2014-HoytPowerpoint-Palm Beach

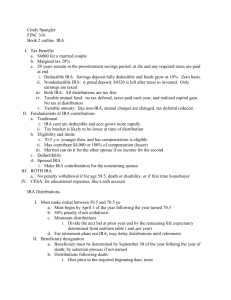

advertisement

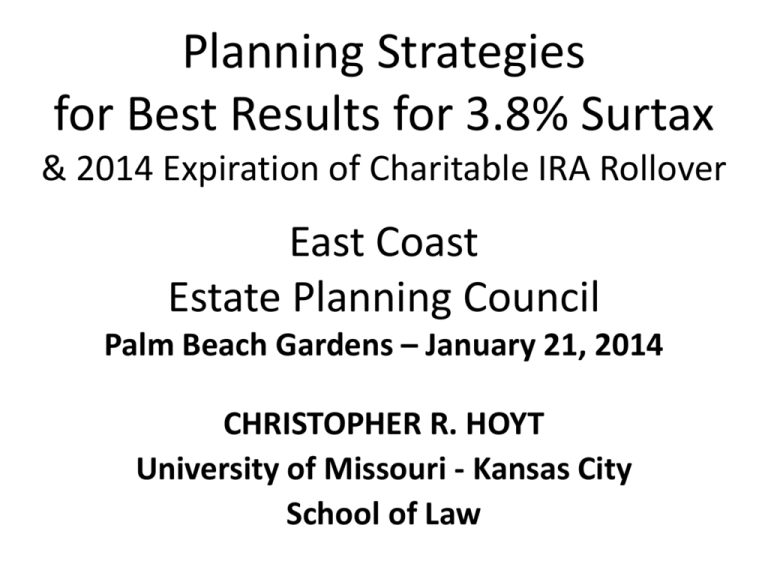

Planning Strategies for Best Results for 3.8% Surtax & 2014 Expiration of Charitable IRA Rollover East Coast Estate Planning Council Palm Beach Gardens – January 21, 2014 CHRISTOPHER R. HOYT University of Missouri - Kansas City School of Law INCOME TAX RATES INVEST WAGES LTCG Income Level -MENT (+1.45%) & Divid • AGI < $200k/$250k 28% 29.4% 15% Congratulations! Brilliant tax planning! “Bush tax cuts” remain in full effect for people with adjusted gross income under $200,000 ($250,000 on a joint return) INCOME TAX RATES INVEST WAGES LTCG Income Level -MENT (+1.45%) & Divid • AGI < $200k/$250k 28% 29.4% 15% • AGI > $200k/$250k 33% 34.4% 15% 33% rate when taxable income > $183,250 -- single > $223,050 – married filing jointly TAX RATES paid on TAXABLE INCOME ADJUSTED GROSS INCOME (“AGI”) • Minus: Greater of -- Standard Deduction ($6,100) or -- Itemized Deductions (Mortgage interest; charitable contributions; state & local taxes) • Minus: Personal Exemption & Dependents ($3,900 each) = TAXABLE INCOME WEALTHY PAY SOME TAXES ON “AGI” ADJUSTED GROSS INCOME (“AGI”) • Minus: Greater of -- Standard Deduction ($6,100) or -- Itemized Deductions (Mortgage interest; charitable contributions; state & local taxes) • Minus: Personal Exemption & Dependents ($3,900 each) = TAXABLE INCOME INCOME TAX RATES INVEST WAGES LTCG Income Level -MENT (+1.45%) & Divid • AGI < $200k/$250k 28% 29.4% 15% • AGI > $200k/$250k 33% 34.4% 15% 33% rate when taxable income > $183,250 -- single > $223,050 – married filing jointly INCOME TAX RATES INVEST WAGES LTCG Income Level -MENT (+1.45%) & Divid • AGI < $200k/$250k 28% 29.4% 15% • AGI > $200k/$250k 33% 34.4% 15% plus health care surtax 3.8% 0.9% 3.8% 36.8% 35.3% 18.8% 0.9% MEDICARE SURTAX: When Compensation Exceeds $200,000 ($250,000 married joint return) • Compensation -- wages & self-employment income (Added to 1.45% Medicare/Medicaid tax ) (Employee pays entire 0.9%; no employer match) • Employer must withhold when W-2 Form compensation exceeds $200,000 • Married joint? Together over $250,000? -- Pay on Form 1040 if neither spouse has over $200,000 . (e.g., Husband has $100k and Wife has $160k = $260k) 3.8% Net Investment Income Tax MAGI > $200,000 ($250,000 joint returns) 3.8% surtax on the lesser of: • Net Investment Income or • MAGI over $200,000 ($250,000 joint) ( $200k/$250k not indexed for inflation ) Trusts and estates pay 3.8% at $11,950 3.8% Net Investment Income Tax MAGI > $200,000 ($250,000 joint returns) Net Investment Income • • • • Interest & Dividends Annuities Rents & Royalties Profits from LLC / S Corp (if not employed) • Business of trading commodities & fin instruments • Most capital gains 3.8% Net Investment Income Tax MAGI > $200,000 ($250,000 joint returns) Income Exempt from Surtax: • Trade / Business income from an LLC, partnership or Subchapter S corporation provided the recipient is employed at the business. -- “material participation” test (work 500+ hours during the year?) • Gain from selling property used in trade/ business [rental property gains -> 3.8% tax] 3.8% Net Investment Income Tax MAGI > $200,000 ($250,000 joint returns) Other Income Exempt from 3.8% Surtax: Income that isn’t interest, rents, gains, etc : • Retirement income – social security, qualified plans: IRAs, 401(k), pensions, etc – (non-qualified annuities are subject to tax) • Wages & self-employment income ( 0.9% tax) • Alimony income • Lottery winnings INCOME TAX RATES INVEST WAGES LTCG Income Level -MENT (+1.45%) & Divid • AGI < $200k/$250k 28% 29.4% 15% • AGI > $200k/$250k 33% 34.4% 15% • AGI > $250k/$300k 33% 34.4% 15% -- 3% phase-out itemized deductions -- Phase-out personal exemptions PHASEOUTS AGI > $250,000 ($300,000 joint returns) • 3% Phase-out Itemized Deductions -- disguised 1% tax rate hike (3% x 33% rate) • Personal and Dependent Exemptions -- $3,900 apiece for self & each dependent -- lose 2% for every $2,500 income increase -- 100% eliminated AGI > $372k ($422k jnt) (Phase-out $250k-$372k ( $300k-$422k jnt)) INCOME TAX RATES INVEST WAGES LTCG Income Level -MENT (+1.45%) & Divid • AGI < $200k/$250k 28% 29.4% 15% • Taxb>$400/$450 39.6% 41.0% 20% INCOME TAX RATES INVEST WAGES LTCG Income Level -MENT (+1.45%) & Divid • AGI < $200k/$250k 28% 29.4% 15% • Taxb>$400/$450 39.6% 41.0% 20% plus 3% phase-out 1% 1 % 1% plus health care surtax 3.8% 0.9% 3.8% With $12,000+ income, 44.4% 42.9% 24.8% Trusts & Estates >> 43.4% 23.8% 3.8% Net Investment Income Tax MAGI > $200,000 ($250,000 joint returns) Two Ways to reduce the 3.8% surtax : #1 - Reduce Net Investment Income and/or #2 – Reduce AGI to less than $200,000 ($250,000 joint) 3.8% Net Investment Income Tax MAGI > $200,000 ($250,000 joint returns) Strategies for three different taxpayers: #1 - Richest 1% - Income over $400,000 -- Reduce NII (not likely to get AGI <200k) #2 – Taxpayers with AGI near $200k ($250 jt) -- Either reduce NII or reduce AGI #3 - Taxpayers with AGI below $200k ($250 jt) -- Avoid spikes in income that trigger 3.8% tax Reduce Net Investment Income Two Ways to reduce Net Investment Income: #1 - Convert NII into income that isn’t NII #2 – Shift NII to family and to charity that aren’t subject to tax on their NII Reduce Net Investment Income Convert NII into Income That Isn’t NII #1 - Taxable interest to tax-free muni interest #2 – Life insurance #3 – Work 500+ hours at business #4 – Monster-size Roth IRA Conversions Roth IRA Conversions Reg IRA Brokerage Roth IRA Assets $300,000 $120,000 -05% income $15,000 $6,000 Tax Rate 39.6% 43.4%/23.8% Tax -5,940 -1,428 $13,632 $9,060 $4,572 Roth IRA Conversions Do a Roth IRA Conversion of IRA • Triggers $300,000 of taxable income • Taxed at 39.6% rate (no 3.8% surtax) • Use $120,000 in brokerage to pay tax CONCEPT: You have moved $120,000 from taxable account into tax-exempt Roth IRA; Moved income out of 3.8% surtax account Roth IRA Conversions Reg IRA Broker Assets $300,000 $120,000 5% income $15,000 $6,000 Tax Rate 39.6% 44.4%/23.8% Tax -5,940 -1,428 Roth IRA $300,000 $15,000 0% . -0- $13,632 $15,000 $9,060 $4,572 Roth IRA Conversions Children liquidate inherited accounts? Reg IRA Brokerage Roth IRA Assets $300,000 $120,000 $300,000 Tax Rate 39.6% -0-0Tax -120,000 -0. -0$300,000 $180,000 $120,000 $300,000 The $420,000 of assets were only worth $300,000, after-taxes. (IRA: pre-tax income) Reduce Net Investment Income Shift NII to Family/Charity who pay no 3.8% tax [note: trusts do pay 3.8%] Family: Give income-generating investments Charity: #1 – Make gifts with appreciated stock #2 – Donor advised funds & private foundations #3 – Charitable lead trusts WHICH ASSET TO GIVE ? PLANNING FOR CHARITABLE GIFTS OF APPRECIATED STOCK IN LIGHT OF FUTURE TAX RATE CHANGES DONORS LIKE TO CONTRIBUTE APPRECIATED STOCK DOUBLE-TAX ADVANTAGE • Charitable Income Tax Deduction for the Full Appreciated Value of the Stock • Never Pay Income Tax on the Growth of the Value of the Stock • Loss Property? Sell for tax loss; give cash DOUBLE BENEFIT FROM GIFT OF APPRECIATED L.T.C.G. PROPERTY << AVOID LONG-TERM CAPITAL GAIN TAX << CHARITABLE INCOME TAX DEDUCTION $ Benefits Max Federal Taxes Saved Person in 2012 50% * 25% RE Dep Recap * 28% Collectibles << 15%* LTCG Tax Rate << 35% Marginal Tax Rate IMPACT OF INDIVIDUAL INCOME TAX RATE CHANGES in 2012 and 2013 FUTURE INCOME TAX RATES Highest tax rates • Investment income 2012 35% 2013 44.4% • Earned income 36.4% (wages – 1.45% health) 43.0% • LT Capital Gains 24.8% 15% $ Benefits Max Federal Taxes Saved Person in the Year 2012 50% * 25% RE Dep Recap * 28% Collectibles << 15%* LTCG Tax Rate << 35% Marginal Tax Rate $ Benefits Max Federal Taxes Saved Person in the Year 2013 65.4% * 29.8% RE Dep Recap * 32.8% Collectibles << 24.8%* LTCG Tax Rate << 39.6*% Marginal Tax Rate (3.8% surtax not avoided by charitable deduction) Reduce Net Investment Income Shift NII to Family/Charity who pay no 3.8% tax [note: trusts do pay 3.8%] Family: Give income-generating investments Charity: #1 – Make gifts with appreciated stock #2 – Donor advised funds & private foundations #3 – Charitable lead trusts SO YOU WANNA BE A PHILANTHROPIST? Administrative Convenience of Donor Advised Funds & Private Foundations – split large gift to many charities -- one receipt from DAF/PF instead of many CWAs from many charities -- anonymous gifts possible with DAFs Shift Net Investment Income Client with $400,000+ of income says: • “My $100,000 investment produces $4,000 of taxable income every year” • “I give away $4,000 to charity every year” • “I want a charitable bequest of $100,000” CONCEPT: Put $100,000 into a DAF while alive. Reducing NII by $4,000 beats itemized deduction. Reduce Net Investment Income Shift NII to Family/Charity who pay no 3.8% tax [note: trusts do pay 3.8%] Charity: #1 – Donor advised funds & private foundations #2 – Charitable lead trusts COST/BENEFIT – Is administrative cost of PF or CLT worth doing just for 3.8% tax savings? Other benefits are needed. ( Compare: DAF cheap!) Taxpayers with AGI Near $200,000 Two Ways to reduce the 3.8% surtax : #1 - Reduce Net Investment Income and/or #2 – Reduce AGI to less than $200,000 ($250,000 joint) Taxpayers with AGI Near $200,000 and with lots of Net Investment Income Reduce AGI to less than $200k ($250 jnt) • Reduce NII (see strategies listed earlier) • Avoid large Roth IRA conversions • Maximize compensation deferral -- 401(k) contributions -- Non-qualified deferred comp (Sec. 409A) • “Charitable IRA Rollover” Taxpayers with AGI Near $200,000 ”Charitable IRA Rollover” - over age 70 ½ • “QCD” – Qualified Charitable Distribution • Have charitable gift made directly from IRA to charity (max: $100,000 /year) • QCD distribution not counted as income (Price? No itemized charitable deduction) • QCD can satisfy annual RMD REQUIRED MINIMUM DISTRIBUTIONS *LIFETIME DISTRIBUTIONS* Age of Account Owner 70 1/2 75 80 85 90 95 100 Required Payout 3.65% 4.37% 5.35% 6.76% 8.75% 11.63% 15.88% ADVANTAGES OF ROTH IRAs • Unlike a regular IRA, no mandatory lifetime distributions from a Roth IRA after age 70 ½ • Yes, there are mandatory distributions after death Taxpayers with AGI Near $200,000 and with lots of Net Investment Income ”Charitable IRA Rollover” - over age 70 ½ 71 year old professional • $150,000 compensation income • $50,000 net investment income • This year: first RMD from IRA ($40,000) • Intends to make charitable gift: $30,000 Taxpayers with AGI Near $200,000 ”Charitable IRA Rollover” - over age 70 ½ Normal Gift Compensation $150,000 Investment 50,000 IRA RMD 40,000 AGI $240,000 << 3.8% surtax Taxable Income $210,000 on $40,000 Taxpayers with AGI Near $200,000 ”Charitable IRA Rollover” - over age 70 ½ Normal Gift Compensation $150,000 Investment 50,000 IRA RMD 40,000 AGI $240,000 3.8% surtax on: $40,000 IRA Gift $150,000 50,000 10,000 $210,000 $10,000 Will Law Be Extended to 2014? Proposed: Public Good IRA Rollover Act of 2013 Expand law to include deferred gifts; DAFs; SOs >Planning strategy for 2014 if, as in 2008, 2010 & 2012, law has not been extended until December!: Give RMD to charity; can’t lose ! (Some IRAs balk) 3.8% Net Investment Income Tax MAGI > $200,000 ($250,000 joint returns) Strategies for three different taxpayers: #1 - Richest 1% - Income over $400,000 -- Need to reduce NII (won’t have AGI <200k) #2 – Taxpayers with AGI near $200k ($250 jt) -- Either reduce NII or reduce AGI #3 - Taxpayers with AGI below $200k ($250 jt) Taxpayers with AGI Under $200,000 Keep AGI Under $200,000, and prepare for future years • Modest-size Roth IRA conversions ($200,000 threshold not indexed for inflation) • Modest-size capital gain harvesting • Avoid spikes in income -- Installment sales -- Charitable remainder trusts CHARITABLE REMAINDER TRUSTS CHARITABLE REMAINDER TRUSTS • Payment to non-charitable beneficiary (ies) for life *or* for a term of years (maximum 20 years) • Remainder interest distributed to charity • Exempt from income tax CHARITABLE REMAINDER TRUSTS EXAMPLE • Husband & wife age 65 • Sell stock or land for $1 million gain • Other option: contribute to CRT before sale is finalized; have CRT make the sale CHARITABLE REMAINDER TRUSTS CRT PROVIDES: • 1. Charitable income tax deduction • 2. Greater cash flow for life • 3. Avoid spike in income – 3.8% tax • 4. “Wealth replacement” strategy with life insurance. CHARITABLE REMAINDER TRUSTS KEEP THE STOCK Sales Price Cost of Stock Gain on Sale Capital Gains Tax (about 25%) Remaining Proceeds $ 1,000,000 -0$ 1,000,000 250,000 $ 750,000 DONATE STOCK TO C.R.T.; C.R.T. SELLS STOCK $1,000,000 -0$1,000,000 None $1,000,000 CHARITABLE REMAINDER TRUSTS DONATE STOCK TO C.R.T.; KEEP THE STOCK C.R.T. SELLS STOCK Remaining Proceeds Interest Rate Annual Income • $ 750,000 x 5% $ 37,500 ══════ $1,000,000 x 5% $ 50,000 ══════ (33% more) CHARITABLE REMAINDER TRUSTS CRT PROVIDES: • 1. Charitable income tax deduction • 2. Greater cash flow for life • 3. Avoid spike in income – 3.8% tax • 4. “Wealth replacement” strategy with life insurance. Planning for Retirement Assets THREE STAGES OF A RETIREMENT ACCOUNT • Accumulate Wealth • Retirement Withdrawals • Distributions After Death Accumulate Wealth • Tax deduction at contribution • Accumulate in tax-exempt trust • Taxed upon distribution = Tax Deferred Compensation Objective of Tax Laws: Provide Retirement Income Consequently, there are laws to: • Discourage distributions before age 59 ½ • Force distributions after age 70 ½ TYPES OF QRPs • 1. Sec. 401 – Company plans • 2. Sec. 408 – IRAs -- SEP & SIMPLE IRAs • 3. Sec. 403(b) & 457–Charities • 4. Roth IRAs & 401(k)/403(b) RETIREMENT ACCOUNTS ESTATE PLANNER’S DILEMMA: • Cannot* make a lifetime gift of retirement assets, like stock or land * exception: “Charitable IRA” • Cannot put into FLP for discount • Can make a bequest of retirement assets, but usually taxable income to recipient Roth IRA, Roth 401(k), or Roth 403(b) INVERSE OF TRADITIONAL: • No tax deduction at contribution • Accumulate in tax-exempt trust • Not taxed upon distribution THREE STAGES • Accumulate Wealth • Retirement Withdrawals • Distributions After Death RETIREMENT TAXATION General Rule – Ordinary income Exceptions: -- Tax-free return of capital -- NUA for appreciated employer stock -- Roth distributions are tax-free USUAL OBJECTIVE: Defer paying income taxes in order to get greater cash flow • Pre-Tax Amount Principal 10% Yield $ 100,000 $ 10,000 • Income Tax on Distribution (40%) • Amount Left to Invest 40,000 $ 60,000 $ 6,000 REQUIRED MINIMUM DISTRIBUTION (“RMD”) BACKGROUND: 50% penalty if not receive distribution from IRA, 401(k), etc: #1 – lifetime distributions from own IRA: beginning after age 70 ½ #2 – an inherited IRA, 401(k), etc – beginning year after death * REQUIRED MINIMUM DISTRIBUTIONS *LIFETIME DISTRIBUTIONS* Age of Account Owner 70 1/2 75 80 85 90 95 100 Required Payout 3.65% 4.37% 5.35% 6.76% 8.75% 11.63% 15.88% ADVANTAGES OF ROTH IRAs • Unlike a regular IRA, no mandatory lifetime distributions from a Roth IRA after age 70 ½ • Yes, there are mandatory distributions after death THREE STAGES • Accumulate Wealth • Retirement Withdrawals • Distributions After Death Distributions After Death > Income taxation > Mandatory ERISA distributions > Estate taxation Collision of three tax worlds at death INCOME IN RESPECT OF A DECEDENT “IRD” – Sec. 691 • No stepped up basis for retirement assets • After death, payments are income in respect of a decedent (“IRD”) to the beneficiaries • Common mistake in the past: children liquidate inherited retirement accounts. Distributions After Death > Income taxation > Mandatory ERISA distributions > Estate taxation Collision of three tax worlds at death Distributions After Death After death, must start liquidating account • Tax planning for family members who inherit: DEFER distributions as long as possible – greater tax savings • “Stretch IRA” – make payments over beneficiary’s life expectancy Distributions After Death “ life expectancy“ Oversimplified: Half of population will die before that age, and half will die after Implication: For the 50% of people who live beyond L.E. date, an inherited IRA will be empty before they die. REQUIRED MINIMUM DISTRIBUTIONS *LIFE EXPECTANCY TABLE* Age of Beneficiary 30 40 50 60 70 80 90 83 83 84 85 87 90 97 Life Expectancy 53.3 more years 43.6 34.2 25.2 17.0 10.2 6.9 REQUIRED MIN. DISTRIBUTIONS *LIFE EXPECTANCY TABLE* “STRETCH IRAS” Age of Beneficiary 30 40 50 60 70 80 90 Life Expectancy 53.3 more years 43.6 34.2 25.2 17.0 10.2 6.9 REQUIRED MIN. DISTRIBUTIONS *LIFE EXPECTANCY TABLE* “STRETCH IRAS” Age of Beneficiary 30 1.9% 40 2.3% 50 2.9% 60 4.0% 70 5.9% 80 10.0% 90 14.5% Life Expectancy 53.3 more years 43.6 34.2 25.2 17.0 10.2 6.9 REQUIRED MINIMUM DISTRIBUTIONS * DEFINITIONS * • Designated Beneficiary (“DB”) A human being. An estate or charity can be a beneficiary of an account, but not a DB. • Determination Date September 30 in year after death. HOW TO ELIMINATE BENEFICIARIES BEFORE DETERMINATION DATE • Disclaimers • Full distribution of share • Divide into separate accounts HOW TO LEAVE ACCOUNT TO BOTH FAMILY & CHARITY • Other beneficiaries cannot do stretch IRA if charity is also a beneficiary? • Solutions: * cash out charity’s share by Sept 30 or * separate account for charity 2012 SENATE PROPOSAL: LIQUIDATE ALL INHERITED IRAs IN FIVE YEARS • Feb 7, 2012 – Highway Bill – not enacted • Senator Baucus – Senator Kyl – “We will look at it again later” EXCEPTIONS • -- Spouse -- minor child -- disabled • -- Person not more than ten years younger REQUIRED MINIMUM DISTRIBUTIONS Example: Death at age 80? CURRENT LAW: *Life Expectancy Table* Age of Beneficiary 30 1.9% 40 2.3% 50 2.9% 60 4.0% 70 5.9% 80 10.0% 90 10.0% Life Expectancy 53.3 more years 43.6 34.2 25.2 17.0 10.2 6.9 * [10.2 yrs] REQUIRED MINIMUM DISTRIBUTIONS Example: Death at age 80? PROPOSED: FIVE YEARS if >10 yrs younger Age of Beneficiary 30 40 50 60 70 5.9% 80 10.0% 90 10.00% Life Expectancy 5 years 5 5 5 17.0 10.2 6.9 * [10.2 yrs] 2012 SENATE PROPOSAL: LIQUIDATE ALL INHERITED IRAs IN FIVE YEARS EXCEPTIONS • -- Spouse -- minor child -- disabled • -- Person not more than ten years younger TAX TRAP: Does naming a trust for a spouse (e.g., QTIP trust; credit shelter trust) as an IRA beneficiary mean required liquidation in 5 years? 2012 SENATE PROPOSAL: LIQUIDATE ALL INHERITED IRAs IN FIVE YEARS IMPLICATIONS FOR CHARITIES Donors more likely to consider • Outright bequests • Retirement assets to tax-exempt CRT – Payable over child’s remaining life – Spouse only (marital estate tax deduction) – Spouse & children (no marital deduction) FUNDING TRUSTS WITH RETIREMENT ASSETS FUNDING TRUSTS General Rule: Trust is not DB Exception: “Look-through” trust if four conditions Types:-- “accumulation trusts” -- “conduit trusts” MULTIPLE BENEFICIARIES OF A SINGLE IRA? • Must liquidate over life expectancy of oldest beneficiary • Payable to a trust? Use life expectancy of oldest trust beneficiary FUNDING TRUSTS WITH RETIREMENT ASSETS Challenges when there are multiple beneficiaries with a big age spread (Mom and children) Common problem with marital bypass trusts and QTIP trusts when surviving spouse is elderly and other beneficiaries are young secret – long marriage AGE AT DEATH MEDIAN AGE AT DEATH ON FEDERAL ESTATE TAX RETURNS: Age 80 – Men Age 84 - Women AGE AT DEATH Percentage of Federal Estate Tax Returns 38.0 24.4 19.4 10.5 2.6 <50 5.2 50-60 60-70 70-80 80-90 90+ AGE AT DEATH Men/Women Percentage of 2007 Federal Estate Tax Returns 66 53 24 20 14 9 Under 60 5 60 - 70 70 - 80 Men Over 80 Under 60 9 60 - 70 70 - 80 Women Over 80 MARITAL STATUS AT DEATH Marital Status of Decedents on Federal Estate Tax Returns (in percentages) 61.5 61.1 24.7 24.4 9.6 8.9 4.9 4.8 Married Widowed Single Men Divorce/Sep Married Widowed Women Single Divorce/Sep AGE AT DEATH MEDIAN AGE AT DEATH ON FEDERAL ESTATE TAX RETURNS: Age 80 – Men Age 84 - Women REQUIRED MINIMUM DISTRIBUTIONS *LIFE EXPECTANCY TABLE* Age of Beneficiary 30 40 50 60 70 80 90 Life Expectancy 53.3 more years 43.6 34.2 25.2 17.0 10.2 more years 6.9 more years USUAL OBJECTIVE: Defer paying income taxes in order to get greater cash flow Principal 10% Yield • Pre-Tax Amount $ 100,000 • Income Tax on Distribution (40%) • Amount Left to Invest $ 10,000 40,000 $ 60,000 $ 6,000 MANDATORY DISTRIBUTIONS [Assume inherit IRA at age 80 and die at 92] AGE Own Accumulation Conduit IRA Trust Trust . 80 5.35% 85 6.76% 19.23% 13.16% 90 91 92 8.78% 9.26% 9.81% 100.00% empty empty 18.18% 19.23% 20.41% 9.80% 9.80% 2-GENERATION CHARITABLE REMAINDER TRUST • Typically pays 5% to elderly surviving spouse for life, then 5% to children for life, then liquidates to charity • Like an IRA, a CRT is exempt from income tax • Can operate like a credit-shelter trust for IRD assets [no marital deduction] 2-GENERATION CHARITABLE REMAINDER TRUST • Can be a solution for second marriages when estate is top-heavy with retirement assets. Example: -- Half of IRA to surviving spouse -- Other half of IRA to a CRT for 2nd spouse and children from 1st marriage 2-GENERATION CHARITABLE REMAINDER TRUST TECHNICAL REQUIREMENTS • Minimum 10% charitable deduction -- all children should be over age 40 • CRUT – minimum 5% annual distrib • Not eligible for marital deduction (see 2002 article on topic) MANDATORY DISTRIBUTIONS [Assume inherit IRA at age 80 and die at 92] AGE Own Accumulation Conduit IRA Trust Trust . 80 5.35% 85 6.76% 19.23% 13.16% 90 91 92 8.78% 9.26% 9.81% 100.00% empty empty 18.18% 19.23% 20.41% 9.80% 9.80% MANDATORY DISTRIBUTIONS [Assume inherit IRA at age 80 and die at 92] AGE Own Accumulation Conduit IRA Trust Trust . 80 5.35% 85 6.76% 90 91 92 8.78% 9.26% 9.81% 9.80% CRT . 9.80% 5.00% 19.23% 13.16% 5.00% 100.00% empty empty 18.18% 19.23% 20.41% 5.00% 5.00% 5.00% WOULD THE OUTCOME OF ROLLOVER vs. TRUST BE ANY BETTER WITH A YOUNGER SURVIVING SPOUSE? ANSWER: NO MANDATORY DISTRIBUTIONS [Assume surv. spouse inherits IRA at age 70] AGE Own Accumulation IRA Trust AGE 70 3.65% 5.88% 75 4.37% 8.33% 80 5.35% 14.29% Own IRA Accumul Trust . 82 83 84 5.85% 6.14% 6.46% 20.00% 25.00% 33.33% 85 86 87 6.76% 50.00% 7.10% 100.00% 7.47% empty MANDATORY DISTRIBUTIONS [Assume surv. spouse inherits IRA at age 70] AGE Own IRA Conduit Trust 70 3.65% 5.88% 75 4.37% 7.46% 80 5.35% 9.80% AGE Own Conduit IRA Trust . 82 83 84 5.85% 6.14% 6.46% 11.00% 11.63% 12.35% 85 86 87 6.76% 7.10% 7.47% 13.16% 14.08% 14.93% RETIREMENT ASSETS IN THE CROSSFIRE OF: > Income taxation > Mandatory ERISA distributions > Estate taxation Collision of three tax worlds at death FUTURE OF ESTATE TAX ? Year 2001 2002-2003 2004-2005 2006-2008 2009 2010 2011-2012 2013 Threshold $ 675,000 $ 1,000,000 $ 1,500,000 $ 2,000,000 $ 3,500,000 REPEALED ! [* carryover basis] $ 5,000,000 inflation indexed $ 5,250,000 inflation indexed MARRIED? 61% of male decedents 24% of female decedents - MARITAL DEDUCTION !! - DEFER ESTATE TAX UNTIL DEATH OF SURVIVING SPOUSE RETIREMENT ACCOUNTS AND PORTABILITY For a surviving spouse, rollovers and portability will usually be your first choice PORTABILITY * Law that gives a married couple a potential combined $10+ million exemption – double the $5+ million exemption available to others. Section 2010( c) * When 2nd spouse dies, estate can claim DSUEA from estate of first spouse RETIREMENT ACCOUNTS AND PORTABILITY • Portability permits rollovers to a surviving spouse • Rollovers are better than retirement assets to a trust for a surviving spouse MANDATORY DISTRIBUTIONS [Assume inherit IRA at age 80 and die at 92] AGE Own Accumulation Conduit IRA Trust Trust . 80 5.35% 85 6.76% 19.23% 13.16% 90 91 92 8.78% 9.26% 9.81% 100.00% empty empty 18.18% 19.23% 20.41% 9.80% 9.80% RETIREMENT ASSETS IN THE CROSSFIRE OF: > Income taxation > Mandatory ERISA distributions > Estate taxation Collision of three tax worlds at death NOT MARRIED? 39% of male decedents 75% of female decedents - NO MARITAL DEDUCTION - ESTATE TAX WILL BE DUE ON I.R.D. NOT MARRIED? NO MARITAL DEDUCTION WHAT IS THE TAX RATE THAT RICH PEOPLE PAY ON THEIR INCOME ? • Income tax? • Estate tax? IF RICH ENOUGH TO PAY ESTATE TAX, CONSIDER CHARITY & PHILANTHROPY. Combination of income & estate taxes Income $100 Income tax 40 (40%) Net $ 60 Estate Tax 24 (40% ) Net to Heirs $ 36 ….. in 2013 Roth IRA Conversion and a Charitable Bequest Disclaimer • Pre-Mortem Planning: Roth IRA Conversion • Post-Mortem Planning: Charitable Bequest via Disclaimer (charity named as contingent beneficiary of a retirement account) A ROTH IRA CONVERSION IS A TAXABLE EVENT Treated as taxable withdrawal from traditional IRA or QRP, followed by a non-deductible contribution to a Roth IRA Roth IRA & Estate Tax Assets Cash, etc. $ 4.1 million IRA (taxable IRD) 1.0 million Tx-exmp Roth - 0Liab -0Net Estate $ 5.1 million Roth IRA & Estate Tax Before Cash, etc. IRA Tx-exmp Roth Liab Net Estate 4.1 1.0 - 0-05.1 After 4.1 0.7 0.3 Roth IRA & Estate Tax Before Cash, etc. IRA Tx-exmp Roth Liab Net Estate 4.1 1.0 - 0-05.1 After 4.1 0.7 0.3 -0.1 5.0 Roth IRA & Estate Tax Before Cash, etc. IRA (taxable IRD) Tx-exmp Roth Liab Net Estate After 4.1 paid> 4.0 1.0 0.7 - 00.3 -0- paid> -05.1 5.0 Roth IRA & Estate Tax Assets Death Cash, etc. $ 4.1 million $4.3 IRA 1.0 million Tx-exmp Roth - 0Charit. Bequest - 0 Liab -0Net Estate $ 5.1 million $5.3 Roth IRA & Estate Tax Before After Cash, etc. IRA Tx-exmp Roth Charit. Bequest Liab Net Estate 4.3 4.3 1.0 - 0- 0-0- 0.7 0.3 -0-0.1 5.3 5.2 Charitable Disclaimer Before After Cash, etc. IRA Tx-exmp Roth Charit. Bequest Liab Net Estate 4.3 1.0 - 0- 0-05.3 4.3 0.7 0.3 -0.2 -0.1 5.0 Charitable Disclaimer Before After Cash, etc. IRA (taxable) Tx-exmp Roth Charit. Bequest Liab Net Estate 4.3 1.0 - 0- 0-05.3 paid> 4.2 paid> 0.5 0.3 paid> 0.2 paid> -05.0 0.2 Charitable Disclaimer Estate planner said to me: “Show me the child that will actually disclaim an inheritance to a charity to avoid an estate tax” Charitable Disclaimer • A charity the child supports • Donor advised fund (problems with disclaimers to a private foundation) HOW TO LEAVE A RETIREMENT ACCOUNT TO BOTH FAMILY & CHARITY Avoiding Problems With Charitable Bequests * Let Other Beneficiaries Have Stretch IRA *Keep IRD Off of Estate’s Income Tax Return * Guarantee Offsetting Charitable Income Tax Deduction if Have to Report Income REQUIRED MIN. DISTRIBUTIONS *LIFE EXPECTANCY TABLE* “STRETCH IRAS” Age of Beneficiary 30 40 50 60 70 80 90 Life Expectancy 53.3 more years 43.6 34.2 25.2 17.0 10.2 6.9 Avoiding Problems With Charitable Bequests * Let Other Beneficiaries Have Stretch IRA *Keep IRD Off of Estate’s Income Tax Return * Guarantee Offsetting Charitable Income Tax Deduction if Have to Report Income WHAT CAN GO WRONG ? TWO WAYS TO MAKE A CHARITABLE BEQUEST FROM A RETIREMENT ACCOUNT #1 – NAME CHARITY AS BENEFICIARY OF THE ACCOUNT #2 – PAY ACCOUNT TO ESTATE OR TRUST THAT THEN MAKES A CHARITABLE BEQUEST Avoiding Problems With Charitable Bequests * Let Other Beneficiaries Have Stretch IRA *Keep IRD Off of Estate’s Income Tax Return * Guarantee Offsetting Charitable Income Tax Deduction if Have to Report Income WHAT CAN GO WRONG #1? • Other beneficiaries cannot do stretch IRA if charity is beneficiary? • Solutions: * cash out charity’s share by Sept 30 or * separate account for charity p. 39 WHAT CAN GO WRONG #2 ? TWO WAYS TO MAKE A CHARITABLE BEQUEST FROM A RETIREMENT ACCOUNT #1 – NAME CHARITY AS BENEFICIARY OF THE ACCOUNT #2 – PAY ACCOUNT TO ESTATE OR TRUST THAT THEN MAKES A CHARITABLE BEQUEST WHAT CAN GO WRONG #2? Estate or trust has taxable income from receiving IRA distribution, but maybe there is no offsetting charitable income tax deduction when the IRA check is given to a charity. WHAT CAN GO WRONG? • IRS Chief Counsel Memorandum ILM 200848020 • Decedent left his IRA to a trust that benefited his six children and several charities • Trust received cash from IRA; paid entire charitable share, leaving the six children as the only remaining beneficiaries of the trust. • IRS: “Taxable income from IRA, but no charitable deduction.” Reason: trust had no instructions to pay income to charities p.39 WHAT CAN GO WRONG? • Solution #1 – Keep IRD off of estate’s/trust’s income tax return a. Name charity as beneficiary of IRA b. “Distribute” IRA to charity if document allows Caution: IRS memo on danger of using retirement accounts to satisfy pecuniary bequests p.41 WHAT CAN GO WRONG? SOLUTION #2 – draft document to get an offsetting charitable income tax deduction in case estate or trust has income • I instruct that all of my charitable gifts, bequests and devises shall be made, to the extent possible, from "income in respect of a decedent" ….. P.42 Planning for Retirement Assets in an Estate CHRISTOPHER R. HOYT University of Missouri - Kansas City School of Law