AP MACRO-MR. LIPMAN KRUGMAN'S UNIT 4

advertisement

AP MACRO-Section 4

NATIONAL INCOME AND PRICE DETERMINATION

MODULES 16-21

• http://bcs.worthpublishers.com/Krugman_AP

_Econ2e/default.asp#944422__946152__

Warm Up

If I were to give you

$1,000,000 dollars, what

would you do with it?

World Record!?

• The Domino Effect?

• http://www.youtube.com/watch?v=vDjcJlDg_i

g

What we will cover in this Module:

• The multiplier, which shows how initial changes in

spending lead to further changes that literally multiply

thru the economy.

• The aggregate consumption function, which shows

how current disposable income affects consumer

spending

• How expected future income and aggregate wealth

affect consumer spending

• The determinants of investment spending

• Why investment spending is considered a leading

indicator of the future state of the economy

In 2009, US government

spent $787 billion in a

“stimulus package” through

the American Recovery and

Reinvestment Act of 2009.

Why did the US

Government want to do

this? Did it work?

Gross Pay: Income before

taxes

Net Pay: After deductions

Disposable Income: Income

after all fixed expenses are

paid.

Marg

inal

Single Taxable

Tax

Income

Rate[

18]

Married Filing

Jointly or

Qualified

Widow(er)

Taxable Income

Married Filing

Separately

Taxable Income

Head of

Household

Taxable Income

10%

$0 – $9,225

$0 – $18,450

$0 – $9,225

$0 – $13,150

15%

$9,226 –

$37,450

$18,451 –

$74,900

$9,226 –

$37,450

$13,151 –

$50,200

25%

$37,451 –

$90,750

$74,901 –

$151,200

$37,451 –

$75,600

$50,201 –

$129,600

28%

$90,751 –

$189,300

$151,201 –

$230,450

$75,601 –

$115,225

$129,601 –

$209,850

33%

$189,301 –

$411,500

$230,451 –

$411,500

$115,226 –

$205,750

$209,851 –

$411,500

35%

$411,501 –

$413,200

$411,501 –

$464,850

$205,751 –

$232,425

$411,501 –

$439,000

39.6

%

$413,201+

$464,851+

$232,426+

$439,001

Marginal Propensity (tendency) to Consume

(MPC)

•How much people consume rather than save when

there is an change in income.

•It is always expressed as a fraction (decimal).

MPC=

Change in Consumer Spending

Change in Disposable Income

Examples:

1. If you received $100 and spent $50.

2. If you received $100 and spent $80.

3. If you received $100 and spent $100.

10

Marginal Propensity to Save (MPS)

•How much people save rather than consume when

there is an change in income.

•It is always expressed as a fraction (decimal)

MPS=

Change in Saving

Change in Disposable Income

Examples:

1. If you received $100 and save $50.

2. If you received $100 your MPC is .7 what is

your MPS?

11

MPS = 1 - MPC

Why is this true?

Because people can either save or consume

12

Autonomous Change in Aggregate Spending

• This is the initial change in aggregate spending

before real GDP rises. It is the cause, not the

result, of the chain reaction.

• The multiplier is the ratio of the total change

in real GDP caused by AAS.

Multiplier = change in real GDP

change in AAS

Yd= 0 and people consume=autonomous

consumption

The size of the multiplier will depend on the MPC.

The higher the MPC the higher the multiplier.

{In other words, the more money spent the greater

the impact the multiplier will have}

How is Spending “Multiplied”?

Assume the MPC is .5 for everyone

•Assume that when the Super Bowl comes to town

there is an increase of $100 in Ashley’s restaurant.

•Ashley now has $100 more income.

•She saves $50 and spends $50 at Carl’s Salon

•Carl now has $50 more income

•He saves $25 and spends $25 at Dan’s fruit stand

•Dan now has $25 more income.

This continues until every penny is spent or saved

Change in

GDP

= Multiplier x

Initial Change

in Spending

15

If the MPC is .5 how much is the multiplier?

1

1

Simple

or 1 - MPC

MPS

Multiplier

=

•If the multiplier is 4, how much will an initial

increase of $5 in Government spending increase

the GDP?

•How much will a decrease of $3 in spending

decrease GDP?

Change in

GDP

= Multiplier x

initial change

in spending

16

The Multiplier Effect

Practice calculating the spending multiplier

1

1

Simple

or 1 - MPC

MPS

Multiplier

1. If MPC is .9, what is multiplier?

2. If MPC is .8, what is multiplier?

3. If MPC is .5, and consumption increased $2M.

How much will GDP increase?

4. If MPC is 0 and investment increases $2M.

How much will GDP increase?

=

Conclusion: As the Marginal Propensity to

Consume falls, the Multiplier Effect is less

17

Warm Up: Why do you think

the MPC is higher in poorer

countries compared to richer

countries?

Current Events: Housing Market

Bubble

What

determines

how much

consumers

spend?

Consumption Function:

equation showing how

household’s consumer spending

varies with the household’s

current disposable income.

c= a + MPC x y d

c= individual household

consumer spending

a= individual

autonomous consumer

spending (how much

individual household

would spend if no

disposable income)

yd = disposable income

Aggregate Consumption

Function:

C = A + MPC x YD

Two factors can change Aggregate Consumption Function

• 1. Changes in expected future disposable

income

– (higher expected future income tends to lead to

lower savings today…this is known as the

permanent income hypothesis)

• 2. Changes in aggregate wealth

– (wealth has an effect on consumer spending

and consumers generally plan their spending

over their lifetime and not just based on

current disposable income…the life-cycle

hypothesis).

Answer these questions in your

notebook as we listen to the broadcast:

• Why do we want people to spend versus

save?

• What are some problems that she cites?

• Why are they nervous about

investment?

• As an economist, what would you advise

the Federal Reserve?

http://www.cnn.com/videos/business/2015/09/17/fed-underthe-hood-lake-pkg.cnn

• Do you understand Monetary Policy?

• Now might be a good time to start reading

articles on what monetary policy does.

• Take a listen to video at the top of the page.

Summarize what you learn.

Investment Spending

• Planned Investment is

what firms intend to

undertake in a given

period but it will depend

on three (3) factors:

• 1- interest rates

• 2-expected future GDP

• 3- current level of

production capacity

Interest Rates

• If a firm predicts high interest rates,

then they will invest less and vice

versa

= a negative relationship between

interest rates and investment

Investment Spending

Expected return on the

investment=expected economic profit from

the factory= (total revenue minus total

cost)/investment cost.

Expected future REAL GDP

• If firms predict a rise in GDP, they are more

likely to invest and vice versa

• ….only if production capacity is taken into

account: the maximum they can produce and

how close to it are they?

Perfect Storm

Production is

near

capacity and

expectations

of strong

real GDP in

the future

Inventories

• Firms that increase inventories are engaging in

a form of investment spending. Higher than

anticipated inventories due to a unplanned

decrease in sales is known as unplanned

inventory investment.

• Rising inventories typically indicates a slowing

economy and falling inventories usually

indicates a growing economy since sales are

better than what was forecast.

Actual Investment Spending

= the sum of planned

investment and unplanned

inventory investment

Investment (I) = I unplanned + I

planned

The Tax Multiplier

•

•

•

•

•

•

•

•

Recipients of a tax decrease treat it as an increase in disposable income.

A typical household increases consumption by a factor of the MPC and increases

savings by a factor of the MPS.

Keep in mind that less than a 100% of this increase in disposable income circulates

through the economy- WHY? Because most households save a proportion of it.

Example: If the MPC is equal to .90 and the govt. transfers back tax revenue to

consumers by sending each taxpayer a $200 check. With an MPC =.90, (.9 x 200) =

$180 is consumed and $20 is saved. The multiplier kicks in, but not on the entire

$200.

Only on the consumed portion of the $180. The multiplier is 1/.10 = 10, GDP

increases by $1800.

Summary: A $200 change in tax policy ( tax rebate in this example) caused an

$1800 change in real GDP. This tax multiplier of 9 measures the magnitude of the

multiplier process when there is a change in taxes.

The tax multiplier is found by : Tm= is (∆GDP)/(∆ taxes)

Tm= MPC*M= MPC/MPS

Be prepared to respond to a free-response question

that asks you to explain why the tax multiplier is

smaller than the spending multiplier

• With an MPC =.90 the spending multiplier is 10, so why is the

tax multiplier Tm smaller?

• The Spending multiplier begins to work as soon as there is a

change in autonomous spending (C,I, G, Xn) but the tax

multiplier but first go through a person’s consumption

function as disposable income.

• In our $200 example some of the injected dollars are leakages

in the form of savings.

• Therefore the final multiplier effect is smaller.

• Tm= MPC*(Spending multiplier)= .90 * (1/.10)= 9 in our

example.

Example #2

• The MPC =.80 and the government decides to impose a $50

increase in taxes.

• Tm=.80*Multiplier =.80 *(1/.20 = 4

• B/cause the tax multiplier is equal to 4 we determine that

GDP falls by $200. 50 x 4= 200.

• Taxes were increases-disposable income falls, consumption

falls, causing GDP to fall, in this case by a factor of 4.

Balanced Budget Multiplier

•

•

•

•

•

•

•

•

•

•

•

The government collects and spends tax revenue

IF the dollars spent equals the dollars collected the budget is balanced.

The spending and tax multipliers are different

Here’s an example of the balanced-budget multiplier

The govt wants to spend $100 on a federal program and pay for it by

collecting $100 in additional taxes.

The MPC = .9 in this case.

Spending multiplier= 10 implies that $100 of new spending (G) creates a

$1000 increase in real GDP.

Taxation effect: The Tm=.9 implies that a $100 increase in taxes decreases

real GDP by $900.

Balanced budget effect: Change in real GDP= $1000 -$900 = +100

So, a $100 increase in spending, financed by a $100 increase in taxes,

created only $100 in new GDP. The balanced-budget multiplier is always

equal to one, regardless of the MPC.

Balanced-Budget Multiplier =1

Warm Up

Do you like to be judged

on one action or your

overall actions? Why?

Current Events

Eyes Turn To The Fed As Unemployment Rate

Falls To 5-Year Low

December 06, 2013 8:40 AM

The nation's unemployment rate dropped to

7 percent — the lowest mark in five years —

and employers added 203,000 jobs to payrolls

last month, the Bureau of Labor Statistics

Friday.

The latest data could build anticipation that

the Federal Reserve might taper its stimulus

program.

Current Events

• Unemployment Article

• http://blogs.wsj.com/briefly/2015/11/06/octo

ber-jobs-report-the-numbers-2/

You are an economic advisor to Congress

After reading the article, create a proposal for what

the government should do in regards to

unemployment benefits.

include the positives and negatives for

extending/cutting the benefits.

include what you think will happen to the MPC

and MPS for people who are unemployed and

people who are afraid they may be unemployed in

the near future.

Predict what you think will happen to aggregate

supply and demand as well (this is what we are

learning about today)

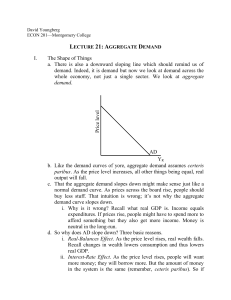

Aggregate Demand: Module 17

When we use aggregates

we combine all prices and all quantities.

Aggregate Demand is all the goods and services (real

GDP) that buyers are willing and able to purchase at

different price levels.

There is an inverse relationship between

price level and Real GDP.

If the price level:

•Increases (Inflation), then real GDP demanded falls.

•Decreases (deflation), the real GDP demanded increases.

44

This is Simple Demand

This is Aggregate Demand

46

Demand and Supply Review

1. Define the Law of Demand.

2. Explain why demand is downward

sloping.

3. Identify the difference between a

change in demand and a change in

quantity demanded.

4. Define the Law of Supply.

5. Why is supply upward sloping?

47

Answers to Review

Define the Law of Demand.

Higher price equals less demand

Explain why demand is downward sloping.

Lower price equals greater quantity demanded

Identify the difference between change in

demand and change in quantity demanded.

Shift in curve vs. movement along the curve

Define the Law of Supply.

P and Q are positively related

Why is supply upward sloping?

higher price equals greater quantity supplied

48

Aggregate Demand Curve

Price

Level

AD is the demand by consumers,

businesses, government, and

foreign countries

Changes in price level cause a

move along the curve not a

shift of the curve

AD = C + I + G + Xn

Real domestic output (GDPR)

49

Aggregate Demand

• The aggregate demand curve shows the

output of goods and services (real GDP)

demanded at different price levels. The

aggregate demand curve slopes down due to:

–The wealth effect

–The interest rate effect

2 Reasons Why is AD downward sloping

1. Wealth Effect

• Higher prices reduce purchasing power of $

• This decreases the quantity of expenditures

• Lower price levels increase purchasing power

and increase expenditures

Example:

• If the balance in your bank was $50,000, but inflation

erodes your purchasing power, you will likely reduce

your spending.

• So…Price Level goes up, GDP demanded goes down.

51

2. Interest-Rate Effect

• As price level increases, lenders need to

charge higher interest rates to get a REAL

return on their loans.

• Higher interest rates discourage consumer

spending and business investment.

• Ex: Increase in prices leads to an increase in the

interest rate from 5% to 25%. You are less likely to

take out loans to improve your business.

• Result…Price Level goes up, GDP demanded goes

down (and Vice Versa).

52

Higher Inflation brings higher interest rates

53

Agenda

• Warm up

• Current Events

• Brief Notes

• Shifting Graphs

• Practice

• Aggregate Supply-Long and short run notes

Homework: Module 18 in SG

How does this cartoon relate to Aggregate Demand?

55

Shifts of the Aggregate Demand

Curve

• ∆C, ∆I, ∆G, ∆X - ∆M

•∆Expectations

•∆Wealth

•∆Existing Stock of

Capital

•∆Fiscal Policy

•∆Monetary Policy

GDP= C+ I+ G+(X-M)

• GDP = private consumption + gross

investment + government spending +

(exports − imports),

How the Government Stabilizes the Economy

The Government

has two different

tool boxes it can

use:

1. Fiscal PolicyActions by Congress &

the President

OR

2. Monetary PolicyActions by the

Federal Reserve

Bank (aka Central

Bank actions)

58

Fiscal Policy Changes to AD Curve

• Direct: The Government’s purchases of final

goods and services.

• Indirect: A change in either tax rates or

transfers to households.

Monetary Policy Changes to AD Curve

• Federal Reserve Bank’s change in the

quantity of money or interest rates will shift

the curve.

• Increasing the quantity of money shifts the

AD curve to the right

• Reducing the quantity of money supply will

shift the AD curve to the left.

• If one of these components of

aggregate spending changes, the

aggregate demand curve will shift.

–A rightward shift of the curve is an

increase in aggregate demand.

–A leftward shift of the curve is a

decrease in aggregate demand.

From Khan: https://www.khanacademy.org/economics-financedomain/macroeconomics/aggregate-supply-demand-topic/aggregate-supplydemand-tut/v/shifts-in-aggregate-demand

Acronym?-turn and talk to your

partner to create an acronym for our

shifters:

Wealth, expectations, existing

physical capital, fiscal and monetary.

Write down your suggestion on the

flashcard

Aggregate Price Level (P)

Shifts in Aggregate Demand

A shift of aggregate demand

to the right means that

more real output will

be demanded at each

price level. If AD shifts

left, less real output

is demanded at

each price level.

P0

AD1

AD2

Q2

Q0

Output (Q)

AD0

Q1

An increase in spending shifts AD right, a decrease in

spending shifts AD left

Price

Level

AD1

AD2

Real domestic output (GDPR)

65

How does this cartoon relate to Aggregate Demand?

66

How does this cartoon relate to Aggregate Demand?

67

Review:

Determine the effect on aggregate demand of each of the

following events. Explain whether it represents a movement along

the aggregate demand curve (up or down) or a shift of the curve

(leftward or rightward). Then, in a correctly labeled graph, show

how each of the following will affect the AD curve.

a. Business owners are less optimistic about the health of the

economy.

b. The government decreases welfare and veteran’s benefits.

c. The Federal Reserve increases interest rates.

d. A rising price level decreases the value of money held for

purchases.

e. The government lowers personal income taxes.

f. Consumers expect the job market to be much stronger in the

next few months.

g. The stock market has reached new records high levels of value.

h. The stock of physical capital has been falling for nearly a year.

a. Leftward shift in AD (a decrease in AD). Weak business optimism will

decrease business spending and capital investment.

b. Leftward shift in AD. Less government spending on these transfer payments

means less income received by those who qualify for them, thus less

consumer spending.

c. Leftward shift in AD. Higher interest rates decrease borrowing for both

capital investment and large consumer spending.

d. Upward movement along the AD curve. The rising price level will reduce

spending because each dollar held by households and firms is worth less than

it used to be.

e. Rightward shift in AD. Lower taxes put more income in the hands of

consumers so consumer spending rises.

f. Rightward shift in AD. Stronger consumer optimism will increase consumer

spending.

g. Rightward shift in AD. Higher value of household wealth causes consumer

spending to rise

h. Leftward shift in AD. A. lower level of physical capital is an indicator that

investment spending has fallen.

1. Change in Consumer Spending

Consumer Wealth (Boom in the stock market…)

Consumer Expectations (People fear a recession…)

Household Indebtedness (More consumer debt…)

Taxes (Decrease in income taxes…)

2. Change in Investment Spending

Real Interest Rates (Price of borrowing $)

(If interest rates increase…)

(If interest rates decrease…)

Future Business Expectations (High expectations…)

Productivity and Technology (New robots…)

Business Taxes (Higher corporate taxes means…)

71

3. Change in Government Spending

(War…)

(Nationalized Heath Care…)

(Decrease in defense spending…)

4. Change in Net Exports (X-M)

Exchange Rates

(If the us dollar depreciates relative to the euro…)

National Income Compared to Abroad

(If a major importer has a recession…)

(If the US has a recession…)

“If the US get a cold, Canada gets Pneumonia”

AD = GDP = C + I + G + Xn

72

Current Events

• http://www.npr.org/2013/12/17/251796694/

year-in-numbers-the-federal-reserves-85billion-question

Warm Up: What do you

think the Consumer

Confidence Index

measures? Why? How

does this tie into

aggregate demand?

Agenda:

Warm Up

Graphing Shifters

Practice Graphing

Current Events:

http://www.bbc.co.uk/news/busin

ess-25299683

http://www.bbc.co.uk/news/busin

ess-25440142

http://www.bbc.co.uk/news/busin

ess-25415501

Aggregate Supply: Module 18

The amount of goods and services (real GDP) that

firms produce in an economy at different price

levels.

Aggregate Supply differentiates between short run

and long-run and has two different curves.

Short-run Aggregate Supply

•Wages and Resource Prices will not increase as

price levels increase.

Long-run Aggregate Supply

•Wages and Resource Prices will increase as price

levels increase.

77

This is Supply

This is Aggregate Supply

79

Short-Run Aggregate Supply

In the Short Run, wages and resource prices will NOT

increase as price levels increase.

Example:

• If a firm currently makes 100 units that are sold for

$1 each and the only cost is $80 of labor how much is

profit?

• Profit = $100 - $80 = $20

What happens in the SHORT-RUN if price level doubles?

• Now 100 units sell for $2 so total return=$200.

How much is profit?

• Profit = $120

With higher profits, the firm has the incentive to

increase production.

80

The SRAS curve is upward sloping..

But why?

If the price of a unit of output is rising faster

than the cost of producing that unit, that unit

of output will be produced.

(some input prices are “sticky” meaning they

don’t rise of fall very quickly in response to a

change in demand for them.)

Aggregate Supply Curve

Price

Level

AS

AS is the production

of all the firms in

the economy

Real domestic output (GDPR)

82

The Shifters for Aggregate Supply can

be remembered as

I. R. A. P.

Shifts in Aggregate Supply

An increase or decrease in national production can shift

the curve right or left

Price

AS2 AS

Level

AS1

Real domestic output (GDPR)

84

Graph Shifters:

1.Commodity Prices:

standardized input bought

and sold in bulk quantities

2. Nominal Wages

3. Productivity:

increasing/decreasing output

Long-Run Aggregate Supply

In the Long Run, wages and resource prices

WILL increase as price levels increase.

Same Example:

• The firm has TR of $100 an uses $80 of labor.

• Profit = $20.

What happens in the LONG-RUN if price level doubles?

• Now Total Revenue=$200

•In the LONG RUN workers demand higher wages to

match prices. So labor costs double to $160

• Profit = $40, but REAL profit is unchanged.

If REAL profit doesn’t change

the firm has no incentive to increase output.

87

Long run Aggregate Supply

In Long Run, price level increases but GDP doesn’t

Price level

LRAS

Long-run

Aggregate

Supply

Full-Employment

(Trend Line)

QY or Yp

GDPR

Assume that in the long run the economy will be

producing at full employment.

89

Potential Output: the level

of Real GDP the economy

would produce if all prices,

including nominal wages,

were fully flexible

Given this, which way do you think

our long run aggregate supply curve

has been shifting?

Practice-CPTS!

a. Leftward shift in SRAS. This disruption would act as a short-term

decrease in a nation’s technology and hinder the nation’s ability to

produce goods and services.

b. Leftward shift in SRAS. When the price of a commodity such as

grain rises, it will increase production costs for many goods and

services; shifting SRAS to the left.

c. Rightward shift in SRAS. A population with higher levels of

education translates into a more productive workforce that is able

to produce more goods and services.

d. Downward movement along the SRAS curve. The SRAS curve is

upward sloping so that, all else equal, a lower aggregate price level

will reduce the level of GDP supplied.

e. Leftward shift in SRAS. Labor is a key resource in the production

of most goods and services so if labor is becoming more

expensive, the SRAS will shift to the left.

Module 19: Putting AD and AS together to

get Equilibrium Price Level and Output

93

How does this cartoon relate to Aggregate Demand?

94

Aggregate Price Level

• Macroeconomic equilibrium occurs at the

intersection of aggregate demand and

short-run aggregate supply.

LRAS

SRAS

AD

It can also happen that this

occurs at the long-run

equilibrium point, but not

necessarily.

Aggregate Output

• As we have learned a Demand Shock can

effect equilibrium:

– Great Depression

– Housing Market crash of 2007-2008

Shocks cause a shift in the Aggregate Demand

or Supply and can also lead

Recessionary Gaps or

Inflationary Gaps or

Stagflation

Shifters of Aggregate Demand

AD = C + I + G + X

Change in Consumer Spending

Change in Government Spending

Change in Investment Spending

Net EXport Spending

Shifters of Aggregate Supply

AS = I + R + A + P

Change in Inflationary Expectations

Change in

Change in

Change in

Resource Prices

Actions of the Government

Productivity (Investment)

97

Answer and identify shifter:

C.I.G.X or

R.A.P

B

A

D

A

D

B

A

A

C

A

A major increase in productivity.

98

Inflationary Gap

Output is high and unemployment is less than NRU

Price

Level

LRAS

AS

Actual GDP

above potential

GDP

PL1

AD1

QY Q1

GDPR

99

Recessionary Gap

Output low and unemployment is more than NRU

Price

Level

LRAS

AS1

Actual GDP

below potential

GDP

PL1

AD

Q1 QY

GDPR

100

Assume the price of oil increases drastically.

What happens to PL and Output?

Price

Level

LRAS

AS1

AS

PL1

Stagflation

PLe

Stagnate Economy

+ Inflation

AD

Q1 QY

GDPR

101

Assume the government increases spending.

What happens to PL and Output?

Price

Level

LRAS

AS

PL and Q will

Increase

PL1

PLe

AD

QY Q1

GDPR

AD1

102

Assume consumers increase spending. What

happens to PL and Output?

Price

Level

LRAS

AS

PL1

PLe

AD

QY Q1

GDPR

AD1

103

Now, what will happen in the LONG RUN?

Inflation means workers seek higher wages and

production costs increase

LRAS AS1

Price

AS

Level

PL2

Back to full

employment with

higher price level

PL1

PLe

AD

QY Q1

GDPR

AD1

104

Negative and Positive Aggregate Demand Shocks

Another Example

Negative and Positive Supply Shocks

Another Example

Long Term Equilibrium

• To summarize how an economy responds to

recessions/inflation we focus on Output Gap

which is the % difference between actual

aggregate output and potential output.

Actual Aggregate Output-Potential Output x 100

Potential Output

In the Long Run the economy is self-correcting but many

times Governments are not willing to wait that long which

brings about Macroeconomic Policy (Module 20)

Short-Run Versus Long-Run Effects of a Positive Demand Shock and a return to Equilibrium via selfcorrecting economy.

MODULE 20

Classical

vs.

Keynesian

Adam Smith

1723-1790

Economic Theory

John Maynard Keynes

109

1883-1946

110

Debates Over Aggregate Supply

Classical Theory

1. A change in AD will not change output even in the short run

because prices of resources (wages) are very flexible.

2. AS is vertical so AD can’t increase without causing inflation.

Price

level

AS

Recessions caused by a fall in AD are

temporary.

Price level will fall and economy will fix

itself.

No Government Involvement Required

AD

AD1

Qf

Real domestic output, GDP

111

Debates Over Aggregate Supply

Keynesian Theory

1. A decrease in AD will lead to a persistent recession because

prices of resources (wages) are NOT flexible.

2. Increase in AD during a recession puts no pressure on prices

AS

Price

level

AD1

“Sticky Wages” prevents wages to

fall.

The government should increase

spending to close the gap

AD

Q1

Qf

Real domestic output, GDP

112

Debates Over Aggregate Supply

Keynesian Theory

1. A decrease in AD will lead to a persistent recession because

prices of resources (wages) are NOT flexible.

2. Increase in AD during a recession puts no pressure on prices

AS

Price

level

AD1

When there is high

unemployment, an increase in AD

doesn’t lead to higher prices until

you get close to full employment

AD3

AD2

Q1

Qf

Real domestic output, GDP

113

The Ratchet Effect

A ratchet (socket wrench)

permits one to crank a

tool forward but not backward.

Like a ratchet, prices can easily move up

but not down!

114

Deflation (falling prices) does not often happen

•If prices fall, the cost of resources must fall or

firms would go out of business.

•The cost of resources (especially labor) rarely fall

because:

•Labor Contracts (Unions)

•Wage decrease results in poor worker morale.

•Firms must pay to change prices (ex: re-pricing

items in inventory, advertising new prices to

consumers, etc.)

115

Module 21:

Fiscal Policy & The Multiplier

116

The Car Analogy

The economy is like a car…

• You can drive 120mph but not for long.

(Extremely Low unemployment)

• Driving 20mph is too slow. The car can easily go faster.

(high unemployment)

• 70mph is sustainable. (Full employment)

• Some cars have the capacity to drive faster then others.

(industrial nations vs. 3rd world nations)

• If the engine (technology) or the gas mileage

(productivity) increase then the car can drive at even

higher speeds. (Increase LRAS)

The government’s job is to brake or speed up when needed

as well as promote things that will improve the engine.

118

(Shift the PPC outward)

Two Types of Fiscal Policy

Discretionary Fiscal Policy• Congress creates a law designed to change AD

through government spending or taxation.

•Problem is time lags due to bureaucracy.

•Takes time for Congress to act.

•Ex: In a recession, Congress increases spending.

Non-Discretionary Fiscal Policy

•AKA: Automatic Stabilizers

•Permanent spending or tax laws enacted to counter

cyclical problem to stabilize the economy

•Ex: Welfare, Unemployment, Min. Wage, etc.

•When there is high unemployment, unemployment

benefits to citizens increase consumer spending.

119

Contractionary Fiscal Policy

(The BRAKE)

Laws that reduce inflation, decrease GDP

Either Decrease Government Spending or Enact

Tax Increases

• Combinations of the Two

Expansionary Fiscal Policy

(The GAS)

Laws that reduce unemployment and increase GDP

• Increase Government Spending or Decrease Taxes

on consumers

• Combinations of the Two

How much should the Government Spend?

120

Example of Expansionary Fiscal Policy

• increase G

• decrease T

• increase transfers

Expansionary Policy: The Stimulus Package

Example of Contractionary Fiscal Policy

• decrease G

• increase T

• decrease transfers

The Multiplier Effect

Spending

Multiplier

OR

As the Marginal Propensity to Consume falls, the

Multiplier Effect becomes less effective

124

Effects of Government Spending

If the government spends $5 Million, will AD

increase by the same amount?

• No, AD will increase even more as spending

becomes income for consumers.

• Consumers will take that money and spend, thus

increasing AD.

How much will AD increase?

• It depends on how much of the new income

consumers save.

• If they save a lot, spending and AD will increase

less.

• If they save a little, spending and AD will be

increase a lot.

125

Problems With

Fiscal Policy

126

Explain this cartoon About Fiscal Policy

2003

127

Who ultimately pays for excessive

government spending?

128

Practice Problem to Draw

Congress uses discretionary fiscal policy to the

manipulate the following economy (MPC = .9)

LRAS

Price level

AS

P2

AD1

1. What type of gap?

2. Contractionary or

Expansionary needed?

3. What are two options

to fix the gap?

4. How much needed to

close gap?

AD

-$5 Billion

$50FE $100

Real GDP (billions)

129

Practice Problem to Draw

Congress uses discretionary fiscal policy to the

manipulate the following economy (MPC = .8)

LRAS

Price level

AS

P1

AD2

$800

1. What type of gap?

2. Contractionary or

Expansionary needed?

3. What are two options

to fix the gap?

4. How much initial

government spending

is needed to close gap?

AD1

+$40 Billion

$1000FE

Real GDP (billions)

130

Price level

• What type of gap and what type of policy is best?

• What should the government do to spending? Why?

• How much should the government spend?

LRAS

AS

The government should increasing

spending which would increase

AD

They should NOT spend 100

billion!!!!!!!!!!

If they spend 100 billion, AD would

look like this:

WHY?

P1

AD2

AD1

$400 $500

FE

Real GDP (billions)

131

Answers to Practice FRQ

132