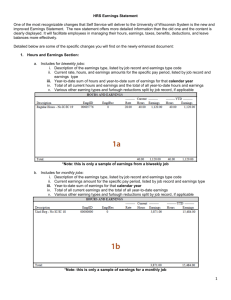

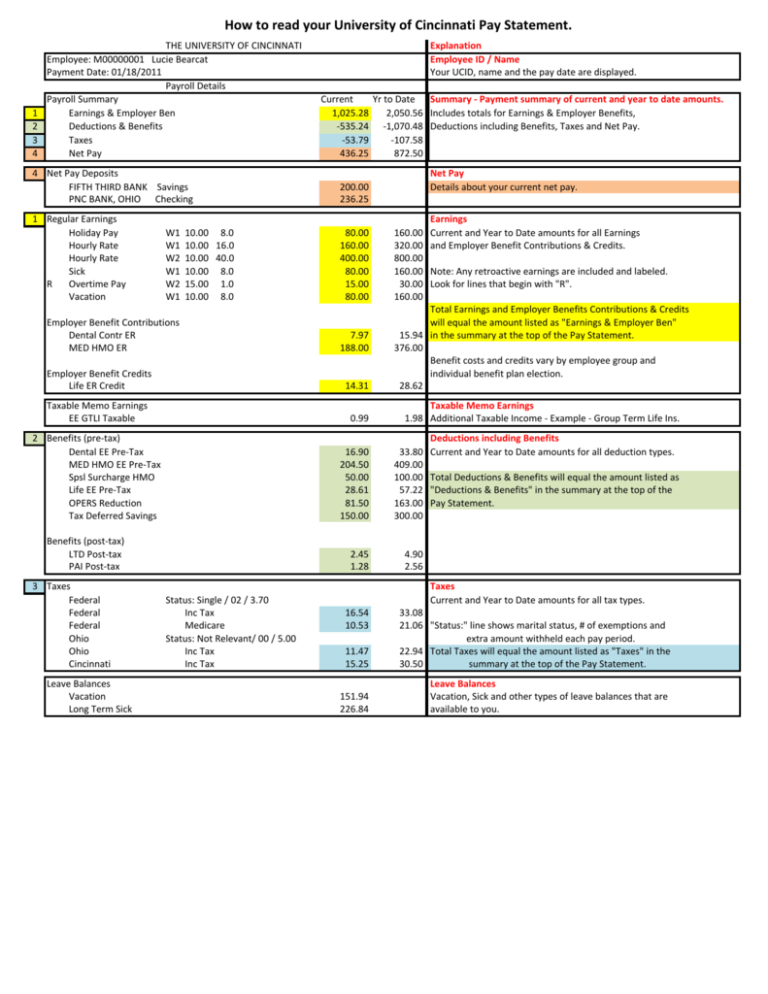

How to read your University of Cincinnati Pay Statement.

advertisement

How to read your University of Cincinnati Pay Statement. 1 2 3 4 THE UNIVERSITY OF CINCINNATI Employee: M00000001 Lucie Bearcat Payment Date: 01/18/2011 Payroll Details Payroll Summary Earnings & Employer Ben Deductions & Benefits Taxes Net Pay Explanation Employee ID / Name Your UCID, name and the pay date are displayed. Current Yr to Date Summary - Payment summary of current and year to date amounts. 1,025.28 2,050.56 Includes totals for Earnings & Employer Benefits, -535.24 -1,070.48 Deductions including Benefits, Taxes and Net Pay. -53.79 -107.58 436.25 872.50 4 Net Pay Deposits FIFTH THIRD BANK Savings PNC BANK, OHIO Checking 200.00 236.25 1 Regular Earnings Holiday Pay Hourly Rate Hourly Rate Sick R Overtime Pay Vacation 80.00 160.00 400.00 80.00 15.00 80.00 W1 W1 W2 W1 W2 W1 10.00 8.0 10.00 16.0 10.00 40.0 10.00 8.0 15.00 1.0 10.00 8.0 Net Pay Details about your current net pay. 160.00 320.00 800.00 160.00 30.00 160.00 Earnings Current and Year to Date amounts for all Earnings and Employer Benefit Contributions & Credits. Note: Any retroactive earnings are included and labeled. Look for lines that begin with "R". Employer Benefit Credits Life ER Credit 14.31 Total Earnings and Employer Benefits Contributions & Credits will equal the amount listed as "Earnings & Employer Ben" 15.94 in the summary at the top of the Pay Statement. 376.00 Benefit costs and credits vary by employee group and individual benefit plan election. 28.62 Taxable Memo Earnings EE GTLI Taxable 0.99 Taxable Memo Earnings 1.98 Additional Taxable Income - Example - Group Term Life Ins. Employer Benefit Contributions Dental Contr ER MED HMO ER 2 Benefits (pre-tax) Dental EE Pre-Tax MED HMO EE Pre-Tax Spsl Surcharge HMO Life EE Pre-Tax OPERS Reduction Tax Deferred Savings Benefits (post-tax) LTD Post-tax PAI Post-tax 3 Taxes Federal Federal Federal Ohio Ohio Cincinnati Leave Balances Vacation Long Term Sick Status: Single / 02 / 3.70 Inc Tax Medicare Status: Not Relevant/ 00 / 5.00 Inc Tax Inc Tax 7.97 188.00 16.90 204.50 50.00 28.61 81.50 150.00 33.80 409.00 100.00 57.22 163.00 300.00 2.45 1.28 4.90 2.56 Deductions including Benefits Current and Year to Date amounts for all deduction types. Total Deductions & Benefits will equal the amount listed as "Deductions & Benefits" in the summary at the top of the Pay Statement. Taxes Current and Year to Date amounts for all tax types. 16.54 10.53 11.47 15.25 33.08 21.06 "Status:" line shows marital status, # of exemptions and extra amount withheld each pay period. 22.94 Total Taxes will equal the amount listed as "Taxes" in the 30.50 summary at the top of the Pay Statement. 151.94 226.84 Leave Balances Vacation, Sick and other types of leave balances that are available to you.