The Federal Reserve System and the Money Supply Process Chaps

advertisement

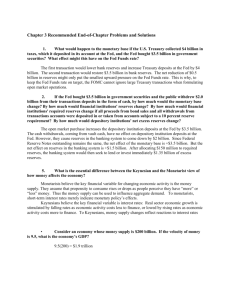

The Federal Reserve System and the Money Supply Process Chaps 13-14 (9th edition), Mishkin 1 I. Goals of monetary policy (in order of priority) 1. 2. 3. 4. 5. 6. 2 II.Brief structure of the FED The FEDERAL RESERVE SYSTEM consists of: 1. 12 regional Federal Reserve Banks (FRB’s) which have jurisdiction over the 12 Federal Reserve districts into which the country is divided. Main functions are, (i) ____________ (ii) ____________ (iii) ____________ (iv) ____________ 2. The Board of Governors (BOG) 7 members appointed by the President, each serving one full nonrenewable 14-year plus part of another term (if coming in place of someone else) chairman serves 4-year renewable terms 3 3. The Federal Open Market Committee (FOMC) meets about every 6 weeks, determines and conducts monetary policy consists of 7 BOG members + president of the New York FRB + 4 presidents chosen from the other FRBs (the other 7 presidents participate but do not vote) Three tools of monetary policy are (i) ___________ (ii) ___________ (iii) ___________ 4 Assets Reserves $10m Loans Securities $90 m $10 m Liabilities Deposits $100 m Bank capital $10 m Q1. Suppose the FED purchases 5m worth of T-bonds from banks (Open market purchase). How does this affect the balance sheet of the bank? Q2. Suppose the FED sells off 5m worth of T-bonds to banks (Open market sale). How does this affect the balance sheet of the bank? Conclusion: Open market purchase ________ cash reserves of banks. Open market sale _______ cash reserves of banks. 5 I. The Fed’s balance sheet Mark as an asset or liability: 1. Securities (US govt. and agency, banker’s acceptances) 2. Notes in circulation ($ bills) 3. Discount loans 4. Bank deposits (also known as bank reserves) 6 II. The monetary base (MB) of an economy The monetary liabilities of the FED, sometimes also referred to as the FED’s monetary liabilities to the private sector = US Treasury’s monetary liabilities to the private sector = The Monetary Base (MB) of an economy = = In symbols, MB = C + R, where C = R= MB is also described as high powered money. 7 FED controls MB directly through open market operations and discount loans. The immediate effect of an open market purchase of $100 from banks create the following changes in the T-accounts of the banking system and the FED The Banking System Assets Liabilities Securities Reserves The Fed Assets Securities Liabilities Reserves (or notes) What happens to the total reserves and the monetary base of the economy? What happens if there is a open market sale? 8 The immediate effect of new discount loans made by the FED to the banks is, Banking System Assets Liabilities Reserves Discount loan The Fed Assets Discount loan Liabilities Reserves or notes What is the effect on R and MB? What happens if the bank pays off some of its loans to the FED? 9 Suppose the FED makes the purchase from the non-bank public and pays for it with a check. The check is deposited at a local bank. Non Bank Public Assets Liabilities Securities Deposits The Fed Assets Securities Banking System Assets Liabilities Reserves Checkable Deposits Liabilities Reserves (or notes) What happens to total reserves, monetary base? What happens if the non-bank public converts the check into currency and prefers holding cash? 10 III. Multiple Deposit Creation: We now show that an open market purchase of $100 creates _____________. Thus although MB goes up by $100, M1 ______________ First National Bank (initial position after open market purchase) Assets Liabilities Securities Reserves Assets First National Bank (final position) Liabilities Securities Loans 11 Multiple Deposit Creation: Banking System Assets Reserves Assets Reserves Loans Assets Reserves Assets Reserves Loans Bank A (initial position) Liabilities Deposits Bank A (final position) Liabilities Deposits Bank B (initial position) Liabilities Deposits Bank B (final position) Liabilities Deposits 12 Total new checkable deposits created by banks A - … as a result of a $100 increase in the monetary base is In symbols, if ΔR = initial increase in reserves, r = required reserve ratio, then total increase in checkable deposits by the banking system as a whole is, 1/r is defined as the _______________. The amount of new deposits created is less than _______ if, 1.people prefer _________________ 2.banks prefer __________________ 13 For the interested student who wants to know more about the monetary tools used by the FED, not important for the final 14 Monetary policy tools – open market operations and how it influences the federal funds rate Federal funds rate Federal funds rate s0 S1 supply of overnight reserves demand for overnight reserves quantity of reserves demand and supply of federal funds, before an open market operations demand for overnight reserves quantity of reserves demand and supply of federal funds, after an open market operations 15 Monetary policy tools – changes in the discount rate and how it influences the federal funds rate Federal funds rate Federal funds rate s0 supply of overnight reserves S1 demand for overnight reserves quantity of reserves demand and supply of federal funds, before a change in the discount rate demand for overnight reserves quantity of reserves demand and supply of federal funds, after a change in the discount rate 16