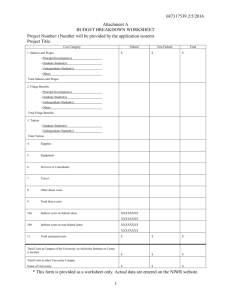

Complete Budget Instructions

advertisement

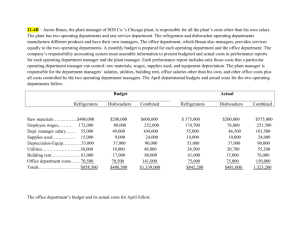

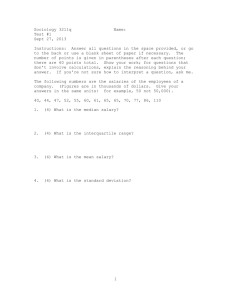

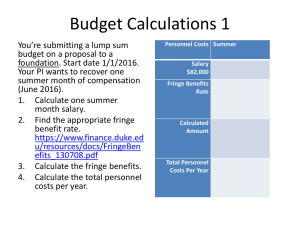

Computing Grant Budgets Thoroughly read over the Request for Proposal (RFP) before creating a budget. Most agencies have restrictions within certain categories (i.e. travel, equipment). Not all budgets will be identical and there will be certain allowable and restricted costs. *NOTE: if uncertain about any amount in the budget contact Steve Dunkley, Grant Services manager in the UTPB Research office; email: dunkley_s@utpb.edu. Budget Categories 1. Salaries & Wages Include only project personnel that will be employed at UTPB. Use updated appointment amounts for calculating faculty salary. Contact the Research office for further instruction on release time (if applicable in RFP) and salary confirmation. Release time example Scenario 1: 9 month faculty appointment at $55,000, release time should normally not exceed one course per semester (quarter time each semester) $55,000 x 25% = $13,750 is the amount requested from agency each year Release time example Scenario 2: For project directors during the summer, compensation is based on a percentage of the director’s academic year salary. For example on month of full time work would equal one-ninth or 11.1% of a nine-month academic year salary. $55,000 x 11.1% = $6,111 (one summer month) 2. Fringe benefits Fringe benefits are budgeted as an estimated percentage of salaries, but are charged directly as an actual expense. Fringe benefits are currently budgeted at 28% of salaries (i.e. Faculty, Classified Employees, and Exempt Employees). Part time employees (i.e. student workers, Graduate Research Assistants), appointed less than 20 hrs per week are budgeted at 17% of salaries. IMPORTANT: These rates are for BUDGETING PURPOSES ONLY. All grants and contracts will be CHARGED FOR ACTUAL fringe benefits incurred. Note: Consultants would not be classified under the salaries and fringe benefits section. They are classified under their own category. Read below for instructions. 3. Travel If foreign travel is anticipated it must be specified. Travel costs expected to exceed intuitional guidelines must also be specified. Institutional guidelines allow $36 for meals and $85 for lodging per day in the State of Texas. Outside the state limits are set by the federal government and vary by locality. Federal funds cannot be used to make trips for the purpose of securing additional funding. Travel vouchers should be completed for reimbursement of travel expenses. 1 Consider all travel cost when computing this amount on a budget (i.e. flights, lodging, meals, transportation-car rental). Group all costs in one category. A copy of the current travel policy can be found through this link: http://www.utpb.edu/docs/default-source/utpbdocs/humanresources/utpbtravelpolicy.pdf?sfvrsn=2 Equipment is defined by the State of Texas as any single item costing over $5,000. Any item that must be added to another piece of equipment is also regarded as equipment if the unit cost of the addition is over $5,000. The federal definition of equipment is an item costing $5,000 or more and with a useful life of more than two years. General purpose equipment and all item s over $5,000 need to be specifically identified in the budget. (General purpose items are things useful for purposes other than scientific research. Computer equipment is considered general purpose equipment). 5. Materials & Supplies Costs include typical office supplies, example: pins, paper and ink. 6. Consultants This category should be itemized. Many agencies, including the Department of Defense, require approval for all consultants. UT employees may only be paid as a consultant if the agency approves the payment, the consultation is across departmental lines or involves a remote operation, and the work is performed in addition to regular duties. Any payments made to UT employees representing extra compensation above base salary are allowable provided that such consulting arrangements are specifically provided for in the agreement or approved in writing by the sponsoring agency. Typical consultant costs include external evaluators or research provided by professors at other institutions. 7. Other Costs Such cost as printing, postage and all other cost not associated within the other categories. 8. Total Direct Costs Includes all costs listed from 1-7 9. Indirect Costs Approved provisional rate through the Department of Health & Human Services: 51.3% on campus & 20% off campus, calculate this rate by the “Total Direct Costs”. Look out for individual RFP exceptions. 2