Health of the United States Economy

advertisement

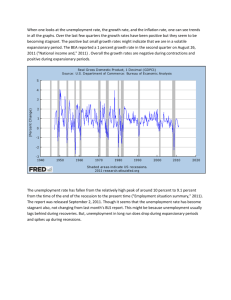

Michael Murawski Assignment 5 Condition of the United States Economy Virtually all economists would agree that there are at least four key figures that indicate the health and direction of an economy: gross domestic product growth, unemployment rate, inflation rate, and the stock market. While there are certainly many more, specified, unique, statistics and numerical methods to help assess the direction of an economy, the aforementioned four are perhaps the first mentioned indicators and are some of the strongest statistics of an economy’s health. When accumulated, these four factors give a well-rounded approximation, but not exact, assessment of an economy at a specified point in time. Thus we can use these numbers and their meaning to assess the current condition of the United States economy, which has been experiencing, what I would label “chronic anemic growth.” Since the collapse of the United States’ economy in late 2007, the economic climate has improved and all economic indicators indicate a relatively better economy. To put this into perspective, the month President Obama was elected president, the United States economy lost over 800,000 jobs (Employment). The latest data from the Bureau of Labor Statistics indicates that in August the economy added 169,000 jobs, meaning that the economy has added jobs for 25 consecutive months (Employment). Nevertheless, the number of jobs added per month is relatively low when compared with past recessions. This is primarily why I would label our current economic period as one of weak growth. However, an examination of the abovementioned economic factors will help to gain even more insight as to the condition of the economy. Real Gross Domestic Product GDP is the most powerful statistic to analyze the size and direction of an economy. During the Great Recession growth in real GDP stagnated and fell, wiping out approximately 700 billion dollars in real GDP; real GDP fell from its highest of 14.996 trillion dollars to 14.356 trillion dollars. Since then real GDP has increased to 15.679 trillion dollars (FRED). Therefore it is evident that the economy has in fact been growing. Unemployment One of the most damaging problems with the United States economy over the last four years has been chronically high unemployment. The unemployment rate was at, or above, nine percent for 23 consecutive months from April 2009 through February 2011. Moreover, from early 2009 to late 2011 unemployment was at, or above, nine percent for 29 out of 30 consecutive months (Unemployment rate). Currently, as of August 2013, unemployment was at 7.3 percent, working its way down from 7.9 percent since January 2013 (Unemployment rate). While unemployment is falling and showing promising numbers, it is partly due to a historic drop in the labor force participation rate, making the unemployment rate deceptively lower than what it otherwise would be (Labor force statistics). Inflation Despite three separate cases of quantitative easing by the Federal Reserve the United States economy has not experienced any large increase inflation. Three years after the first round of quantitative easing has been completed, increases in the price level have not been anywhere near identical to the amount of money infused in the economy. In fact, 2009 saw deflation or net decreases in the price level, despite the $1.25 trillion dollar QE that took place over that year (Current US Inflation). In fact, the last 15 consecutive months have all seen core inflation at a level below two percent, a number relatively lower than the United States’ historical monthly average and, as of August 2013 the inflation rate was a healthy 1.5 percent (Current US Inflation). Stock Market The stock market has been perhaps one of the brightest points of the economic recovery. For example the Dow Jones industrial average is currently above 15,000, at one of the highest points it has ever been. Prior to the Great Recession, the Dow Jones reached as high as 14,093 before falling 6,000 points; since then it has steadily climbed back up ("Dow jones industrial," 2012). Not only the Dow, but the NASDEQ and the S&P500 have also recovered past 2009 levels. While the stock market is not the most powerful indicator, it reflects the markets optimism and levels of investment. Conclusion In all, the United States economy has drastically improved since the Great Recession. Over the past three years the economy has grown in size and jobs have been added. Inflation is lower now than it has ever been in decades. The stock market has rallied from its losses, and has bounced back to a point stronger than before the recession. Unemployment, still relatively high when compared to the last couple of decades, is, nevertheless, falling, and has been headed in the right direction for about three years now. In conclusion, the United States is relatively healthy and is experiencing weak growth. Predictions I predict that the United States economy will continue its current trend—that is, anemic growth— into the near future. Real GDP will continue to rise, unemployment will continue to creep down month to month and inflation will remain relatively low. This, however, is based on certain assumptions; first, that Congress will raise the debt ceiling by October 17, 2013 and will not default on the United States debt; and second, the Federal Reserve will not abruptly nor drastically change monetary policy. If congress refuses to raise the debt ceiling and internal politics outweigh smart public policy, I predict, at worst, a new recession and, at best, an even more sluggish economy. Not raising the debt ceiling would have plethora of effects: a plunge in consumer economic confidence and public confidence in our political system; a falling stock market, wiping out a majority of the gains made since the great recession; raising interest rates; and massive austerity, which would be necessary to pay off the debt. Thus, I would advise this policy step: President Obama should sign an executive order to raise the debt ceiling based on the 14th amendment. Specifically, the constitution states: “The validity of the public debt of the United States, authorized by law, including debts incurred for payment of pensions and bounties for services in suppressing insurrection or rebellion, shall not be questioned.” Thus I would advise the President to use the language of the constitution to make the debt ceiling unconstitutional and to avoid a possible economic slowdown. Furthermore, the economy will continue its current trajectory as long as no unexpected or exceptionally outlandish policy is announced by the Federal Reserve. Financial markets, businesses, and investors want consistency, which provides them with a reasonable assumption for the future, encouraging economic activity and investment. A major announcement by the fed to, for instance, quadruple the price of the federal funds rate from .25 to 1 would certainly throw off many economic and financial entities and players (Fed funds rate). Financial entities are already sensitive enough and an arbitrary announcement by the Fed could be counterproductive. References Dow jones industrial average (djia) history. (2012). Retrieved from http://www.fedprimerate.com/dowjones-industrial-average-history-djia.htm Fed funds rate. (n.d.). Retrieved from http://www.bankrate.com/rates/interest-rates/federal-fundsrate.aspx FRED. (n.d.). Real gross domestic product, billions of chained 2009 dollars, quarterly . Retrieved from http://research.stlouisfed.org/fred2/graph/?utm_source=research&utm_medium=website&ut_ campaign=data-tools United States Department of Labor , Bureau of Labor Statistics. (n.d.). Labor force statistics from the current population survey. Retrieved from website: http://data.bls.gov/timeseries/LNS11300000 United States Department of Labor , Bureau of Labor Statistics. (n.d.). Employment, hours, and earnings from the current employment statistics survey (national). Retrieved from website: http://data.bls.gov/timeseries/CES0000000001?output_view=net_1mth United States Department of Labor , Bureau of Labor Statistics. (n.d.). Unemployment rate, labor force statistics from the current population survey. Retrieved from website: http://data.bls.gov/timeseries/LNS14000000 US inflation calculator. (n.d.). Current us inflation rates: 2003-2013. Retrieved from http://www.usinflationcalculator.com/inflation/current-inflation-rates/ (2013). Real Gross Domestic Product [Web Graphic]. Retrieved from http://research.stlouisfed.org/fredgraph.png?g=mUK (2013). Consumer Price Index for all Urban Consumers: All Items [Web Graphic]. Retrieved from http://research.stlouisfed.org/fredgraph.png?g=mUJ (2013). Civillian Unemployment Rate [Print Photo]. Retrieved from http://research.stlouisfed.org/fredgraph.png?g=mUI