Energy Market Concepts (ppt)

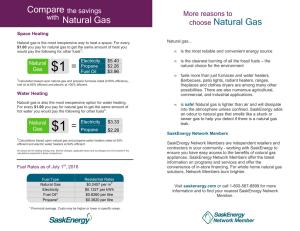

advertisement

TROUBLE AHEAD, TROUBLE BEHIND SOME THOUGHTS ON THE ENERGY OULOOK AND THE LOW-INCOME CONSUMER INTEREST NCAF LEVERAGING CONFERENCE ST. PETERSBURG, FLORIDA OCTOBER 25, 2006 EIA Winter Outlook For 2006-2007 Heating Oil Prices Flat Heating Oil at $2.46 per gallon Natural Gas Prices Down 16%, Propane Down 5% Natural Gas at $12.23 per mcf, Propane at $1.85 per gallon Electricity Prices up 5 % National average of 10.1 cents per kwh A Normal Winter Will Wash Away The Price Drop Last Winter Was So Warm It Was Off The Charts! HISTORY OF MIDWINTER NATURAL GAS COMMODITY PRICE Price Trend For January 07 Futures Contract Source: Wall Street Journal, 9/19/06 EXPECTED EXPENDITURES FOR 2006-2007 Low-Income Households By Primary Heating Fuel $2,714 $3,000 $2,500 $2,000 $2,311 $1,832 $1,289 $1,500 $1,000 $806 $1,344 Heating/Cooling Total Bill $1,034 $520 $500 $0 Natural Gas Propane Source: ORNL Tabulation from EIA STEO & RECS Fuel Oil Electricity SHORT-TERM MARKET CONDITIONS SUPPLY Inventories well above average levels for all major fuels No repeats of Hurricanes Katrina and Rita Most (but not all) production losses from last year restored DEMAND Normal weather will increase demand Consumers of fuel oil and propane now compete with European demand Natural gas demand is highly dependent on industrial and power generation growth RESIDENTIAL PRICE TRENDS SINCE 1997 EIA HISTORICAL DATA Home Heating Oil Prices have increased 138% since 1997 140.0% 120.0% 100.0% 80.0% Natural Gas Prices have increased 85% since 1997 60.0% 40.0% 20.0% 0.0% Electricity Prices are up 26% since 1997 Heating Oil Natural Gas Electricity AGGREGATE RESIDENTIAL ENERGY EXPENDITURES BY LOW-INCOME HOUSEHOLDS Eligible for LIHEAP By Primary Heating Fuel Millions of Dollars $70,000 $60,000 $50,000 Fuel Oil Nautral Gas Propane Electricity $40,000 $30,000 $20,000 $10,000 $0 2001 2004 2005 SOURCE: ORNL TABULATION BASED ON EIA STEO AND RECS 2006 2007 Natural Gas Supply, Consumption, and Imports Are Projected to Expand Through 2025 (1970-2025, trillion cubic feet) 35 History Projections Net Imports 30 25 Consumption Production 20 Natural Gas Net Imports, 2001, 2025 (trillion cubic feet) 6 15 5 4 3 10 Source: AEO 2003 2 1 0 5 0 1970 1980 2001 2025 1990 2000 Pipeline 2010 Liquefied Natural Gas 2025 HOME HEATING OIL NO PRICE CONTROLS NO SIGNIFICANT PRICE REGULATION LARGE COMPANIES AT TOP OF PRODUCTION CHAIN AND SMALL ONES AT THE BOTTOM WELL DEVELOPED FUTURES MARKETS AND ESTABLISHED PRICE/VOLATILITY REDUCTION METHODS JAWBONING NATURAL GAS DEREGULATED AT THE WELL HEAD, COMMODITIES TRADING MARKETS FEDERAL PIPELINE REGULATION LOCAL DISTRIBUTION COMPANY REGULATION MAJOR CHANGES IN MARKET CONDITIONS REGULATORY INTERVENTION OPPORTUNITIES IN PRICE VOLATILITY REDUCTION, RESOURCE ACQUISITION AND CONSUMER PROTECTION ELECTRICITY PARTIAL DEREGULATION OF WHOLESALE ELECTRICITY IN SOME PLACES AND COMPANY CONSOLIDATION, NEW MARKET MECHANISMS LIKE RTOs CONTINUED REGULATION OF TRANSMISSION AT FEDERAL AND STATE LEVEL STATE REGULATION OF LOCAL DISTRIBUTION PUBLIC BENEFIT FUND PARADIGM, EFFICIENCY INVESTMENTS, RATE CASE PROCEEDINGS TIGHT MARKETS MEAN MISCHIEF REMEMBER ENRON AND CALIFORNIA? AN INVITATION TO SPECULATION AND MANIPULATION WATCH OUT FOR THE ECONOMISTS! HISTORY OF MIDWINTER NATURAL GAS COMMODITY PRICE Price Trend For January 07 Futures Contract Source: Wall Street Journal, 9/19/06 MARKET DANGERS MISALLOCATION PROBLEMS COMMON TO ‘NETWORK’ INDUSTRIES SUPPLY IS PRICED AT THE MARGIN WHILE CONSUMER PRICES DISCRIMINATE BOOM AND BUST INVESTMENT CYCLES CREATE INCENTIVES FOR PRODUCERS TO TRY TO SHIFT RISKS TO CONSUMERS MARKET DANGERS SPECULATION A GROWING PERCENTAGE OF TRADE IN ENERGY MARKETS IS SPECULATIVE THIS INCREASES PRICE VOLATILITY AND PUSHES PRICES UP AND DOWN MORE SHARPLY MUCH OF THE TRADE IS UNREGULATED WITH NO OVERSIGHT MARKET DANGERS MANIPULATION WITH POOR REGULATION COMES LACK OF INFORMATION NEEDED TO PREVENT PROFITEERING PRICES CAN BE MOVED IN EITHER DIRECTION! UNDER THE RIGHT CIRCUMSTANCES INDIVIDUAL ACTORS CAN CONTROL AND DIRECT PRICES WHAT CAN WE DO? Don’t Drink The kool-Aid Defend The Provider Of Least Resort With A Balanced Supply/Price Portfolio Pursue Supply Surplus Fight Monopoly Market Pricing Keep Public Benefits Together- Sustainability and Affordability Hand In Hand Consumer Protection Regulation & Info Vital When’s The Next Train? IN SHORT… SIGN AND ORGANIZE AROUND THE PRINCIPLES OF ENERGY AND WATER SECURITY FOR ALL AMERICANS www.ncaf.org/issues/energy