax): The more you earn – the higher amount of tax comes out of your pocket (Tax Brackets) Regressive Taxes (SALES TAX): Smaller share of income is collected as income grows – SALES TAX is regressive – straight % for sales tax Proportional Taxes (PROPERTY TAX): FLAT TAX – all members of a community pay the same amount regardless of earnings or value FEDERAL INCOME TAX THE UNITED STATES TAX SYSTEM All U.S. citizens and businesses pay taxes to the government which the government uses for a variety of purposes – public education / police / fire / roads / etc. INCOME TAX – DOCUMENTS Statement of Annual Earnings (Form W-2) Sent by employer before January 31 Employee Withholding Sheet (Form W-4) This will let the employer know how much to take out of you pay for taxes (page 201) If this form is completed incorrectly you may have too much or too little take out of your paycheck Withholding too much This will result in a tax REFUND after filing Some people may use this to save money – no saving’s interest Withholding too little This will result in a tax liability – you will owe more $$ to IRS Avoid this tax bill by: paying extra $$ / change your allowances Progressive Taxes INCOME TAX The ability-to-pay principle - individuals with higher income should pay a higher percentage of their income Income tax is progressive – the more money earned the higher % is required to pay to the government Approved and changed by Congress and the President Collected by the Internal Revenue Service (IRS) Based on Voluntary Compliance & people paying fair share Determined by a tax return filled out by April 15 of each year based on the “Tax Formula” GROSS INCOME (Wages / interest / tips / etc.) -ADJUSTMENTS (Retirement plans / alimony / etc.) =ADJUSTED GROSS INCOME -ITEMIZED DEDUCTION or STANDARD DEDUCTION -EXEMPTIONS =TAXABLE INCOME ***Tax Tables will determine how much will be paid TAX RETURNS Returns should be completed with the idea of paying your fair share & taking advantage of all laws designed to give tax relief Every American files a tax return before April 15th of each year to determine if they have paid the correct tax amount based on their total income You may file online (www.irs.gov) – Turbo-tax Filing Status Single (not married) Married filing jointly Married filing separately Head of Household (providing a home for dependent people whether married of single & qualified) WHICH TAX FORM? Form 1040EZ Single or Married filing jointly One Exemption for self & spouse if applicable Income less than $50,000 on Line 6 of form Income from wages, salaries, tips / Interest income of less than $1500 / Unemployment compensation / Taxable scholarship Form 1040A Any filing status All exemptions you qualify for Income less than $50,000 on Line 25 Income from same as above Form 1040 Any filing status All exemptions you are entitled to Any amount of Income All sources income are eligible Taxable Income Wages / salaries / tips Interest income Dividend income Unemployment compensation Social Security benefits (85% in some cases) Alimony -- maintenance “Other” income (businesses / royalties / estate income / trust income / pensions / gambling winnings / sale of personal items Dependents / Exemptions More dependents claimed the less tax paid (WHO?) 1. 2. 3. 4. 5. 6. Person living with you receiving more than half his/her living expenses from you Person must be a relative – child, stepchild, adopted child, etc. Person must be a U.S. citizen of resident of the U.S. The person may not file a return and claim himself or herself as an exemption The person’s income may not exceed the amount of his or her exemption After age 1 all dependents must have a social security number Self-Employed Individuals Required to claim income over $400 annually (Form 1040) Many businesses must pay taxes quarterly depending on revenue Schedule C (Profit or Loss Statement) is attached Tax Planning Understanding laws and guidelines for filing taxes is important to pay the correct amount each year http://www.youtube.com/watch?v=IroCYzwW ZtU Financial Planning