Presentation

advertisement

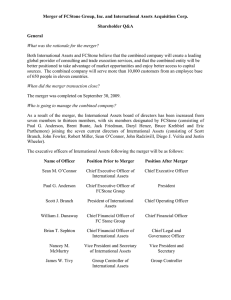

Use and limits of market definition 11 November 2015 St. Martin’s conference, Brno Alexis Walckiers Belgian Competition Authority and ECARES-Université libre de Bruxelles Introduction • market definition is a tool to define the boundaries of competition o establish competitive constraints that undertakings face o alternative sources of supply for the customers of the undertakings involved o product dimension o geographic dimension • in practice, defining a market makes it possible to calculate market shares, which conveys information on market conduct and performance o existence, creation or strengthening of market power o but to what extent? o In how far does the structure of a market determines a firm’s conduct on that market and the performance of the market? Structure-conduct-performance benchmark • identifying competitors that are capable of preventing firms from behaving independently is crucial o to assess whether a company is dominant o which is necessary to find an abuse o to analyse whether and how a notified merger affects consumers o if the combined market share of the notifying parties post-merger is high, they will be able and have an incentive to raise prices o if there are few competitors left on the market, their ability to coordinate their conduct rises • according to the Structure-conduct-performance paradigm o performance follows from structure o there is an inverse relationship between market share and degree of market competition o in a Cournot model the price cost margin of a firm raises when its market share increases o in a Cournot model, welfare decreases when market concentration increases (HHI) Limits of structure-conduct-performance • difficulty to delineate the market o some markets are easier to define than others o in differentiated markets, some products are closer substitutes than others: not black and white o in some markets, price discrimination is crucial, and different categories of consumers end up paying significantly different prices o some goods must be used with a secondary product that is a complement (aftermarkets); are these separate markets o two-sided markets are difficult to define, because the indirect effect of the other side can be significant o defining the market for an innovative good can be difficult, because the good may be unique in the eyes of consumers, or a complement and a substitute of alternatives o in cluster markets, companies provide a range of goods or services; purchasing from a single provider brings transaction complementarities Limits of structure-conduct-performance • are market shares a good proxy for competitive constraints? o in differentiated markets, competitive constraints relate to intensity of competition and substitution between products more than to market shares o in bidding markets, closeness of competition between bidders is more informative than market shares o in aftermarkets, a high market share in the secondary product may not mean that competitive constraints are inexistent ); ex post, consumers can be locked in, but ex ante they may be able to choose between a number of options o platforms with significant market shares on one side can experience significant competitive constraints from the other side o in some innovation-driven markets, firms compete for the market, and not necessarily in the market Policy implications • how much resources should be invested in defining markets? o market definition is and will remain a crucial tool for competition investigations o in some markets (eg, those discussed above), it is less important to carefully define markets o better to directly focus on competitive constraints, and on the likely effects of the merger, or the abuse • some competition authorities downplay the role of market definition in merger assessment o eg. US horizontal merger guidelines (2010), UK merger assessment guidelines o … and highlight other techniques to more directly assess the effect of the merger (UPP, GUPPI, merger simulation, etc.)