FIS Accounts Receivable System

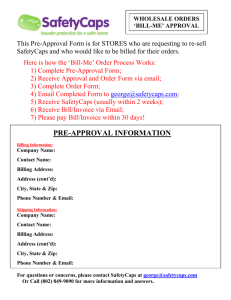

advertisement

Non-student (External) Accounts Receivable System Overview • Decentralized system allows departments to manage their own receivables • Payments are sent to a lockbox (internal or through a bank) which is processed centrally • Accounting entries are automatically generated through eDocs which can be routed for approval or as an “FYI” Organization Roles • Billing Organization: Department that provides goods and/or services to external customers. Responsible for creating and mailing invoices to customers. Each Billing Organization reports to a Processing Organization. • Processing Organization: Unit (typically centralized) that processes payments for Accounts Receivable invoices. Each Processing Organization processes payments on behalf of 1 or more billing organizations. Organization Relationships Processing Organization Banking, Remit, and Payment Functions Billing Organization Customer Relationship Mgmt Billing Organization Billing Organization Process Flow • Billing Org generates & mails invoice – Includes a remit slip • Customer mails payment with slip to lockbox (either a bank or campus feed) • Bank/Cashier tenders funds, sends paperwork to processing organization, and uploads a file to KFS • Processing Org applies unmatched pmts (matched pmts post automatically) Demonstration • Kuali Financial System • Come experience AR for yourself! • AR lab today at 11:00am System Configuration Parameters Receivable Method • Allows implementation of cash basis (revenue shown net of receivable balance) – Receivable object code controlled by • Chart, or • Sub-Fund Group • Or accrual basis (revenue in one account, receivable held elsewhere in the Chart/Account/Object entered by the user, with defaults provided) Sales Tax • If enabled, checks to make sure the item, customer, and sale are taxable • Calculates the tax due based on state, county, and postal code of delivery • Recognizes liabilities to tax authorities on the general ledger • Write-offs can either reduce tax payable or not Write-Off Method • Bad debt recorded in the account which received the revenue originally, or • Bad debt recorded in a central account by billing organization Maximum Invoice Recurrence • Specifies the maximum number of invoice recurrences – Some schools may want to limit billing organizations to 1, 2, 3, … years, quarters, months, … worth of billing before they need to reaffirm the underlying invoice Maximum Customers / Batch • Controls the largest size batch of customer data that may be uploaded in a single batch – Limits exposure to errant data uploads Credit Terms • Permits institutions to establish a maximum amount of time (days between invoice generation and due date) credit may be extended Aging Buckets • KFS comes with standard 30, 60, 90 day aging buckets • Institutions may define the last buckets to be 91-120, 91-365, or any other value that is useful to them • Can also run an aging report retroactively for a prior date Remit Name & Address • Controls whether Billing Organizations have the ability to manipulate the Remittance Name and/or Address Enhancements After Release 3.0 Statement Flexibility Additional statement / invoice enhancements to permit flexibility in the invoice body are slated for Release 4.0, primarily to support C&G receivables. Others • Invoice feeding (1,000 hrs) • Support for centralized collection and bankruptcy management activity (1,800 hours) • Streamline of customer overpayment processing (700 hours) • Tracking of memo or “unbilled” amounts (400 hours)