Assigned Text Problems for Exam 3

advertisement

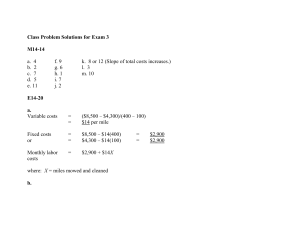

Exam 3 Class Problem Solutions M14-13 a. b. c. d. e. 8 8 11 1 11 f. g. h. i. j. 8 7 5 2 3 k. 12 l. 5 m. 4 n. 3 o. 8 E14-20 a. Variable costs = = ($9,000 $4,800)/(400 100) $14 per mile Fixed costs or = = $9,000 $14(400) $4,800 $14(100) = $3,400 = $3,400 Monthly labor costs = $3,400 + $14X where: X = miles mowed and cleaned b. Representative values $10,000 $8,000 Total labor $6,000 cost $4,000 $2,000 $0 0 200 400 Miles mowed & cleaned Variable costs = = ($9,000 $5,000)/(400 200) $20 per mile Fixed costs = $9,000 $20(400) = $1,000 600 or = $5,000 $20(200) = $1.000 Monthly labor costs = $1,000 + $20X where: X = miles mowed and cleaned E14-20 (concluded) c. The equation used in (a) is influenced by the unusually high costs incurred in October when only 100 miles were mowed and cleaned. The October activity is low, perhaps due to the reduced growth of grass and less highway litter after the end of the summer vacation season. Employees may have had extra time and may have paced their work to fill the available time. The effect of including the October observation in the high-low cost estimate is to understate the variable costs and to overstate the fixed costs. The effect of basing a cost-estimating equation on this observation is to overstate the variable costs and to understate the fixed costs. d. The effect of a 7 percent wage increase is to increase the amount of each cost element by 7 percent. Total costs = $1,070 + $21.40X M15-15 a. Selling price Variable costs Contribution margin $5.00 per hot dog 3.50 per hot dog $1.50 Break-even point = $750,000/$1.50 = 500,000 hot dogs 250 1,000 b. $5,000 Total revenues and Total costs (000) $4,000 $3,000 $2,000 $1,000 $0 0 500 750 Unit sales (000) c. Total Profit or (Loss) (000) $750 $600 $450 $300 $150 $0 ($150) 0 ($300) ($450) ($600) ($750) 250 500 750 1,000 Total units (000) d. It is easier to determine profit or loss at any volume with a profit-volume graph than with a cost-volume-profit graph. This is especially true in situations, such as this, where the unit contribution margin is small and the scale of activity is large. Although a profit-volume graph provides a clear illustration of profits, it does not illustrate revenues and costs. Hence, a manager using a profit-volume graph does not see the relationship between revenues, costs, and profits. M15-16 Product A B C Unit Contribution Margin $1 2 3 Sales Mix (units)* 6 3 1 10 Weight $1 x 6/10 = 2 x 3/10 = 3 x 1/10 = $0.60 0.60 0.30 $1.50 *B = 3C and A = 2B, so A = 3 x 2 = 6 Average unit contribution margin = $1.50 Break-even unit sales volume = $112,500/$1.50 = 75,000 units Units of A at break-even = 75,000 x 6/10 = 45,000 EXERCISES E15-17 a. Alberta Company Contribution Income Statement For the Month of May 2012 Sales (6,000 x $40) Less variable costs: Direct materials (6,000 x $10) Direct labor (6,000 x $2) Manufacturing overhead (6,000 x $5) Selling and administrative (6,000 x $5) Contribution margin Less fixed costs: Manufacturing overhead Selling and administrative Profit $240,000 $ 60,000 12,000 30,000 30,000 40,000 20,000 (132,000) 108,000 (60,000) $ 48,000 b. Note: The instructor might extend this assignment in class, computing the break-even point, the margin of safety, and the impact on profits of a change in sales. E15-18 a. Sales Variable costs Contribution margin $750,000 (450,000) $300,000 Contribution margin ratio = $300,000/$750,000 = 0.40 Annual break-even dollar sales volume = $210,000/0.40 = $525,000 b. Annual margin of safety in dollars: Sales $750,000 Break-even sales dollars (525,000) Margin of safety $225,000 c. To determine the variable and total cost lines, it is necessary to compute the variable cost ratio: Variable cost ratio = Variable costs Sales = $450,000 $750,000 = 0.60 At a volume of $1,000,000 sales dollars, variable costs are $600,000. Profit = $1,000,000 Fixed costs = $210,000 $750,000 $90,000 Total Revenues and Total Costs $500,000 Variable costs = $250,000 $0 $0 $250,000 $500,000 Total Revenues d. Revised annual break-even dollar sales: ($210,000 + $35,000)/0.40 = $612,500 $750,000 $1,000,000 M16-17 The current production volume is 100,000 units ($4,400,000/$44). The variable production costs are ($3,200,000 $800,000)/100,000 = $24. Hence, at a unit selling price of $30, the order provides a contribution of $6 per unit and a total contribution of $75,000 ($6 12,500). Even if it is profitable, the large sale to the hospital supply company may take away some of the attention of management from regular customers, and it may upset regular customers who learn of the lower price, resulting in pressure to lower overall prices. M16-18 Relevant cost analysis Increase in revenues: Sell complete sailboats Sell sailboat hulls Costs of masts, sales, and rigging Advantage (disadvantage) of further processing $6,000 (5,000) $ 1,000 (1,500) $ (500) An alternative analysis treats the selling price of the uncompleted hulls as an opportunity cost: Revenues from complete sailboats Costs: Outlay costs of masts, sails, and rigging Opportunity cost of not selling hull Advantage (disadvantage) of further processing $ 6,000 $1,500 5,000 (6,500) $ (500) E16-22 Cost to make: Variable costs (10,000 units $24.00) Fixed costs (10,000 units $5.00) Rent income (opportunity cost) Cost to buy (10,000 units $32.00) Advantage (disadvantage) of buying Making has an advantage of $5,000. $240,000 50,000 25,000 $315,000 (320,000) $ (5,000) E16-25 Information is provided about the cost of raw material D and the cost of processing this material into E and F. However, students should recognize that these are joint costs incurred prior to the decision point. Consequently, they are irrelevant to a decision to sell product F or to process it further. Revenues from G Costs: Outlay cost of additional processing Opportunity cost of not selling F Advantage of further processing $12 $4 5 (9) $ 3 Product F should be processed further into product G. E16-26 a. Unit contribution margin Labor hours per unit Contribution per labor hour X $ 60 4 $ 15 Y $ 50 2 $ 25 Z $ 30 4 $7.5 1. Product Z has the highest unit selling price. 2. Product X has the highest unit contribution margin. 3. Product Y has the highest contribution per labor hour. The weekly contribution obtained with the use of each criterion is: Labor hours available Labor hours per unit Weekly production Unit contribution margin Weekly contribution Highest Unit Selling Price Z 220 4 55 $30 $1,650 Highest Highest Contribution Contribution per Unit per Labor Hour X Y 220 220 4 2 55 110 $60 $50 $3,300 $5,500 E16-26 (concluded) b. To achieve short-run profit maximization, a for-profit organization should allocate limited resources in a manner that maximizes the contribution per unit of constraining factor. c. The decision to produce 12 units of Z will result in a weekly opportunity cost of $1,200. This is the net benefits that would have been derived from producing 20 units of Y. Labor hours to produce 12 units of Z (12 units 4 hours per unit) 48 Labor hours per unit of Y 2 Required reduction in the production of Y 24 Unit contribution margin for Y $50 Opportunity cost $1,200 Producing 12 units of Z will reduce profits by $840 from their maximum possible amount. Contribution from Z (12 units $30) Opportunity cost Net disadvantage of producing 12 units of Z $ 360 (1,200) $ (840) This can also be computed as the difference between the hourly contribution of Y and Z times the 48 labor hours that would be required to product 12 units of Z, or ($25 - $7.50) 48 = $840. d. First, there may not be enough demand to allocate all limited resources to the most profitable product. Second, even if there is sufficient demand, it may be advisable to produce and sell some less profitable products for the sake of offering a full line of products and giving customers alternatives. Third, less profitable products may be offered if they are complimentary to the more profitable products. In some cases, what appears to be the main and most profitable product is actually the secondary product in terms of profits. For example, The warehouse retailers, such as Sam’s and Costco, essentially break even on the merchandise they sell in their stores, and make most of their profit on membership fees. Similarly, some retailers earn more profit on warranty programs sold than on the products for which the warranties are offered. E17-24 Case 1 Sales Direct materials Direct labor Total direct costs Conversion cost Manufacturing overhead Current manufacturing costs Work in process, beginning Work in process, ending Cost of goods manufactured Finished goods inventory, beginning Finished goods inventory, ending Cost of goods sold Gross profit Selling and administrative expenses Net income Case 2 $80,000 $72,000 (2) 15,000 19,000 5,000 13,000 (3) 20,000 (1) 32,000 13,000 (2) 26,000 8,000 13,000 (4) 28,000 (3) 45,000 (5) 7,000 10,000 5,000 23,000 (6) 30,000 (4) 32,000 9,000 8,000 6,000 5,000 (7) 33,000 (5) 35,000 47,000 (6) 37,000 (1) 20,000 15,000 27,000 (7) 22,000 Case 3 Case 4 $120,000 $95,000 (2) 65,000 (6) 21,000 20,000 9,000 (3) 85,000 (5) 30,000 30,000 (7) 58,000 (7) 10,000 49,000 (6) 95,000 79,000 29,000 (4) 21,000 21,000 18,000 (5) 103,000 (3) 82,000 7,000 12,000 8,000 14,000 (4) 102,000 (2) 80,000 18,000 15,000 6,000 (1) 7,000 (1) 12,000 8,000 Solution steps are indicated by the number next to each solved item. There are other correct solution steps. E17-25 a. The basic accounting problem that Arton and Yount are arguing about stems from the use of actual overhead rates when there are wide fluctuations in the volume of activity. In periods of high activity, fixed overhead is spread over a large number of units, producing a relatively low per-unit cost assignment. In periods of low activity, fixed overhead is spread over a small number of units, producing a relatively high perunit cost assignment. Daytona should use a predetermined overhead rate to avoid variations in costs assigned to identical products because of seasonal variations in manufacturing overhead. E17-25 (concluded) In addition to the accounting problem, Daytona Parts Company also has a pricing problem. Cost-based pricing should be used as a guideline, not an inflexible rule. Management should adjust cost-based prices in response to market conditions. If competitors are lowering their prices, Daytona should consider doing the same. Likewise, if competitors are raising their prices, Daytona should consider the desirability of a similar action. In any case, management should strive to avoid frequent price changes. Finally, if the market for Daytona’s products is highly competitive, management should use the market price as a starting point to determine allowable product costs, rather than basing prices on costs. This approach, known as target costing, is discussed in Chapter 10. b. Cost estimating equation for total manufacturing overhead: Variable costs = ($237,500 $200,000)/(27,500 20,000) = $5.00 Fixed costs = $200,000 (20,000 $5.00) = $100,000 Total costs = $100,000 + $5X c. Predetermined rate for 2012: Predetermined Overhead rate = $100,000 + $5(25,000) = $9.00 per direct labor hour 25,000 d. Overapplied manufacturing overhead at the end of 2012 is $20,000: Actual overhead Applied overhead (30,000 $9) Overapplied overhead $250,000 (270,000) $ (20,000) e. The overapplied overhead may be: Written off to Cost of Goods Sold. Allocated among Work-in-Process, Finished Goods Inventory, and Cost of Goods Sold. M18-16 Activity cost calculations: Machine setup cost = $600,000 12,000 setup hours = $50 per setup hour Material handling cost = $120,000 2,000 tons = $60 per ton of materials Machine operation = $500,000 10,000 = $50 per machine hour Product costs: Direct materials Direct labor Manufacturing overhead: Machine setups (3 setup hours $50) Material handling (12.5 tons $60) Machine operation (4 hours $50) Total job costs Units produced Cost per unit produced C23 Cams U2 Shafts $30,000 5,000 $20,000 10,000 150 750 200 $36,100 500 $ 72.20 (7 setup hours $50) (8 tons $60) 350 480 (5 machine hours $50) 250 $31,080 300 $103.60 M21-19 The Music Shop Purchases Budget January - May, 2012 Purchase units: Budgeted sales Plus desired end. inv.* Total inventory needs Less beginning inv. Purchases January February March 130,000 64,000 194,000 (40,000) 154,000 160,000 80,000 240,000 (64,000) 176,000 200,000 84,000 284,000 (80,000) 204,000 April May 210,000 180,000 72,000 96,000 282,000 276,000 (84,000) (72,000) 198,000 204,000 *For example, 40% of the following month's sales, 240,000 × 0.40 for May. January Purchase dollars ($5 per unit): February March April May Budgeted cost of. sales $650,000 $ 800,000 $1,000,000 $1,050,000 $ 900,000 Plus desired end. inv.* 320,000 400,000 420,000 360,000 480,000 Total inventory needs 970,000 1,200,000 1,420,000 1,410,000 1,380,000 Less beginning inv. (200,000) (320,000) (400,000) (420,000) (360,000) Purchase dollars $770,000 $ 880,000 $1,020,000 $ 990,000 $1,020,000 *For example, 40% of the following month's sales, $1,050,000 x 0.40 for March. M21-20 Wilson's Retail Company Cash Budgets February, March, and April February March Cash balance, beginning $ 30,000 Cash receipts: 60% of current month's sales 135,000 40% of previous month's sales 120,000 Total receipts 255,000 Cash available 285,000 Budgeted disbursements: 80% of previous month's sales Operating expenses Total disbursements Cash balance, ending 240,000 41,000 (281,000) $ 4,000 April $ 4,000 $ (7,000) 120,000 90,000 210,000 214,000 105,000 80,000 185,000 178,000 180,000 41,000 (221,000) $ (7,000) 160,000 41,000 (201,000) $ (23,000) M21-21 Wooly Rug Company Production Budget For the Months of July, August, & September, 2012 July Budgeted sales - sq. yards Plus desired ending inventory* Total inventory requirements Less beginning inventory Budgeted production – sq. yards *40 percent following month’s sales 200,000 72,000 272,000 (100,000) 172,000 August September October 180,000 150,000 160,000 60,000 64,000 240,000 214,000 (72,000) (60,000) 168,000 154,000 M21-21 (concluded) Wooly Rug Company Purchases Budget For the Months of July & August, 2012 July Current needs for production (5 lb. per sq. yard) Plus desired ending inventory* Total requirements Less beginning inventory Purchases in pounds August 860,000 252,000 1,112,000 (400,000) 712,000 840,000 321,000 1,161,000 (252,000) 909,000 September 770,000 *30 percent of following month’s production requirements. P22-32 a. Materials price variance (usage basis) = = = = or Materials price variance (purchase basis) AQ × (AP SP) 7,000 yds. × ($4.90 $5.00) 7,000 yds. × $0.10 $700 F = = = = AQ × (AP SP) 9,000 yds. × ($4.90 $5.00) 9,000 yds. × $0.10 $900 F Materials quantity variance = SP × (AQ - SQ) = $5.00 × (7,000 6,800*) = $5.00 × 200 = $1,000 U *SQ = 1,700 tents × 4 yards per tent = 6,800 P22-32 (concluded) Labor rate variance = = = = AH × (AR SR) 3,600 × ($12.50 $12.00) 3,600 × $0.50 $1,800 U Labor efficiency variance = SR × (AH SH) = $12 × (3,600 3,400*) = $12 × 200 = $2,400 U *SH = 1,700 tents × 2 labor hours per tent = 3,400 b. Direct materials price variance: Buying in larger quantities, resulting in discounts; buying lower quality goods than standard; using competitive bids. Direct materials quantity variance: Inefficient workers on machines; old, inefficient machines; inferior raw materials. Labor rate variance: Higher paid workers than in budget, unexpected wage increases, using different skilled workers than in budget. Labor efficiency variance: Unskilled workers, using inferior quality materials, new workers. Note: A possible explanation for any of the variances could be incorrect standards. c. Direct materials Direct labor Total standard variable cost for 1,700 tents *(2 hours × $12) Standard Cost per Unit $20 × 24* × Units Produced 1,700 = 1,700 = Total Standard Cost $34,000 40,800 $74,800