Document

advertisement

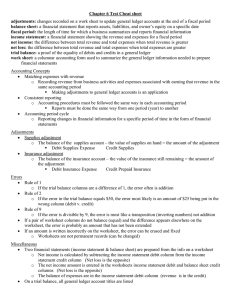

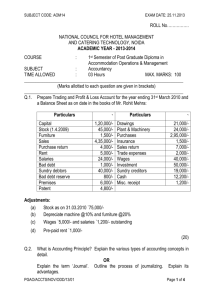

Financial Accounting Module 1 An Overview 1 Module 1 (6 Hours) Financial Accounting An overview, Accounting concepts, principles, accounting standards. Ledger posting, Trial Balance. 2 Definition And Meaning Of Accounting The American Institute of Certified Public Accountants (1941) defines ‘Accounting is the art of recording, classifying and summarising in significant manner and in terms of money, transactions and events which are in part, at least of a financial character and interpreting the results thereof. Accounting As An Information Cycle Input Process Output 3 Accountancy, Accounting And Book-keeping 4 IMPORTANCE OF ACCOUNTING 1. Facilitates to replace memory and comply with legal requirements 2. Facilitates to ascertain net result of operations and also to know the financial position 3. Facilitates the users to take effective decisions 4. It is helpful in a comparative study 5. It assists the management 6. It facilitates to have control over assets 7. It facilitates the settlement of tax liability 8. It facilitates raising of loans 9. It acts as a legal evidence 10. It facilitates ascertainment of value of business. 5 SCOPE OF ACCOUNTING • • • • • • • Identifying Measuring Recording Classifying Summarising Analysing Interpreting • Communication 6 Accounting Principles Accounting principles are a body of doctrines commonly associated with the theory and procedures and as a guide for selection of conventions or procedures where alternatives exist. These principles are classified into two categories: 1. Accounting Concepts 2. Accounting Conventions 7 TYPES OF ACCOUNTING Accounting Financial Accounting Cost Accounting Management Accounting Social Responsibility Accounting 8 ACCOUNTING CONCEPTS Concept means a general notion, a theory or belief held by person or group of persons. The term ‘concepts’ includes those basic assumptions or conditions upon which the science of accounting is based. 1. 2. 3. 4. 5. 6. 7. Business entity concept Money measurement concept Cost concept Going concern concept Dual aspect concept Realisation concept Accrual concept 9 ACCOUNTING CONVENTIONS A convention means a custom or an established usage formed or adopted by an agreement. The term ‘conventions’ includes those customs or traditions which guide the accountant while preparing the accounting statements. 1. 2. 3. 4. Convention of consistency Convention of full disclosure Convention of conservatism Convention of materiality 10 Accounting Standards The Accounting standards bring uniformity in the preparation and presentation of financial statements and aids in comparison of different financial statements of companies in the same or different industries. Procedure for framing Accounting Standards • The International Accounting Standards are issued by the IASC • These Standards are received by ICAI assigned to ASB • The Accounting standards are issued under the authority of the council of ICAI. So far the ASB of ICAI has issued 28 Accounting standards as shown below: 11 Accounting Standard AS-1 Title Mandatory for Accounting period beginning on or after Disclosure of Accounting Policies 1.4.1991 AS2(Revised) Valuation of inventories 1.4.1999 AS3(Revised) Cash Flow Statements 1.4.2001 AS4(Revised) Contingencies and Events occurring after Balance Sheet Date 1.4.1995 AS5(Revised) Net Profit or Loss, prior period items and changes in Accounting policies 1.4.1996 AS6(Revised) Depreciation Accounting 1.4.1995 AS7(Revised) Accounting for construction contracts 1.4.2003 12 AS-8 Accounting for Research and Development 1.4.1991 AS-9 Revenue Recognition 1.4.1991 AS-10 Accounting of Fixed Assets 1.4.1991 Accounting for the effect of changes in foreign exchange rates 1.4.1995 AS-12 Accounting for Government Grants 1.4.1994 AS-13 Accounting for Investments 1.4.1995 AS-14 Accounting for Amalgamations 1.4.1994 AS-15 Accounting for retirement benefits in the financial statements of employers 1.4.1995 AS-16 Borrowing costs 1.4.2000 AS-17 Segment reporting 1.4.2001 AS-11(Revised) 13 AS-18 Related Party Disclosures 1.4.2001 AS-19 Leases 1.4.2001 AS-20 Consolidated Financial Statements 1.4.2001 AS-21 Earnings per share 1.4.2001 AS-22 Accounting for taxes on income 1.4.2001 AS-23 Accounting for investments in consolidated finance statements 1.4.2002 AS-24 Discounting operations 1.4.2004 AS-25 Interim financial reporting 1.4.2002 AS-26 Intangible assets 1.4.2003 14 AS-27 Financial reporting of interest in joint ventures 1.4.2002 AS-28 Impairment of Assets 1.4.2004 AS-29 Provisions, Contingent Liabilities and Contingent Assets 1-4-2004 15 USERS OF FINANCIAL STATEMENTS 1. 2. 3. 4. 5. 6. 7. 8. Creditors (short term & long term) Investors (present & potential) Management Employees Tax Authorities Customers Government and their agencies Public 16 Double Entry System Of Book-keeping The main principle involved in Double Entry system is the duality transactions i.e., for every debit, there is an equal and opposite credit. Total Debits = Total Credits Principles Of Double Entry System Classifications of accounts under double entry system Traditional classification of Accounts Personal Accounts Names of individuals, firms, companies and other entities Real Accounts Assets And Liabilities Nominal Accounts Expenses, losses and incomes and gains 17 Assets: Resources, things or rights or value owned by a business Liability: Claims of others against a business / Assets owned by the business to the outsiders Expenses:An expenditure in return for which a benefit is received. Loss: An expenditure in return for which no benefit is received. Income: Refers to the earnings of a business for the expenses incurred Profit: Refers to the earnings of a business for no expenses incurred or proportionally meagre expenses incurred Rules for debit and credit under traditional classification Type of Account Debit Credit Personal Account The receiver The giver Real Account What comes in What goes out Nominal Account All expenses and losses All incomes and gains 18 ACCOUNTING CYCLE Step 1 Journalising Step 6 – Position Statement Step 2 – Posting Step 5 – Income Statement Step 3 – Balancing Final Accounts Step 4 – Trial Balance 19 Records Maintained By An Organisation The books of accounts maintained by an organisation may be classified into two as a. Books of Prime / Original Entry b. Books of Second entry / Final entry Books of Prime / Original Entry 1. Journal 2. Cash Book 3. Subsidiary Books 20 JOURNAL / DAY BOOK Journal is a daily record of each business transaction. It is also called a day book and it is used for recording all day to day transactions in the order in which they occur. Format of a Journal Date Particulars Ledger Debit Credit Rs. Rs. Folio ……………. Dr To…………. (Being…………) 21 CASH Debit: BOOK All Cash receipts and Bank receipts and Discount Allowed Credit: All Cash payments and Bank payments and Discount Received. The cashbook is classified into 4 types viz., 1. Single column cash book 2. Two columnar cash book 3. Three columnar cash book 4. Petty cash book 22 Tips to decide whether a cash transaction or not 23 In a purchase or a sale: If there is no mention about the payment made, No name of the party given, but the amount is given, then It is a cash transaction Ex: If there is the name of the party and no mention about the payment, then it is a credit transaction If name of the party given and payment in cash or credit then it is a cash transaction. 24 LEDGER Also called as General Ledger, this is a principal book that contains all the accounts i.e., accounts of Assets liabilities, capital, revenue and expenses. The entries from the books of original entry are transferred to this book. Hence it is also called as a book of final entry. There are a number of accounts in a general ledger. All similar transactions are grouped under one account. Dr Date Cr Particulars To Balance b/d (Opening balance) Folio Amount Rs. Date Particulars Folio Amount Rs. -------- By Balance c/d (Closing balance) -------- The opening and closing balances will appear only in case of assets, liabilities and capital accounts but not in case of incomes and expenditures. 25 Format of a single column cash book Dr Date Cr Particulars To Balance b/d (Opening balance) L.F. Amount Rs. Date Particulars L.F. Amount Rs. ------- By Balance c/d (Closing balance) ------- 26 Illustration: I. Single column cash book 2007 June 1. Balance as on 31/5 2. Purchases made 3. Cash drawn from Bank 4. Cash paid towards salary 5. Purchased goods from Kishan & co. on credit 6. Rent payable 7. Cash deposited into Bank 42,000 12,000 5,000 8,000 8,000 5,000 20,000 27 Soln: Single Column Cash Book Date Particulars 1/6/07 To balance b/d 3/6/07 To Bank LF Amount Date 42,000 5,000 47,000 Particulars 2/6/07 By Purchases 4/6/07 By Salary 7/6/07 By Bank By balance c/d LF Amoun t 12,000 8,000 20,000 7,000 47,000 28 PROBLEM JAN 1 : Opening cash balance Rs 5,000 JAN 4 : Rent paid Rs 2,000 JAN 6 : Interest received Rs 3,000 JAN 15 : Cash purchases Rs 4,000 JAN 25 : Cash sales Rs 8,000 JAN 31 : Salaries paid Rs 2,000 29 Format of a single column cash book Dr Date Cr Particulars JAN 1 To Balance b/d JAN 2 To Interest JAN 25 To Sales L.F. Amount Rs. 5,000 3,000 8,000 ----------16,000 ----------To Balance b/d Date JAN JAN JAN JAN 4 15 31 31 Particulars By By By By Rent Purchase a/c Salaries a/c Balance c/d L. F. Amount Rs. 2,000 4,000 2,000 8,000 ----------16,000 ----------- 8,000 30 Format of a double column cash book Dr Date Cr Particulars To Balance b/d (Opening balance) L. F Discoun t Rs. Cash Rs. Date Particulars L. F Discount Rs. Cash Rs. ------ By Balance c/d (Closing balance) OR ------ 31 Format of a double column cash book Dr Date Cr Particulars To Balance b/d (Opening balance) L. F Discount Rs. Bank Rs. Date Particulars L. F Discount Rs. Bank Rs. ------ By Balance c/d (Closing balance) OR ------ 32 Format of a double column cash book Dr Date Cr Particulars To Balance b/d (Opening balance) L. F Cash Rs. Bank Rs. Date Particulars L. F Cash Rs. Bank Rs. ------ By Balance c/d (Closing balance) ------ 33 PROBLEM Two Columnar Cash Book with discount and cash columns: 2006 October Opening balance Paid salary Purchased goods Purchases made from Shreya & co. Cash sales Sales made to Rajinikanth & co. To Shreya returned 20% of goods due to damage, paid to 18,000/- in full Settlement of the account. Received from Rajinikanth 48,000/- in full settlement after he made returns 10,000/Deposited into Bank 80,000 10,000 12,000 25,000 1,15,000 60,000 3,000 34 Solution: Date Particulars To balance b/d To sales To Rajinikanth & co. Working Note: Shreya & co. Puchases (-)Returns 20% Payable (-)Paid Discount received L Discount F allowed Cash 2,000 80,000 1,15,000 48,000 2,000 2,43,000 25,000 5,000 20,000 18,000 2,000 Date Particulars By Salary By Purchases By Shreya & co. By Bank By balance c/d Rajinikanth & co. Sales (-)Returns Receivable (-)Received Discount allowed L F Discount Cash received 10,000 12,000 2,000 18,000 3,000 2,00,000 2,000 2,43,000 60,000 10,000 50,000 48,000 2,000 35 PROBLEM JAN 1 : Cash Balance Rs 5,000 JAN 6 : Sold Goods to Mahesh Rs 4,000 JAN 8 : Purchased Goods from Mukesh Rs 3,000 JAN 15 : Cash Received from Mahesh Rs 3,900 in full settlement JAN 20 : Paid to Mukesh Rs 2,850 in full settlement JAN 25 : Sold Goods to Suresh Rs 3,000 JAN 31 : Received Cash from Suresh Rs 2,900 36 double column cash book Dr Date Cr Particulars To Balance b/d To Mahesh To Suresh L . F Disco unt Rs. Cash Rs. 100 100 5,000 3,900 2,900 ------200 ------- --------11,800 --------- Date Particulars By Mukesh By Balance c/d L.F Disco unt Rs. 150 Cash Rs. 2,850 8,950 --------11,800 --------- 37 Format of a three columnar cash book Dr Date Cr Particulars To Balance b/d (Opening balance) L. F Disc ount Rs. Cash Bank Rs. Date Particulars L. F Disc o-unt Rs. Cash Rs. Bank Rs. ------ By Balance c/d (Closing balance) OR ------ 38 CONTRA ENTRY • It is an accounting transaction that involves both CASH account and BANK account • No posting will be done from the CASH BOOK to the LEDGER in case of a contra entry • A contra entry is indicated by the letter C which gives a hint to the ledger keeper that no posting is required 39 CONTRA ENTRY Ex : Cash deposited to bank Credit side of cash book : Amount will be entered in cash column against the words “ By Bank” Debit side of cash book: Amount will be entered in bank column against the words “To Cash” Ledger folio column : C which represents a contra entry is entered 40 CONTRA ENTRY Ex : Cash withdrawn from bank Credit side of cash book : Amount will be entered in bank column against the words “ By Cash” Debit side of cash book: Amount will be entered in cash column against the words “To Bank” Ledger folio column : C which represents a contra entry is entered 41 PROBLEM JAN 1 : Paid into Bank Rs 6,000 JAN 2 : Withdrew for private expenses Rs 1,000 JAN 3 : Withdrew from bank Rs 3,000 JAN 4 : Withdrew from bank for private use Rs 1,500 42 Format of a three columnar cash book Dr D at e 1 3 Cr Particulars To Cash a/c To Bank a/c L.F C C Disco -unt Rs. Cash 3000 Bank Rs. Date 6000 1 2 3 4 Particulars By By By By Bank a/c Drawings Cash a/c Drawings L.F C C Disco -unt Rs. Cash Rs. Bank Rs. 6000 1000 3000 1500 43 III. Three Columnar Cash Book On 1st Jan 2001 Raj Opened a Bank account by depositing 6,000/- in cash. All remittances are to be paid to the Bank Date Jan 2 Jan 5 Jan 7 Jan 10 Jan 12 Jan 15 Jan 20 Jan 27 Particulars Goods sold to Mohan for cash 9,250/Settled Harish’s account of 200/- at a discount of 5% Received from Shyam a cheque of 725/- discount allowed 25/Purchased Typewriter for 200/- and spent 50/- on its repairs Shyam’s cheque was returned as dishonoured Received a money order for 25/- from Harish Shyam settled his accounts by means of a cheque for 755/-, 5/for being Interest charge. Purchased Machinery from Rajeev for 5,000/- and paid him by means of a Bank draft purchased from a Bank for 5,005/44 Solution: Date Particular s 1/1 2/1 7/1 15/1 20/1 20/1 L F To Cash c To Sales To Shyam To Harish To Shyam To Intt charge Dis allowed Cash Bank Date Particulars 9,250 6,000 1/1 5/1 725 10/1 25 25 750 10/1 12/1 5 27/1 31/1 25 9,275 7,480 L Dis F received By Bank c By Harish By Typewriter By Repairs By Shyam By Machinery By balance c/d 10 Cash Bank 6,000 190 200 50 725 5,005 2,835 1,750 10 9,275 7,480 45 Petty cash book It is a cash book in which all the petty cash expenses incurred daily by an organisation is recorded. Such as postage, cartage, stationery, cleaning charges, etc. 46 A petty cashier is appointed to make payments of all such types, he works under the supervision of chief cashier, who advances money in the beginning of every period to meet such expenses. At the end of the period the petty cashier submits a statement of accounts of the expenses incurred by him during the period and gets a fresh advance. 47 Petty Cash Book It is a cash book in which all the petty cash expenses incurred daily by an organisation is recorded. Dr Dt Cr Particulars CBF Total Rs. Dt Particulars Vr. No Postage Conveyance Wages Business Promotion Total Rs. 48 PETTY CASH BOOK Record the following petty cash book maintained on the imprest system 1-10-2007 2-10-2007 3-10-2007 4-10-2007 5-10-2007 6-10-2007 cash received from cashier paid for coffee and tea for staff travelling expense by the sales manager subscription for the newspaper purchase of paper and other stationery expenses for taking employees for an outing Rs 10000 Rs 125 Rs 1200 Rs 100 Rs 250 Rs 4200 49 PETTY CASH BOOK Dt 10 /0 7 Particu lars 1 To cash from head cashier C B F Total Rs. D t 10 / 07 Particular s Vr . N o Employ ees welfare exp 10000 2 By coffee & tea 1 125 3 By travelling exp of manager 2 4 Travell ing exp Newspaper s& stationery postag e Tota l Rs. 125 1200 1200 3 100 100 4 250 250 By newspaper 5 6 7 By stationery By staff outing 5 6 4200 4200 75 7550 Problem: Enter the following transactions in petty cash book for the month of January, 1999. Jan 1, cash received from the chief cashier Rs.200 Jan 3, typing papers Rs. 8 Jan 6, office cleaning Rs.4 Jan 8, postage Rs. 2 Jan 10, cartage Rs. 2 Jan 15, postage Rs. 6 Jan 18, ink Rs 3, typing paper Rs. 10 Jan 20, type writer ribbon Rs. 10 Jan 22, telephone charges Rs. 7 Jan 24, office cleaning Rs. 2 Jan 25, nail polish Rs. 27 Jan 27, telegrams Rs. 25 Jan 29, typing paper Rs. 30 51 Dr Dt Cr Partic ulars Jan to cash 1 From chief cashier CB F To D tal t Rs. 20 0 Particu lars Vr. No Stati Posta oner ge y charg es Typing Clean Post n off clean 10 Cartage 15 Postage 18 Ink, typing paper 1,2 3 4,5 8 3 6 8 20 Typ ribbon Car tag e 4 4 2 2 6 7 Cleanin g 2 6 misce total llane ous 12 4 4 2 6 8,9 13 13 10 10 10 52 Dt Partic ulars C B F Tota D l t Rs. Particu lars Vr. No Stati Posta oner ge y charg es 22 Telepho 11 ne charges 24 Cleaning 12 25 Nail 13 polish Car tag e Cleanin g misce total llane ous 7 7 2 2 27 27 27 Telegra ms 29 Typing paper Fe 1 Fe 1 To bal b/d Cash from chief cashier 200 58 Lf bal c/d 14 15 25 25 30 61 2 30 44 3 2 4 8 5 27 6 142 58 200 142 53 PURCHASES BOOK This is a subsidiary book in which all the credit purchases made by the organisation is recorded. The monthly total from the purchase book is transferred to the General Ledger to the Purchases Account. Date Purchase invoice no. Name of the supplier L F Details Rs. Ps. Total Amount Rs. Ps. 54 PURCHASE RETURNS BOOK A book in which all the purchase returns (returns outwards) are recorded. Date Debit Note No. Name of the supplier L F Details Rs. Ps. Total Amount Rs. Ps. 55 SALES BOOK The credit sales are recorded in this book. The monthly totals are transferred to the sales account in the General Ledger. Date Sales invoice no. Name of the purchaser L F Details Rs. Ps. Total Amount Rs. Ps. 56 SALES RETURNS BOOK A book of account in which all the sales returns (returns inwards) made by the organisation are recorded. Date Credit Note No. Name of the Purchaser L F Details Rs. Ps. Total Amount Rs. Ps. 57 Enter the following in subsidiary books. Jan 1: Purchased goods from Sudarshan paid by cheque Rs.15000 3: Sold goods to Bimal Rs.11000. 6: Purchased goods from Satish & co Rs. 12000. Returned goods to him Rs. 700 . 8: Purchased stock worth Rs.42000 from Reliance industries of which only 40% is on cash basis. 10: Sold goods worth Rs.38000 to Karimlal & co allows him a trade discount of 1% . 11: Murugeshan & co supplies stock worth Rs. 64000 and allowed us a trade discount of 1.5% . 12: Returns out of the previous 2 transactions amount to 5% each. 58 Purchases Book Date Purchas e Invoice No. Name of the supplier LF Amount (Rs) Total (Rs) Amount Jan 6 Satish & Co 21 12000 12000 Jan 8 Reliance & Co. 23 25200 25200 Jan 11 Murugesh & Co. 25 63040 63040 100240 100240 59 Purchases Returns Book Date Debit Note No. Name of the Party LF Amount (Rs) Total (Rs) Amount Jan 6 Satish & Co 21 700 700 Jan 12 Murugesh & Co. 25 3152 3152 3852 3852 60 Sales Book Date Invoice No. Name of the Party LF Amount (Rs) Total (Rs) Amount Jan 3 Bimal & Co. 32 11000 11000 Jan 10 Karimlal & Co. ( -1%) 35 37620 37620 48620 48620 61 Sales Returns Book Date Jan 12 Credit Note No. Name of the Party LF Amount (Rs) Total (Rs) Amount Karimlal & Co. ( -1%) 35 1881 1881 1881 1881 62 JOURNAL PROPER Those journal entries that cannot be recorded in any of the subsidiary books are recorded in the journal proper. The following are recorded in the journal proper: a. Opening Entries b. Closing Entries c. Transfer Entries d. Adjustment Entries e. Rectification Entries 63 TRAIL BALANCE A trail balance may be simply defined as a statement prepared by putting all debits on one side and all credits on the other side to check the arithmetical accuracy of the ledger balances. In otherwords,the trail balance is a connecting link between the ledger accounts and final accounts. 64 TRIAL BALANCE It is a statement that shows the balance in all the accounts in a ledger. It contains all the debit and credit balances. A trial balance is a list of debit and credit balances of all the ledger accounts prepared on any particular date to verify whether the entries in the books of accounts are arithmetically correct or not. Sl. No. Head of Account LF Debit Balance Rs. Ps. Credit Balance Rs. Ps. 65 characteristics basically trial balance is a statement or list. It contains all the debit and credit balances. The trail balance is the only base for the preparation of final accounts. Trail balance can be prepared at any time and not necessarily at the end of a calendar or accounting year. 66 Importance • Before preparing the final accounts, the accountant should prove/satisfy the arithmetical accuracy and correctness on which the entire final accounts were prepared. The net profit/balance sheet does not resemble true and fair picture which which was prepared from a trail balance which lacks the quality of arithmetical accuracy. 67 Advantages To examine the implementation of a double entry book keeping and its principles. To know the arithmetical accuracy. To find the profit of the firm. To find out the errors and mistakes in passing journal entries and their posting. To facilitate the process of the preparation of final accounts. 68 Preparation of Trail balance • Debit side • Assets accounts: land, building, machinery, furniture, debtors, stock, bills receivables etc. • Accounts relating to expenses and losses: salaries, wages, rent, carriage, discount, bad debts, depreciation, purchases, return inward. 69 • Credit side • Liabilities accounts: creditors, loan, mortgage, bills payable, bank overdraft, reserves and funds. • Incomes and gain account: interest realised, rent collected, discount received, sales account, returns outward. • Capital Account 70 Trail balance methods • Trail balance can be prepared in two methods. They are total balances method and net balances method. • Total balances method: in this method, debit as well as credit sides of all accounts will be summed up and with this totals the trail balance will be prepared. This method is called “gross trail balance method”. This method is now out of use. 71 • Net balances method: this is the most commonly used trail balance. In this method the net balance of the accounts were ascertained on a particular date and arranged in the proforma of trail balance. If these totals of debit and credit agree, we can say the trail balance has arithmetical accuracy. 72 Example: Prepare a trial balance from the following balances of the year 2002. (Dec 05/ Jan 06- 10M) Capital 28,000 Stock of goods 4000 Motor car 8000 Discount received 400 Bad-debts 400 Sales 40,000 Cash-at-bank 4000 Return inwards 2000 Cash in hand 600 Rent 3500 Discount allowed 300 Carriage 1500 Purchases 15,000 plant 15,000 furniture 5000 wages 8200 creditors 6500 salaries 2800 commission (cr) 600 return outwards 1000 debtors 5600 general expenses 300 interest received 200 advertisement 500 73 SOLUTION: DEBIT(ASSETS & EXPENSES) CREDIT (LIABILITIES & REVENUES) dt Name of the account LF Debit 1 Capital 2 Stock of goods 4000 3 Motor car 8000 4 Discount received 5 Bad-debts 6 Sales 7 Cash-at-bank 4000 8 Return inwards 2000 9 Cash in hand 600 10 Rent 3500 11 Discount allowed 300 credit 28,000 400 400 40,000 74 dt Name of the account LF Debit credit 12 Carriage 1500 13 Purchases 15,000 14 plant 15,000 15 furniture 5000 16 wages 8200 17 creditors 18 salaries 19 commission (cr) 600 20 return outwards 1000 21 debtors 5600 22 general expenses 300 6500 2800 75 dt Name of the account LF Debit 23 Interest received 24 Advertisement 500 TOTAL 76,700 credit 200 76,700 76 End of the Module 77