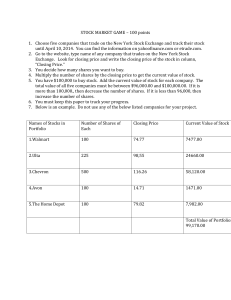

Assessment Investment 04: Purchasing Stocks – Option 1 Name: It's

advertisement

Assessment Investment 04: Purchasing Stocks – Option 1 Name: It's time to invest some virtual money of your own! To begin, choose one of the companies below in which to invest. The Coca-Cola® Company IBM® Corporation McDonald's® Corporation Nike® Inc. Wal-Mart® Stores, Inc. The Walt Disney® Company Visit www.nyse.com and search for the company you chose. Part I: Research Today’s date: Company Name: Ticker Symbol: The highest stock price for the previous 52 weeks: The lowest stock price for the previous 52 weeks: Annual dividend payment, if applicable: The return on the dividend: Price to earnings ratio: The number of shares trade: Highest stock price paid: Lowest stock price paid: Closing price: The change in price from the previous day’s closing: Part II: Calculations 1. List the closing stock price for all five business days. Day 1 Day 2 Day 3 Day 4 Day 5 – 2. Imagine you purchased 75 shares of this stock on Day 1 and sold all of those shares on day 3. What is the return on your investment? Show your work Day 1 75 shares × price = Day 3 75 shares × price = Return on Investment = (Final value – Initial value) ÷ Initial Value If you had sold all of the stock on Day 5 instead of Day 3, what is the difference between the return of your investment? Show your work. Day 1 75 shares × price = Day 5 75 shares × price = Return on Investment = (Final value – Initial value) ÷ Initial Value Difference on Returns = (Day 5 ROI – Day 3 ROI) Part III: Analysis Using the information found in your research and calculations, answer the following questions in complete sentences 1. Is it better to sell the stock on Day 3 instead of Day 5? Why or why not? 2. Ideally, when would you like to sell these shares? Day 3? Day 5? Or longer than 5 days? When developing your response, consider the trend for the stock in the last 5 days and what could potentially happen in the days ahead. 3. Would you advise others to invest in this company? Why or why not? Answer the following questions to help guide your response: Do you believe investor confidence is high or low in the company? Why? Do you believe there is a high or low demand from the company’s product? Why? How would the state of the economy today affect someone purchasing this company’s product?