When one looks at the unemployment rate, the growth rate, and the

advertisement

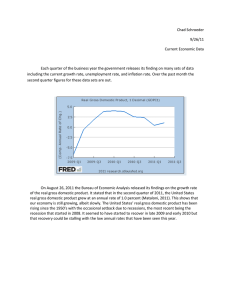

When one looks at the unemployment rate, the growth rate, and the inflation rate, one can see trends in all the graphs. Over the last few quarters the growth rates have been positive but they seem to be becoming stagnant. The positive but small growth rates might indicate that we are in a volatile expansionary period. The BEA reported a 1 percent growth rate in the second quarter on August 26, 2011 ("National income and," 2011) . Overall the growth rates are negative during contractions and positive during expansionary periods. The unemployment rate has fallen from the relatively high peak of around 10 percent to 9.1 percent from the time of the end of the recession to the present time ("Employment situation summary," 2011). The report was released September 2, 2011. Though it seems that the unemployment rate has become stagnant also, not changing from last month’s BLS report. This might be because unemployment usually lags behind during recoveries. But, unemployment in long run does drop during expansionary periods and spikes up during recessions. The inflation rate currently is 3.8 percent according to the BLS report that was released on September 15, 2011 ("Consumer price index," 2011). The inflation rate moves like the growth rate increasing during expansionary periods and decreasing during contractions. Recently, it has been increasing, so the growth rate, inflation rate and the unemployment rate (not so much) point towards the economy being in some sort expansionary period. 1. U.S. Department of Labor, Bureau of Labor Statistics. (2011). Employment situation summary (USDL11-1277). Washington D.C.: Retrieved from http://www.bls.gov/news.release/empsit.nr0.htm 2. Department of Labor, Bureau of Labor Statistics. (2011). Consumer price index summary (USDL-111327). Washington D.C.: Retrieved from http://www.bls.gov/news.release/cpi.nr0.htm 3. Department of Commerce, Bureau of Economic Analysis. (2011). National income and product accounts (BEA 11-42). Washington D.C.: Retrieved from http://www.bea.gov/newsreleases/national/gdp/gdpnewsrelease.htm 4. Federal Reserve Bank of St. Louis, Economic Research. (2011). Retrieved from http://research.stlouisfed.org/fred2/graph/?id=GDPC1 5. Federal Reserve Bank of St. Louis, Economic Research. (2011). Civilian unemployment rate (unrate) Retrieved from http://research.stlouisfed.org/fred2/series/UNRATE/ 6. Federal Reserve Bank of St. Louis, Economic Research. (2011). Retrieved from http://research.stlouisfed.org/fred2/graph/?id=CPIAUCSL