Lesson 2.2 State Taxes

advertisement

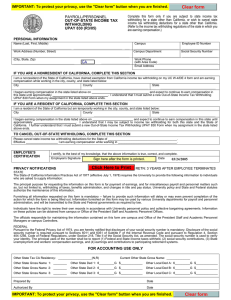

Lesson Objective Compute state taxes on a straight percent basis. Most states require employers to withhold a certain amount of pay for state income tax. Each state may calculate this differently, but in the state of Pennsylvania, your state income tax is calculated using your Gross Pay and 3.07%. Tax rates of the 50 states Lesson 2.2 State Income (Withholding) Tax On-The-Go Employee SSN Check # Beakens, Joe 201-92-4856 164 Check Amount $1,102.98 Employee Address 293 Michael Grove Billings, MT 59102 Pay TypeGross Pay Deductions Current Year-to-date $1,353.33 Federal Withholding State Withholding Fed OASDI/EE or Social Security Fed MED/EE or Medicare Medical 401K $106.00 $40.82 $83.91 $19.62 $0.00 $0.00 $503.46 $117.72 $636.00 $244.92 $0.00 $0.00 Totals $250.35 $1,502.10 Pay Period 6/11/2004-7/11/2004 State Income (Withholding) Tax – The percentage deducted from an individual’s paycheck to assist in funding government agencies within the state – The percentage deducted depends on the amount of gross pay earned State Calculations State Income Tax = Taxable wages x Tax Rate Check stub for accuracy: State Tax / Gross Pay = % Rate $40.82 / $1353.33 = .03016 = 3.02% What is PA’s State tax rate? Example 1 • Patricia’s gross pay is $65,800 per year. She lives in PA. How much is withheld from her gross earnings for state income tax each month? • $65,800 x .0307 = 2020.06 (per year) • $2020.06 ÷ 12 = $168.34 rounded (per month) Example 2 (on your own) Jack earns $43,500 per year in PA. How much is withheld from his gross earnings for state income tax each week? 43,500 x .0307 = $1335.45 (per year) $1,335.45 ÷ 52 = $25.68 (weekly) Closure: What is state tax money used for? Summarize main point: why, PA state tax rate? How is this collected? Calculate the state withholding for Jim: He made $1200 in gross wages last week. What was his PA state withholding? Answer: 36.84 Assessment • Gross wages 50,000 for the year. What amount of PA state tax should be withheld? • Answer • 50,000 x .0307 = 1535 Homework • Complete handout on payroll deductions and study for percentage quiz