ACS2013

advertisement

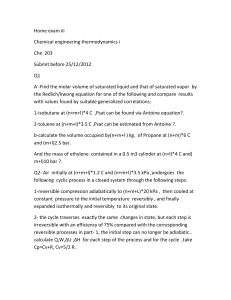

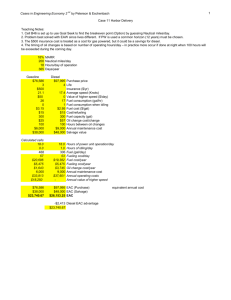

Shale gas conversion: Processing and economics Gennaro J Maffia, gennaro.maffia@manhattan.edu, Alex Bertuccio. Chemical Engineering, Manhattan College, Riverdale, NY, NY 10471, United States With the discovery of vast quantities of natural gas available in various shale formations in Pennsylvania, New York and several adjoining states comes the opportunity to convert this gas, traditionally used for fuel, into more value added products. The methane fraction can be converted into intermediates such as ethylene via oxidative coupling, whereas the ethane/propane fraction can be converted into ethylene via conventional steam pyrolysis. In this paper the processing requirements of a variety of technologies starting with methane and E/P mixes will be presented along with the expected material and energy balances and production economics. Prof. Gennaro J. Maffia “Jerry” Often called a fracking engineer; or words to that effect Jerry Maffia – background 1. Professor of Chemical Engineering – Manhattan College 2. Manager of Technology Development – ARCO a. Petrochemical & Refining b. Start-up & Technical Services gennaro.maffia@manhattan.edu http://home.manhattan.edu/~gennaro.maffia/ACS2013.pptx Jerry Maffia – some projects Energy Related Projects a. Alaskan Pipeline and Remote Gas b. Fuel Oxygenates c. Biofuels/Bioseparations d. Energy Integration e. Novel Separations f. Manufacture of Proppants Shale Gas – an opportunity • One point of view “The outlook for advantaged U.S. natural gas was a significant factor in Dow’s decision to invest $4 billion to grow our overall ethylene and propylene production capabilities in the U.S. Gulf Coast region,” said Jim Fitterling, Dow Executive Vice President and President of Feedstocks & Energy and Corporate Development. “Today, 70 percent of the Company’s global ethylene assets are in regions with cost advantaged feedstocks – and we’ve seen the benefits this advantage provides given oil-based naphtha margin pressure in Europe and Asia. This plan represents a game-changing move to strengthen the competitiveness of our high-margin, high-growth derivatives businesses as we continue to capture growth in the Americas.” Economic Impact A World Scale Petrochemical Plant In Pittsburgh .....are you crazy professor? Maybe, but ............... Shale Gas – a curse • Another point of view Shale Gas – a textbook • Call a professor Mining Natural Gas – Wiley Text (work in progress) Table of Contents Chapter Chapter Chapter Chapter Chapter Chapter Chapter Chapter Chapter Chapter Chapter Chapter Chapter Chapter Chapter 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Worldwide energy picture Current domestic energy situation and opportunities Worldwide carbon dioxide balance – current and anticipated Review of basic fluid flow Overview of hydraulic fracturing – all issues Two phase flow and flow through porous media Fluidization, sedimentation and suspension of proppants Details of the hydraulic fracturing process Composition of fracturing fluids – current and alternatives Alternative fracturing methods and fluids Environmental issues and safety concerns Economic evaluation Societal impact and safety concerns Sustainability issues Future expectations What is all the fuss about ......... Mining Methodology….... hydraulic fracturing ……….how? drill a vertical well extend the drilling horizontally case the well perforate the casing pump in high pressure water and sand to fracture the shale at the perforations recover/dispose of the water cap the well bore send gas to treatment treated gas to interstate pipeline system Hey Jerry what’s the story? Hey Professor, would it help if we didn’t use water? Dry Frac Atmospheric CO2 – approaching 400 ppm Flue Gas CO2 – much higher, depends on EA Light HCs The FracKINGS Design Group Morgan, Jimmy, Amanda, Amanda Drexel University Senior Project Team – Using CO2 as a Fracking Fluid Amanda, Amanda Prof. M. and the FracKINGS 12 10 USD per thousand CF 8 6 4 2 0 0 50 100 150 200 250 Month from April 1976 300 350 400 450 500 SOME HEADLINES......... Regulations and Current Policy May 2012 News Safe Drinking Water Act Several statutes may be leveraged to protect water quality, but EPA's central authority to protect drinking water is drawn from the Safe Drinking Water Act (SDWA). The protection of USDWs is focused in the Underground Injection Control (UIC) program, which regulates the subsurface emplacement of fluid. Congress provided for exclusions to UIC authority (SDWA § 1421(d)), however, with the most recent language added via the Energy Policy Act of 2005: May 2012 News "The term 'underground injection' – (A) means the subsurface emplacement of fluids by well injection; and (B) excludes – (i) the underground injection of natural gas for purposes of storage; and (ii) the underground injection of fluids or propping agents (other than diesel fuels) pursuant to hydraulic fracturing operations related to oil, gas, or geothermal production activities." While the SDWA specifically excludes hydraulic fracturing from UIC regulation under SDWA § 1421 (d)(1), the use of diesel fuel during hydraulic fracturing is still regulated by the UIC program. May 2012 News State oil and gas agencies may have additional regulations for hydraulic fracturing. In addition, states or EPA have authority under the Clean Water Act to regulate discharge of produced waters from hydraulic fracturing operations. Clean Water Act Disposal of flowback into surface waters of the United States is regulated by the National Pollutant Discharge Elimination System (NPDES) permit program. The Clean Water Act authorizes the NPDES program. Topics • • • • • • Current Ethylene Business Environment ODH and Competing Cases – Processing Economics Preliminary Reactor Design CO2 Sequestration and Management ODH Upside Potential – Energy Upgrade Ethylene Business Background • Current Cracking Strategy • Feedstocks and Leveraging Issues Ethylene Producers • Domestic • North America • World-wide US Producers Petral Information • Raw data – play it straight Implications: In the US, with its advantaged natural gas–based feedstock, cash margins in the next cycle should be 2.4x the average of the past 20 years. Dow and LyondellBasell should be the main beneficiaries. Asian utilization rates are set to tighten the most from current low levels. In Asia/Middle East, we prefer companies with exposure to gas-based feedstocks such as PTT Chemicals and SABIC. Europe should remain structurally weak due to low demand, high feedstock costs, and proximity to potential Middle East imports. Definitions VC = RMC + Utilities FC = LC + MC + OVHD + Other CC = FC + VC RNB = FC + VC + CR The US and Europe Have Driven Ethylene Demand From 1990 to 2000, global ethylene demand growth averaged 5.0%, or 1.9x global GDP growth. However, from 2000 to 2009, it averaged just 2.5%, or 0.9x global GDP growth. The US and Europe Have Driven Ethylene Demand From 1990 to 2000, global ethylene demand growth averaged 5.0%, or 1.9x global GDP growth. However, from 2000 to 2009, it averaged just 2.5%, or 0.9x global GDP growth. The ethane to ethylene program is an offshoot from another related TDC program which involves alternatives routes to styrene starting from ethane as one of the components in the feed. The new reaction concept of ethane to ethylene is a controlled catalytic oxydehydrogenation (ODH) process at low temperature. This process undergoes no reaction in the absence of the catalyst till a temperature of 400 C . This new process provides an alternative to ethylene production compared to naphtha or ethane cracker. The main driver for this program is that the process has several potential applications including an alternative to present day ethane cracker, replacement of recycle cracker and the possibility of feed for EB/SM and EO plants. C2H6 + ½ O2 C2H4 + H2O + Heat The process operates at low temperature (< 400 oC) and dry run experiments have proven that there are no reactions without the catalyst. To date many ethane ODH processes do exist in literature and sufficient research efforts have also been given in this regard, but none of them have yet been commercialized The catalyst is capable of maintaining high ethane reaction rate, high ethylene selectivity and self stability. Several phases of improvement have been carried out with the catalyst and the results have also been promising when compared with an ethane pyrolysis furnace. 100 TDC DATA: 10 mol% ethane + 8 mol% oxygen + 10 mol% water + 72 mol% nitrogen % C2= Selectivity 95 90 85 Best Literature data (2005 ODH) : 9 mol% ethane + 6 mol% oxygen + 85 mol% helium 80 75 70 30 40 50 60 % C2 Conversion 70 80 Pyrolysis cracker (commercial plants) : S/O = 0.3 Oxidative Dehydrogenation Study Cases Case 1: Case 2: Case 3: Case 4: Case 5: Air plus process water recycle Air plus nitrogen recycle Oxygen plus process water recycle Case 3 @ SP Conversion and High Selectivity Dow ATR ABB ODH Basis: 90 % conversion, 90% selectivity (Cases 1-3) CO/CO2 equimolar yield 0.08/0.1/0.82 = O2/C2/Carrier 450 C; 4 bar reactor inlet or as noted in sub-cases Case Specifics Case 1-HT 3-HT 3-MT 3-LT 3-MT-A 4-MT O2 source Recycle diluent Rx inlet P, barA Feed O2 mole% C2H6 mole% C2H6 % conv. % selectivity Effl mole% O2 Rx exit T, oC air H2O 4 8 10 90 90 1.2 450 O2 H2O 4 8 10 90 90 1.2 450 O2 H2O 4 8 10 90 90 1.2 425 O2 H2O 4 8 10 90 90 1.2 375 O2 H2O 4 8 10 90 90 1.2 425 O2 H2O 3 8 by calc. 70 95 1.2 425 Trim Rx yes yes yes yes no yes Case 1 N2 Purge/Sales Ethylene Compression Drying & N2 Removal Ethane Recycle CO2 Ethane Air ODH/Trim Quench Process Water Amine System Net Water Uses combination of N2/stm as diluent replaced by Case 3 (all stm) as the Base Case Case 2 Compression, Drying Purge and Recycle N2 recycle loop Ethylene N2 (net) CO2 Ethane Air ODH/Trim Quench water Amine System Ethane Recycle Not pursued further due to N2 loading Cases 3,4 Ethylene CO2 Ethane O2 ODH/Trim Compression & Drying Quench Process Water Amine System Net Water Case 3 Case 4 Ethane Recycle 90/90 70/95 Case 5 – Based on examples in Dow patent USP 6566573 E-1; looks like an OP EA/H2 CO2 Quench dryer Ethane RCTR CaO Steam compression water Fuel gas C2= Product C3s De-C2 De-C3 chilling train De-C1 DOW ATR Process C2 Fract Summary ( cents/lb C2H4) Case 1 2 3 3 - LT 4 5 6 7 ODH - air ODH - N2 ODH ODH ODH Dow SP - Hi H2 SP - Lo H2 CC high high 26.8 27.1 25.8 32.2 24.1 25.8 RNB (20%) high high 35 36.8 35.8 46.2 40 41.7 Cash Costs, US cts./lb Fuel Value conventional conventional $/1e6 BTU H2 chem H2 fuel 6 19 21.2 8 24.1 25.9 10 29.1 30.5 12 34.2 35.1 ODH Case 3 is breakeven CC with Conventional (H2 as fuel) CC for ODH will improve greatly with upgrade of low level heat rejection Cash Costs, US cts./lb Fuel Value conventional conventional Case 3 $/1e6 BTU H2 chem H2 f uel 1.2 ethane 6 19 21.2 20.8 8 24.1 25.9 26.2 10 29.1 30.5 31.6 12 34.2 35.1 37 ODH Case 3 is breakeven CC with Conventional (H2 as fuel) CC for ODH will improve greatly with upgrade of low level heat rejection Case 3 1.23 ethane 21.3 26.8 32.3 37.9 Required Netback, US cts./lb Cents per Pound Ethylene Fuel Value conventional conventional Case 3 $/1e6 BTU H2 chem H2 f uel 1.2 ethane 6 29.7 32 26.2 8 34.8 36 31.7 10 40 41.4 37.2 12 45.2 46.1 42.7 Much better capital and plant simplicity result in favorable RNBs for the ODH case Case 3 1.23 ethane 26.8 32.4 38.1 43.7 Reactor Heat Balance • Needs Significant Heat Rejection at a High Temperature – Similar to EO (Shell) or ACC Oxidative Coupling – Current research data puts reactor conditions on the threshold of the need for molten salt cooling Case 3 – 420 C coolant 490.000 470.000 temperature, C 450.000 430.000 410.000 390.000 370.000 350.000 0.000 1.000 2.000 3.000 length, m 4.000 5.000 6.000 Case 3 390 C Coolant 440.000 430.000 temperature, C 420.000 410.000 400.000 390.000 380.000 370.000 360.000 350.000 0.000 1.000 2.000 3.000 length, m 4.000 5.000 6.000 Case 3 390 C Coolant 0.120 Ethane, mol fraction 0.100 0.080 0.060 0.040 0.020 0.000 0.000 1.000 2.000 3.000 length, m 4.000 5.000 6.000 Case 3 390 C Coolant Basis Conversion Selectivity CO/CO2 Production Scale 3818 kg mol/h 90% 90% 1/1 2978.04 kg mol/h 1500.06 PPY 1.00 to 1.5 BPPY ethane <------------------------ kg mols/h ---------------------> S1 S2 S3 S4 S5 0.00 11492.18 11492.18 11492.18 11492.18 0.00 3054.40 477.25 0.00 0.00 0.00 0.00 3092.58 3002.44 3002.44 3818.00 0.00 381.80 371.79 371.79 0.00 0.00 343.62 0.00 0.00 0.00 0.00 343.62 887.53 887.53 0.00 19815.42 23938.86 24149.23 2127.01 0.00 0.00 0.00 0.00 0.00 3818.00 34362.00 40069.91 39903.17 17880.94 114540.00 776199.40 890739.40 890740.43 494340.40 Component N2 O2 C2H4 C2H6 CO CO2 H2O Abs. Oil Total MW 28 32 28 30 28 44 18 142 mol/h kg/h S6 11492.18 0.00 3002.44 371.79 0.00 0.00 2127.01 0.00 16993.41 455288.98 Component N2 O2 C2H4 C2H6 CO CO2 H2O Abs. Oil Total MW 28 32 28 30 28 44 18 142 mol/h kg/h <------------------------ kg mols/h ---------------------> S7 S8 S9 S10 S11 S12 11492.18 11492.18 11492.18 11492.18 11492.18 11492.18 0.00 0.00 0.00 0.00 0.00 0.00 3002.44 3002.44 3002.44 3002.44 3002.44 3002.44 371.79 371.79 371.79 371.79 371.79 371.79 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 1076.03 550.14 550.14 265.93 0.00 0.00 0 0 0 0 0 0 15942.43 15416.54 15416.54 15132.33 14866.40 14866.40 436371.323 426905.28 426905.279 421789.6 417002.838 417002.8381 Component N2 O2 C2H4 C2H6 CO CO2 H2O Abs. Oil Total MW 28 32 28 30 28 44 18 142 mol/h kg/h <------------------------ kg mols/h ---------------------> S13 S14 S15 S16 S17 10799.59 427971.84 0.00 0.00 692.59 0.00 0.00 0.00 0.00 0.00 11.34 114621.71 2978.04 2978.04 11.34 0.01 14194.76 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 10810.94 556788.30 2978.04 2978.04 703.92 302706.446 15618462 83385.12 83385.12 19709.8905 S18 0.00 0.00 0.00 371.87 0.00 0.00 0.00 0.00 371.87 11156.196 Basis Conversion Selectivity CO/CO2 Production Scale 100 90% 90% 1/1 78 39.29 38.18 Component MW N2 28 O2 32 C2H4 28 C2H6 30 CO 28 CO2 44 H2O 18 Total kg mol/h kg/h kg mol/h ethane kg mol/h PPY to 1.5 BPPY <------------------------ kg mols/h ---------------------> S1 S2 S3 S4 S5 S6 0.00 0.00 0.00 0.00 0.00 0.00 0.00 3040.00 0.00 3040.00 475.00 0.00 0.00 0.00 0.00 0.00 3078.00 2988.30 3800.00 0.00 0.00 3800.00 380.00 370.00 0.00 0.00 0.00 0.00 342.00 0.00 0.00 0.00 0.00 0.00 342.00 883.30 0.00 0.00 31160.00 31160.00 35264.00 35473.00 3800.00 3040.00 31160.00 38000.00 39881.00 39714.60 114000.00 97280.00 560880.00 772160.00 772160.00 Component MW N2 28 O2 32 C2H4 28 C2H6 30 CO 28 CO2 44 H2O 18 Total kg mol/h kg/h <------------------------ kg mols/h ---------------------> S7 S8 S9 S10 S11 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 2988.30 0.00 2988.30 2988.30 0.00 370.03 0.00 370.00 370.00 0.00 0.00 0.00 0.00 0.00 0.00 883.30 0.00 0.00 0.00 0.00 477.20 3836.00 1177.22 186.97 290.25 4718.83 3836.00 4535.52 3545.27 290.25 142228.1 69048 115962.4 98137.86 5224.5 Component MW N2 28 O2 32 C2H4 28 C2H6 30 CO 28 CO2 44 H2O 18 Total kg mol/h kg/h <------------------------ kg mols/h ---------------------> S13 S14 S15 S16 S17 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 2988.30 0.00 2988.30 2986.90 1.37 370.00 0.00 370.03 0.00 370.02 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 5.09 79.15 0.00 0.00 0.00 3363.39 79.15 3358.33 2986.90 371.39 94864.02 1424.7 94773.3 83633.2 11138.96 772151.60 S12 0.00 0.00 2988.30 370.00 0.00 0.00 186.97 3545.27 98137.86 water 69048 ethane 114000 oxygen 97280 CO2 38865.2 CASE 3 water 11,14,15 8589.96 ethylene 83633.2 ethane 11139 211280 211275.4 overall material balance ethane 1.229906 -1.229906305 oxygen 1.163174 -1.163174433 water 0.928315 0.928315071 ethane recycle ethylene 1 1 CO2 0.46471 0.464710187 -5.54804E-05 7 LEL O2/fuel 5.04 9.34 1.19 15.94 11.46 10.40 1.54 6.79 7.57 6.15 29.79 5.04 11.46 11.46 26.37 15.70 14.79 29.79 3.99 19.79 18.88 12.52 13.79 9.79 10.29 18.88 17.29 18.88 UEL O2/fuel 0.14 0.04 0.54 2.75 2.29 1.97 0.07 1.48 0.37 0.90 3.99 0.07 1.98 2.12 3.33 2.08 2.55 3.99 1.19 2.92 2.59 2.52 2.48 1.87 1.68 3.23 2.75 2.79 O2/C2 O2/C2 feed exit 0.8 0 (LEL/LFL) (UEL/UFL) (%) (%) Acetaldehyde 4 60 Acetylene 2.2 85 Ammonia 15 28 Benzene 1.3 7.1 Butane 1.8 8.4 Butylene 1.98 9.65 Carbon Monoxide 12 75 Ethane 3 12.4 Ethylene 2.7 36 Ethyl Alcohol 3.3 19 Fuel Oil No.1 0.7 5 Hydrogen 4 75 Isobutane 1.8 9.6 Isobutene 1.8 9 Isooctane 0.79 5.94 Isopentane 1.32 9.16 Gasoline 1.4 7.6 Kerosine 0.7 5 Methane 5 15 n-Heptane 1.05 6.7 n-Hexane 1.1 7.5 n-Pentene 1.65 7.7 Pentane 1.5 7.8 Propane 2.1 10.1 Propylene 2 11.1 Styrene 1.1 6.1 Toluene 1.2 7.1 p-Xylene 1.1 ODH Case 3 LEL fuel/O2 0.20 0.11 0.84 0.06 0.09 0.10 0.65 0.15 0.13 0.16 0.03 0.20 0.09 0.09 0.04 0.06 0.07 0.03 0.25 0.05 0.05 0.08 0.07 0.10 0.10 0.05 0.06 0.05 UEL fuel/O2 7.14 26.98 1.85 0.36 0.44 0.51 14.29 0.67 2.68 1.12 0.25 14.29 0.51 0.47 0.30 0.48 0.39 0.25 0.84 0.34 0.39 0.40 0.40 0.53 0.59 0.31 0.36 0.36 "Low er Explosive or Flam m able Lim it" "Upper Explosive or Flam m able Lim it" (LEL/LFL) (%) (UEL/UFL) (%) 1.8 8.4 Butylene 1.98 9.65 LEL UEL Fuel/O2 Fuel/O2 0.087285 0.436681 0.09619 0.508604 Ethane 3 12.4 0.147 0.674 Ethylene 2.7 36 Hydrogen 4 75 Isobutane 1.8 9.6 Isobutene 1.8 9 Gasoline 1.4 7.6 Kerosine 0.7 5 Methane 5 15 Methyl Alcohol 6.7 36 n-Hexane 1.1 7.5 n-Pentene 1.65 Fuel Gas Butane 7.7 0.132139 0.198413 0.087285 0.087285 0.067613 0.033568 0.250627 0.341959 0.052964 0.07989 2.678571 14.28571 0.505689 0.470958 0.391672 0.250627 0.840336 2.678571 0.3861 0.397255 ABB Wang Lopez Suzaki % C2 10 30 30 10 C2/O2 >1 1 1 1 EO Reactor 90 9 Section 100 R-101 R-102 E-101 E-102 E-103 E-104 F-101 F-102 F-103 D-101 D-102 D-103 D-104 ODH Primary Reactor ODH Trim Oxidizer ODH Primary Reactor Cooler ODH Trim Oxidizer Cooler Effluent Cooler # 1 Effluent Cooler # 2 Ethane Preheat Furnace O2 Preheat Furnace PS Preheat Furnace ODH Primary Reactor Cooler Steam Drum ODH Trim Oxidizer Cooler Steam Drum Effluent Cooler # 1 Steam Drum Effluent Cooler # 2 Steam Drum Duty, MM kJ/h 704 245 704 245 175 175 108 35 1710 30000 gal 10440 gal 7500 gal 7500 gal net energy, MM kJ/h (upper end) $/lb C2H4 555 0.024 Quench Drum (2 reqd) Quench Water Coolers Amine Interchanger CO2 Stripper Reboiler Amine Scrubber Amine CO2 Stripper Quench Water Pump Amine Interchange Pump Amine Recycle Pump 60000 gal 1650 package package package package 2150 SHP package package SA m2 26107 9075 6519 2269 1620 1620 per 1.5 in tube 0.96 0.96 0.96 n tubes 27195 9453 TIC, $ MM 56.17 19.53 7.01 2.44 1.74 1.74 10.84 3.53 25.65 0.75 0.25 0.2 0.2 130.07 Section 200 D-201 E-201 E-202 E-203 T-201 T-202 P-201 P-202 P-203 1.5 13 10 20 1 - 60000 45.5 Section 300 C-301 C-302 E-301 E-302 E-303 D-301 D-302 D-303 T-301 P-301 DR-301 DR-302 DR-303 Charge Gas Compressor Stg 1 Charge Gas Compressor Stg 2 Stage 1 After Cooler Stage 2 After Cooler Stage 2 After Chiller C2 Gas KO Pot #1 C2 Gas KO Pot #2 C2 Gas KO Pot #3 Caustic Gas Scrubber Caustic Solution Circulating Pump C2 Gas Primary Dryer C2 Gas Guard Dryer C2 Gas Dryer - Regen Cycle 26.7 16.1 11.1 4000 gal 2500 gal 2500 gal package package 3000 gal 3000 gal 3000 gal 5500 BHP 4400 BHP 320 200 135 4.1 3.3 1 0.65 0.5 0.08 0.06 0.06 3 0.5 0.5 0.5 20 ton dscnt 20 ton dscnt 20 ton dscnt 14.25 Section 400 T-401 C-401 E-401 E-402 E-403 E-404 P-401 P-402 P-403 D-401 D-402 Ethylene Fractionator Heat Pump Ethylene Fractionator Condenser Ethylene Product Heater Ethylene Fractionator Reboiler Ethane Recycle Heater Ethylene Product Pump Ethane Recycle Pump Reflux Pump (may not be required) Ethylene Product Drum Ethylene Fractionator Reflux Drum 5 m x 60 m 6000 160 18 140 2 400 SHP 25 SHP 80 stages 5 4 1 0.25 0.15 0.05 0.02 2400 m2 0.15 0.25 10.87 Total TIC 200.69 capital cost 100 BTPB 4.5 cost/y 22.22222 tax rate 45% ATCF project life inflation 12.22222222 15 3% 1 2 3 4 5 6 7 year 1 year 2 year 3 year 4 year 5 year 6 year 7 12.22222222 12.58888889 12.96656 13.35555 13.75621879 14.16891 14.59397 10.96118488 10.12516374 9.352907 8.639551 7.980603081 7.371914 6.80965 8 9 10 11 12 13 14 15 year 8 year 9 year 10 year 11 year 12 year 13 year 14 year 15 15.03179169 15.48274544 15.94723 16.42564 16.91841398 17.42597 17.94875 18.48721 6.290271167 5.810505544 5.367332 4.95796 4.579811215 4.230504 3.907839 3.609784 ROR ROR PW capital PWCF Ratio 0.115045714 11.50 100 99.99498133 1.000050189 BTPB 4.5 4 3.5 3 2.5 ATROI, % 11.51 13.58 16.11 19.31 23.57 Procedure: define a PB period, inflation rate and tax rate goal seek cell B20 to be 1 by changing cell A16 26.00 24.00 BTPB, y 22.00 20.00 18.00 16.00 14.00 12.00 10.00 2 2.5 3 3.5 ATROR, % 4 4.5 5 Production Economics - Ethane ODH 9090 O2 Case Variable Costs Fixed Costs Capital Recovery RNB raw material, utilities labor, overhead, depreciation, taxes, insurance amount of cost associated with the capital equipment [MARR; hurdle rate] Production Capacity Plant Costs Property/Value Bases 420 C Coolant 0.324 $/lb C2H4 IBL+OBL +20% 1500 $201 $80 $281 $338 MMPPY MM IBL MM OBL MM MM Fuel Hydrogen Ethane FG, LHV Fuel eff $8.00 190 3.1 18 85 per MMBTU SCF/lb lb/gal MBTU/lb % firing efficiency Production Costs Raw Materials/By-products Ethane 3.1 lbs/gal O2 Process Steam Nitrogen CO2 Process Water Cat/Chem miscellaneous Basis lb lb lb lb lb lb lb Unit, $ 0.18 0.02 na na na na 1.00 lb/lb C2H4 1.230 1.17 0 0 0 0 0.001 Total Raw Material Costs Utilities Power, KWH Cooling Water, M Gal Steam, M lb Refrigeration, MM BTU Natural Gas, lbs (net) usage 0.08 0.03 0 0 0.15 $/unit 0.1 0.15 10 10 0.1 Total Utility Costs 0.2214 $/lb C2H4 0.008 0.005 0.000 0.000 0.015 0.028 Total Variable Cost Fixed Costs usage shifts Labor 6 4 Foremen (@ 33 %) Supervision (@ 7.5 %) Maintenance Matl & Labor (6 % 0f ISBL) Direct Overhead (50 % of L & S) Plant Overhead (65 % L & M) Insurance (1.5 % Plant Investment) $/lb C2H4 0.221 0.023 0.000 0.000 0.000 0.000 0.001 rate 50000 0.249 $/lb C2H4 0.0008 0.00026 0.00006 0.00804 0.00056 0.00596 0.00338 Total Fixed Costs 0.01906 Total Cash Costs (FC + VC) 0.268 Capital Recovery (ATROI based on BTPB) BT Payback, y ATROI, % 4.500 4 3.5 3 11.500 13.6 16.1 19.3 Capital Recovery 0.05003 0.05628 0.06432 0.075 0.332 0.343 Total Cost of Production (minus SGA) 0.318 plus 2 % SGA Required Netback 0.324 0.32435 0.33072 0.338925 0.3499 0.324 0.331 0.339 0.350 Production Economics - Ethane ODH 9090 O2 Case Variable Costs Fixed Costs Capital Recovery RNB 0.338 $/lb C2H4 raw material, utilities labor, overhead, depreciation, taxes, insurance amount of cost associated with the capital equipment [MARR; hurdle rate] Production Capacity Plant Costs Property/Value Bases IBL+OBL +20% 1500 $240 $96 $336 $403 MMPPY MM IBL MM OBL MM MM Fuel Hydrogen Ethane FG, LHV Fuel eff $8.00 190 3.1 18 85 per MMBTU SCF/lb lb/gal MBTU/lb % firing efficiency 390 C Coolant Production Costs Raw Materials/By-products Ethane 3.1 lbs/gal O2 Process Steam Nitrogen CO2 Process Water Cat/Chem miscellaneous Basis lb lb lb lb lb lb lb Unit, $ 0.18 0.02 na na na na 1.00 lb/lb C2H4 1.230 1.17 0 0 0 0 0.001 Total Raw Material Costs Utilities Power, KWH Cooling Water, M Gal Steam, M lb Refrigeration, MM BTU Natural Gas, lbs (net) usage 0.08 0.03 0 0 0.15 $/unit 0.1 0.15 10 10 0.1 Total Utility Costs 0.2214 $/lb C2H4 0.008 0.005 0.000 0.000 0.015 0.028 Total Variable Cost Fixed Costs usage shifts Labor 6 4 Foremen (@ 33 %) Supervision (@ 7.5 %) Maintenance Matl & Labor (6 % 0f ISBL) Direct Overhead (50 % of L & S) Plant Overhead (65 % L & M) Insurance (1.5 % Plant Investment) $/lb C2H4 0.221 0.023 0.000 0.000 0.000 0.000 0.001 rate 50000 0.249 $/lb C2H4 0.0008 0.00026 0.00006 0.0096 0.00056 0.00697 0.00403 Total Fixed Costs 0.02229 Total Cash Costs (FC + VC) 0.271 Capital Recovery (ATROI based on BTPB) BT Payback, y ATROI, % 4.500 4 3.5 3 11.500 13.6 16.1 19.3 Capital Recovery 0.05973 0.0672 0.0768 0.0896 0.331 0.338 0.348 0.361 Total Cost of Production (minus SGA) plus 2 % SGA Required Netback 0.33754 0.34516 0.354948 0.338 0.345 0.355 0.368 0.368 Production Economics - Ethane Steam Cracker results of analysis: RNB Variable Costs Fixed Costs Capital Recovery 0.348 $/lb C2H4 raw material, utilities labor, overhead, depreciation, taxes, insurance amount of cost associated with the capital equipment [MARR; hurdle rate] Production Capacity Plant Costs SP H2 Chem Property/Value Bases IBL+OBL +20% 1500 $405 $162 $567 $680 MMPPY MM IBL MM OBL MM MM Fuel Hydrogen Ethane FG, LHV Fuel eff $8.00 190 3.1 18 85 per MMBTU SCF/lb lbs/gal MBTU/lb % firing efficiency Production Costs Raw Materials/By-products Ethane 3.1 lbs/gal Hydrogen 380 SCF/lb mol Fuel Gas 18MBTU/lb, 85% Propylene < Chem grade Cat/Chem miscellaneous Basis lb lb lb lb lb Unit, $ 0.18 0.50 0.12 0.35 1.00 lb/lb C2H4 1.275 -0.072 -0.163 -0.020 0.001 Total Raw Material Costs Utilities Power, KWH Cooling Water, M Gal Steam, M lb Refrigeration, MM BTU Natural Gas, lbs usage 0.008 0.036 0 0 0.3 $/unit 0.1 0.15 10 10 0.1 Total Utility Costs Total Variable Cost Fixed Costs usage shifts Labor 10 4 Foremen (@ 33 %) Supervision (@ 7.5 %) Maintenance Matl & Labor (6 % 0f ISBL) Direct Overhead (50 % of L & S) Plant Overhead (65 % L & M) Insurance (1.5 % Plant Investment) rate 50000 $/lb C2H4 0.230 -0.036 -0.020 -0.007 0.001 0.167 $/lb C2H4 0.001 0.005 0.000 0.000 0.030 0.036 0.203 $/lb C2H4 0.001 4E-04 1E-04 0.016 9E-04 0.012 0.007 Total Fixed Costs 0.038 Total Cash Costs (FC + VC) 0.241 Capital Recovery ( Linked ATROI and BTPB) Before Tax Pay Back, y ATROI, % Capital Recovery Total Cost of Production (minus SGA) 4.5 11.5 3.5 16.1 3 19.3 0.101 0.1134 0.1296 0.1512 0.342 plus 2 % SGA Required Netback 4 13.8 0.354 0.370 0.392 0.348 0.3612 0.3777 0.3997 0.348 0.361 0.378 0.400 Production Economics - Ethane Steam Cracker results of analysis: RNB Variable Costs Fixed Costs Capital Recovery 0.366 $/lb C2H4 raw material, utilities labor, overhead, depreciation, taxes, insurance amount of cost associated with the capital equipment [MARR; hurdle rate] Production Capacity Plant Costs Property/Value Bases IBL+OBL +20% 1500 $405 $162 $567 $680 MMPPY MM IBL MM OBL MM MM Fuel Hydrogen Ethane FG, LHV Fuel eff $8.00 190 3.1 18 85 per MMBTU SCF/lb lbs/gal MBTU/lb % firing efficiency Production Costs Raw Materials/By-products Ethane 3.1 lbs/gal Hydrogen 380 SCF/lb mol Fuel Gas 18MBTU/lb, 85% Propylene < Chem grade Cat/Chem miscellaneous Basis lb lb lb lb lb Unit, $ 0.18 0.26 0.12 0.35 1.00 lb/lb C2H4 1.275 -0.072 -0.163 -0.020 0.001 SP H2 Fuel Total Raw Material Costs Utilities Power, KWH Cooling Water, M Gal Steam, M lb Refrigeration, MM BTU Natural Gas, lbs usage 0.008 0.036 0 0 0.3 $/unit 0.1 0.15 10 10 0.1 Total Utility Costs Total Variable Cost Fixed Costs usage shifts Labor 10 4 Foremen (@ 33 %) Supervision (@ 7.5 %) Maintenance Matl & Labor (6 % 0f ISBL) Direct Overhead (50 % of L & S) Plant Overhead (65 % L & M) Insurance (1.5 % Plant Investment) rate 50000 $/lb C2H4 0.230 -0.019 -0.020 -0.007 0.001 0.184 $/lb C2H4 0.001 0.005 0.000 0.000 0.030 0.036 0.220 $/lb C2H4 0.001 4E-04 1E-04 0.016 9E-04 0.012 0.007 Total Fixed Costs 0.038 Total Cash Costs (FC + VC) 0.258 Capital Recovery ( Linked ATROI and BTPB) Before Tax Pay Back, y ATROI, % Capital Recovery Total Cost of Production (minus SGA) 4.5 11.5 3.5 16.1 3 19.3 0.101 0.1134 0.1296 0.1512 0.359 plus 2 % SGA Required Netback 4 13.8 0.371 0.388 0.409 0.366 0.3788 0.3953 0.4174 0.366 0.379 0.395 0.417 Production Economics - Ethane Steam Cracker results of analysis: RNB Variable Costs Fixed Costs Capital Recovery 0.418 $/lb C2H4 raw material, utilities labor, overhead, depreciation, taxes, insurance amount of cost associated with the capital equipment [MARR; hurdle rate] Production Capacity Plant Costs Dow ATR E-1 Property/Value Bases IBL+OBL +20% 1500 $350 $140 $490 $588 MMPPY MM IBL MM OBL MM MM Fuel Hydrogen Ethane FG, LHV Fuel eff $8.00 190 3.1 18 85 per MMBTU SCF/lb lbs/gal MBTU/lb % firing efficiency Production Costs Raw Materials/By-products Ethane 3.1 lbs/gal Oxygen Hydrogen 380 SCF/lb mol Fuel Gas 18MBTU/lb, 85% Propylene < Chem grade Cat/Chem miscellaneous Basis lb lb lb lb lb lb Unit, $ 0.18 0.02 0.25 0.12 0.35 1.00 lb/lb C2H4 1.330 1.890 0.127 -0.300 -0.057 0.001 Total Raw Material Costs Utilities Power, KWH Cooling Water, M Gal Steam, M lb Refrigeration, MM BTU Natural Gas, lbs usage 0.008 0.036 0 0 0.3 $/unit 0.1 0.15 10 10 0.1 $/lb C2H4 0.239 0.038 0.032 -0.036 -0.020 0.001 0.253 $/lb C2H4 0.001 0.005 0.000 0.000 0.030 Total Utility Costs 0.036 Total Variable Cost 0.289 Fixed Costs usage shifts Labor 10 4 Foremen (@ 33 %) Supervision (@ 7.5 %) Maintenance Matl & Labor (6 % 0f ISBL) Direct Overhead (50 % of L & S) Plant Overhead (65 % L & M) Insurance (1.5 % Plant Investment) rate 50000 $/lb C2H4 0.001 4E-04 1E-04 0.014 9E-04 0.01 0.006 Total Fixed Costs 0.033 Total Cash Costs (FC + VC) 0.322 Capital Recovery ( Linked ATROI and BTPB) Before Tax Pay Back, y ATROI, % Capital Recovery Total Cost of Production (minus SGA) plus 2 % SGA Required Netback 4.5 11.5 4 13.8 3.5 16.1 3 19.3 0.087 0.098 0.112 0.1307 0.409 0.420 0.434 0.453 0.418 0.4286 0.4429 0.4619 0.418 0.429 0.443 0.462 Comparison 0.42 conventional Ethylene RNB, cts/lb 4.5 4 3.5 3 Required Netback, cents/lb conventional ODH 0.3483317 0.324346 0.3611837 0.330724 0.3777077 0.338925 0.3997397 0.349859 ODH 0.4 0.38 0.36 0.34 0.32 0.3 3 3.5 4 Payback, y 4.5 Fuel Value Hydrogen Comparison 0.44 Ethylene RNB, cts/lb 4.5 4 3.5 3 Required Netback, cents/lb conventional ODH 0.3666917 0.324346 0.3795437 0.330724 0.3960677 0.338925 0.4180997 0.349859 0.42 conventional ODH 0.4 0.38 0.36 0.34 0.32 0.3 3 3.2 3.4 3.6 3.8 BTPB, y 4 4.2 4.4 Summary Economics – Cash Costs • Conventional Pyrolysis – Byproduct value result in lower CC than Case 3 – With byproduct H2 (conventional) taken as fuel, then the CCs are approximately equivalent • ODH - Case 3 – No byproducts and significant heat is rejected to the atmosphere during recovery of process water – Potential for heat pump on the quench system Suggestions for Economic Improvement of the ODH Process • Low level heat upgrade – power and/or steam generation • Higher reactor operating pressure – higher level of waste heat – lower capital due to reduced compression • Reduced excess oxygen required – reduced oxidation required beyond CO conversion to CO2 • Reduced process steam Waste Heat Upgrade • Many Options – Rankine cycle – Thermo-electric Exchangers – Chemical Heat Pump – Absorptive Refrigeration – Stirling Engine Waste Heat Upgrade • Rankine Cycle – Compressor – Condenser (high level heat recovery) – Let-down Valve – Evaporator (waste heat) Impact of Reactor Pressure on the Temperature of the Quench Water Conclusion – higher pressure will allow a hotter quench water with the same amount of water going forward kg mols/h water . 6000 1.8 bar 5000 5 bar 4000 10 bar 3000 2000 1000 0 50 60 70 80 90 100 Quench Tem perature, C X-axis Y-axis Quench Temperature Amount of water in the product gas Temperature of Waste Heat 79.5 C Energy Cost, kJ/100 kJ recovered Temperature of Heat Recovery Energy Spent per 100 kJ recovered 114 17.88 127 27.19 139 39.46 150 61.56 80.00 60.00 40.00 20.00 0.00 110 120 130 140 150 Temperature Upgrade, C DOE Data - First Purchase Prices 1977 1982 1987 1992 1997 2002 2005 average Crude Nat Gas $/crude $/MCF 22.2 2.05 50.2 4.3 23.17 2.51 20.3 2.21 19.72 2.66 23.74 3.11 50.3 7.51 29.94714 3.478571 Ratio 10.82927 11.67442 9.231076 9.18552 7.413534 7.633441 6.697736 8.952142 average 8.952142 std dev 1.837358 % std dev 20.52422 14 12 10 8 6 4 2 0 1970 1990 2010 (LEL/LFL) (UEL/UFL) (%) (%) Acetaldehyde 4 60 Acetylene 2.2 85 Ammonia 15 28 Benzene 1.3 7.1 Butane 1.8 8.4 Butylene 1.98 9.65 Carbon Monoxide 12 75 Ethane 3 12.4 Ethylene 2.7 36 Ethyl Alcohol 3.3 19 Fuel Oil No.1 0.7 5 Hydrogen 4 75 Isobutane 1.8 9.6 Isobutene 1.8 9 LEL O2/fuel 5.04 9.34 1.19 15.94 11.46 10.40 1.54 6.79 7.57 6.15 29.79 5.04 11.46 11.46 26.37 15.70 14.79 29.79 3.99 19.79 18.88 12.52 13.79 9.79 10.29 18.88 17.29 18.88 UEL O2/fuel 0.14 0.04 0.54 2.75 2.29 1.97 0.07 1.48 0.37 0.90 3.99 0.07 1.98 2.12 3.33 2.08 2.55 3.99 1.19 2.92 2.59 2.52 2.48 1.87 1.68 3.23 2.75 2.79 LEL fuel/O2 0.20 0.11 0.84 0.06 0.09 0.10 0.65 0.15 0.13 0.16 0.03 0.20 0.09 0.09 0.04 0.06 0.07 0.03 0.25 0.05 0.05 0.08 0.07 0.10 0.10 0.05 0.06 0.05 UEL fuel/O2 7.14 26.98 1.85 0.36 0.44 0.51 14.29 0.67 2.68 1.12 0.25 14.29 0.51 0.47 0.30 0.48 0.39 0.25 0.84 0.34 0.39 0.40 0.40 0.53 0.59 0.31 0.36 0.36 Inlet mol % 10 8 82 Outlet kgmol/h 380 475 35264 Outlet mol % 0.95 1.19 88.42 Isooctane 0.79 5.94 Isopentane 1.32 9.16 Gasoline 1.4 7.6 Kerosine 0.7 5 Methane 5 15 n-Heptane 1.05 6.7 n-Hexane 1.1 7.5 n-Pentene 1.65 7.7 Pentane 1.5 7.8 Propane 2.1 10.1 Propylene 2 11.1 Styrene 1.1 6.1 Toluene 1.2 7.1 p-Xylene 1.1 7 ODH Case 3 Ethane Oxygen Water Inlet kg/h 114000 97280 560880 Inlet kgmol/h 3800 3040 31160 sum 772160 38000 O2/C2 0.8 39881 1.25 T, oC 323.0 252.0 194.0 138.0 32.0 1.7 -20.6 -40.0 -59.4 -76.1 -101.1 -115.0 -134.4 $/MM kJ 14.7 9.0 5.8 3.6 0.8 13.2 20.1 27.3 39.8 50.1 71.9 99.5 133.5 SPS 1700 HPS 600 MPS 200 LPS 50 CW C3 C3 C3 C2 C2 C2 C1 C1 200 400 160 140 120 100 Value, $/MM kJ Value/Cost in Typical OP Cycles T, oF 613.4 485.6 381.2 280.4 89.6 35.0 -5.0 -40.0 -75.0 -105.0 -150.0 -175.0 -210.0 80 60 40 20 0 -200 0 -20 Level, F 600 CO2 Sequestration, Removal and Recovery/Removal Options Amine Membrane CaO Ryan Holmes Comparison between base case catalyst (29524CCG) and base case+ H2O2 treated catalyst (240-15C ) Ethylene selectivity (%) 98 96 94 92 240-15C catalyst 90 Base case catalyst 88 Target 86 20 30 40 50 60 Ethane conversion (% ) 70 80 Student Researchers – they do all the work and so on............. Thank you