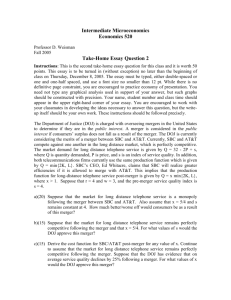

Quiz 2: vertical mergers and R&D

advertisement

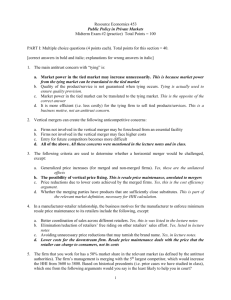

Quiz 2: vertical mergers and R&D 1. Consider an industry which produces good X. To produce this good one needs to transform an input, Y, which is not substitutable with other inputs or raw materials. There is only one firm, A, which can supply input Y. Suppose now that there exists only one firm, B, which produces X. Would you allow a merger between these two firms? Yes Allowing a merger prevents the problem of double marginalization, which lowers the total price and lifts up demand => welfare increasing 2. Suppose there are 10 manufacturers operating in one region and they produce fashion products which are not the same, but differentiated products (e.g. 10 different types of pullovers). Every manufacturer has about 10% of market share. All manufacturers sell their products to the 20 retailers that are located in this region who have approximately a market share of 5% each. Now one manufacturer wants to vertically integrate 2 of the retailers. Should the competition authority allow this merger? Yes Because of the fact all these manufacturers and retailers don't have much market power, competition authorities shouldn't really be worried of the merger. The market system keeps working as it should be and undercutting will lead to competitive pricing. 3. Suppose you work for a retailer that shares its market with 9 other retailers. Now your CEO suggests that you could vertically integrate with one of the 20 manufacturers that supply a product for your market. Your colleague who is assistant of the CEO mentions that the competition authority would possibly not allow the merger as you cannot claim that the merger will be beneficial for consumers. He argues that the authorities would only allow the merger if you could prove that you reduce the double marginalization problem because of the merger. Due to the tough competition in the market, you could not claim this, your colleague says. Is he right? Will the competition authority forbid the proposed merger because there is no double marginalization problem in your market? No Very insignificant market power => no possible harm 4. Suppose your company is in a market where it currently achieves a profit margin of 20% per product unit sold. Now a new firm enters this market and offers its very similar product for 10% below your price. Now your CEO suggests that your company should reduce your price by 20%, so that you sell at a price which is equal to total unit cost. She would hope that the new entrant cannot compete with the price and will leave the market soon again. Then you could increase the price later again. One of her advisors warns her that this practice may be considered to be illegal by the competition authority, and that you run the risk of getting fined heavily. What do you think? The CEO's strategy could be implemented without problem As you only lower your price to production cost, you simulate the market price under perfect competition which the authorities cannot forbid. If the competitor can't supply the market at this price and disappears from the market that's just competition working and you can raise prices again (which will trigger entry by other competitors and starts the whole process all over again). 5. Indicate whether you agree or not agree with the following statement, based on your economic knowledge: "If an incumbent company is threatened by an entrant, it will always be more profitable for the incumbent to merge with the entrant than engaging in predatory pricing behavior (price war)." Not agree ............................................................ 6. Indicate whether you agree or not agree with the following statement, based on your economic knowledge: "A joint-stock company that invests all its retained earnings into R&D and physical assets instead of paying any dividends to its shareholders should be investigated carefully by the competition authority. It may be the case that this company engages in strategic over-investments to preempt entry into its market." Not agree See slide 2.23 7. Indicate whether you agree or not agree with the following statement, based on your economic knowledge: "A firm has 10% of market share and decides to sell 2 complementary products as bundle should not be accused of abusive practices, as the potential benefits from product bundling most likely outweigh the possible harm to welfare." Agree ...........................................................