Main Title - NAIOP Greater Toronto

advertisement

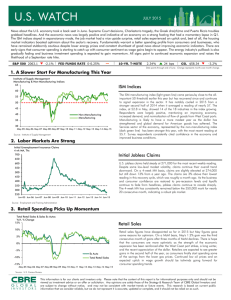

Strictly Private and Confidential NAIOP Toronto 2009 Forecast Breakfast Disclaimer This presentation was prepared exclusively for the benefit and internal use of the recipient for the purpose of considering the transaction or transactions contemplated herein. This presentation is confidential and proprietary to RBC Capital Markets and may not be disclosed, reproduced, distributed or used for any other purpose by the recipient without our express written consent. The information and any analyses contained in this presentation are taken from, or based upon, information obtained from the recipient or from publicly available sources, the completeness and accuracy of which has not been independently verified, and cannot be assured by RBC Capital Markets. The information and any analyses in these materials reflect prevailing conditions and our views as of this date, all of which are subject to change. To the extent projections and financial analyses are set forth herein, they may be based on estimated financial performance prepared by or in consultation with the recipient and are intended only to suggest reasonable ranges of results. The printed presentation is incomplete without reference to the oral presentation or other written materials that supplement it. Employees of RBC Capital Markets are expressly prohibited from offering directly or indirectly a specific price target, or offering or threatening to change research, a rating or a price target, to a company as inducement for the receipt of business or compensation. Canadian Real GDP Canada’s real GDP Growth 8 Annualized % change, quarter-over-quarter Annual Grow th rates '07 6 2.7 '08f '09f '10f 0.6 0.0 2.7 06 07 08 Forecast 4 2 0 -2 -4 00 01 02 03 04 05 09 10 Source: Statistics Canada, RBC Economics Research 2 Equity Market Volatility CBOE S&P500 Volatility Index (VIX) - 2002 – present 85 75 Index Level 65 55 45 35 25 15 5 Jan-02 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 3 Financial Index Performance Relative Performance Canadian and U.S. Financial Index Performance - 2005 – present 150% 140% 130% 120% 110% 100% 90% 80% 70% 60% 50% 40% 30% 20% Jan-05 Jan-06 S&P 500 Financial Index Jan-07 Jan-08 Jan-09 S&P/TSX Financial Index 4 Canadian Labour Market Canadian labour market % % change, year-over-year 8.8 Unemployment rate (LHS) Employment (RHS) 8.3 4.5 4.0 3.5 7.8 3.0 7.3 2.5 2.0 6.8 1.5 6.3 1.0 5.8 0.5 5.3 0.0 00 01 02 03 04 05 06 07 08 Source: Statistics Canada, RBC Economics 5 Bank of Canada Overnight Rate and 10-Year GoC Yield Bank of Canada overnight rate & 10 year bond yield 7 6 % Forecast BoC overnight rate 10 year bond yield 5 4 3 2 1 0 00 01 02 03 04 05 06 07 Source: Bank of Canada, RBC Economics Research 08 09 10 6 Corporate Bond Spreads Canadian Corporate Bond Spreads Spread over GoC (bps) 600 531 bps 500 458 bps 400 300 299 bps 200 100 0 Jan-07 Mar-07 May-07 Jul-07 Source: RBC Capital Markets Sep-07 Nov-07 Jan-08 Mar-08 May-08 Jul-08 AA A Sep-08 Nov-08 Jan-09 BBB U.S. Corporate Bond Spreads 700 600 Spread over UST (bps) 564 bps 500 400 394 bps 300 327 bps 200 100 0 Jul-07 Sep-07 Nov-07 AA Jan-08 Mar-08 A May-08 Jul-08 BBB Sep-08 Nov-08 Jan-09 Source: Bloomberg 7 Canadian CMBS Spreads Canadian CMBS Spreads 800 800bps 700 700 bps 600 550 bps Spreads (bps) 500 450 bps 400 300 200 100 0 Dec-00 Jun-01 Dec-01 Jun-02 Dec-02 Jun-03 Dec-03 Jun-04 Dec-04 Jun-05 Dec-05 Jun-06 Dec-06 Jun-07 Dec-07 Jun-08 AAA 10 year AA 10 year A 10 year BBB 10 year Source: RBC Capital Markets 8 U.S. High Yield Spreads Since January 2008 Spread (bps) 4,000 3,500 3,000 HY Index Spread BB Spread B Spread CCC Spread 3,037 bps 2,500 2,000 1,500 1,683 bps 1,450 bps 1,000 1,141 bps 500 0 Jan-08 Mar-08 May-08 Jul-08 Sep-08 Nov-08 Jan-09 Source: Bloomberg 9 REIT Index Performance and Cdn. REIT Price Premium / Discount to NAV 2008 Index Price Performance Historical Premium/Discount to NAV 40% 120% 110% 30% Maximum: 28.0% 100% 20% 90% 10% 80% 70% -35.0% 60% -41.5% 50% -43.1% 0% -10% Current: -12.4% -20% 40% Maximum: -25.0% 30% -30% J a n08 F e b08 M a r08 A pr08 M a y08 S&P/TSX REIT Index Note: Average: 5.4% Price only return J un08 J ul08 A ug08 RMZ Index S e p08 Oct08 N o v08 D ec08 S&P/TSX Composite 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 Group-Average Premium (Discount) To NAV Period Average Source: RBC Capital Markets Research 10 Canadian REIT Universe – Equity Market Capitalization Total Equity Capitalization of Canadian REIT Universe ($billions) $35 Jan-07: Summit REIT privatized, equity value of $2.1B Feb- 07: Retirement Residences REIT privatized, equity value of $780MM Apr-07: Sunrise Senior Living REIT acquired, equity value of $1.1B May-07: Alexis Nihon REIT acquired, equity value of $0.5B Aug-07: Dundee REIT: Cancellation of ~66% of its units following a large portfolio sale to GE Real Estate, equity value of $1.1B Sep-07: Legacy Hotels REIT acquired, equity value $1.5B Dec-07: CHIP REIT privatized, equity value $925MM Dec-07: IPC US REIT acquired, equity value of $425MM $30 $25 $20 $14.3 Billion Jun-06: TGS NA REIT privatized, equity value of $265MM $15 Nov-05: O&Y REIT privatized, equity value of $1.0B $10 $5 $0 Q1/95 Q1/96 Q1/97 Q1/98 Q1/99 Q1/00 Q1/01 Q1/02 Q1/03 Q1/04 Q1/05 Q1/06 Q1/07 Q1/08 Current 11 Canadian REIT Comparables NAV Estimate (2) Canadian REITs Commercial REITs Allied Properties REIT Artis REIT Calloway REIT Cominar REIT CREIT Crombie REIT Dundee REIT H&R REIT Huntingdon REIT InStorage REIT Morguard REIT Primaris Retail REIT Retrocom Mid-Market REIT RioCan REIT Scott's REIT Whiterock REIT 19-Jan-09 Close Total / Weighted Average Residential REITs Boardwalk REIT CAP REIT InterRent REIT Lanesborough REIT Northern Property REIT Total / Weighted Average Hospitality REITs Holloway Lodging REIT InnVest REIT Royal Host REIT Total / Weighted Average Seniors Housing REITs Chartwell Seniors Housing REIT Extendicare REIT Total / Weighted Average $11.90 $7.15 $12.40 $16.13 $21.00 $8.00 $10.90 $7.93 $0.25 $3.77 $10.84 $11.30 $1.69 $13.50 $4.27 $14.80 $25.25 $14.65 $1.30 $2.99 $18.21 $1.13 $3.53 $3.29 $5.65 $5.77 2008 Price Change Mkt Cap ($MM)(1) (2) Yield FFO Multiples 2009E 2010E -40.0% -51.1% -53.7% -21.5% -22.1% -30.3% -62.6% -62.4% -91.3% -46.4% -11.2% -41.5% -63.7% -37.4% -42.9% -56.8% $372 $236 $1,176 $739 $1,282 $419 $229 $1,161 $18 $98 $640 $703 $47 $2,976 $32 $58 11.1% 15.1% 12.5% 9.0% 6.5% 11.1% 20.1% 9.1% 0.0% 0.0% 8.3% 10.8% 26.6% 10.2% 19.9% 22.7% 6.9 x 4.2 x 7.0 x 8.8 x 9.0 x 5.6 x 3.6 x 5.1 x 1.4 x 11.4 x 9.1 x 8.7 x 3.3 x 8.8 x 4.3 x 3.6 x 7.2 x 4.5 x 7.3 x 8.4 x 8.9 x 5.6 x 3.9 x 5.9 x n/a n/a 9.2 x 8.7 x n/a 8.7 x n/a n/a -38.8% $10,185 10.2% 7.7 x 7.9 x -42.6% -1.8% -73.1% -53.9% -27.5% $1,359 $988 $24 $53 $456 7.1% 7.4% 9.2% 18.7% 8.1% 10.5 x 11.4 x 5.7 x 4.7 x 8.6 x 11.0 x 11.0 x 5.8 x 5.4 x 8.4 x -26.7% $2,879 7.6% 10.4 x 10.5 x -77.9% -64.1% -49.5% $44 $263 $68 18.6% 21.2% 20.1% 2.9 x 2.9 x 5.0 x n/a 2.9 x 4.8 x -63.1% $375 20.7% 3.3 x 3.3 x -52.4% -53.2% -52.7% $574 $428 $1,002 13.1% 14.6% 13.7% 8.0 x 4.1 x 6.3 x 7.8 x 3.7 x 6.1 x Per Unit $15.25 $8.25 $15.00 $15.75 $24.00 $9.58 $18.50 $12.50 $0.46 $4.00 $12.50 $14.25 $2.43 $16.00 $5.51 $28.35 $34.63 $15.25 $2.29 $3.90 $18.00 $2.75 $5.00 $2.60 $6.50 $9.35 Prem / (Disc) 1. Based on most recent publicly available information 2. Estimates from RBC Research, except for Charter, Crombie, Huntingdon, Retrocom, Scott's, Whiterock, InterRent, Lanesborough, Holloway, Extendicare, BTB, Charter, Lakeview and Temple, whose estimates are consensus App. CR -22.0% -13.3% -17.3% 2.4% -12.5% -16.5% -41.1% -36.6% -45.1% -5.8% -13.3% -20.7% -30.5% -15.6% -22.6% -47.8% 8.75% 9.00% 8.00% 8.50% 7.75% 9.00% 9.00% 8.25% 10.18% 8.25% 8.00% 8.00% 9.85% 7.75% 8.98% 7.88% -17.7% 8.09% -27.1% -3.9% -43.2% -23.3% 1.2% 7.00% 6.75% 7.69% 8.50% 9.00% -14.7% 7.26% -58.9% -29.4% 26.5% n/a 9.00% 10.00% -22.7% 9.21% -13.1% 8.50% -38.3% 14.00% -23.8% 10.85% 12 Canadian REIT M&A Overview: Deals Completed in 2007 2007 was an extremely active year for REIT M&A market in Canada, with transactions totaling ~$17 billion in value being completed Transaction acquisition of Date Announced/ Closing Date 8/14/2007 / 12/12/2007 acquisition of 8/1/2007 / 12/4/2007 acquisition of 7/12/2007 / 9/18/2007 acquisition of a large portfolio of real estate from, and an equity stake in 6/4/2007 / 8/24/2007 (Real Estate Sale) / 8/27/2007 (Equity acquisition of acquisition of acquisition of acquisition of 1/12/2007 / 4/26/2007 12/1/2006 / 5/22/2007 10/5/2006 / 2/2/2007 8/30/2006 / 1/26/2007 $2.3 Billion $1.0 Billion $2.8 Billion $3.3 Billion Investment) Transaction Value US$1.4 Billion $1.2 Billion $2.5 Billion i) $2.3B in Direct Real Estate ii) $165MM of Equity (~16%) Bid Price US$9.75 $19.10 $12.60 $47.50 $16.50 $18.60 $8.35 $30.00 Price Prior to Announcement US$9.30 $14.26 $12.00 $39.96 $11.05 $14.89 $6.79 $25.45 Bid Premium Over Prior Day Price 4.8% 33.9% 5.0% 18.9% 49.3% 24.9% 23.0% 17.9% Implied Cap Rate at Bid Price(1) 7.5% 6.7% 6.5% 6.0% 5.8% 6.8% 8.4% 6.0% FFO Multiple(1,2) 10.9x 12.2x 12.7x 16.3x 21.0x 13.4x 10.0x 15.1x AFFO Multiple(1,2) 15.5x 15.2x 20.1x 20.5x 22.6x 18.2x 13.0x 18.1x (1) Implied cap rates and FFO/AFFO multiples are based on consensus street estimates (2) Multiples are based on 1-year forward estimates 13 Class ‘A’ Cap Rate Trends1 Vs. 10-Year GoC Bond Yields 7.5% Multi-Tenant Industrial Single-Tenant Industrial Power Centres 7.0% CBD Office 6.5% Regional Mall Cap Rate 6.0% The “rear view” nature of this information is likely causing it to underestimate current market cap rates 5.5% 5.0% 4.5% 4.0% 3.5% 10-Year GoC Yield 3.0% 2.5% Sep-06 Dec-06 Mar-07 Jun-07 Sep-07 December 31, 2007 Dec-07 Mar-08 Jun-08 Sep-08 December 31, 2008 Dec-08 YoY Change GoC: 3.99% Power: 5.90% GoC: 2.69% Power: 6.80% GoC: -1.30% Power: +0.90% CBD: 5.90% Multi: 6.50% CBD: 6.60% Multi: 7.50% CBD: +0.70% Multi: +1.00% Single: 6.30% Reg: 5.50% Single: 7.20% Reg: 6.1% Single: +0.90% Reg: +0.60% Source: Altus InSite Investment Trends Survey Note 1: Toronto cap rates used as proxy 14 Canadian GoC Bond Yields and Mortgage Rates 8.00% 7.00% 10-Year Mortgage 6.00% 5.00% 4.00% Spread 3.00% 10-Year GoC Yield 2.00% 1.00% 0.00% Jan-07 Apr-07 Jul-07 Source: RBC Capital Markets Oct-07 Jan-08 Apr-08 Jul-08 Oct-08 Jan-09 15