Ch 26

advertisement

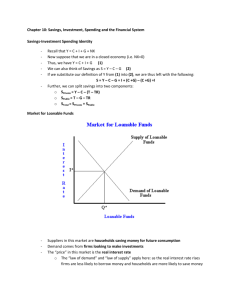

© 2013 Pearson Finance, Saving, and Investment 26 CHECKPOINTS © 2013 Pearson Click on the button to go to the problem Checkpoint 26.1 Checkpoint 26.2 Checkpoint 26.3 Problem 1 Problem 1 Problem 2 Problem 2 In the news Problem 3 Problem 3 In the news In the news © 2013 Pearson Problem 1 Clicker version Problem 2 CHECKPOINT 26.1 Practice Problem 1 Michael is an Internet service provider. On December 31, 2011, he bought an existing business with servers and a building worth $400,000. During his first year of operation, his business grew and he bought new servers for $500,000. The market value of some of his older servers fell by $100,000. What was Michael’s gross investment, depreciation, and net investment during 2012 and what is Michael’s capital at the end of 2012? © 2013 Pearson CHECKPOINT 26.1 Solution Michael’s gross investment during 2012 was $500,000—the market value of the new servers he bought. Michael’s depreciation during 2012 was $100,000—the fall in the market value of some of his older servers. Michael’s net investment during 2012 was $400,000. Net investment equals gross investment minus depreciation, which is ($500,000 $100,000). © 2013 Pearson CHECKPOINT 26.1 The capital grew during 2012 by the amount of net investment. Michael’s net investment during 2012 was $400,000. So that at the end of 2012, capital was $400,000 + $400,000, which equals $800,000. © 2013 Pearson CHECKPOINT 26.1 Practice Problem 2 Lori earns $20,000 after paying her taxes. At the beginning of 2011, Lori owned $1,000 worth of books, CDs, and golf clubs and she had $5,000 in a savings account at the bank. During 2011, the interest on her savings account was $300 and she spent $15,300 on consumption goods. The market values of her books, CDs, and golf clubs did not change. How much did Lori save in 2011? What was her wealth at the end of 2011? © 2013 Pearson CHECKPOINT 26.1 Solution Lori saved $5,000. Saving equals income (after tax) minus the amount spent. That is, Lori’s saving equaled $20,300 minus $15,300, which is $5,000. Lori’s wealth at the end of 2011 was $11,000—the sum of her wealth at the start of 2011 ($6,000) plus her saving during 2011 ($5,000). © 2013 Pearson CHECKPOINT 26.1 In the news IMF urges EU banks to raise capital The G-20 aims to take stock of the economic recovery. One achievement in Pittsburgh could be a deal to require that financial institutions hold more capital. Source: USA Today, September 24, 2009 What are the financial institutions that the IMF urges to raise more capital? What exactly is the “capital” referred to in the news clip? How might raising more capital make financial institutions safer? © 2013 Pearson CHECKPOINT 26.1 Solution The institutions are some European banks. “Capital” in the news clip is the banks’ own funds. By using more of its own funds and less borrowed funds, a financial institution decreases its risk of insolvency in the event that its assets lose value. © 2013 Pearson CHECKPOINT 26.2 Practice Problem 1 First Call, Inc. is a cellular phone company. It plans to build an assembly plant that costs $10 million if the real interest rate is 6 percent a year. If the real interest rate is 5 percent a year, First Call will build a larger plant that costs $12 million. And if the real interest rate is 7 percent a year, First Call will build a smaller plant that costs $8 million. Draw a graph of First Call’s demand for loanable funds curve. © 2013 Pearson CHECKPOINT 26.2 Solution The demand for loanable funds curve is the blue downward-sloping curve DLF0 and passes through the points highlighted in the figure. © 2013 Pearson CHECKPOINT 26.2 Practice Problem 2 First Call, Inc. is a cellular phone company. The graph shows its demand for loanable funds. First Call expects its profit to double next year. If other things remain the same, explain how this increase in expected profit influences First Call’s demand for loanable funds. © 2013 Pearson CHECKPOINT 26.2 Solution An increase in the expected profit increases investment today, which increases the quantity of loanable funds demanded at each real interest rate. The demand for loanable funds curve shifts rightward to DLF1 in the figure. © 2013 Pearson CHECKPOINT 26.2 Study Plan Problem First Call, Inc. expects its profit to double next year. If other things remain the same, First Call _________. A. increases the quantity of funds demanded along its demand for loanable curve. B. decreases its demand for loanable funds C. increases its demand for loanable funds D. decreases the quantity of funds demanded along its demand for loanable curve © 2013 Pearson CHECKPOINT 26.2 Practice Problem 3 Draw a graph that illustrates how an increase in the supply of loanable funds and a decrease in the demand for loanable funds can lower the real interest rate and leave the equilibrium quantity of loanable funds unchanged. © 2013 Pearson CHECKPOINT 26.2 Solution The increase in the supply of loanable funds shifts the supply curve rightward. The decrease in the demand for loanable funds shifts the demand curve leftward. The real interest rate falls. If the shifts are of the same magnitude, the equilibrium quantity of funds remains unchanged. © 2013 Pearson CHECKPOINT 26.2 In the news Poof! How home loans transform Banks make a profit by transforming home loans into mortgage-backed securities and trading them on financial loans markets. Banks then use this profit to issue more home loans. During the credit crisis, the market for mortgage-backed securities issued by banks almost stopped functioning. Source: The New York Times, September 18, 2009 Explain why the market for mortgage-backed securities almost stopped functioning during the credit crisis of 2007–2008. © 2013 Pearson CHECKPOINT 26.2 Solution The banks that create and sell mortgage-backed securities demand loanable funds and the banks that buy these securities supply loanable funds. When home prices started to fall and home owners defaulted, banks made fewer home loans and the demand for mortgage-backed securities decreased. These securities also became riskier, so the supply of loanable funds to buy them dried up. © 2013 Pearson CHECKPOINT 26.3 Practice Problem 1 The table shows the demand for loanable funds schedule and the private supply of loanable funds schedule. If the government budget surplus is $1 trillion, what are the real interest rate, the quantity of investment, and the quantity of private saving? © 2013 Pearson CHECKPOINT 26.3 Solution With a government budget surplus of $1 trillion, the supply of loanable funds curve is SLF. The equilibrium real interest rate falls from 7 percent to 6 percent a year and the quantity of loanable funds increases to $2.5 trillion. Investment is $2.5 trillion and private saving is $1.5 trillion. © 2013 Pearson CHECKPOINT 26.3 Practice Problem 2 The table shows the demand for loanable funds schedule and the private supply of loanable funds schedule. If the government budget deficit is $1 trillion, what are the real interest rate, the quantity of investment, and the quantity of private saving? Is there any crowding out? © 2013 Pearson CHECKPOINT 26.3 Solution With a government budget deficit of $1 trillion, the demand for loanable funds curve is DLF. The real interest rate rises from 7 percent to 8 percent a year, the quantity of loanable funds increases to $2.5 trillion. © 2013 Pearson CHECKPOINT 26.3 Investment on the PDLF curve decreases to $1.5 trillion. Crowding out occurs because the deficit raises the real interest rate, which decreases investment. © 2013 Pearson CHECKPOINT 26.3 Practice Problem 3 The table shows the demand for loanable funds schedule and the private supply of loanable funds schedule. If the government budget deficit is $1 trillion and the RicardoBarro effect occurs, what are the real interest rate and the quantity of investment? © 2013 Pearson CHECKPOINT 26.3 Solution If the Ricardo-Barro effect occurs, private saving adjusts to offset the budget deficit if $1 trillion. The supply of loanable funds increases by $1 trillion and the equilibrium interest rate remains at 7 percent a year. © 2013 Pearson CHECKPOINT 26.3 The quantity of loanable funds is $3 trillion and it finances investment of $2 trillion and the budget deficit of $1 trillion. Crowding out does not occur because the real interest rate does not change. © 2013 Pearson CHECKPOINT 26.3 In the news Budget vote surprises GOP leaders A group of lawmakers joined to defeat a bill to fund a federal government deficit of $1,043 trillion for 2012. Source: The Wall Street Journal, September 22, 2011 Explain the effect of a large federal deficit and debt on economic growth. © 2013 Pearson CHECKPOINT 26.3 Solution Compared to a balanced budget, a large federal government deficit and debt increase the demand for loanable funds. The real interest rate rises and private investment decreases. Investment increases the capital stock and increases labor productivity, the engine of growth. The higher real interest rate slows the growth of the capital stock, slows labor productivity growth, and slows real GDP growth. © 2013 Pearson