Reseberättelse – EM Lyon 2014-2015 The School EM Lyon is

advertisement

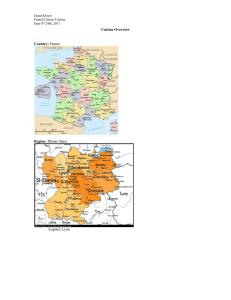

Reseberättelse – EM Lyon 2014-2015 The School EM Lyon is considered one of france´s top business schools and is highly sought after by the French students. A degree from EM Lyon often means higher salaries in France but the school is also well known outside of France, for example in the UK. As compared to universities, most if not all professors have substantial experience from working in their respective industries and are as such able to not only give you a theoretical explanation of the subjects taught but also how it works in practice. The school is known for its tight connections with the corporate world and seminars are given almost every week where banks or financial institutions come to EM Lyon to present their company and also to find new employees. The teaching system is built around the classes, two per day. One and a half ours between 9-10.30, a short break and then another session before lunch. With another 3 hours in the afternoon. Attendance is also mandatory so you will have to expect to be there between 9-17 pretty much every day. On a brighter note, there is little homework or group work to be done at your spare time. Lyon Lyon is the seconds largest city in France and in my opinion it is the perfect size. Given that you live relatively central, you can walk to almost anything. The city offer absolutely stunning views, great nightlife and diner possibilities. The people are nice and friendly and I had no issues whatsoever without speaking a word of French. The city is also located 2 hours from Paris, Switzerland, Italy and the Riviera, making it a great place to start out if you are interested in weekend get aways. Courses The finance exchange program with the quantitative specialized master at EM Lyon is not your typical Erasmus. All courses are pre-chosen and must be attended. You will probably get the option to study more than 30 ECTS and can therefore choose whether or not to do so (it is recommended and the additional course in Commodities is quite interesting). I would like to stress the importance of mathematics knowledge before going, they expect a level which is a lot higher than the masters in Finance in Lund so do prepare yourself with some linear algebra, probability theory and mathematical analysis. Stochastic processes – highly mathematical and quite difficult course. The themes however will come back in every single course in the program. The teacher is Francois Quittard-Pinon who is also the head of the specialized master. There is a high level of in-class excercises to prove the findings. The exam is closed book. Life insurance – Less mathematical, short course that is given over a week by a teacher from Canada. You look at how life insurance policies are priced in reality. The exam is open book. VBA-Matlab-C++ - We spent most of the time on VBA but all languages will be taught and also used in several courses when doing practical implementations and building pricing models. The exam is a multiple choice. Options theory – goes from the basics to derivinge black and scholes to pricing exotic options. The teacher is a former exotic options trader who also holds a Phd in mathematics. Exam is closed book. Time series analysis – Short course where the main focus is on maximum likelihood and how do derive it, rather than traditional linear regressions. Open book exam. Fixed income – probably the least mathematical course, covers the basic aspects of bond pricing, how it trades on the market and how to determine things like convexity and duration. Closed book exam. Portfolio management – cover the traditional mean variance theories and portfolio optimization. Exam is part closed book and part group projects. Risk measures – covers the traditional Value at risk/expected shortfall and also copulas. Exam is closed book. Pension funds – course given in a week by a professor from Italy. It is basically similar to life insurance but the pricing models involve parameters. Exam is open book. Interest rate risk management – an extension to the fixed income course, more mathematical and also covers pricing of swaps and other instruments with underlying cash flows. Exam is closed book. Model implementation – The course is aiming to put your knowledge (this far) to use and to program algorithms to price various things like options, swaps or optimizing a portfolio. Commodities – I did not take this course as it is optional but the course covers all aspects of the commodities market and the teacher is great. Model risk – Value at risk again and some topics on Basel and mainly Solvency for insurance companies. Closed book exam. Housing I would Highly recommend anyone to Not live at campus but in the city. I lived at Bellecour and it took me 30 min to get to school but it is so worth living in the actual city rather than at campus (which is not even in Lyon, it is in Ecully). There are direct buses and it is very easy to get to school and back but for the people living in Ecully it was a lot harder to get in to town during weekend etc. You also miss out on the experience of living in a proper French city and all what that means by living at campus. Expect to pay around 4-500 euro per month. Thought and recommendations The program is though and you will have to work, but it will work out in the end, everyone is helpful and studies together. I say enjoy your exchange and make the most it, Lyon is a great place to be so definitely explore, enjoy and get in to the French culture. And don’t live at campus. Feel free to email me at David.sjoberg01@gmail.com with any questions. David Sjöberg, HT/VT 14-15