Section 1.1: Responsibility for Expending University Funds

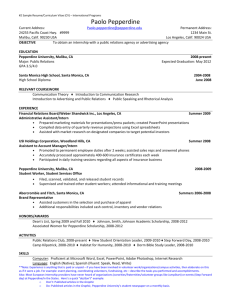

advertisement