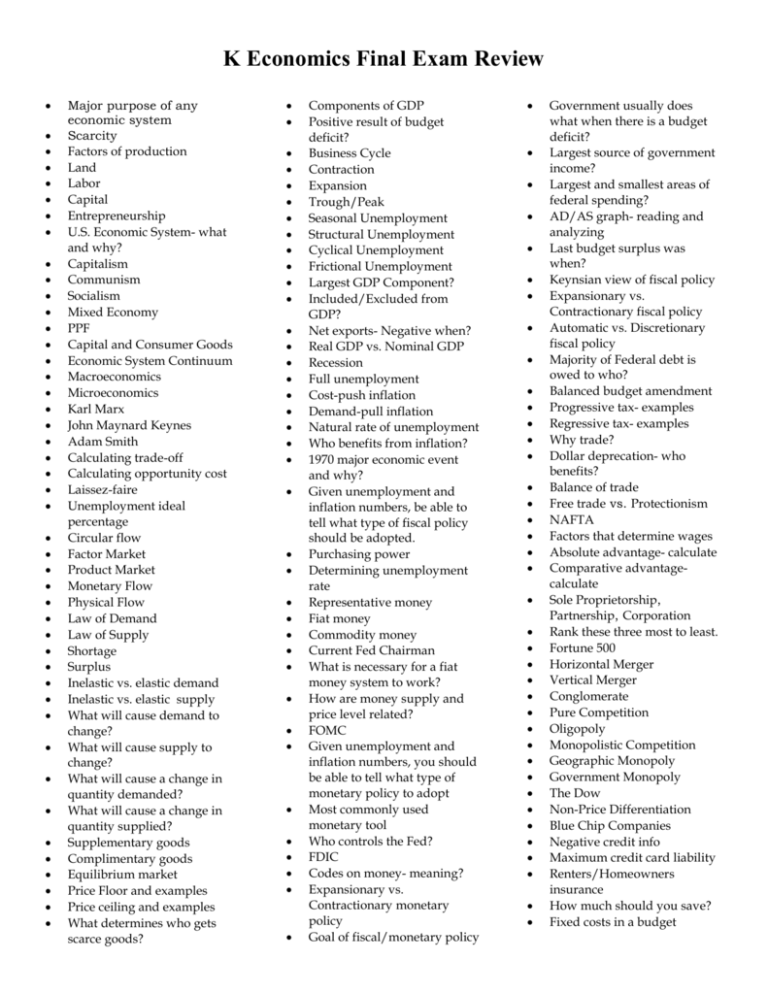

K Economics Final Exam Review

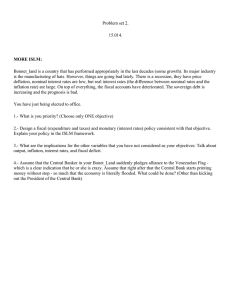

advertisement

K Economics Final Exam Review Major purpose of any economic system Scarcity Factors of production Land Labor Capital Entrepreneurship U.S. Economic System- what and why? Capitalism Communism Socialism Mixed Economy PPF Capital and Consumer Goods Economic System Continuum Macroeconomics Microeconomics Karl Marx John Maynard Keynes Adam Smith Calculating trade-off Calculating opportunity cost Laissez-faire Unemployment ideal percentage Circular flow Factor Market Product Market Monetary Flow Physical Flow Law of Demand Law of Supply Shortage Surplus Inelastic vs. elastic demand Inelastic vs. elastic supply What will cause demand to change? What will cause supply to change? What will cause a change in quantity demanded? What will cause a change in quantity supplied? Supplementary goods Complimentary goods Equilibrium market Price Floor and examples Price ceiling and examples What determines who gets scarce goods? Components of GDP Positive result of budget deficit? Business Cycle Contraction Expansion Trough/Peak Seasonal Unemployment Structural Unemployment Cyclical Unemployment Frictional Unemployment Largest GDP Component? Included/Excluded from GDP? Net exports- Negative when? Real GDP vs. Nominal GDP Recession Full unemployment Cost-push inflation Demand-pull inflation Natural rate of unemployment Who benefits from inflation? 1970 major economic event and why? Given unemployment and inflation numbers, be able to tell what type of fiscal policy should be adopted. Purchasing power Determining unemployment rate Representative money Fiat money Commodity money Current Fed Chairman What is necessary for a fiat money system to work? How are money supply and price level related? FOMC Given unemployment and inflation numbers, you should be able to tell what type of monetary policy to adopt Most commonly used monetary tool Who controls the Fed? FDIC Codes on money- meaning? Expansionary vs. Contractionary monetary policy Goal of fiscal/monetary policy Government usually does what when there is a budget deficit? Largest source of government income? Largest and smallest areas of federal spending? AD/AS graph- reading and analyzing Last budget surplus was when? Keynsian view of fiscal policy Expansionary vs. Contractionary fiscal policy Automatic vs. Discretionary fiscal policy Majority of Federal debt is owed to who? Balanced budget amendment Progressive tax- examples Regressive tax- examples Why trade? Dollar deprecation- who benefits? Balance of trade Free trade vs. Protectionism NAFTA Factors that determine wages Absolute advantage- calculate Comparative advantagecalculate Sole Proprietorship, Partnership, Corporation Rank these three most to least. Fortune 500 Horizontal Merger Vertical Merger Conglomerate Pure Competition Oligopoly Monopolistic Competition Geographic Monopoly Government Monopoly The Dow Non-Price Differentiation Blue Chip Companies Negative credit info Maximum credit card liability Renters/Homeowners insurance How much should you save? Fixed costs in a budget