AR/BI CSUMB End User Training PowerPoint

advertisement

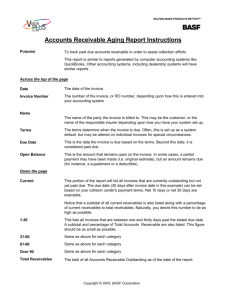

CFS AR/BI Module University Centralized Billing and Cashiering of Non-Student Invoicing to Third-parties, including Auxiliary CSUMB END USER TRAINING April 24, 2013 Why is CFS AR/BI being implemented? The Chancellor’s Office has mandated that all CSUs implement the University Centralized Billing and Cashiering of Non-Student Invoicing to Third-parties, including Auxiliary by May 1, 2013 What is the purpose of a Accounts Receivable and Billing Module (AR/BI)? • For tracking the money owed by customers (individuals or corporations) to another entity (CSUMB) in exchange for goods or services (may be taxable) that have been delivered or used, but not yet paid for. • Provides historical data on customer charges and payments. • Provides current data on customer balances due. 3 Why does CSUMB track receivables? • CSUs report income on the accrual basis of accounting in accordance with GASB (Government Accounting Standards Board) guidelines. Accrual accounting requires the recording of income when earned and expenses when incurred. • If have not received payment for goods and services provided, need to invoice customer. 4 What types of receivables should CSUMB Univ. AR be billing for? • Third-party transactions: – Contractual goods and services including prepayments and deposits NOTE: For campus events Departments should be working with ‘Conference and Events Services’ (CES) who invoice the customer per contract. Departmental revenue and expense is transferred once services have been rendered and not upon collections of invoice. 5 Cont’d FYI: Invoicing covering payroll activity invoicing is generated by Univ AR: • MB570 or Trust: Send a copy of the payroll adjustment (related to a project #) to Univ AR clearly stating who to bill (name, address and phone #) and who to contact if Univ AR has questions. 6 Cont’d • Purpose of invoicing a contractual prepayment – – – – If goods and/or services not rendered then prepayment may be due back to the customer – then able to process refunds thru CFS AR/BI To verify payment is made according to contract, authority to collect revenue and such revenue is permissible on the University side To track historical data on the customer For tracking transactions between University and Auxiliary 7 Cont’d • Chargebacks to the University Corporation and the Foundation including student activity – Purpose: need to track for GAAP reporting purposes therefore all transactions need to be invoiced; do not net what is payable against what is receivable. • This includes formal and informal financial agreements between the Auxiliary and University • Fines • If the prepayment creates an overpayment either a credit memos is created or a refund is issued. 8 How to handle contracts not requiring billing? There are certain contracts and agreements where payment is expected without an invoice issued. For such cases, Univ AR will create courtesy invoices which, upon determination of the department, can be mailed or not. A system invoice has to be created for the payment to be apply against in order, and to record and track the receivable. 9 What types of receivables should CSUMB Univ AR not be billing for? • Direct student receivables i.e. tuition, fees, residential life, etc. This is processed by Student Accounts Receivable (STAR). Contact: Christine Frederick for processing this type of activity 10 Cont’d • Transactions with other CSUs and the CO A CPO (Cash Posting Order) is issued instead of an invoice. At year-end a receivable is created between these entities and CSUMB. More YE instructions to come. • For non-contractual payments paid simultaneously when the service and/or goods are received. Payments can be by cash, check or credit card. For example: box office tickets purchased at the ticket window, or the selling of concessions and apparel 11at events, etc. BENEFITS System will: • Track invoice, payments and receivables • Depts. can run and view their own reports (i.e. customer activity and Aging reports, etc.) Univ AR will: • Process collections • Remedy over payments & errors • Setup recurring billing per contract Including: • Training support on AR/BI by ASM • Compliance with CSU policies & procedures 12 BENEFITS TRAINING OPPORTUNITIES IN 84D LAB (Mountain Hall): May 17, Friday 9:00 a.m. - 10:30 p.m. May 28, Tuesday 10:30 a.m. - noon 13 Support and Information Required • Approved Contracts • Agreements, i.e. formal or informal, e.g. emails between Univ and Auxiliary • Social security number if doing business with an individual e.g. library fines – Required to be able to collect through the FTB Intercept Program (intercept state refunds) – Complete contact information for invoicing and collections purposes: – Business Name – Name Contract is Under – Individual Full Name – Mailing Address – Phone number (work, home and cellular) – Email address 14 – Fax Cont’d • Description of what is being purchased including unit, price, and quantity • Complete chartstring to post revenue to (contra expense); must be posted to the requestor’s Trust or Department ID • Sales Orders • Work Orders • Purchase Orders • Auxiliary has their Accounts Payable requirements that you need to submit as well SUBMIT support by attaching pdf to email or mailing (when original signature is required) 15 How are receivables recorded in the GL? Prior to Centralized AR/BI Some Departments have been doing their own billing, mailing of invoices and recording revenue upon receipt of payment (cash basis accounting), therefore not recognizing receivables: DEPOSIT: Debit (+) - Cash Credit (-) - Revenue (Contra-Expense) 16 Centralized AR/BI With ‘Centralized Billing’ there will be one invoice issued to the customer by Univ AR Accountant (Depts. can issue Sales Orders): INVOICE – Unique number beginning with (6XXXXX): Debit (+) - AR Credit (-) - Revenue (Contra-Expense) DEPOSIT thru CashNet against unique invoice number: Debit (+) - Cash Credit (-) - AR 17 Centralized AR/BI If Departments create their own invoice with an unique invoice number and so does CFS AR/BI, then deposits may not be applied to the correct system invoice Problems this can cause: • Potential for duplicate payments (over-payment) • Disgruntle customers due to billing & collection errors • Incorrect reports • Unreliable system data 18 AR/BI PROCESS FLOW & BUSINESS PROCESSES FOR END USERS by Jennifer Stone 19 • Customer Upload – Template for new customers • Verify customer does not exist before requesting add – Submit with or prior to Billing Upload • Changes to Customers for Billing Upload – Template for customer changes – Submit with or prior to Billing Upload 20 • Billing Upload – Template for new activity only and not for Credit Memos – Instructions are included on the template – Use all CAPS when completing template except for conversation page field – Each area wanting to be able to run an “Aging Report” needs to have their own Collector Code • Contact University AR to provide your area with a Collector Code, if not already assigned – Submit Wednesday by noon for Friday mailing or the last Wednesday of the month in order to 21 be processed for that month • Changes to Billing for regenerating invoices – Email Univ AR with billing changes – If customer or address changes, correction will be made and the invoice regenerated • Marked ‘REVISED INVOICE’ – If amount changes, invoice will be voided and a new invoice will be reissued. • Marked ‘THIS INVOICE REPLACES INVOICE #’ – Only Univ AR can generate invoices and these will be mailed to the customer – Departments will not receive a copy of the invoices since can view online or run an aging report 22 • Customer Payments – Customer must write invoice # on check – Include invoice stub with payment – Customer mails to main Cashier – Mountain Hall, Suite C • Deposits – Posted by main Cashier into CashNet – System applies payment against invoice # for cash, check, credit card and wires • Over Payments – Univ AR creates a CREDIT MEMO • Depts. contacted to determine if: – Apply CM to another invoice (outstanding balance) – Refund through Accounts Payable 23 Communication and uploads send to: Accounts-receivable_non-student@csumb.edu 24 Sample Template and Resulting Invoices 25 Submit Customer Upload and Billing Upload, including changes to customers if billing, by Wednesday at noon to have invoice created for mailing by Friday of same week. Recommend monthly billing 26 Able to view activity for month end, of the prior month, approximately on the 10th of the preceding month. Sign up to be notified when the month is closed to review reports. 27 Year-End Close Deadlines May 3, Friday – April billing June 3, Monday – May billing June 7, Friday – Last day for revisions of May billing June 12, Wed – June billing Review your contracts to make sure all FY12/13 billing is processed no later than June 12, 2013 28 COLLECTION PROCESS • Collection Letter Series • Two-step Collection Agency Referrals • FTB Intercept Program – Capture state refunds CSU Procedure-Revenue Management Program 29 Action Item #17 WRITE-OFF PROCESS • Under $50 per customer Departmental decision • $50 and over have to be requested by Departments and approved by Director of Accounting 30 AR/BI TIMELINE 1. 4/29 (noon) – Departmental deposits to Main Cashier 2. 4/30 (noon) - All non-student payments related to Univ invoices need to be deposited into CashNet 3. 5/1 - Customer list validated by Depts. 4. 5/1-5/14 - Checks deposited to Uncleared Collections (holding account) until AR/BI conversion completed 5. 5/10 – Unpaid balances (receivables) as of 4/30 31 moved into AR/BI AR/BI TIMELINE Cont’d 5. 5/10 – Load new customers for May 2013 invoicing only 6. 5/15 - Customer list re-validated by Depts. 7. 5/1-5/14 – Apply payments in Uncleared Collections to invoices in AR/BI 8. 5/14 and forward – New May invoices sent to Customers. Payments posted directly to AR/BI 9. 5/17 & 5/28 – Open Lab for Department Staff 32 33 REMINDERS TO YOUR CLIENTS • University invoices will have a new look • University invoices will be mailed by Univ AR directly to customer • Customer to mail check direct to University Main Cashier (84C) • Customer to reference invoice # on the check, include payment stub (bottom of the invoice) • Customer to contact Department directly for billing inquiries (they will need to reference the invoice #) 34 REMINDERS TO YOU Univ Accounts Receivable and ASM will continue to provide you more help: • • • • • Training as requested User guides Instructions Procedures Reminders by email and on ‘Staff & Faculty’ End-user business processes will be written formally and made available on the Accounting Website under Accounts Receivable 35 Contact Persons and Resources University Accounts Receivable Team: • Mila Stoupnikova x3745 • George White (Lead) x4269 • Michele Zollna (Manager) x4302 ASM Team for training: • Marlene Sabanal x3502 • Jennifer Stone (Lead) x3301 • Susan McFarlane (Director) x3501 Accounts Receivable Website for procedures and training materials: http://finance.csumb.edu/accounts-receivable 36 What can we do for you to make the transition smoother? 37