File

advertisement

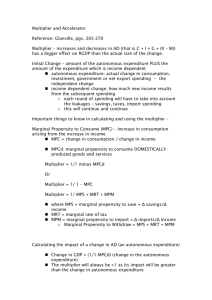

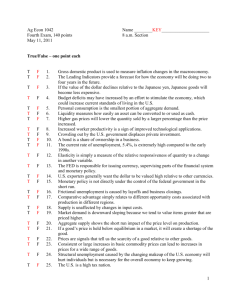

14.1 Expenditure Plans and Real GDP Expenditure Plans Aggregate expenditure equals consumption expenditure plus investment plus government expenditures on goods and services plus exports minus imports, or C + I + G + NX. Aggregate planned expenditure is equal to planned consumption expenditure plus planned investment plus planned government expenditures on goods and services plus planned exports minus planned imports. The components of aggregate expenditure that do not change when real GDP changes are called autonomous expenditure. The components of aggregate expenditure that change when real GDP changes are called induced expenditure. The Consumption Function The consumption function is the relationship between consumption expenditure and disposable income, other things remaining the same. Disposable income is aggregate income minus taxes plus transfer payments. The figure shows a consumption function. Along the 45 degree line, consumption equals disposable income. When the consumption function is above the 45 degree line, there is dissaving. When the consumption function is below the 45 degree line, there is saving. The consumption expenditure when disposable income is zero, $4 trillion in the figure, is autonomous consumption. Consumption expenditure in excess of this amount is induced consumption. Marginal Propensity to Consume The marginal propensity to consume (MPC ) is the fraction of a change in disposable income that is consumed. The MPC is equal to Change in consumption expenditure Change in disposable income . The MPC is slope of the consumption function, which is 0.67 in the previous figure. Other Influences on Consumption Expenditure A change in the real interest rate, wealth, or expected future income shifts the consumption function. o An increase in wealth, an increase in expected future income, or a decrease in the real interest rate increase consumption and shift the consumption function upward. o When the consumption function shifts in it means that there will be more consumption expenditure for a given amount of disposable income. Representations of the Consumption function The consumption function can also be represented in a table or as an equation Disposable Income Aggregate Consumption 0 4 8 12 16 20 4 6.67 9.33 12 14.67 17.33 2 The corresponding equation in CF = 4 + 3(disposable income) 2 Where 4 equals the autonomous expenditure and 3 equals the Marginal Propensity to Consume. The general consumer function equation is CF = a + 𝑏(disposable income) Where a equals the autonomous expenditure and 𝑏 equals the Marginal Propensity to Consume. Marginal Propensity to Save The marginal propensity to save (MPS ) is the fraction of a change in disposable Change in Savings income that is saved. The MPS is equal to . Change in disposable income Aggregate savings = disposable income – aggregate consumption Aggregate Savings Disposable Income Aggregate Consumption 0 4 8 12 16 4 6.67 9.33 12 14.67 -4 -2.67 -1.33 0 1.33 20 17.33 2.67 1 The savings function is then SF= -4 + 3(disposable income) 1 Where 4 equals the autonomous expenditure and 3 equals the Marginal Propensity to Save. Because we assume that all disposable income is saved or consumed, The MPC +MPS =1 Imports and GDP Imports depend on U.S. real GDP. The marginal propensity to import is the fraction of an increase in real GDP that is spent on imports and is equal to 14.2 Change in imports Change in real GDP . Equilibrium Expenditure Aggregate planned Real Consumption Government expenditure GDP expenditure Investment expenditures Exports Imports (AE=C+I+G+XM) (Y ) (C ) (I ) (G ) (X ) (M ) (trillions of 2005 dollars) 11.0 12.0 13.0 6.2 7.1 8.0 2.0 2.0 2.0 3.0 3.0 3.0 1.0 1.0 1.0 0.8 0.9 1.0 11.4 12.2 13.0 14.0 8.9 2.0 3.0 1.0 1.1 13.8 Aggregate Planned Expenditure and Real GDP Aggregate planned expenditure, AE, is the sum of planned consumption expenditure plus planned investment plus planned government expenditures on goods and services plus planned exports minus planned imports. The table above shows the calculation of an aggregate planned expenditure schedule. The figure shows the resulting AE curve. I, G, and X, are autonomous because they do not depend on the current level of real GDP. o Investment is based on the real interest rate and expectations of profit o government expenditure is based on a political process. o Exports depend on foreign income, not on domestic real GDP Equilibrium Expenditure Equilibrium expenditure is the level of aggregate expenditure that occurs when aggregate planned expenditure equals real GDP. In the figure, equilibrium expenditure is $13 trillion. o The 45° line is where AE = Real GDP and we have equilibrium expenditure. o Actual expenditures can differ from planned expenditures because firms do not always sell what they plan to, in which case they have unplanned inventory investment. For instance, a car that is manufactured but not immediately sold is part of that firm’s inventory investment regardless of whether it was planned or not. Real GDP levels to the left of the intersection point of the aggregate planned expenditure curve and the 45° line involve an unplanned inventory decrease. o This means that businesses and households are drawing down on the inventories left over from the previous year. That is, the economy is consuming part or all of last year’s output that went unsold. Real GDP levels to the right of the intersection point of the aggregate planned expenditure curve and the 45° line involve an unplanned inventory increase. o This means that businesses and households are increasing their inventories by more than they expected. Convergence to Equilibrium If aggregate expenditure does not equal its equilibrium, there are forces that lead to convergence. For example, if real GDP exceeds aggregate planned expenditure, firms find their inventories are increasing more than planned. The unplanned inventory accumulation leads firms to cut production so that real GDP decreases, which decreases aggregate planned expenditures. Real GDP still exceeds aggregate planned expenditure, but by less than before. The process continues until real GDP equals aggregate planned expenditure so that there is no unplanned inventory accumulation. o You should know how to solve for the equilibrium expenditure using a table or graph. 14.3 Expenditure Multipliers The Basic Idea of the Multiplier The multiplier is the amount by which a change in any component of autonomous expenditure is magnified or multiplied to determine the change that it generates in equilibrium expenditure and real GDP. An increase in investment increases real GDP, which increases disposable income and consumption expenditure. The increase in consumption expenditure adds to the increase in investment and a multiplier determines the magnitude of the resulting increase in aggregate expenditure. The Size of the Multiplier Change in equilibrium expenditure The multiplier equals If there are no imports or income taxes, the multiplier equals Change in autonomous expenditure . 1 . 1 MPC o You should know how to derive this equation The size of the multiplier depends on the MPC. The smaller the MPC, the smaller the increase in expenditure at each step of the multiplier process and so the smaller the multiplier. You should know how to determine the multiplier from the aggregate planned expenditure table if you are given information about the size of the change in investment. You should also be able to derive the new Aggregate Expenditure column if given information on the size of the multiplier and information about the size of the change in investment. The Multiplier, Imports and Income Taxes Imports and income taxes both mean that the increase in expenditure on domestic production will be smaller at each step of the multiplier process and so the multiplier is smaller. The larger the marginal propensity to import, the smaller is the multiplier. The marginal tax rate is the fraction of a change in real GDP that is paid in income taxes – the change in tax payments divided by the change in real GDP. The larger the marginal tax rate, the smaller are the changes in disposable income and real GDP that result from a given change in autonomous expenditure. When imports and income taxes are included, the multiplier equals 1 . 1 slope of the AE curve When the multiplier is smaller, it means that the magnitude of the impact of investment on real GDP will be smaller. Business Cycle Turning Points An unexpected decrease in autonomous expenditure is signaled by a buildup of unplanned inventories. The buildup in inventories sets the multiplier process in motion that decreases aggregate expenditure and real GDP so that a recession follows. An unexpected increase in autonomous expenditure is signaled by an unwanted depletion of inventories. The depletion in inventories sets the multiplier process in motion and an expansion follows. The multiplier is just a representation of the relationship between autonomous spending and real GDP. For example, Amazon is constructing a new headquarters downtown. (This is an increase in investment)This will increase the disposable income of the construction workers who are building the headquarters. Since we assume that the Marginal Propensity to consume is between 0 and 1, the construction workers will increase their consumption as a result of the increase disposable income. Suppose that construction workers all buy their lunches out while working on the project because they have more income. This would increase the revenue of local restaurants in the area, which increase the disposable income of the workers and the owners. Since the marginal propensity to consume is between 0 and 1, these people will also increase consumption as a result of the increase in disposable income. Therefore the initial increase in investment, also increased the consumption of the construction workers and restaurant workers in the local area. These purchases will then create even more consumption. All the added consumption expenditure makes the multiplier larger than 1. The magnitude of the change is limited by the size of the marginal propensity to consume. landscaping haha and that person pays his employees and they pay for gas/supplies and those employees pay for lunch etc...that initial $500 becomes wayyyy more when you think about how much money is being spent as a result. Paradox of Thrift What happens if households become concerned about the future and want to save more today to prepare for hard times tomorrow? o To increase savings they will reduce consumption. Drop in spending leads to a drop in income GDP will decrease because of the drop in consumption. o Since investment= savings and investment does not change, savings will remain constant. o Real GDP will decrease, causing the recession that people were worried about, but savings will not change. Paradox because when a society tries to save more income drops but there is no increase in savings. Paradox is resolved if we allow desired investment to change with desired savings. Multiplier in reality We are using a very simplified picture of the economy. o Assumed that investment is exogenous(not true in reality because it depends on the interest rates) o Ignored role of government, financial markets and the rest of the world in the macroeconomy o Ignored the fact that part of an expansion is likely to take to form of increased prices instead of only increases in output. In reality the multiplier is about 1.4 14.4 The AD Curve and Equilibrium Expenditure Difference between the Aggregate Demand curve and the Aggregate Expenditure Curve It is important to remember that these curves do not mean the same thing, but they are closely related. o The aggregate expenditure model is a fixed price model that examines how aggregate expenditure depends on disposable income. As a result, the AE curve shifts due to a change in the price level, which is not on either axes of the AE graph. o The aggregate demand curve, however, is a variable price model that examines how aggregate demand depends on the price level. For the AD curve, a change in the price level leads to a movement along the curve because the price level is on the vertical axis. . Deriving the AD Curve from Equilibrium Expenditure The AE curve is the relationship between aggregate planned expenditures and real GDP, all other influences (such as the price level) remaining the same. The AD curve is the relationship between the aggregate quantity of goods and services demanded and the price level. The AD curve is derived from the AE model. A rise in the price level decreases aggregate planned expenditure. So, as shown in the figure to the left, a rise in the price level from 120 to 140 decreases aggregate planned expenditure and shifts the AE curve downward from AE0 to AE1. In the figure, equilibrium expenditure decreases to $12 trillion. The diagram to the right shows that when the price level rises from 120 to 140, there is a movement along the AD curve from point a to point b. The aggregate quantity of real GDP demanded decreases from $14 trillion (which is the initial equilibrium expenditure in the AE diagram to the left) to $12 trillion (which is the new equilibrium expenditure along AE1 in the AE diagram to the left).