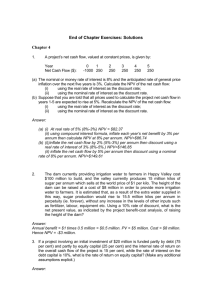

End of Chapter Exercises: Solutions Chapter 4 1. A project’s net cash flow, valued at constant prices, is given by: Year Net Cash Flow ($): 0 1 -1000 250 2 250 3 250 4 250 5 250 (a) The nominal or money rate of interest is 8% and the anticipated rate of general price inflation over the next five years is 3%. Calculate the NPV of the net cash flow: (i) using the real rate of interest as the discount rate; (ii) using the nominal rate of interest as the discount rate. (b) Suppose that you are told that all prices used to calculate the project net cash flow in years 1-5 are expected to rise at 5%. Recalculate the NPV of the net cash flow: (i) using the real rate of interest as the discount rate; (ii) using the nominal rate of interest as the discount rate. Answer: (a) (i) At real rate of 5% (8%-3%) NPV = $82.37 (ii) using compound interest formula, inflate each year’s net benefit by 3% per annum then calculate NPV at 8% per annum. NPV=$86.74 (b) (i))inflate the net cash flow by 2% (5%-3%) per annum then discount using a real rate of interest of 3% (8%-5%.) NPV=$146.85 (ii) inflate the net cash flow by 5% per annum then discount using a nominal rate of 8% per annum. NPV=$149.61 2. The dam currently providing irrigation water to farmers in Happy Valley cost $100 million to build, and the valley currently produces 15 million kilos of sugar per annum which sells at the world price of $1 per kilo. The height of the dam can be raised at a cost of $8 million in order to provide more irrigation water to farmers. It is estimated that, as a result of the extra water supplied in this way, sugar production would rise to 15.5 million kilos per annum in perpetuity (ie. forever), without any increase in the levels of other inputs such as fertilizer, labour, equipment etc. Using a 10% rate of discount, what is the net present value, as indicated by the project benefit-cost analysis, of raising the height of the dam? Answer: Annual benefit = $1 times 0.5 million = $0.5 million. PV = $5 million. Cost = $8 million. Hence NPV = -$3 million. 3. If a project involving an initial investment of $20 million is funded partly by debt (75 per cent) and partly by equity capital (25 per cent) and the internal rate of return on the overall cash flow of the project is 15 per cent, while the rate of interest on the debt capital is 10%, what is the rate of return on equity capital? (Make any additional assumptions explicit.) Answer: If return on equity = i % then 0.75x10%+0.25xi%=15% i = 30% 4. Suppose that a firm has borrowed $1000 in the current year at a 10% interest rate, with a commitment to repay the loan (principal and interest) in equal annual installments over the following five years. Calculate: (i) (ii) the amount of the annual repayment; the stream of interest payments which can be entered in the tax calculation of the private benefit-cost analysis. Answer: (i) $263.80 (ii) year 1 = $100; year 2 = $83.62; year 3 = $65.60; year 4 = $45.78; year 5 = $23.98 5. A firm’s stock of working capital at the end of each year in the life of a project was as follows: Year Working Capital ($) 0 0 1 50 2 75 3 70 4 30 5 20 Calculate the working capital cost stream which should be entered in the project analysis. Answer: Expressing the working capital cost stream as a positive cost: year 0 = $0; year 1 = $50; year 2 = $25; year 3 = -$5; year 4 -40; year 5 -$10 (some students may choose to use the negative sign to indicate a cost in which case the signs of the above figures are reversed). 6. Explain why depreciation and interest should not be included as costs in a discounted cash flow (DCF) analysis of a project. Answer: In both instances it would amount to double counting if they were included. Capital cost is treated as an expenditure in the year in which it is incurred. By including depreciation on that same capital each year would be double counting. Interest on debt is a component of the firm’s cost of capital. The cost of capital is expressed as a discount rate (or is compared with the IRR) which is used to derive NPV. If interest on debt was included as a cost in deriving the cash flow, this component of capital cost would be counted twice. However, when we derive the cash flow on equity, all components of debt finance (amount borrowed, repayments and interest) should be deducted from the cash flow, with the residual being the cash flow on equity.