7 Perfect Competition

advertisement

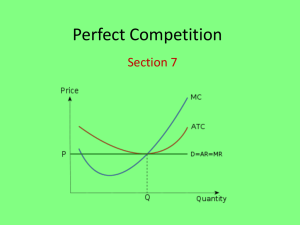

Perfect competition Learning Objectives At the end of this chapter you will be able to Explain the assumptions of perfect competition Distinguish between the demand curve for the industry and for the firm in perfect competition (pc) Explain how the firm maximises profit in pc Explain and illustrate short run profit and loss situations in perfect competition Explain and illustrate the long-run equilibrium in pc Explain and illustrate the movement from short run to long run in pc Define and illustrate productive efficiency Define and illustrate allocative efficiency Explain and illustrate productive and allocative efficiency in the short run and long run in pc • mjmfoodie Video see You Tube (http://www.youtube.com/watch?v=61GCo galzVc) Perfectly competitive markets We can look at the market as a spectrum At one end we have perfect competition where there is a large number of small firms These are price takers (a firm that has to accept the price dictated by the market) At the other end is the natural monopoly where the industry comprises of one firm only This is a price maker (it decides the price) Perfectly competitive markets Firms operating under conditions of competition have to remain price competitive and will try to improve the quality of their product/service to stay ahead of their competitors Perfect competition is an extreme form of competition and is based on the following assumptions Large number of buyers and sellers – this is to ensure the product is sold and the firm is a price taker No one is large enough to affect the market price Buyers and seller have perfect information on product and prices Homogeneous products (all the same) Freedom of entrance and exit – cost free to move in and out. Firms will make normal profit in the long run All firms have equal access to technological improvements – firms are unlikely to engage in R&D Factors of production are perfectly mobile – they can undertake any types of work in any location Perfectly competitive markets Many, if not all, of these assumptions are unrealistic The model is good because it serves as a benchmark to compare other market structures Economists use this as the model that shows how competition creates an efficient market While perfect competition may not be possible some competition is welcome The diagrams below show the perfectly competitive firm and the market (industry) Perfectly competitive markets The firm has to sell its product at £5 (it is a price taker) If it sells above this price consumers will go elsewhere If it sells below this price all the consumers will come to this firm but they will not be able to service all of their needs and it will not be maximising its returns We saw before that the demand curve is perfectly elastic and D=AR=MR=P (they are all £5) The diagram of the industry shows that both consumer and producer surplus are maximised – the market is allocatively efficient How many does the firm produce? We saw before that the profit maximising firm will chose its output level using the relationship between marginal revenue and marginal cost Profit maximising output is where MR = MC At this point the firm will make £800 revenue Notice that we label our y axis Revenue and Cost Short run profits and the industry response To work out how much profit the firm is making we have to work out the total costs (profit = total revenue – total costs) To do this we need to add the average total cost curve (ATC) as per the diagram below Don’t forget that the MC curve cuts the ATC curve at its lowest point We can see that when the output is 10 the firm’s costs will be £60 which means the total costs will be 60 x10 = 600 Profit = Revenue – total costs; 800 – 600 = £200 We include normal profit in total costs so this £200 is abnormal profit Short run profits and the industry response A firm in the perfectly competitive market is a price taker That means it has to accept the market price If it increases the price customers will go elsewhere If it decreases the price it will not be able to serve all of the customers and they will be dissatisfied and leave Whenever the price is above the red line (where the MC cuts the ATC at its lowest point) the firm will make abnormal profits This can only happen in the short run (we will find out why in a minute) Time for you to do some work!! Complete P111 Q 1 (10 marks) 20 minutes to complete With the help of a diagram, explain how it is impossible for a firm in perfect competition to earn abnormal profits in the long run Short run profits and the industry response If there are abnormal profits other firms will be attracted to the market (there are no barrier to entry) This will shift the supply curve to the right and the price will fall to 60 This means that MR has changed The output of the firm will have to fall to 8 at the new profit maximising point (MC=MR) At this point revenue and costs are equal Short run profits and the industry response This does not mean the firm is making zero profit – it means the firm is making normal profits In a perfectly competitive market when there is abnormal profit in the short run firms keep entering the market until the abnormal profits are competed away and only normal profits are available This is the long run equilibrium position for firms in perfect competition; average total costs equals average revenue Time for you to do some work!! Complete P111 Q 2 (10 marks) Productive efficiency Firm’s are said to be productively efficient if they produce at the lowest possible unit cost (average cost) As we have seen, firms in a perfectly competitive market operate at this point in the long-run If a firm is producing at this level they are combining their resources as efficiently as possible and resources are not being wasted by inefficient use MC = AC Allocative efficiency This is sometimes also called the socially optimum level of output This happens when suppliers are producing the optimal mix of goods and services required by consumers Price reflects the value that consumers place on a good and is shown on the demand curve (average revenue) Marginal cost reflects the cost to society of all the resources using in producing an extra unit of a good including the normal profit that firms require to stay in business Allocative efficiency If the price were higher than the marginal cost consumers would value the good more than it cost to make it If both sets of stakeholders are to meet at the optimal mix then output would expand until price equalled mc If the marginal cost were to be greater than price society would be using more resources to produce the goods than value it gives to consumers and output would fall So allocative efficiency occurs when marginal cost (the cost of producing one more unit) equals average revenue (the price received for a unit) The allocative efficient level of output is where MC= AR MC = AR In the long run the perfectly competitive firm is allocatively efficient Time for you to do some work!! Q 2 P111 (10 marks) – to hand in this lesson Complete Q3 P111 – to hand in after lesson 2mrw Complete essay Q 1 (a) and (b) - to hand in after lesson 2mrw