Government Contracts Outline

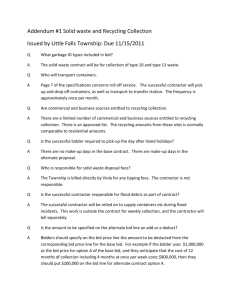

advertisement