Incentives And Fringe benefits

advertisement

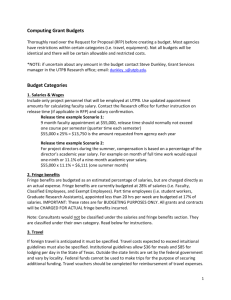

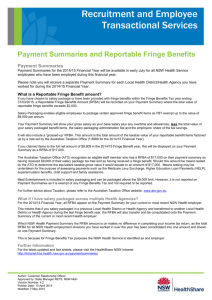

Meaning Incentives are the rewards to an employee, over and above his base wage or salary, in recognition of his performance and contribution. “ An incentive scheme is a plan or programmes to motivate individual or group performance. An incentive programme is most frequently built on monetary rewards but may also include a variety of non-monetary rewards or prizes.” By- Burack and Smith Pre-requirements For Effective Incentive System Incentive plan should be simple so that it may be easily understood by the workers. The plans should be acceptable to the workers, trade unions and management. The incentives rates should be made attractive so as to encourage the worker to give his best results. All incentives should guarantee a minimum day’s wages. The scheme should be explained and discussed with all employees and supervisors before it is implemented. Standards once fixed should not be changes unless it is necessary. Two Types Of Incentives 1. Financial Incentives 2. Non-Financial Incentives Types Of Financial Incentives Piecework plan • Hourly rate for an expected minimum output. • For production over the standard, incentives as per piece produced. Measured DayWork • Standards are determined using time study or allied techniques. • Individuals who have high merit rating score are paid higher hourly pay. 100 % Bonus System or Standard Hour Plan • A worker is paid a basic hourly rate and is paid an extra percentages of his or her base for production exceeding the standard per hour or per day. Group Incentive/ Bonus Plan It is a plan in which a production standard is set for a specific work group and its members are paid incentives if the group exceeds the production standard. Profit Sharing Scheme It is an incentive plan that engages many or all employees in a common effort to achieve a company’s productivity and any resulting incremental cost-savings gains are shared among employees and the company. Gainsharing Plan It is an incentive plan that engages many or all employees in a common effort to achieve a company’s productivity objectives and any resulting incremental cost saving are shared among employees and the company. At-Risky Pay plan These are some times called variable pay plans but are essentially plans that put some portion of the employee’s pay at risk, subject to the firm’s meeting its financial goals. Salary plan Salary plan varies from organization to organization. Some firms pay sales people fixed salaries and no specific commission or bonus schemes are paid on achieving the sales targets. The emphasis being on customer service rather on high pressure selling. Commission Plan Commission plans provide sales representatives with payment based on a percentage of sales turnovers they generate. Combination Plan Most companies pay their salespeople a combination of salary and commission. A portion of total earnings is paid in form of fixed salary. Bonus Scheme And Awards Bonus scheme provide pay in addition to basic salary which is related to the achievement of defined and preferably agreed targets. These may refer simply to sales volume or profit. Base Salary Decisions on the base salary of directors and senior executives are usually formed on the basis of market worth of the individuals. Remuneration on joining the company is usually settled by negotiation, often subject to the approval of a remuneration committee The Annual Bonus Annual bonus plans are those which are aimed at motivating the short term performance of their managers and executives and are given on the basis of the profitability of the company. Stock Option A stock option is the right to purchase a specific number of shares of company stock at a specific price during a period of time. Book Value Plan Managers are permitted to purchase stock at current book value. Executives can earn dividend on the stock they own, as the company grows the book value of their shares may grow too. Stock Appreciation Rights The employee is given the appreciation in the value of shares from the date the option was granted till the date it was relinquished. He earns without investing any money in buying the options. Restricted Stock Plans Shares are usually awarded without cost to the executive but with certain restrictions. One of the major restrictions is that the shares may be forfeited if they are not earned out over a specified period of time. Phantom Stock Plan Executives receive not shares but “units” that are similar to shares of company stock. Then at some future time they receive value equal to the appreciation of the “phantom” stock they own. Employee Stock Option Plan: A company contributes shares of its own stock or cash to be used to purchase such stock to a trust. The trust holds the stock in individual employee accounts and distributes it to employees upon their retirement or at the time of separation from service. Employee Stock Purchase Plan The employees are given the right to acquire shares of the company, normally at a price lower than the prevailing market price. Non-Financial Incentives Materialistic Incentives Canteens Housing Facilities Education Facilities Pension Provident Fund Schemes Non-Materialistic Incentives Recognition and praise Good working environment Cordial human relations Job satisfaction “Imagine life as a game in which you are juggling some five balls in the air. You name them - work, family, health, friends and spirit - and you're keeping all of these in the air. You will soon understand that work is a rubber ball. If you drop it, it will bounce back. But the other four balls - family, health, friends and spirit - are made of glass. If you drop one of these, they will be irrevocably scuffed, marked, nicked, damaged or even shattered. They will never be the same. You must understand that and strive for balance in your life.” -Brian G. Dyson President and CEO Coca-Cola Enterprises Definition Fringe benefits are those monetary and non monetary benefits given to the employee during and post-employment period which are connected with employment but not to the employees contribution to the organization. For Example You Could receive a benefit when you Use a work car for private purposes. Are provided with a cheap loan. Are provided with free private health insurance. Are provided with cleaning services for your private residence or enter in to a salary sacrifice arrangement. Need & Importance of Fringe Benefits: To retain the employees. To motivate performance. As a social security. Trade Union demand. Skill shortage. Employee Demand. Principles of Fringe Benefits Satisfaction of Real Needs. Flexibility. Proper Communication. Educate the workers. Corporate Tools. Participation Fringe Benefits Categories : Car Fringe benefits. Loan Fringe Benefits. Expenses Payment Fringe Benefits. Housing Fringe Benefits. Airline Transport Fringe benefits. Living-Away-from-Home allowance fringe benefits. Car Parking Fringe Benefits. Property Fringe Benefits. Fringe Benefits In India : Payment for Time not Worked. Voluntary Benefits. Payment For Special Duties. Payment For Health and Security Benefits. Conclusion: Basically, a fringe benefit is a benefit provided to an employee or an associate (For Example: Family, Spouse and children) because of his employment. Fringe Benefits provide output in terms of employee loyalty and co-operation, employee welfare and create Organizational image. References 1. Ajai Kumar Singhal,“Human Resource Management.” 2. Gary Dessler & Biju Varkkey, “Human Resource Management.”