Chapter 17

Business Tax Credits and

Corporate Alternative

Minimum Tax

Essentials of Taxation

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

1

The Big Picture

• Mike, the CEO of Progress Corporation, has committed to

helping revitalize the downtown area in his hometown.

• Mike is considering expanding his business and purchasing an

old office building in a historic section of downtown.

– The building will require substantial renovations.

– Mike has heard that there are tax credits that might help reduce his

costs.

• He would also like to

– Hire inner-city workers, and

– Help working families by providing on-site child care for working

families.

• He is interested in learning whether his company might take

advantage of any other tax credits offered by the Federal

government that might reduce his costs.

• Read the chapter and formulate your response.

2

Tax Credit VS. Tax Deduction

• Tax benefit received from a tax deduction depends on

the marginal tax rate of the taxpayer

– Tax benefit received from a tax credit is not affected by the

taxpayer’s marginal tax rate

• Example: $1,000 expenditure: tax benefit of 25%

credit compared to tax deduction at various marginal

tax rates

MTR

0% 15% 35%

Tax benefit if a 25% credit is allowed $250 $250 $250

Tax benefit if tax deduction is allowed –0– $150 $350

3

General Business Credit (slide 1 of 2)

• Comprised of a number of business credits

combined into one amount

• Limited to net income tax reduced by greater

of:

– Tentative minimum tax

– 25% of net regular tax liability that exceeds

$25,000

• Unused credit is carried back 1 year, then

forward 20 years

4

General Business Credit (slide 2 of 2)

• Includes the following:

–

–

–

–

–

–

Tax credit for rehabilitation expenditures

Work opportunity tax credit

Research activities credit

Low-income housing credit

Disabled access credit

Credit for small employer pension plan startup

costs

– Credit for employer-provided child care

5

General Business Credit (slide 2 of 2)

• Includes the following:

–

–

–

–

–

–

Tax credit for rehabilitation expenditures

Work opportunity tax credit

Research activities credit

Low-income housing credit

Disabled access credit

Credit for small employer pension plan startup

costs

– Credit for employer-provided child care

6

Rehabilitation Expenditure Credit

(slide 1 of 3)

• Credit is a percentage of expenditures made to

substantially rehabilitate industrial and

commercial buildings and certified historic

structures

• Credit rate

– 20% for nonresidential and residential certified

historic structures

– 10% for other structures originally placed into

service before 1936

7

Rehabilitation Expenditure Credit

(slide 2 of 3)

• To qualify for credit, building must be

substantially rehabilitated meaning qualified

rehab expenditures exceed the greater of:

– The adjusted basis of the property before the rehab

expenditures, or

– $5,000

• Qualified rehab expenditures do not include

the cost of the building and related facilities or

cost of enlarging existing building

8

Rehabilitation Expenditure Credit

(slide 3 of 3)

• Basis in structure is reduced by the credit

amount

• Subject to recapture if rehabilitated property

held less than 5 years or ceases to be

qualifying property

9

The Big Picture - Example 4

Tax Credit For Rehabilitation Expenditures (slide 1 of 2)

• Return to the facts of The Big Picture on p. 17-1.

• Assume that Progress spends $60,000 to

rehabilitate a building (adjusted basis of

$40,000) that had been placed in service in

1932.

– Progress is allowed a credit of $6,000 (10% X

$60,000) for rehabilitation expenditures.

– The corporation then increases the basis of the

building by $54,000.

• $60,000 (rehabilitation expenditures) - $6,000 (credit

allowed).

10

The Big Picture - Example 4

Tax Credit For Rehabilitation Expenditures (slide 2 of 2)

• If the building were a historic structure,

– The credit allowed would be $12,000 (20% X

$60,000), and

– The building’s depreciable basis would increase by

$48,000.

• $60,000 (rehabilitation expenditures) - $12,000 (credit

allowed).

11

Work Opportunity Tax Credit

(slide 1 of 2)

• Applies to first 12 months of wages paid to

individuals falling within target groups

– Credit limited to a percentage of first $6,000

wages paid per eligible employee

• 40% if employee has completed at least 400 hours of

service to employer

• 25% if at least 120 hours of service

– Deduction for wages is reduced by credit amount

12

Work Opportunity Tax Credit

(slide 2 of 2)

• Targeted individuals generally subject to high

rates of unemployment, including

– Qualified ex-felons, high-risk youths, food stamp

recipients, veterans, summer youth employees, and

long-term family assistance recipients

• Summer youth employees: Only first $3,000 of wages

paid for work during 90-day period between May 1 and

September 15 qualify for credit

13

The Big Picture - Example 6

Work Opportunity Tax Credit

• Return to the facts of The Big Picture on p. 17-1.

• In January 2015, Progress Corporation hires 4

members of a qualifying targeted group.

– Each employee works 1,000 hours and is paid wages of

$8,000 during the year.

• Progress’s work opportunity credit is $9,600

– ($6,000 X 40%) X 4 employees.

– If the tax credit is taken, Progress reduces its deduction for

wages paid by $9,600.

• No credit is available for wages paid to these

employees after their first year of employment

14

Work Opportunity Tax Credit: Long-Term

Family Assistance Recipient (slide 1 of 2)

• Applies to first 24 months of wages paid to

individuals who have been long-term

recipients of family assistance welfare benefits

– Long-term is at least an 18 month period ending on

hiring date

15

Work Opportunity Tax Credit: Long-Term

Family Assistance Recipient (slide 2 of 2)

• Maximum credit is a percentage of first

$10,000 qualified wages paid in first and

second year of employment

– 40% in first year

– 50% in second year

• Maximum credit per qualified employee is

$9,000

– Deduction for wages is reduced by credit amount

16

Research Activities Credit

(slide 1 of 5)

• Comprised of three parts

– Incremental research activities credit

– Basic research credit

– Energy research credit

17

Research Activities Credit

(slide 2 of 5)

• Incremental research activities credit

– Credit amount = 20% × (qualified expenditures – base

amount)

• Expenditures qualify if research relates to discovery

of technological info intended for use in developing a

new or improved business component for taxpayer

– Expenditures qualify fully if research done in-house

– Only 65% qualifies if research conducted by outside party

(under contract)

18

Research Activities Credit

(slide 3 of 5)

• Tax treatment of R&E expenditures

– Full credit and reduce expense deduction by credit

amount

– Full expense deduction and reduce credit by

(100% × credit × max. corp. tax rate)

– Full credit and capitalize research expenses and

amortize over 60 months or more

• Amount capitalized is reduced by full amount of credit

only if the credit exceeds the amount allowable as a

deduction

19

Research Activities Credit

(slide 4 of 5)

• Basic research credit

– Additional 20% credit is allowed on basic research

payments in excess of a base amount

• Basic research payments - amounts paid in cash to a qualified basic

research organization, such as a college or university or a taxexempt organization operated primarily to conduct scientific

research

– Basic research is any original investigation for the

advancement of scientific knowledge not having a specific

commercial objective

• The definition excludes basic research conducted outside the

United States and basic research in the social sciences, arts, or

humanities

20

Research Activities Credit

(slide 5 of 5)

• Energy Research Credit –

– This credit is intended to stimulate additional

energy research

– Credit amount = 20% of amounts paid or incurred

by a taxpayer to an energy research consortium for

energy research

21

Disabled Access Credit

• Credit available for eligible access expenditures

made by small businesses

– Includes amounts paid to remove barriers that would

otherwise make a business inaccessible to disabled and

handicapped individuals

– Facility qualifies if placed in service before November

6, 1990

• Credit amount

– 50% × expenditures that exceed $250 but not in excess

of $10,250

• Thus, max. credit is $5,000

– Basis in asset is reduced by credit amount

22

Disabled Access Credit

• Credit available for eligible access expenditures

made by small businesses

– Includes amounts paid to remove barriers that would

otherwise make a business inaccessible to disabled and

handicapped individuals

– Facility qualifies if placed in service before November

6, 1990

• Credit amount

– 50% × expenditures that exceed $250 but not in excess

of $10,250

• Thus, max. credit is $5,000

– Basis in asset is reduced by credit amount

23

Credit For Pension

Plan Startup Costs

• Small businesses can claim nonrefundable tax credit

for admin costs of establishing and maintaining a

qualified retirement plan

– Small business has < 100 employees who have earned at

least $5,000 of compensation

• Credit amount = 50% of qualified startup costs

limited to max credit of $500 per year for 3 years

– Deduction for startup costs is reduced by amount of credit

24

Credit For Employer-Provided Child Care

(slide 1 of 2)

• Employers can claim a credit for providing

child care facilities to their employees during

normal working hours

– Limited to $150,000 per year

• Credit amount:

– 25% of qualified child care expenses

– 10% of qualified child care resource and referral

services

25

Credit For Employer-Provided Child Care

(slide 2 of 2)

• Deductible qualifying expenses must be

reduced by the credit amount

• Basis of qualifying property must be reduced

by credit amount

• Credit may be subject to recapture if child

care facility ceases to be used for qualifying

purpose within 10 years of being placed in

service

26

The Big Picture - Example 13

Credit For Employer-provided Child Care

(slide 1 of 2)

• Return to the facts of The Big Picture on p. 17-1.

• During the year, Progress Corporation

constructs a child care facility for $400,000 to

be used by its employees’ preschool-aged

children.

– In addition, Progress incurs $100,000 in salaries

and other administrative costs associated with the

facility.

27

The Big Picture - Example 13

Credit For Employer-provided Child Care

(slide 2 of 2)

• As a result, Progress’s credit for employerprovided child care is $125,000.

– ($400,000 + $100,000) X 25%.

• The basis of the facility is reduced to $300,000

($400,000 - $100,000), and

• The deduction for salaries and administrative

costs is reduced to $75,000 ($100,000 $25,000).

28

Foreign Tax Credit

(slide 1 of 2)

• The purpose of the foreign tax credit (FTC) is

to mitigate double taxation since income

earned in a foreign country is subject to both

U.S. and foreign taxes

– Credit applies to both individuals and corporations

that pay foreign income taxes

– Instead of claiming a credit, a deduction may be

claimed for the taxes paid

29

Foreign Tax Credit

(slide 2 of 2)

• Amount of the credit allowed is the lesser of:

– The foreign taxes imposed, or

– The overall limitation determined using the following formula:

Foreign-source TI × U.S. tax before credit

Worldwide TI

= Overall FTC limitation

• For individual taxpayers, worldwide taxable income is

determined before personal and dependency exemptions

• Unused FTCs can be carried back 1 year and forward 10

years

30

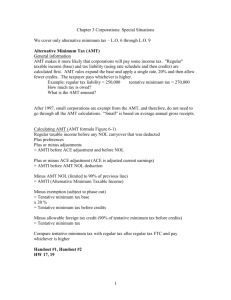

Alternative Minimum Tax (slide 1 of 2)

• Designed to ensure that corporations with

substantial economic income pay at least a

minimum amount of federal taxes

• Essentially, a separate tax system with a quasiflat tax rate applied to a corporation’s

economic income

31

Alternative Minimum Tax (slide 2 of 2)

• If tentative alternative minimum tax > regular

corporate income tax, corporation must pay

regular tax plus the excess, the alternative

minimum tax (AMT)

32

Small Corporation Exemption

(slide 1 of 2)

• For tax years beginning after 1997, many small

corporations are not subject to AMT

• A corporation initially qualifies as a small

corporation in its first tax year in existence

regardless of its gross receipts.

• After the initial year, the exemption applies if

the corp. meets two requirements

Small Corporation Exemption

(slide 2 of 2)

• The exemption applies if these 2 requirements are

met:

– The corp. was treated as a small corporation exempt from

the AMT for all prior years beginning after 1997

– Annual average gross receipts for the 3 year period ending

before its current tax year did not exceed $7.5 million

• $5 million if the corporation had only one prior tax year

• This provision exempts up to 95% of all C corps from

the AMT

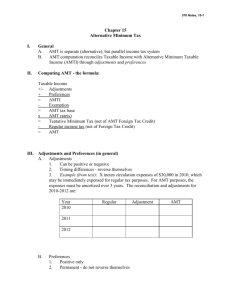

AMT Formula for Corporations

35

Tax Preference Items

• Percentage depletion in excess of the adjusted

basis of property

• Tax-exempt interest on “private activity

bonds”

36

Adjustments for AMT

(slide 1 of 2)

• Adjustments for AMT:

– A portion of depreciation on property placed in

service after 1986

– A portion of amortization claimed on certified

pollution control facilities

– Difference between percentage of completion and

completed contract income

– Difference between gain (loss) on sale of property

for regular tax and AMT purposes

37

Adjustments for AMT

(slide 1 of 2)

• Adjustments for AMT:

– A portion of depreciation on property placed in

service after 1986

– A portion of amortization claimed on certified

pollution control facilities

– Difference between percentage of completion and

completed contract income

– Difference between gain (loss) on sale of property

for regular tax and AMT purposes

38

Adjustments for AMT

(slide 1 of 2)

• Adjustments for AMT:

– A portion of depreciation on property placed in

service after 1986

– A portion of amortization claimed on certified

pollution control facilities

– Difference between percentage of completion and

completed contract income

– Difference between gain (loss) on sale of property

for regular tax and AMT purposes

39

Adjustments for AMT

(slide 1 of 2)

• Adjustments for AMT:

– A portion of depreciation on property placed in

service after 1986

– A portion of amortization claimed on certified

pollution control facilities

– Difference between percentage of completion and

completed contract income

– Difference between gain (loss) on sale of property

for regular tax and AMT purposes

40

Adjustments for AMT

(slide 2 of 2)

• Adjustments for AMT (cont’d):

– Passive activity losses of certain closely held

corporations and personal service corporations

– A portion of the difference between “ACE” and

“AMTI”

41

ACE Adjustment

(slide 1 of 2)

• Ace adjustment = 75% of difference between

unadjusted AMTI and ACE

– Can be positive or negative

– Negative adjustment is limited to aggregate

positive adjustments less previous negative

adjustments

42

ACE Adjustment

(slide 2 of 2)

• Starting point for determining ACE is AMTI

– AMTI is defined as regular taxable income after

AMT adjustments and tax preferences (other than

the NOL and ACE adjustments)

43

Impact of Certain Transactions on ACE

and E & P (slide 1 of 2)

44

Impact of Certain Transactions on ACE

and E & P (slide 2 of 2)

45

Exemption

• Exemption amount for a corp = $40,000

– Reduced by 25% of excess of AMTI over

$150,000

– Exemption is totally phased-out when AMTI

reaches $310,000

46

Minimum Tax Credit

• AMT paid in one year can be used as a credit

against future regular tax liability that exceeds

its tentative minimum tax

– Indefinite carryforward

– Cannot be carried back

– Cannot offset any future minimum tax liability

47

AMT Example

(slide 1 of 4)

•

•

•

•

•

Moreland Co. has the following income, etc. in 2015:

Taxable income

$100,000

Depreciation adjustment

18,000

Installment gain (not on inventory sale)

80,000

Federal income tax provision on

financial stmts.

75,000

• Penalties and fines

2,000

• Private activity bond interest income (Issued 2007) 25,000

• Other tax-exempt interest

20,000

– The depreciation adjustment is an AMT adjustment and the private

activity bond interest is a tax preference for AMTI.

48

AMT Example

(slide 2 of 4)

Calculation of AMTI before ACE:

Taxable income

Plus: private activity bond income

Plus: depreciation adjustment

AMTI

$100,000

25,000

18,000

$143,000

49

AMT Example

(slide 3 of 4)

Calculation of ACE Adjustment:

AMTI before ACE

Plus: deferred installment gain

Plus: other tax-exempt income

Adjusted current earnings

Less: AMTI

Base amount for Ace Adjustment

Times rate:

ACE Adjustment (positive)

$143,000

80,000

20,000

$243,000

143,000

$100,000

75%

$ 75,000

50

AMT Example

(slide 4 of 4)

Calculation of AMT:

AMTI before ACE

$143,000

Plus: ACE Adjustment

75,000

AMTI

$218,000

Less: Exemption

23,000

Alternative minimum tax base

$195,000

20% rate

× 20%

Tentative minimum tax

$ 39,000

Less: regular tax

(22,250)

AMT(TMT-Regular tax)

$ 16,750

Total cash paid = Regular tax + AMT = $ 39,000

51

Individual AMT

(slide 1 of 3)

• AMT applicable to individuals is similar to the

corporate AMT with several important

differences

– The individual AMT rate is slightly progressive,

with rates at 26% on first $185,400 ($92,700 for

married, filing separately) of AMTI and at 28% on

any additional AMTI

– The alternative rate on net capital gain of 0% or

15% applies

52

Individual AMT

(slide 2 of 3)

– The AMT exemption and phaseout amounts are

tied to the individual’s filing status for the year

– Individuals make no AMT adjustment for ACE

– Taxes, misc. itemized deductions subject to the 2%

floor, the standard deduction and personal and

dependency exemptions are not allowed

– Medical expenses are allowed only to the extent

that they exceed 10% of AGI (instead of a 7.5%

for those at least age 65)

53

Individual AMT

(slide 3 of 3)

– Interest expense deductions are limited to

• Qualified residence interest

• Interest on certain student loans, and

• Investment interest (subject to limitations)

– The 3% phaseout of itemized deductions for

certain high-income taxpayers does not apply in

computing the individual AMT

– Determination of the minimum tax credit is more

complex for individual taxpayers

• The credit applies only to AMT generated as a result of

timing differences

54

Refocus On The Big Picture (slide 1 of 4)

• Tax credits are used by the Federal government to promote

certain social and economic objectives.

– Credits are dollar-for-dollar reductions in tax liability.

• Progress Corporation qualifies for the following tax credits.

– A 10% tax credit for rehabilitating a building placed in service before

1936 (see Example 4).

– The work opportunity tax credit (see Example 6).

– The credit for employer-provided child care, equal to 25% of qualified

child care expenses (see Example 13).

• Mike might also want to take advantage of the disabled access

credit.

– Designed to encourage small businesses to make their facilities

accessible to disabled individuals.

55

Refocus On The Big Picture (slide 2 of 4)

What If?

• Mike has heard horror stories about the

alternative minimum tax (AMT) and is

concerned about its potential impact on

his company.

• What if Mikes company is subject to the

AMT?

56

Refocus On The Big Picture (slide 3 of 4)

What If?

• If Progress Corp. is subject to the AMT, the company’s

general business credits are limited to

– Regular income tax, less the greater of

• Tentative minimum tax, or

• 25% X (regular income tax - $25,000)

– Thus, much of the tax benefit may be lost or require a carryback or

carryover to another tax year.

• Credits subject to this limit include

–

–

–

–

The tax credit for rehabilitation expenditures,

The work opportunity tax credit,

The disabled access credit, and

The credit for employer-provided child care.

57

Refocus On The Big Picture (slide 4 of 4)

What If?

• However, many small corporations are exempt

from the AMT.

– Before Mike proceeds with his plans, his exposure

to the AMT should be determined.

58

If you have any comments or suggestions concerning this

PowerPoint Presentation for South-Western Federal

Taxation, please contact:

Dr. Donald R. Trippeer, CPA

trippedr@oneonta.edu

SUNY Oneonta

© 2016 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

59