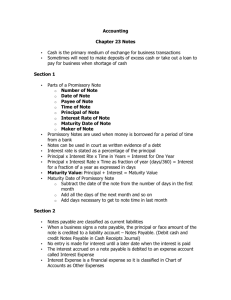

Chapter 20 PowerPoint

advertisement

Accounting for Notes and Interest 12. Promissory Notes Promissory note – a written and signed promise to pay a sum of money at a specific time Creditor – a person or organization to whom a liability is owed Notes payable – promissory notes signed by a business and given to a creditor *Notes have an advantage over oral promises and accounts receivable or payable – can be useful in a court of law as written evidence of a debt 2 USES OF PROMISSORY NOTES 1. Number 4. Time of a note page 589 2. Date of a note 3. Payee 5. Principle 3 8. Maker LESSON 20-1 6. Interest rate 7. Maturity date Promissory Notes Interest – an amount paid for the use of money for a period of time Maturity value– the amount that is due on the maturity date of a note *Sometimes partial payments on a note are made each month (car payment) *Each monthly payment includes part of the principal amount owed and part of the interest 4 *When calculating notes, use 360 days in a year INTEREST ON PROMISSORY NOTES page 590 Interest for One Year Principal × Interest Rate $20,000.00 × 6% × Time in Years = Interest for One Year × 1 = $1,200.00 Interest for Fraction of Year 5 Principal × Interest Rate $20,000.00 × 6% LESSON 20-1 Time as × Fraction of = Year Interest for Fraction of Year 90 360 $300.00 × = page 590 INTEREST ON PROMISSORY NOTES Maturity Value 6 Principal + Interest = Maturity Value $20,000.00 + $300.00 = $20,300.00 LESSON 20-1 MATURITY DATE OF PROMISSORY NOTES May 18, 90-Day Note May18–May 31 June July August 1–August 16 Total 13 days 30 days 31 days 16 days 90 days 1 2 3 4 1. Subtract the date of the note from the number of days in the first month. 2. Add 30 days for June. 3. Add 31 days for July. 4. Add only 16 days in August. 7 LESSON 20-1 page 591 13. Notes Payable and Notes Receivable Current liabilities – liabilities due within a short time (usually a year) *A receipt is prepared as the source document for the principal amount of the note (Accounting concept: Objective Evidence) 8 SIGNING A NOTE PAYABLE page 593 May 18. Signed a 90-day, 6% note, $20,000.00. Receipt No. 345. 1 2 1. 2. 3. 4. 5. 9 3 4 Write the date. Write the account title. Write the receipt number. Write the principle amount in the General Credit column. Write the same amount in the Cash Debit column. LESSON 20-2 5 13. Notes Payable and Notes Receivable Interest expense – interest accrued on money borrowed 10 PAYING PRINCIPLE AND INTEREST ON A NOTE PAYABLE page 594 August 16. Paid cash for the maturity value of the May 18 note: principal, $20,000.00, plus interest, $300.00; total, $20,300.00. Check No. 721. 2 1 3 6 7 1. 2. 3. 4. Write the date. Write the account title. Write the check number. Write the note’s principal amount. 5. Write the account title. 11 4 LESSON 20-2 6. Write the interest expense amount. 7. Write the amount of cash paid. 5 13. Notes Payable and Notes Receivable *A business may ask for an extension of time if it is unable to pay an account when due. The vendor may ask the business to sign a note payable Ex: An accounts payable needs an extension, transferred to a note payable 12 SIGNING A NOTE PAYABLE FOR AN EXTENSION OF TIME page 595 June 5. Restaurant Supply signed a 90-day, 12% note to Hayport Company for an extension of time on its account payable, $4,000.00. Memorandum No. 66. 1 2 1. Debit to Accounts Payable 2. Credit to Notes Payable 13 LESSON 20-2 PAYING A NOTE PAYABLE ISSUED FOR AN EXTENSION OF TIME September 3. Paid cash for the maturity value of the note payable to Hayport Company: principal, $4,000.00, plus interest, $120.00; total, $4,120.00. Check No. 722. 14 LESSON 20-2 page 596 13. Notes Payable and Notes Receivable Notes receivable – promissory notes that a business accepts from customers *Usually paid within a year, thus classified as current assets Interest income – interest earned on money loaned Interest Income *Classified as “Other Revenue” 15 ACCEPTING A NOTE RECEIVABLE FROM A CUSTOMER April 14. Accepted a 90-day, 8% note from Martin Sterling for an extension of time on his account, $3,000.00. Note Receivable No. 9. 1 2 1. Debit to Notes Receivable 2. Credit to Accounts Receivable 16 LESSON 20-3 page 598 COLLECTING PRINCIPAL AND INTEREST ON A NOTE RECEIVABLE page 599 July 13. Received cash for the maturity value of Note Receivable No. 9, a 90-day, 8% note: principal, $3,000.00, plus interest, $60.00; total, $3,060.00. Receipt No. 562. 2 1 3 5 1. 2. 3. 4. 17 4 6 Write the date. Write the account title. Write the receipt number. Write the principal amount. LESSON 20-3 7 5. On the next line, write the account title. 6. Calculate and write the interest income amount. 7. Write the maturity value. 13. Notes Payable and Notes Receivable Dishonored note – a note that is not paid when due *Transferred back to accounts receivable, interest income earned even though the note has not been paid *Company does not initially write off an account, they will continue to try and collect the balance *Later, the company may decide to write off the account and use some of the allowance for uncollectible accounts balance 18 RECORDING A DISHONORED NOTE RECEIVABLE page 600 May 6. Jill Davis dishonored Note Receivable No. 12, a 90-day, 8% note, maturity value due today: principal, $600.00; interest, $12.00; total, $612.00. Memorandum No. 92. 1 2 3 1. Debit to Accounts Receivable 2. Credit to Notes Receivable 3. Credit to Interest Income 19 LESSON 20-3