Target Company Report

advertisement

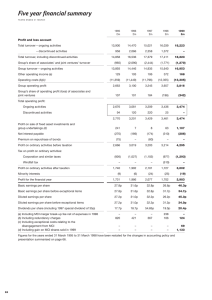

Jeremy English Professor Palmer Financial Acct. 2301 04/09/2013 Target Annual Report Project A. Introduction 1. Gregg W. Steinhafel is the Chief Executive Officer of Target Corporation. 2. Target corporate headquarters buildings located in Minneapolis, Minnesota, and lease and own additional office space in the United States. 3. The ending date of the latest fiscal year is February 2, 2013. 4. Target offers retail which includes all of their U.S. merchandising operations. They offer Household essentials that includes pharmacy, beauty, personal care, baby care, cleaning and paper products; electronics (including video game hardware and software), music, movies, books, computer software, sporting goods and toys; apparel for women, men, boys, girls, toddlers, infants and newborns, as well as intimate apparel, jewelry, accessories and shoes; dry grocery, dairy, frozen food, beverages, candy, snacks, deli, bakery, meat, produce and pet supplies; furniture, lighting, kitchenware, small appliances, home décor, bed and bath, home improvement, automotive and seasonal merchandise such as patio furniture and holiday décor. 5. A significant portion of total sales is derived from stores located in five states: California, Texas, Florida, Minnesota and Illinois. 6. Ernst & Young LLP are the independent auditors 7. The auditors say the information displayed on Target’s financial statements fairly represent their financial position according to GAAP. Then they gave Target an unqualified opinion. 8. These financial statements are not the responsibility of the independent accountants. 9. The financial statements are the responsibility of Target’s Corporate Management. 10. Target’s close market price of common stock was $68.90 Per share as of 04/09/2013 11. $1.38 was the dividend per share for the year 2012 12. New York Stock Exchange 13. Ticker symbol is TGT B. Industry Situation and Company Plans The Discount Retail Industry is very competitive but that doesn’t seem to stop Target from expanding. Management for Target have announced plans to open 124 stores in Canada in 2013, with locations in each province along with 3 distribution centers. Consolidated Revenues were $73,301 million for 2012, an increase of 4.9% from the prior year. It looks as if the macro economy is coming back at least for Target. C. Financial Statements Income Statement 1. Target used Multi-step format 2. Gross Profit = $22,733 Million, Income from Operations = $4609 Million, 3. Net Income for 2012 is $2999 and for 2011 is $2929. A steady increase from the past two years. Balance Sheet: 1. Total Assets = Total Liabilities + Stockholders equity for past two years $48,163 = $31,605 + $16,558 for year 2013 $46,630 = $30,809 + $15,821 for year 2012 Statement of Cash Flows: 1. Cash Flows from operations are more than Net income for each of the past two years. 2. Expenditures for property and equipment 3. Additions to long term Debt are the company’s most important source of financing. 4. Cash has increased over the past two years D: Accounting Policies 1. As of February 2, 2013, Target’s receivables were classified as held for sale and recorded at the lower of cost (par) or fair value. As a result, Target no longer reported an allowance for doubtful accounts in their Consolidated Statements of Financial Position. These amounts represent the gross margin effect of sales returns during respective years. Expected merchandise returns after year-end for sales made before year-end were $114 million, $98 million and $97 million for 2012, 2011 and 2010, respectively. 2. List of the other topics in the Footnotes : EPS or Earnings per share policy, Rate analysis metrics, Earnings before income taxes, RED card policy, Return on investment Capital, LIBOR, Write-off policy, Gains on receivables, effect of income taxes, contractual lease payment stipulations. 3. No not really. Nothing of real significance was disclosed in the footnotes except for the fact that they want to discontinue the RED credit card program. Their accounts receivable turnover ratio indicated that Target is getting very little in return from the credit card program. But by discontinuing the program Target shows its ability to make common sense decisions. E: Ratio Analysis Tests of Liquidity 1. Current Ratio = (Current Assets)/(Current Liabilities) 1.16 = ($16,388)/($14,031) 2. Quick Ratio (Acid Test) = (Quick Assets)/(Current Liabilities) 0.47 = ($6,625)/($14,031) Asset Management 3. Inventory Turnover = (Cost of Goods Sold)/(Average Inventory) 6.51 = ($50,568)/(7760.50) 4. Accounts Receivable Turnover = (Net Credit Sales)/(Average Net Accounts Receivable) 0.23 = ($1341)/($5,884) Tests of Solvency and Equity Position 5. Debt ratio = (Total Liabilities)/(Total Assets) 65.6% = ($31,605)/($48,163) 6. Times Interest Earned = (Earnings before interest and taxes)/( Interest Expense) 7.05 = ($5,371)/($762) Tests of Profitability 7. Return on Net Sales = (Net Income)/(Fixed Assets + Net Working Capital) 8.79% = ($2,999)/($31,775 + $2,357) 8. Return on Total Assets = (Earnings before interest and taxes)/(Total Net Assets) 15.4% = ($5,371)/($34,852) 9. Return on Common Stockholder’s Equity = (Net Income)/(Average Stockholder’s Equity) 18.5% = ($2,999)/($16,189.50) 10. Earnings per share of Common Stock = (Net Income – Dividends on Preferred Stock)/(Average Outstanding Shares) $4.56 = ($2,999,000,000)/($657,293,676) Market Analysis 11. Price/Earnings ratio = (Current Trading Price)/(Earnings per share) $15.45 = ($70.43)/($4.56) Stock price quoted May 1, 2013 12. Dividend Yield ratio = (Annual Dividends per share)/(Price per share) 1.96% = ($1.38)/($70.43) Conclusion If I were to buy Target stock that would depend on whether I am looking for a short-term or long-term investment. For the short-term I would not make any real money for my investment but if I were to invest in Target for my 401k retirement account I would have a pretty safe investment. According to the Current Ratio the company has enough current assets to cover all of its current liabilities. A ratio under 1 would suggest that Target would be unable to pay off its obligations if they came due within the current year. . The company has seen a big downturn in income in the year 2008 but has bounced back since then, and has increased its income and stockholders equity gradually over the past three years. Target’s quick ratio indicates that the corporation has very little liquid assets that could meet its current liabilities, but for corporations like target their business relies on their continuous heavy volume of sales to meet their current liabilities in which the inventory turnover rate of 6.5 times a year would indicate. Target’s accounts receivable turnover rate at about 0.23 which is horrible, but Mr. Akin decided that it is in the Corp. best interest to discontinue the RED credit card program. The two biggest determining factor for me as an investor is the Return on Common Stockholder’s Equity and Earnings per share of Common Stock. The return I would get investing in common stock from Target is about 18.5% per share of common stock and the Earnings per share was about $4.56 for the 2012 fiscal year. The return from me investing my money is well worth what little risk it would impose considering that Target has seen growth every year since 2009 and looking at current forecasts by the FED and the continued deficit spending by the government Target’s future outlook at least for the upcoming year is looking very good. According to Reuters, Target has an average comparison in its earnings per share with the rest of its industry. Reuters figures also indicate that the Dividend Yield ratio for Target is almost double that of the rest of the industry which means more return for my investment. Overall, Target is a solid investment with steady growth going back as far as three years. Target’s bounce back from 2008 to today is very impressive and Target’s expanding markets in Canada indicate the Corporations plans to keep expanding further. If all goes well in Target’s new emerging markets in Canada then expect I would expect to see my hypothetical investment make me even more money.