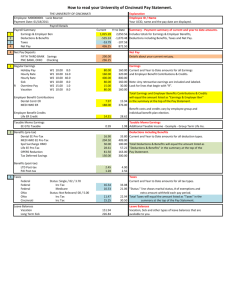

HRS Earnings Statement One of the most recognizable changes that

advertisement

HRS Earnings Statement One of the most recognizable changes that Self Service will deliver to the University of Wisconsin System is the new and improved Earnings Statement. The new statement offers more detailed information than the old one and the content is clearly displayed. It will facilitate employees in managing their hours, earnings, taxes, benefits, deductions, and leave balances more effectively. Detailed below are some of the specific changes you will find on the newly enhanced document: 1. Hours and Earnings Section: a. Includes for biweekly jobs: i. Description of the earnings type, listed by job record and earnings type code ii. Current rate, hours, and earnings amounts for the specific pay period, listed by job record and earnings type iii. Year-to-date sum of hours and year-to-date sum of earnings for that calendar year iv. Total of all current hours and earnings and the total of all year-to-date hours and earnings v. Various other earning types and furlough reductions split by job record, if applicable *Note: this is only a sample of earnings from a biweekly job b. Includes for monthly jobs: i. Description of the earnings type, listed by job record and earnings type code ii. Current earnings amount for the specific pay period, listed by job record and earnings type iii. Year-to-date sum of earnings for that calendar year iv. Total of all current earnings and the total of all year-to-date earnings v. Various other earning types and furlough reductions split by job record, if applicable *Note: this is only a sample of earnings for a monthly job 1 c. Includes for employees with multiple job records: i. Earnings split by job record to easily distinguish the earnings breakdown ii. Year-to-date Earnings and/or hours balance for positions paid on another end date 2. Taxes Section a. Outlines these tax types: i. Federal employee paid Social Security, current and year-to-date taxable wage and deduction amounts ii. Federal employer contributed Social Security, current and year-to-date taxable wage and contributed amounts iii. Federal employee paid Medicare, current and year-to-date taxable wage and deduction amounts iv. Federal Withholding, current and year-to-date taxable wage and deduction amounts v. Federal employer contributed Medicare, current and year-to-date taxable wage and contributed amounts vi. State Withholding, current and year-to-date taxable wage and deduction amounts vii. 1042 Federal tax , current and year-to-date taxable wage and deductions *applicable to participating foreign nationals only* b. Includes a total of all current tax deductions and a total of all year-to-date tax deductions c. Includes YTD value for taxable wages or deduction amounts if the tax did not apply to this specific pay period *Note: this is only a sample of employee tax types 2 3. Before-Tax Deductions Section a. Outlines the description of the employee before-tax deduction, or the amount deducted before taxes are calculated and deducted from earnings b. Includes the current amount and the year-to-date amount c. Includes total of all current before-tax deductions and all year-to-date before-tax deductions *Note: this only a sample of before-tax deductions types 4. After-Tax Deduction Section a. Outlines the description of the employee after-tax deduction, or the amount deducted after taxes are calculated and deducted from earnings b. Includes the current deduction amount and the year-to-date deduction amount c. Includes total of all current after-tax deductions and all year-to-date after-tax deductions *Note: this is only a sample of after-tax deductions types 3 5. Employer Paid Benefits Section a. Outlines the description of each employer paid benefit, the amounts contributed by the employer that do not impact an employee’s individual earnings (except for taxes which are reflected in the Taxes section) b. Includes the current employer paid benefit amount and the year-to-date amount c. Includes total of all current employer paid benefits and total of all year-to-date employer paid benefits d. Includes Imputed Income for State Group Life, as noted with a asterisk to signify that the amount is taxable *Note: this is only a sample of employer paid benefits types 6. Totals section a. Displays the Total Gross for current and year-to-date earnings, which corresponds to the total current earnings and total YTD earnings in Hours and Earnings section b. Displays the Total Employee Taxes for current and year-to-date taxes, which corresponds to the total current deductions and YTD deductions in the Taxes section c. Displays the Total Deductions for current and year-to-date deductions, which is a sum of all the current and YTD amounts in the Before-Tax Deductions and After-Tax Deductions sections d. Displays the Net Pay for current and year-to-date amounts, which corresponds to the amount the employee receives on the paycheck for this period or previous periods in this calendar year. 7. The Net Pay Distribution Section a. Shows the net pay amount that the employee will receive for the specified pay period b. Indicates if employee receives a paper check or if their earnings are directly deposited c. Shows the pay distribution between financial institutions, if the employee has created up to 3 direct deposits into different bank accounts *Note: this is only a sample of net pay distribution types 4 8. Leave Balances Section *Note: this is only a sample of monthly leave balances First pay period in HRS, employees will only see the Ending Earned Balance and the Available Balance, the other balances will appear on all future payrolls a. Includes leave types for all eligible employees with monthly positions, per fiscal year: i. Vacation ii. Carryover iii. Sick Leave iv. Unclassified ALRA (Annual Leave Reserve Account) v. Personal Holidays vi. Legal Holidays vii. Furlough b. Includes leave types for all eligible employees with biweekly positions, per calendar year: i. Vacation ii. Carryover iii. Sick Leave iv. Personal Holidays v. Legal Holidays vi. Furlough vii. Comp Time viii. Classified Sabbatical c. Includes 5 columns differentiating the leave balance amounts: i. Beginning Earned1 Balance: earned balance from the prior pay period ii. Earned: leave earned in the current pay period iii. Used/Adjusted: leave amount used/adjusted in the current pay period iv. Ending Earned1 Balance: the beginning earned balance plus the hours earned in the current pay period minus the hours used or adjusted in the current pay period v. Available2 Balance remaining balance available to be used d. Separates leave balances for each job, if employees have multiple positions i. Allows employees to more effectively manage their leave balances, per job ii. Determines the amount of leave earned year-to-date, per job Leave Balance Notes: Earned1 Balance represents the year to date number of hours earned less number of hours used o Important balance if you consider leaving UW, if you transfer to another agency, or if you are between classifications. o Positive Earned Balance would represent the number of hours to be paid out, with the exception of Sick Leave o Negative Earned Balance would reflect that you would owe this back to UW Available2 Balance represents the remaining balance available to be used o Available Vacation, Legal Holiday and Furlough hours are based on the amount projected to be earned for the entire year less the year to date hours used 5 Special considerations: Earnings Statement from HRS will include converted hours, earnings, taxes, deductions, and leave balance values from the legacy system Use the Earnings Statement in conjunction with the Benefits Summary on Self-Service o Benefits Summary displays the plan in which the employee is enrolled o Benefit deductions listed on the Earnings Statement show the cost paid for that benefits plan May Multiples, or the deduction amounts collected in advance for employees who will not receive earnings for a long period of time, will appear dramatically different on the new Earnings Statement PREBTX deduction code will combine all before tax deduction amounts to take on May paycheck PREATX deduction code will combine all after tax deduction amounts to take on May paycheck Budget Repair Bill (**Amanda**this might need to change based on if this is actually passed) o Specific WRS deductions will be eliminated for future payrolls due to this bill o Deductions not applicable to future payrolls will display on the Earnings Statement as a year-to-date balance for the remainder of the calendar year Employees with multiple job records: o Benefit deductions: Benefit deductions by default will be taken from the primary job record o Earnings Statement will list all deductions, regardless of the job record from which they were deducted Earnings Statement reflects a “0.00” in the current amount field and includes the YTD deduction amount to denote that the deduction was not taken from the job earnings on that pay period Deductions can be taken on one job earnings but not the other, and vice versa Imputed Income o Employees with a Wisconsin dependent child not tax qualified, 26 years of age and under: Earnings code, “State Imputed Income Adjust,” will appear in the Hours and Earnings section Increase the employee’s state taxable gross o Employees with a domestic partner not tax qualified and/or a dependent older than 26 years old where the employer share exceeds deductable amount: Indicated by two line items for health insurance, one being the taxable amount which will appear in the Employer Paid Benefits section Taxable amount, represented with an asterisk, will increase employee’s state and federal taxable gross Some employees may see before and after tax employee share 6 Offset the increased amount paid by the employer Legacy Earnings Statement The Earnings Statement from legacy proves more difficult for employees to manage their earnings, taxes, deductions, and leave balances because of its lack of clarity and content. In comparison to the new HRS Earnings Statement, it provides minimal information regarding the details of that pay period’s net pay. The Earnings Statement from the legacy system: 1. Consolidates earnings amount and overall hours amount for the current pay period a. Does not split earnings amounts by job record 2. Lists only the deduction amounts taken from the specific pay period a. Does not distinguish if it was taken before-tax or after-tax b. Does not include the year-to-date amount paid for each deduction type 3. Lists only the earned, used, balance amounts for each leave type a. Does not include the beginning earned balance or the ending earned balance fields b. Does not provide employees with the details regarding remaining c. Provides only vague leave type descriptions, which are difficult to understand 4. Reports only employee paid Federal Withholding, State Withholding, and Social Security taxes 5. Does not provide net pay distribution information (i.e. direct deposit or check) Classified Legacy Earnings Statement Example 7 Unclassified Legacy Earnings Statement Example 8