MEL Exam Review2009sem1

advertisement

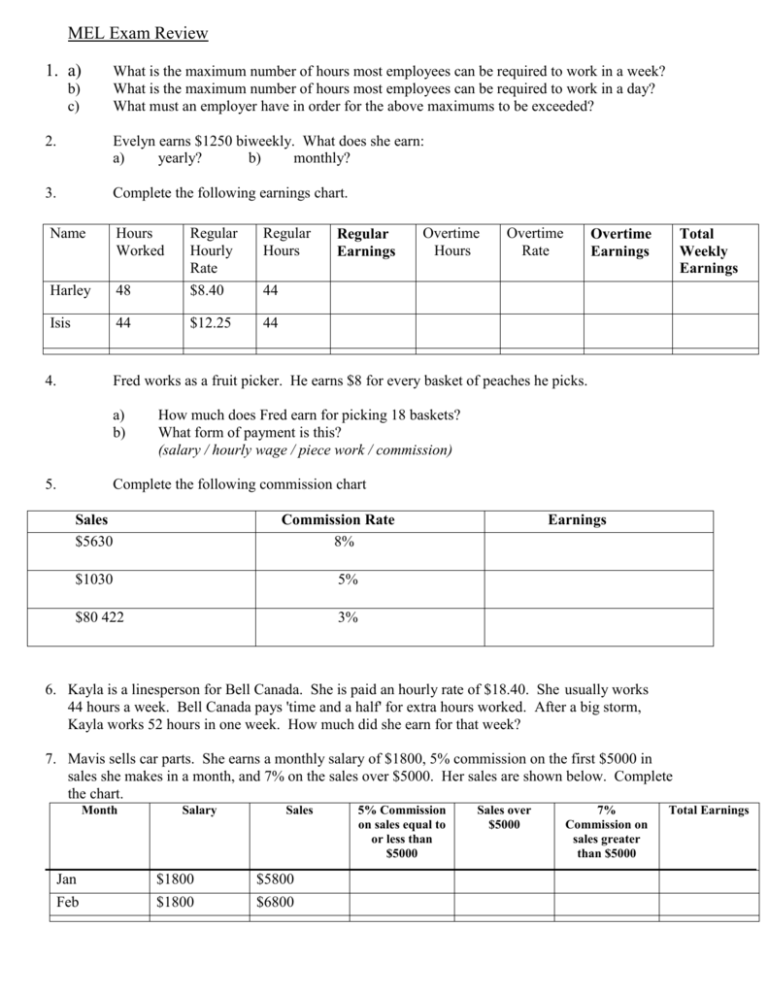

MEL Exam Review 1. a) What is the maximum number of hours most employees can be required to work in a week? What is the maximum number of hours most employees can be required to work in a day? What must an employer have in order for the above maximums to be exceeded? b) c) 2. Evelyn earns $1250 biweekly. What does she earn: a) yearly? b) monthly? 3. Complete the following earnings chart. Name Hours Worked Harley Isis 4. Regular Hours 48 Regular Hourly Rate $8.40 44 $12.25 44 Regular Earnings Overtime Hours Overtime Rate Overtime Earnings Total Weekly Earnings 44 Fred works as a fruit picker. He earns $8 for every basket of peaches he picks. a) b) 5. How much does Fred earn for picking 18 baskets? What form of payment is this? (salary / hourly wage / piece work / commission) Complete the following commission chart Sales $5630 Commission Rate 8% $1030 5% $80 422 3% Earnings 6. Kayla is a linesperson for Bell Canada. She is paid an hourly rate of $18.40. She usually works 44 hours a week. Bell Canada pays 'time and a half' for extra hours worked. After a big storm, Kayla works 52 hours in one week. How much did she earn for that week? 7. Mavis sells car parts. She earns a monthly salary of $1800, 5% commission on the first $5000 in sales she makes in a month, and 7% on the sales over $5000. Her sales are shown below. Complete the chart. Month Jan Feb Salary $1800 $1800 Sales $5800 $6800 5% Commission on sales equal to or less than $5000 Sales over $5000 7% Commission on sales greater than $5000 Total Earnings 8. a) b) Bill works 40 hours a week at an hourly rate of $15.25. What is his gross pay? Bill’s deductions are $132.62 a week. What is his net pay? 9. Karl earns $18.25 per hour. He works 40 hours a week. Here are his weekly deductions: federal income tax $96.80 provincial income tax $ 72.30 EI $ 14.60 CPP $16.35 company pension $25.00 health plan $12.78 Determine Karl's weekly a) gross pay 10. c) net pay The Provincial Sales Tax (PST) is what percent?____________ The Goods and Services Sales Tax (GST) is what percent?_________ For each purchase of $1245.35 calculate a) the GST c) the total tax charged 11. b) total deductions b) the PST d) the total cost (price + tax) Using the below tax forms determine the following: a) d) income tax: Union Dues b) e) Canadian Pension Plan Social Insurance Number: c) Employment Insurance: 12. Alex invests $6500 at 7.5% compounded annually, for 5 years. a) what will his investment be worth after 5 years? b) how much interest will he earned? 13. $12 000 is borrowed at 8% simple interest for 3 years. a) How much simple interest is earned? b) What is the total amount to be paid back? 14. A $6500 investment earns $487.50 in simple interest in 9 months. What was the interest rate? 15. Carter owes $7 500. The debt is to be paid in 5 years. His creditor will discount the debt at 15% compounded monthly, if he pays today. What is the discounted value of the debt today? 16. A $3 500 investment with a rate of 8.4% earns $2058 in simple interest. How long was the loan for (time) ? 17. Abbey invests $4 500 at 8% compounded quarterly for 6 years. a) what will her investment be worth after 6 years? b) how much interest will she earned? 18. Calculate the monthly amount for each of the following. a) $410 weekly b) $1200 biweekly c) $90 daily d) $30 000 yearly 19. Consider these three ways of selling raisins: A: $6.35 for 2.25 kg B: $10.05 for 5 kg a) b) Calculate the unit price per kg for each size. (to 4 decimals) Which amount is the best deal (cheapest)? C: $3.05 for 1.5kg 20. Abel purchases a Playstation that costs $455.65 plus taxes. He puts 25% down and lays away the Playstation for 3 months. a) What is the total cost of the Playstation, including taxes? b) How much of a deposit does he put down? c) How much does he pay when he picks up the Playstation? 21. Janet pays $90.28 a month (installment payments) for 36 months for a big screen TV that sells for $2500. A $52 administration fee is charged for not paying the total amount at the time of purchase. a) What is the cash price (price plus taxes) of the TV? b) If Janet buys the TV using the installment plan, what is the total amount to be paid at the time of purchase? c) What is the total cost of paying by installments? d) How much more does it cost to pay by installments? 22. David enters into a rent-to- own agreement for a living room set with a cash price of $3250. The maximum rental period is 30 months. The rental fee is $140.83 per month. a) b) c) d) 23. 24. Solve each of the following. Include at least one middle step. a) 2 X 10 + 21 7 + 9 + 11 – 3 b) 80 10 + 6 - 1 + 10 + 9 X 3 You put 25L of gas in your car. You can drive your car 342km. a) b) c) 25. What is the total cash price of the living room set, including taxes? What does he pay if he rents the living room set for the entire 30 months? How much more money will David pay if he rents the living room set for 30 months instead of buying it initially? The rent-to-own store David bought the living room set at has the following early buy out option: - bought within the first 3 months 100% of rental towards purchase - bought after the first 3 months 50% of rental towards purchase How much more must David pay if he decides to buy the living room set after 8 months? What is your car's fuel consumption? (L/100km) How far can you drive on 60L of gas? How much gas do you need to drive 5776 km (Saint John, NB to Vancouver, BC)? Given the below exchange rates: a) b) c) d) $150 Canadian Dollars equals how many Moroccan Dirhams? $200 Canadian Dollars equals how many Argentine Pesos? 800 Norwegian Kroners equals how many Canadian Dollars? 500 British Pounds equals how many Canadian Dollars?