Recitation 6 – Lecture Outline

advertisement

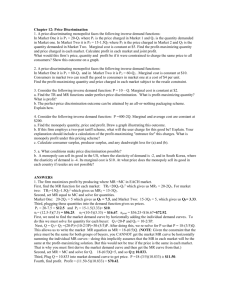

Recitation 6 Notes 1. Outline a. Exam sheets from last time b. Office is PA 202: Office Hours are 2:00 – 4:00 a. I encourage everyone to stop by if they have any questions or need any clarifications c. Next week we will do a touch point quiz on monopolies and price discrimination to make sure everyone is getting the concepts. I will try to make it multiple choice so that you can get a little practice before the next midterm. d. Little Test Taking note for Dr. Conway’s Class: Appeal if you have any doubt. e. Review of Monopolies f. Price Discrimination Under Monopolies 2. Review of Monopolies a. A pure monopoly is an industry in which there is only one supplier of a product for which there are no close substitutes and in which it is very difficult or impossible for another firm to coexist. b. Barriers to Entry are attributes of a market that make it more difficult or expensive for a new firm to open for business than it was for the firms already present in that market (in other words, the incumbent has an advantage) a. Legal Restrictions – post office b. Patents – temporary monopoly to incentivize research c. Control of a scarce resource or input – south African diamond syndicate d. Deliberately erected entry barriers – start costly lawsuits against new rivals e. Sunk Costs f. Technical superiority g. Economies of Scale c. A natural monopoly is an industry in which advantages of large-scale production make it possible for a single firm to produce the entire output of the market at lower average costs than a number of firms each producing a smaller quantity. d. Determining the Profit-Maximization Output a. Find the output at which MC = MR or the last reported value where MR>MC (on a graph you will be able to find the exact value) to select the profit-maximizing output level b. Find the height of the demand curve at that level of output to determine the corresponding price c. Compare the height of the demand curve with the height of the AC curve at that output to see whether the net result is an economic profit or loss. e. Monopoly profits are any excess of the profits earned persistently by a monopoly firm over and above those that would be earned if the industry were perfectly competitive. f. Long run profits comparison between monopolies and perfect competition a. Perfectly competitive firms will not have any long run economic profit because more firms will enter until no one is making economic profit b. Monopolies can make economic profit 3. Price Discrimination a. Price discrimination is the sale of a given product at different prices to different customers of the firm when there is no difference in the costs of supplying these customers. Prices are also discriminatory if it costs more to supply one customer than another but they are charged the same price. 1 b. When a firm charges discriminatory prices, profits are normally higher than when the firm charges non-discriminatory (uniform) prices because the firm then divides customers into separate groups and charges each group the price that maximizes its profits from those customers. c. The marginal revenue from a sale to Group A customer must be the same as that from the sale to Group B consumer d. Given price and output in one of two markets, to determine the profit-maximizing output and price in the other market under price discrimination, do the following: i. Draw the demand and marginal revenue curves for the different customer groups side by side ii. For the first market, draw a horizontal line through the point corresponding to the marginal revenue – quantity combination, which will set the price and quantity for Customer Group A at (Pa, Qa) iii. Knowing the marginal revenue H and output (Qa), point J, for the first market, find the profit maximizing sales quantity for the 2nd market where the horizontal line cuts the MR curve for the 2nd group, so that MR levels are the same for both customer groups. iv. Knowing the marginal revenue H and point maximizing sales quantity Qb for the second market, determine the 2nd customer groups profit maximizing price Pb, point W, by locating the point on the demand curve corresponding to the profit maximizing quantity. 4. Price Discrimination Unique Price (No price discrimination): Expand production as long as MR>MC and stop MR=MC. Max. profit at Q=5 and P=9 and so profit=19 Price Qtotal 14 13 12 11 10 9 8 7.5 7 6 5 4 3 2 1 0 1 2 3 4 5 6 7 8 10 12 14 16 18 20 FC VC 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 TC 0 5 10 15 20 25 30 35 40 50 60 70 80 90 100 MC 1 6 11 16 21 26 31 36 41 51 61 71 81 91 101 TR 5 5 5 5 5 5 5 5 5 5 5 5 5 5 MR 0 13 24 33 40 45 48 52.5 56 60 60 56 48 36 20 Profit 13 11 9 7 5 3 4.5 3.5 2 0 -2 -4 -6 -8 Now segment the market into two groups → we see two different demand curves: Q1 and Q 2 2 -1 7 13 17 19 19 17 16.5 15 9 -1 -15 -33 -55 -81 Group1: Profit is maximized at Q=5 and P=9 so TR=45 Qold Price 0 1 2 3 4 5 6 6.5 7 8 9 10 11 12 13 TRold 14 13 12 11 10 9 8 7.5 7 6 5 4 3 2 1 MRold MC 0 13 24 33 40 45 48 48.75 49 48 45 40 33 24 13 13 11 9 7 5 3 1.5 0.5 -1 -3 -5 -7 -9 -11 5 5 5 5 5 5 5 5 5 5 5 5 5 5 10 12 14 Chart Title 20 15 10 5 0 0 2 4 6 8 -5 -10 -15 Price MRold MC 3 Group2: Profit is maximized at Q=2 and P=6 so TR=12 Qyoung Price TRyoung MRyoung MC 0 14 0 0 13 0 0 12 0 0 11 0 0 10 0 0 9 0 0 8 0 0.5 7.5 3.75 7.5 1 7 7 6.5 2 6 12 5 3 5 15 3 4 4 16 1 5 3 15 -1 6 2 12 -3 7 1 7 -5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 Chart Title 10 8 6 4 2 0 -2 0 1 2 3 4 5 6 7 8 -4 -6 Series1 Series2 Series3 Total profit with price discrimination: P1*Q1+P2*Q2 -TC=45+12-36=21 which is bigger than the profit with unique price case (19). 4