Eco120Int_Lecture3

advertisement

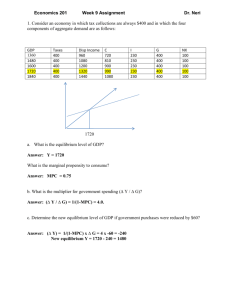

ECO 120 Macroeconomics Week 3 AE Model and the Multiplier Lecturer Dr. Rod Duncan News • Wednesday 4-5pm tutorial has been moved from C2-213 to C2-216 starting tomorrow. Topics • • • • Two sector AE model Three sector AE model Equilibrium in the AE model The multiplier in the AE model What the AE model for? • Always try to see the forest for the trees! • Always ask “what is this for?” “what is the purpose of this model?” • The aggregate expenditure (AE) model is a simple model of GDP: – It can be used to predict what GDP will do? Is Australian GDP rising? How fast? – It can be used to explain what happened to GDP? For example GDP might be rising because net exports are rising. The big picture P, Wealth, H/h Expectations, H/h Taxes C P, i, Business Expectations, Business Taxes I AE Government policy, and? P, and? G NX AD Consumption function • • The consumption function relates the level of private household consumption of goods and services (C) to the level of aggregate income (Y). We can represent the consumption function in three different and equivalent ways. 1. An mathematical equation 2. A graph 3. A table • For example the consumption function could be: – C = $100bn + 0.5Y Consumption function • We can represent this same function with a graph. C C(Y) = $100bn + 0.5Y $150bn Slope is 0.5 The MPC is 0.5 $100bn $100bn Y Consumption function • Or we can represent the same function with a table. • Three ways of representing the same function. Y C(Y) = 100 + 0.5Y C 0 100 + 0.5 (0) 100 100 100 + 0.5 (100) 150 200 300 100 + 0.5 (200) 100 + 0.5 (300) 200 250 400 500 100 + 0.5 (400) 100 + 0.5 (500) 300 350 Two sector model • Aggregate expenditure (AE) in the two sector model is composed of consumption (C) and investment (I). AE = C + I • In this model, we treat I as exogenous, so it is a constant. • Let’s use the same simple linear consumption function: C = 100 + 0.5Y I = 100 AE = C + I = 100 + 0.5Y + 100 = 200 + 0.5Y Aggregate expenditure function • This equation is a relationship between income (Y) and aggregate expenditure (AE). AE = 200 + 0.5Y $250bn Slope is 0.5 $200bn $100bn Y Aggregate expenditure function • But we could also use the table form. Y 0 100 C 100 150 I 100 100 AE 200 250 200 300 200 250 100 100 300 350 400 500 300 350 100 100 400 450 Equilibrium in two sector model • Equilibrium in a model is a situation of “balance”. In our AE model, equilibrium requires that demand for goods (AE) is equal to supply of goods (Y). Y = AE = C + I • For the equilibrium we are looking for the value of GDP, Y*, such that goods demand and goods supply are equal. • In our two sector AE model that means that we can look up our AE table and find where AE = Y. • The equilibrium value of Y will be our prediction of GDP for our AE model. Equilibrium • The equilibrium value of GDP is $400bn. Y C I AE 0 100 100 200 100 150 100 250 200 200 100 300 300 250 100 350 400* 300 100 400* 500 350 100 450 Equilibrium • We could accomplish the same by using our graph of the AE function. – The AE line shows us the level of goods demand for each value of Y. – The 45 degree line represents the value of Y or supply of goods. – Equilibrium will occur when the 45 degree line and the AE line cross. At the crossing, goods demand is equal to goods supply for that level of Y. Equilibrium Y AE = 200 + 0.5Y 400 400 Y • The equilibrium value of Y is where the 45 degree line and the AE line cross. Y* is at $400bn. Equilibrium • Finally, if you are comfortable with the mathematics, you can solve for the equilibrium value of Y using the equations: Y* = AE = 200 + 0.5Y* Y* – 0.5Y* = 200 0.5Y* = 200 Y* = 400 • You arrive at the same answer no matter which way you use to derive it. Autonomous expenditure • In our model we have two part of aggregate expenditure: AE = $200bn + 0.5Y – One part does not depend on the value of Ythe $200bn. This portion is called “autonomous expenditure”. – The other part does depend on the value of Ythe 0.5Y. • In our model part of autonomous expenditure is C and part is I. Scenario: Investment falls • What happens if I drops from 100 to 50 perhaps because of uncertainty due to terrorism scares? • Equilibrium GDP drops to 300. Y C I AE 0 100 50 150 100 150 50 200 200 200 50 250 300* 250 50 300* 400 300 50 350 500 350 50 400 Scenario • But you could also find the same answer with some algebra: AE = C + I = 100 + 0.5Y + 50 = 150 + 0.5Y Y* = AE = 150 + 0.5Y* Y* – 0.5Y* = 150 0.5Y* = 150 Y* = 300 • Find the answer in the way you feel most comfortable. Multiplier • So a $50bn drop in investment (or autonomous expenditure) leads to a $100bn drop in equilibrium GDP. • The ratio of the change in GDP over the change in autonomous expenditure is called the multiplier: Multiplier = (Change in GDP)/(Change in I) Multiplier • In our scenario the multiplier is: Multiplier = $100bn / $50bn = 2 • This term is given the name “multiplier” because each $1 change in I lead to a 2x$1 change in GDP. • We will come back to the multiplier after we talk about the three sector model. Three sector AE model • Now we make our model slightly more complicated by bringing in the government. The government has two effects on our model: – The government raises tax revenues (T) by taxing household incomes. – The government purchases some goods and services for government consumption (G). • We treat the levels of T and G as exogenous to our AE model. Government policy determines what T and G will be, and policy is not affected by the equilibrium level of GDP. Three sector model • Household consumption depended on household income, Y, in our two sector model. • In the three sector model, the income that households have available to spend or save is now income net of taxes, Y – T. We call this amount “disposable income”, YD. • The consumption function will now depend on disposable income, not income. C = C(Y – T) = C(YD) Three sector model • Our new aggregate expenditure function includes government purchases of goods and services, so we have: AE = C + I + G • Let’s assume we have the same linear consumption function as before, but now in disposable income: C = 100 + 0.5 (Y – T) • Let T = G = 50 and let I = 100. We can follow the same steps as before to find our AE function and then to find equilibrium GDP. Aggregate expenditure function • Our AE function is: AE = C(Y – T) + I + G AE = 100 + 0.5(Y – 50) + 100 + 50 AE = 100 + 0.5Y – 25 + 100 + 50 AE = 225 + 0.5Y • We can also represent this as a table. Our C function with disposable income is: C = 100 + 0.5(Y-50) = 75 + 0.5Y Table form Y C = 75 + 0.5Y 0 75 I G AE 100 50 225 100 125 100 50 275 200 175 100 50 325 300 225 100 50 375 400 275 100 50 425 500 325 100 50 475 Equilibrium • If we want to find equilibrium GDP in our three sector model, we need to find the level of GDP, Y*, for which goods demand (AE) is equal to goods supply (Y). • If we look at our table, we see that for an income level of Y of 400, AE is 425 which exceeds Y. At an income level of Y of 500, AE is 475 which is less than Y. • We would guess that the equilibrium value of Y lies between 400 and 500. • We construct a new table of values of Y between 400 and 500. Equilibrium Y C = 75 + 0.5Y 400 275 I G AE 100 50 425 425 287.5 100 50 437.5 450* 300 100 50 450* 475 312.5 100 50 462.5 500 325 100 50 475 Equilibrium • The equilibrium value of Y is 450. • We could find the answer with our equations: AE = 225 + 0.5Y Y* = AE = 225 + 0.5Y* Y* - 0.5Y* = 225 0.5Y* = 225 Y* = 450 Scenario: Investment falls • What happens if we have the same drop in investment in the three sector model? So I drops from 100 to 50? • Using our equations: AE = 100 + 0.5(Y - T) + I + G AE = 75 + 0.5Y + 50 + 50 AE = 175 + 0.5Y • Solving for Y*, we get: Y* = AE = 175 + 0.5Y* Y* = 350 • Our multiplier = 100/50 = 2 as before. Generalizing the AE model • In all our models, we have had Y (and also C) as our endogenous variable. • Exogenous variables are variables in a model that are determined “outside” the model itself, so they appear as constants. • For the aggregate expenditure model, we treat as exogenous: – – – – Investment (I) Government consumption (G) ( three sector) Taxes (T) (three sector) Net Exports (NX) (four sector) Aggregate expenditure • In a two sector model: AE = C(Y) + I • In a closed (no foreign trade) economy or three sector model: AE = C(Y - T) + I + G • In an open economy or four sector model: AE = C(Y - T) + I + G + NX • Changes in the exogenous variables (I, G, T or NX) will shift the AE curve. Equilibrium in the AE model • Exogenous variables are just constantsnumbers. • Supply of goods equals demands of goods (in the closed economy): Y=C+I+G Y = a + b(Y – T) + I + G (1 – b)Y = a – bT + I + G • Finally we get: 1 Y [a bT I G] 1 b Equilibrium • The value 1/(1-b) is the multiplier in our AE model. • So if I or G changes by 1, we know that Y will change by 1/(1-b). • The constant b here is just the MPC. • So we have: Multiplier = 1 / (1 – MPC) • In our simple linear model, b was 0.5, and we get: Multiplier = 1 / (1 – 0.5) = 1/0.5 = 2 Expenditure multiplier • Imagine the government wishes to affect the economy. One tool available is government consumption, G, or government taxes, T. This is called “fiscal policy”. • Any change in G (∆G) in our AE model will produce: 1 ΔY ΔG 1- b Multiplier • If b=0.75, then the multiplier is (1/0.25) or 4, so $1 of new G will produce $4 of new Y. • Our multiplier is equal to 1/(1-MPC). • Since 0<MPC<1, our multiplier will be greater than 1. • The larger is the MPC, the larger is our multiplier. Practice exam question The Howard government plans to spend $600m on new coast guard ships for the Australian armed forces. These ships will be built in Tasmania. Explain (using both a diagram and text based on what you have learned so far in class) how the Australian economy will be affected by: [Hints: Remember to draw the initial equilibrium before the new spending and new taxes on your diagrams. Treat the new taxes and new spending as separate policies.] (a) the $600m in new government purchases; and (b) the $600m in new income taxes the government will have to use to pay for the ships.