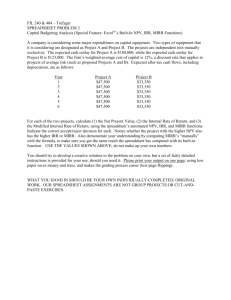

Capital Budgeting Analysis

advertisement

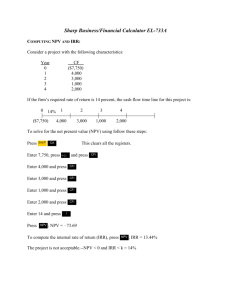

Harris Inc. Capital Budgeting Analysis of the Proposed Server Expansion Ryan Revia Table of Contents Section A: Page 1-2 Section B: Page 3 Section C: Page 4 Section D: Page 5-6 Section E: Pages 7-8 Section F: Pages 9-10 Section A The attached spreadsheet details the development of a new server for Harris Inc., including all of its relevant costs, inputs, amortization of assets, cash flows, and the final appraisal of the proposed project. It was used to analyze the project through the four capital budgeting techniques (Net Present Value (NPV), Internal Rate of Return (IRR), Modified Internal Rate of Return (MIRR), and the Profitability Index (PI)) to find whether or not it would be suitable for Harris Inc. to undertake. The NPV criterion is the most representative of all relevant costs, the time value of money, risk, the effect on the value of the firm, and includes securement of the initial working capital needed to execute the project; which makes it the most important of the criteria for making capital budgeting decisions. The project was found to be worth $690,437.10 under the Net Present Value (NPV) criterion. Since the NPV of the project is greater than zero, by rule the project should be accepted because it will add value to the firm, and thus increase shareholder wealth. The Internal Rate of Return (IRR), or the rate that equates the present value (NPV) of the project to zero, is measured against the required return, or in this case, the Weighted Average Cost of Capital (WACC). The WACC indicates the cost for the firm to generate the funds needed to invest in projects. Since the IRR of the project was found to be 14.57%, which is greater than the WACC of 11.25%, by rule the project should be accepted on the basis of the IRR criterion. This supports the findings of the NPV criterion to accept the project because the cost to ascertain the funds to generate the project is less than a rate that, all things being equal, would make the project worth nil. In other words, the rate at which Harris Inc. can attain the funds necessary to develop the new server is less than the rate that would make the project unattractive to the firm. Thus, we can conclude that the costs associated with the issuance of debt and equity will be acceptable as long as they do not exceed the rate at which the project is no longer valuable to Harris Inc. Similarly, the Modified IRR of 13.17% exceeded the WACC (11.25%), indicating by rule to accept the project. The Profitability Index (PI) also indicated that the project should be accepted, as the PI was greater than one. At 1.11, the Profitability Index projects the development to generate about 11% in profit. Even though one could have inferred that the PI would be greater than one because of the aforementioned NPV calculation and their positive correlation (If NPV > 0, by rule the PI > 1), understanding the benefit-cost ratio helps support findings of the Net Present Value by putting the value in the form of a return adjusted for the appropriate discount rate and the initial cost of the investment. Although the NPV is the most critical criterion in evaluating a potential investment, the IRR, MIRR, and PI help to support the decision made through the NPV technique. Each of the capital budgeting techniques indicates the acceptance of the project, and thus the addition of value to the firm and a subsequent increase in shareholder wealth. As all techniques used support acceptance, a much stronger argument can be made in support of the decision to accept the project. Thus, the project should be accepted on the basis of all four capital budgeting techniques (NPV, IRR, MIRR, and PI). Section B After conducting an NPV profile chart for Harris Inc.’s proposed development, one can see the relationship between the Internal Rate of Return (IRR) and the Net Present Value (NPV) of the project through different Weighted Average Cost of Capital (WACC) discount rates, ranging from 0%-20%. As the discount rate increases, the present value of the project decreases until it reaches the X-intercept, or IRR, of 14.57% where it is equal to zero. From this, one can see that the project will generate value for the firm when the WACC is less than 14.57% and it will lose money in a financial sense when the WACC is greater than 14.57%. This graphically confirms the findings of Section A by showing that the project, at a WACC of 11.25%, will add value to the firm and thus increase shareholder wealth. Section C In order to forecast the risk associated with the growth rate of the number of units sold, a sensitivity analysis was executed to show how different growth rates affect the Net Present Value (NPV) of the project. The base-case growth rate was 4%, generating an NPV of $690,437.10. The worst growth rate was 2%, generating an NPV of $392,956.77. Finally, the best-case growth rate was 6%, resulting in an NPV of $1,002,924.59. Relative to the base case, the worst case generated $297,480.33 less than the base case, or $148,740.16 less in the present value of the investment per 1% decrease in the annual growth rate of units sold. Conversely, the best case generated $312,487.49 more than the base case, an increase of $156,243.74 in the present value of the project per 1% increase in the annual growth rate of units sold. From the sensitivity analysis, one can conclude that the NPV has a strongly positive correlation to the growth rate of units sold and is thus very sensitive to changes in the growth rate, whether positive or negative. For example, an increase of only 1% would result in the NPV increasing by about 22%, while a 1% decrease would lower the present value of the investment by about 21%. From the firm’s standpoint, the annual growth rate in units sold will be a critical value driver of NPV, as it affects Harris Inc.’s revenue (i.e. sales) base and thus, the projected cash flows of the project that the NPV is derived from. The annual growth rate of unit sales will have to be monitored closely as the project moves forward in order to maintain projected valuations of the project relative to the firm. Section D The attached spreadsheet for Section C and D details the expected values of the capital budgeting techniques used (NPV, IRR, MIRR, and PI) as a function of the probability of each of the three cases occurring from the sensitivity analysis in Section C. By doing so, Harris Inc. can forecast the risk associated with different market conditions, specifically looking at the annual growth rate of units sold and its effect on NPV. The base condition was given a 50% chance of occurring; the best condition a 25% chance of occurrence, and the worst condition had a 25% chance of occurrence. The expected value of the NPV was $694,188.89, with a standard deviation $215,688.82. This shows that the expected NPV is actually higher than the base case with the varying market conditions; however, it is also very volatile (or sensitive to changes in the annual growth rate of unit sales) as the standard deviation is about 31% of the expected NPV. Although the standard deviation is high, the project will still generate value to the firm within 3 standard deviations in either direction, making greater than 99% of the possible outcomes valuable to the firm. By rule, the project should be accepted because the NPV is expected to be positive. The expected Internal Rate of Return was found to be 14.58% with a standard deviation of 0.98%. Similarly, the IRR exceeds the WACC (11.25%) in over 99% of the expected outcomes (within 3 standard deviations either way). Since the expected IRR is greater than the WACC (or the rate at which Harris Inc. attain the funds needed to take on the proposed project) in the vast majority of outcomes, the project should be accepted on the basis of the IRR rule. In other words, as long as the rate that Harris Inc. incurs for generating the funds necessary for the development does not exceed the rate that makes the project worthless to the firm, the project will add value to the firm and thus increase shareholder wealth. The expected Modified IRR (MIRR) was found to be 13.17% with a standard deviation of 0.57%. Like the IRR, the MIRR also exceeds the WACC (11.25%) within three standard deviations in either direction. Since the MIRR exceeds the WACC in over 99% of possible outcomes, the project should be accepted under the MIRR rule. Aforementioned above, as long as the cost (or rate) of generating the project’s required funds is less than the rate that equates the present value of the investment to zero, the investment will add value to the firm and thus increase shareholder wealth. The expected Profitability Index (PI) was found to be 1.11 with a standard deviation of .03. The expected value of the PI exceeds one in 99% of the possible outcomes (within three standard deviations in either direction), indicating to accept the project under the PI rule. Since the expected PI remains greater than one in the vast majority of possible outcomes, one can conclude that the project will be expected to add value on a benefit-cost basis, again increasing shareholder wealth. Even with the addition of varying market conditions, the expected values of the four capital budgeting techniques nearly mirrored the project’s NPV, IRR, MIRR, and PI originally found in Section A (also known as the base case). This indicates that the base case is not only a solid representation of the projected value of the development, but also allows Harris Inc. to forecast how market uncertainty (or risk) affects the expected return from the project. In addition, all the expected values from the capital budgeting techniques support the acceptance of the project, making it very attractive to Harris Inc. because of its likelihood to add value to the firm and increase shareholder wealth. Section E The penultimate section is comprised of a series of financial break-even points that were executed by using the Solver function in a copy of the spreadsheet from Section A. The values of the requested inputs were modified by Solver to find the value that equates the worth (NPV) of the project to zero. The break-even level of unit sales in the first year was found to be 449,830 units. In other words, Harris Inc. must sell 449,830 units in the first year and grow unit sales at the expected 4% per year in order to generate income from the project. Harris Inc. must be certain that they can generate the forecasted sales and then sustain them; otherwise the project could end up costing the firm money. The break-even point of sales price was found to be $15.50, just $0.50 less than the expected sales price. This indicates that the firm is only generating income from the $0.50 difference in the break-even price and the sales price. Because of that, the firm will not be able to discount the product significantly for sales or volume buyers. In addition, it leaves a very small margin for any price decreases if consumers do not respond favorably to the price. The final break-even point requested was the debt-equity ratio that equates the NPV to zero, which is not feasible under this project. Even if the funds for the project were generated through equity only, which has the higher cost at 13.5%, the cost of generating the initial investment would still be less than the IRR (or rate that equates the NPV to zero) of 14.57%. The flexibility in how Harris Inc. can generate the funds for the project is very beneficial to the firm, as it gives the firm a range of financing options. Although the break-even points in first year unit sales and sales price offer narrow margins for error in our forecasts of unit sales and price, the project can still add value to the firm and increase shareholder wealth. In sum, the project should still be accepted after reviewing the requested break-even points. Section F i. After adjusting the WACC for the actual risk associated with the project, the project-specific discount rate was found to be 16.79%, 5.54% more than the WACC used in previous sections. Since the CAPM-derived risk-adjusted WACC greatly exceeded the previous WACC, the value of the project found in previous sections reflects a higher return than what would be generated under the risk-adjusted conditions. ii. Using the project-specific discount rate resulted in the NPV of the project being -$403,356.21, or a loss of about 7% of the initial investment. After evaluating the NPV using the risk-adjusted WACC, the project should be rejected because it will lose $403,356.21, discounted to today’s value. In other words, it will cost the firm over $400,000 (in a present value sense) and decrease shareholder wealth if they decide to accept the project. iii. The CAPM-derived project-specific discount rate is a better measure of the firm’s cost of capital for a number of reasons. For example, it finds the risk associated with the project by aggregating the risk associated with similar companies in their industry, which is used to find the expected return of the project through the CAPM formula. That rate is then used as the WACC, rather than the WACC of the entire firm. This is important because the project and firm may be financed in different proportions, which would result in different costs of capital for each. In addition, risk-adjusted WACC only accounts for costs associated with the project, rather than the entire firm. In the case of Harris Inc., the project would have been accepted under the original WACC because it was less than the IRR. Using the risk-adjusted WACC, one can see that the project should actually be rejected because it generates a negative NPV. In addition, the risk-adjusted WACC is greater than the IRR and MIRR, meaning that the costs associated with the generation of the funds for the project are greater than the discount rate that equates the NPV to zero. In conclusion, understanding the difference between the firm’s WACC and the project-specific WACC is vital to being able to recognize whether or not the project offers a return that correctly compensates its level of systematic risk.