Mutual Funds and Other

Investment Companies

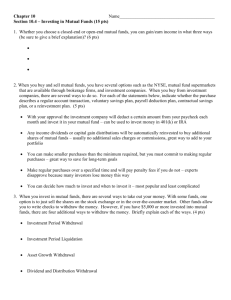

Chapter 4

McGraw-Hill/Irwin

Copyright © 2005 by The McGraw-Hill Companies, Inc. All rights reserved.

Investment Companies

Investment Company Act of 1940 which

classifies into:

Unit trusts – portfolio fixed for life of fund

(unmanaged)

Managed Investment Companies

Closed End

Open End – “Mutual Funds” About 90% of

investment company assets are here.

4-2

Other Investment Organizations

Commingled Funds – partnerships that pool

funds (e.g. trust or retirement accounts pool into

a common fund). Are like large investor open

ended funds

REIT (Real Estate Investment Trusts) – similar to

closed end funds, but established by separate

legislation and must invest passively in real

estate

Hedge Funds – not registered and not subject to

SEC regulation. Used by “sophisticated”

investors and financial intermediaries. Often use

high leverage

4-3

Mutual Funds

• Our goal in this chapter is to understand the

different types of mutual funds, their risks,

and their returns.

• Around 1980, 5 million Americans owned

mutual funds.

• However, by 2001, 93 million Americans in 55

million households owned mutual funds.

• In 2001 investors added $505 billion in net

new funds to mutual funds.

• In 2001, mutual fund assets totaled $7 trillion.

• In 2002, mutual fund assets totaled 6.4

trillion.

4-4

Mutual Funds

Mutual funds are simply a means of combining

or pooling the funds of a large group of

investors.

The buy and sell decisions for the resulting

pool are then made by a fund manager, who

is compensated for the service provided.

Like commercial banks and life insurance

companies, mutual funds are a form of

financial intermediary.

4-5

Mutual Fund Operations: Organization and Creation

A mutual fund is simply a corporation. It is

owned by shareholders, who elect a board of

directors.

Most mutual funds are created by investment

advisory firms (say Fidelity Investments), or

brokerage firms with investment advisory

operations (say Merrill Lynch).

Investment advisory firms earn fees for

managing mutual funds.

4-6

Taxation of Investment Companies

A “regulated investment company” does not

have to pay taxes on its investment income.

To qualify, an investment company must:

Hold almost all its assets as investments in

stocks, bonds, and other securities,

Use no more than 5% of its assets when

acquiring a particular security, and

Pass through all realized investment income to

fund shareholders

4-7

The Fund Prospectus and Annual Report

Mutual funds are required by law to

supply a prospectus to any investor who

wishes to purchase shares.

Mutual funds must also provide an

annual report to their shareholders.

4-8

Services of Investment Companies

Administration & record keeping

Diversification & divisibility

Professional management

Reduced transaction costs (economies

of scale in trading)

4-9

Investment Companies and Fund Types

An Investment company is business that

specializes in pooling funds from individual

investors and making investments.

An Open-end fund is an investment

company that stands ready to buy and sell

shares in itself to investors, at any time.

A Closed-end fund is an investment

company with a fixed number of shares that

are bought and sold by investors, only in the

open market.

4-10

Open-End and ClosedEnd Funds: Key Differences

Shares Outstanding

Closed-end: no change unless new stock is

offered.

Open-end: changes when new shares are

sold or old shares are redeemed.

Pricing

Open-end: Net Asset Value(NAV)

Closed-end: Premium or discount to NAV

4-11

Net Asset Value

Used as a basis for valuation of

investment company shares.

Selling new shares

Redeeming existing shares

Calculation

Market Value of Assets - Liabilities

Shares Outstanding

4-12

Mutual Fund Costs and Fees

Sales charges or “loads”

Front-end loads are charges levied on purchases.

Back-end loads are charges levied on redemptions.

12b-1 fees. SEC Rule 12b-1 allows funds to spend up to

1% of fund assets annually to cover distribution and

marketing costs.

Management fees:

Usually range from 0.25% to 1.00% of the funds total assets

each year.

Are usually based on fund size and/or performance.

4-13

Mutual Fund Costs and Fees

Trading costs

Not reported directly

Funds must report "turnover," which is related to

the amount of trading. ((Avg Assets)/Sales)

The higher the turnover, the more trading has

occurred in the fund which increases costs.

Turnover also creates capital gains for investors

Mutual Funds may be “reimbursed” for order flow

(increases trading costs, but is not a fee that is

reported). So called “soft dollars”

Benefit – a large trader like a mutual fund can get

good allocation of IPO’s

4-14

Expense Reporting

Mutual funds are required to report

expenses in a fairly standardized way in

their prospectus.

Shareholder transaction expenses - loads

and deferred sales charges.

Fund operating expenses - management

and 12b-1 fees, legal, accounting, and

reporting costs, director fees.

Must provide hypothetical example

showing the total expenses paid by

investors through time per $10,000

invested.

4-15

Example: Fee Table

4-16

Example: Fee Table

4-17

Why Pay Loads and Fees?

After all, many good no-load funds exist.

Don’t know any better? Or,

You may want a fund run by a particular

manager. All such funds are load funds.

Or, you may want a specialized type of fund.

Perhaps one that specialized in Italian

companies

Loads and fees for specialized funds tend to

be higher, because there is little competition

among them.

4-18

Investment Companies and Fund Types

4-19

Short-Term Funds, I.

Short-term funds are collectively known

as money market mutual funds.

They hold money market instruments

Money market mutual funds

(MMMFs) are mutual funds specializing

in money market instruments.

MMMFs maintain a $1.00 net asset value

to make them resemble bank accounts.

Depending on the type of securities

purchased, MMMFs can be either taxable

or tax-exempt.

Often allow “check writing”

4-20

Short-Term Funds, II.

Most banks offer what are called

“money market” deposit accounts, or

MMDAs, which are much like MMMFs.

The distinction is that a bank money

market account is a bank deposit and

offers FDIC protection.

4-21

Long-Term Funds

There are many different types of longterm funds, i.e., funds that invest in longterm securities.

Historically, mutual funds were classified

as stock funds, bond funds, or income

funds.

Nowadays, the investment objective of the

fund is the major determinant of the fund

type.

4-22

Stock Funds, I.

Some stock funds trade off capital appreciation

and dividend income.

Capital appreciation

Growth

Growth and Income

Equity income

Some stock funds focus on companies in a

particular size range.

Small company

Mid-cap

Some stock fund invest internationally.

Global

International

Region

Country

Emerging markets

4-23

Stock Funds, II.

Sector funds specialize in specific sectors of the

economy, such as:

Biotechnology

Internet

Energy

Other fund types include:

Index funds

Social conscience, or “green,” funds

“Sin” funds (i.e., tobacco, liquor, gaming)

Tax-managed funds

4-24

Index Funds

Pioneered by Vanguard. Its “Index Trust

500”, based on the S&P 500 is the largest

mutual fund in the world (Inception:

August 31, 1976)

Very low costs – typically 20 bp or less for

S&P 500 based funds. Higher for

specialty indexes and international

Low turnover (5% annually, versus 85%

for the average managed stock fund)

Tax efficient – it is typically near the top

20% of funds on an after tax basis

4-25

From Vanguard.com

Statistical snapshots

71% of Vanguard index funds outperformed

their respective peer-group averages over the

ten years ended March 31, 2006.

When Vanguard 500 Index Fund began

operations in 1976, it was one of 360 U.S.

stock funds; 149 of these no longer exist.

2005 expense ratios for funds tracking the

S&P 500 Index: Industry average: 0.59%;

Vanguard 500 Index Fund: 0.09% (Admiral™

Shares) and 0.18% (Investor Shares).Source

of industry data: Lipper Inc.

4-26

Bond Funds

Bond funds may be distinguished by their

Maturity range

Credit quality

Taxability

Bond type

Issuing country

Bond fund types include:

Short-term and intermediate-term funds

General funds

High-yield funds

Mortgage funds

World funds

Insured funds

Single-state municipal funds

4-27

Stock and Bond Funds

Funds that do not invest exclusively in either

stocks or bonds are often called “blended” or

“hybrid” funds.

Examples include:

Balanced funds

Asset allocation funds

Convertible funds

Income funds

4-28

Mutual Fund Objectives:

A mutual fund “style” box is a way of

visually representing a fund’s

investment focus by placing the fund

into one of nine boxes:

Value

Style

Blend

Growth

Size

Large

Medium

Small

4-29

Mutual Fund Objectives:

In recent years, there has been a trend

toward classifying a mutual fund’s objective

based on its actual holdings.

For example, the Wall Street Journal

classifies most general purpose funds based

on the market “cap” of the stocks they hold,

and also on whether the fund tends to invest

in “growth” or “value” stocks (or both).

4-30

Mutual Fund Objectives

4-31

Mutual Fund Performance

Mutual fund performance is very closely

tracked by a number of organizations.

Financial publications of all types

periodically provide mutual fund data.

The Wall Street Journal is particularly

timely print source.

www.morningstar.com has a “Fund

Selector” that provides performance

information

4-32

Mutual Fund Performance

4-33

Mutual Fund Performance

4-34

A First Look at Fund Performance

Benchmark: Wilshire 5000

Results

Most funds underperform

Not fair comparison because of costs

Adjusted Benchmark: Wilshire 5000

with passive management costs

considered.

The majority of funds still under-perform.

4-35

Consistency of Fund Performance

Do some mutual funds consistently

outperform?

Evidence suggests that some funds

show consistent stronger performance.

Depends on measurement interval

Depends on time period

Evidence shows consistent poor

performance.

4-36

Mutual Fund Performance

While looking at historical returns, the

riskiness of the various fund categories

should also be considered.

Whether historical performance is useful

in predicting future performance is a

subject of ongoing debate.

Some of the poorest-performing funds are

those with very high costs.

4-37

Closed-End Fund Performance

A closed-end fund has a fixed number

of shares.

These shares are traded on stock

exchanges.

There are about 450 closed-end funds that

have their shares listed on U.S. Stock

Exchanges.

There are about 7,000 long-term open-end

mutual funds.

4-38

Mutual Fund Performance

4-39

The Closed-End Funds Discount

Most closed-end funds sell at a discount

relative to their net asset values.

The discount is sometimes substantial.

The typical discount fluctuates over time.

Despite a great deal of academic

research, the closed-end fund discount

phenomenon remains largely

unexplained.

4-40

Exchange Traded Funds

An exchange traded fund, or ETF,

Is basically an index fund.

Trades like a closed-end fund (without the discount

phenomenon). They are heavily traded.

An area where ETFs seem to have an edge

over the more traditional index funds is the

more specialized indexes.

A well-known ETF is the “Standard and Poor’s

Depositary Receipt” or SPDR.

This ETF mimics the S&P 500 index.

It is commonly called “spider."

A list of ETFs can be found at www.amex.com.

4-41

Hedge Funds

Like mutual funds, hedge funds collect pools of

money from investors. However,

Hedge funds are not required to register with the SEC.

Hedge funds are not required to maintain any particular degree

of diversification or liquidity. Are often highly levered.

Hedge fund investors must qualify as “financially sophisticated”

investors.

Hedge fund managers have considerable

freedom to follow various investment strategies,

or styles.

Hedge fund fees:

General management fee of 1-2% of fund assets

Performance fee of 20-40% of profits

4-42

Useful Internet Sites

www.ici.org (reference for mutual fund facts and figures)

www.vanguard.com (example of major fund family website)

www.fidelity.com (website of largest investment advisory firm in

US)

www.ipsfunds.com (reference for “plain language” risk disclosure)

www.mfea.com (reference for info on thousands of funds)

www.morningstar.org (reference for one of the best mutual fund

sites)

www.vicefund.com (reference for “vice” funds)

www.socialinvest.org (reference for “social conscience” funds)

www.hedgefundworld.com (reference for hedge fund information)

www.turnkeyhedgefunds.com (reference to start your own hedge

fund)

4-43

Review: Mutual Funds

Investment Companies and Fund Types

Open-End versus Closed-End Funds

Net Asset Value

Mutual Fund Operations

Mutual Fund Organization and Creation

Taxation of Investment Companies

The Fund Prospectus and Annual Report

Mutual Fund Costs and Fees

Types of Expenses and Fees

Expense Reporting

Why Pay Loads and Fees?

Short-Term Funds

Money Market Mutual Funds

Money Market Deposit Accounts

4-44

Review: Mutual Funds

Long-Term Funds

Stock Funds

Taxable and Municipal Bond Funds

Stock and Bond Funds

Mutual Fund Objectives: Recent Developments

Mutual Fund Performance

Mutual Fund Performance Information

How Useful are Fund Performance Ratings?

Closed-End Funds and Exchange Traded Funds

Closed-End Funds Performance Information

The Closed-End Fund Discount Mystery

Exchange Traded Funds

4-45