Chapter 9 – Part 1: Inventories

advertisement

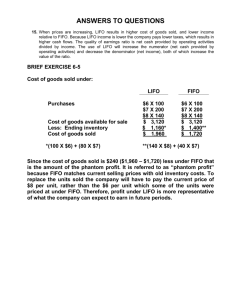

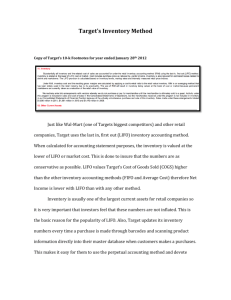

Chaptger 9: Inventories Learning objectives 1. The relationship between inventory valuation and cost of goods sold. 2. The two methods used to allocate the total inventory cost between the COGS and the ending inventories—perpetual and periodic. 3. What kinds of costs are included in inventory. 4. What absorption costing is and how it complicates financial analysis. 5. The difference between inventory cost flow assumptions—weighted average, FIFO and LIFO. 9-1 Learning objectives concluded 6. How LIFO reserve disclosures can be used to estimate inventory holding gains and to transform LIFO firms to a FIFO basis. 7. How LIFO affects firms’ income taxes. 8. How to eliminate realized holding gains from FIFO income. 9. Economic incentives guiding the choice of inventory methods. 9-2 Learning objectives concluded 10.How to apply the lower of cost or market method. 11.The key differences between GAAP and IFRS requirements for inventory accounting. 9-3 Main Types of Businesses Service Companies: Merchandising Companies: Travel agency, Entertainment, Internet, etc. Wholesalers and retailer: to buy and sell ready-to-sell merchandise. Manufacturing Companies Acquire and process raw materials into finished goods. 4 Main Types of Businesses For both merchandising and manufacturing companies, inventories are important assets. Therefore, inventory accounting is crucial to financial reporting. 5 Inventory types Wholesaler or retailer: Manufacturer: Manufacturer Supplier Firm Firm Merchandise inventory Raw materials Work-in-process Finished goods Customer Includes other manufacturing costs ( Direct labor costs, direct materials, manufacturing overhead, etc.) Customer Gross Profit: Sales – Cost of Goods Sold 6 Overview of accounting issues Old unit New unit Issue: What kind of costs are included in inventory? Issue: How is the cost of goods available for sale split between the balance sheet and the income statement? 9-7 Overview of accounting issues: Summary Three methods for allocating the cost of goods available for sale: Weighted average FIFO LIFO GAAP does not require the cost flow assumption to correspond to the actual physical flow of inventory. If the cost of inventory never changes, all three cost flow assumptions would yield the same financial statement result. No matter what assumption is used, the total dollar amount assigned to the balance sheet and the income statement is the same ($640 in this example). 9-8 Overview of accounting issues: Allocating the cost of goods available for sale Weighted average approach: Uses the the average average cost cost of of the the two two Uses units. units. First-in, first-out (FIFO) approach: Oldest unit cost flows to income. Last-in, last-out (LIFO) approach: Newest unit cost flows to income. FIFO produces a smaller expense LIFO produces a larger expense 9-9 Overview of accounting issues: How to allocate total inventory between the COGS and the ending inventory? What items should be included in ending inventory? What costs should be included in inventory purchases (and eventually in ending inventory)? What different cost flow assumptions can be used in determine the COGS under each inventory method (i.e., perpetual vs. periodic)? 9-10 Learning Objective: How to allocate total inventory between the COGS and the ending inventory? 11 Perpetual inventory system This approach keeps a running (or “perpetual”) record of the amount of inventory on hand. The inventory T-account under a perpetual inventory system looks like this: Entries are made as units are purchased Entries are made as units are sold 12 Determining inventory quantities: Periodic inventory system This approach does NOT keep a running (or “perpetual”) record of the amount of inventory on hand. Entries are made as units are purchased Ending inventory and cost of goods sold must be determined by physically counting the goods on hand at the end of the period. 13 Determining inventory quantities: Journal entries illustrated Beginning Inv.(1,400) + Purchases (9,100) – Ending Inv. (3,500)=COGS (7,000) 14 Periodic and perpetual compared Periodic inventory Perpetual inventory Less recordkeeping means lower cost to maintain. More complicated and usually more expensive. Less management control over inventory. Does NOT eliminate the need to take a physical inventory. COGS is a “plug” figure and there is no way to determine the extent of inventory losses (“shrinkage”). Better management control over inventories including “stock outs”. Typically used for low volume, high unit cost items or when continuous monitoring of inventory levels is essential. Typically used when inventory volumes are high and per-unit costs are low. 15 Learning Objective: What items should be included in ending inventory? . 16 Items included in inventory In day-to-day operations, most firms record inventory when they physically receive it. When it comes to preparing financial statements, the firm must determine whether all inventory items are legally owned. Goods in transit may be “owned” by the buyer or the seller. The party that has legal title during transit will record the items as inventory. Consignment goods should not be counted as inventory for the consignee. 9-17 What is Included in Ending Inventory? General Rule All goods legally owned by the company on the inventory date, regardless of their location. Goods in Transit Goods on Consignment Depends on FOB shipping terms. 18 Goods in transit The party with the legal title during transit will record the items as inventory. FOB Shipping Point: the title transfers to the buyer at the shipping point (i.e., the seller’s facility). Thus, the buyer has the title during the transit. FOB Destination: the title transfers to the buyer at the destination (i.e., buyer’s facility. Thus, the seller has the title during the transit. 19 In Class Exercise : Houston Corporation had the following inventory transactions in transit on 12/31/08. Indicate whether the inventory would be included in Houston’s ending inventory on 12/31/2010. 1. Purchased inventory “FOB Shipping Point”; shipped on 12/31/10. 2. Sold inventory “FOB Shipping Point”; shipped on 12/31/10. 3. Purchased inventory “FOB Destination”; shipped on 12/31/10. 4. Sold inventory “FOB Destination”; shipped on 12/31/10. 20 Learning Objective: What costs should be included in inventory purchases? 21 Costs included in inventory All costs necessary to obtain the inventory and to make it saleable should be accounted for. These costs include: Purchase cost or production costs Sales taxes and transportation costs (if paid by the buyer). In-transit insurance costs (if paid by the buyer). Storage costs. 22 Costs included in inventory In theory, costs such as the costs of the purchasing department and other general and administrative costs associated with the acquisition and distribution of inventory should also be included in the inventory costs(referred to as the “indirect” costs”). However, most firms exclude these items. 23 Costs included in inventory : Non-manufacturing firms consider the following items in the cost of inventories: Purchase costs ( invoice price) + Freight-in (transportation-in) - Purchase returns - Purchase allowances (reduce the purchase price due to damages on goods). - Purchase discounts (from early cash payments for the purchase) . 24 Costs included in inventory: Manufacturing firms The inventory costs (i.e., product costs)of a manufacturer include: Raw Material (variable) Direct Labor (variable) Overhead items: Variable overhead: indirect labor, indirect material, electricity used for production, etc. Fixed overhead: depreciation expense of machine, property taxes of factories, rent expense for the factories, etc. 25 Costs included in inventory: Manufacturing firms (contd.) The inventory costs are treated as assets (in work-in-process account for any raw material, labor and overhead in production process and in finished goods account when the production process is complete) until finished goods are sold. When finished goods are sold, the carrying value of these finished goods is charged to cost of goods sold. 26 Costs included in inventory: Manufacturing industry ( FYI ) Two views on treatment of manufacturing overhead costs: Absorption and variable costing 27 Manufacturing Overhead: Variable costing versus Absorption costing Fixed production costs Variable costs will change in proportion to the level of production. Variable production costs Variable production costs Fixed overhead: Manufacturing rentals and depreciation Property taxes Raw materials Direct labor Variable overhead, like electricity Variable costing Absorption costing of inventory (not allowed by GAAP) of inventory (required by GAAP) Costs are considered to be Includable in inventory if they provide future benefits to the firm. The rationale for absorption costing is that both variable and fixed production costs are assets since both are needed to produce a saleable product. 28 Manufacturing Overhead: Summary This approach is not allowed by GAAP. These are never included in inventory. 29 Costs included in inventory: How absorption costing can distort profitability As we shall see, the GAAP gross margin increases from $110,000 in 2011 to $130,000 in 2012 even though variable production costs and selling price are constant, and sales revenue has fallen. 9-30 Costs included in inventory: Absorption costing distortion 9-31 Costs included in inventory: Variable costing illustration Under variable costing the gross margin falls 9-32 Absorption Costing and Earnings Management (source: RCJM Textbook) A research study found that firms in danger of producing zero earnings resort to overproducing inventory to reduce sort of goods sold and thereby boost profits. The evidence suggests that absorption costing provides opportunities for firms to manipulate earnings. 33 Cost Flow Assumptions: Differentiate between the specific identification, FIFO, LIFO, and average cost methods used to determine the cost of ending inventory and cost of goods sold. 34 Cost flow assumptions: The concepts In a few industries, it is possible to identify which particular units have been sold. Examples include jewelry stores and automobile dealerships. These firms use specific identification inventory costing. For most firms, however, a cost flow assumption is required. 9-35 Cost Flow Assumptions: Allocating the cost of goods available for sale Assumption: the cost of inventory is rising Older inventory purchase: Unit price:$300 Most recent inventory purchase: Unit price ;$340 Weighted average Uses the average cost of the two units. First-in, first-out (FIFO) FIFO produces a smaller expense Oldest unitunit cost cost flows to income. Oldest flows to income. Last-in, first-out (LIFO) LIFO produces a larger expense Newest unit cost flows to income. 36 Cost Flow Assumptions: Summary GAAP does not require the cost flow assumption to correspond to the actual physical flow of inventory. If the cost of inventory never changes, all three cost flow assumptions would yield the same financial statement result. No matter what assumption is used, the total amount assigned to the balance sheet and the income statement is the same (i.e., the amount of goods available for sale). 37 Cost flow assumptions: What assumptions do firms use?(Accounting Trends and Techniques) 38 Inventory Cost Flow Methods Specific cost identification Average cost First-in, first-out (FIFO) Last-in, first-out (LIFO) 39 Specific Cost Identification Companies which can identify specific units sold can adopt the specific identification method to allocate costs of goods sold and cost of ending Inventory. Examples include jewelry stores and automobile dealerships. Items are added to inventory at cost when they are purchased. COGS for each sale is based on the specific cost of the item sold. The specific cost of each inventory item must be known. By selecting specific items from inventory at the time of sale, income may be manipulated. 40 Weighted Average Cost Method Periodic average cost uses a weighted-average unit cost: Weightedaverage unit cost Cost of goods = available for sale ÷ Quantity available for sale Perpetual average cost uses a moving average unit cost that is recomputed each time a new purchase is made. 41 Weighted Average Method – Periodic system Begin Inventory 20 @ $ 9.00 $180 Purchase 1/10 40 @ 10.00 400 Purchase 1/22 30 @ 11.00 330 Sales 1/13 : 55 Units Ending Inventory on 1/31:20 + 40 + 30 - 55=35 units Average unit cost: $ of Goods available cost( 180+400+330 ) = $10.11per unit Units of Goods available ( 20+40+30 ) Ending Inventories: 35 units x $10.11 = $354 Cost of Goods Sold: $180+ (400+330)– 354 = $556 42 Weighted Average Method – Perpetual system Begin Inventory 20 @ $ 9.00 $180 Purchase 1/10 40 @ 10.00 400 Purchase 1/22 30 @ 11.00 330 Sales 1/13 : 55 Units Ending Inventory on 1/31:20 + 40+ 30 – 55 = 35 units Calculate weighted average unit cost on 1/10: Goods available cost ( 180+400 ) = $580 = $9.67 per unit Goods available units ( 20+40 ) 60 Cost of Goods sold on 1/13: 55 units x $9.67 per unit = $ 531.85 Calculate weighted average unit cost on1/22: Goods available cost ( 5*9.67+30*11) = $378 = $10.81 Goods available units ( 20+40-55+30 ) 35 Cost of ending inventory on 1/31: 35 units x $10.81 per unit = $378.35 43 First-In, First-Out The FIFO method assumes that items are sold in the chronological order of their acquisition. The cost of the oldest inventory items are charged to COGS when goods are sold. The cost of the newest inventory items remain in ending inventory. The COGS and ending inventory cost are the same under periodic and perpetual approaches regardless their differences in the timing of adjustments to inventory. 44 First-in, First-out (FIFO) Newest units assumed still on hand Oldest units assumed sold 45 First-in, First-out (FIFO) illustrated The computations are: 46 Practice Problem: FIFO - Periodic system Beginning Inventory 20 @ $ 9.00 Purchase 1/10 40 @ 10.00 Purchase 1/22 30 @ 11.00 Sales on 1/13: 55 Units Ending Inventory: 20+40+30-55 = 35 units $180 $400 $330 FIFO of cost of ending units (bottom up) : 30 @ $11 = $330 Alternatively 5 @ $10 = $ 50 (recommended), Total = $380 COGS = beg. Inv. + net pur. FIFO for COGS (top down) – end. Inv. 55 units 20 @ $ 9 = $180 = $180 + (400+330) 35 @ $10 = $350 – 380 = $530. Total = $530 35 units 47 Practice Problem: FIFO -Perpetual system Beginning Inventory 20 @ $ 9.00 $180 Purchase 1/10 40 @ 10.00 $400 Purchase 1/22 30 @ 11.00 $330 Sales on 1/13: 55 Units Ending Inventory: 20 + 40+ 30 - 55 = 35 units FIFO COGS for 1/13 Sale FIFO Inventory on 1/13 55 units 20 @ $ 9 = $180 5 @ $10 = $50 35 @ $10 = $350 Total = $530 Inventory on 1/22 (same as inventory on 1/31 due to no other transactions after 1/22 in January) 35 units 5 @ $10 = $ 50 30 @ $11 = $330 Total = $380 48 Last-In, First-Out The LIFO method assumes that the newest items are sold first, leaving the older units in inventory. The cost of the newest inventory items are charged to COGS when goods are sold. The cost of the oldest inventory items remain in inventory. Unlike FIFO, using the LIFO method may result in COGS and ending inventory Cost that differ under the periodic and perpetual approaches. 49 Last-in, First-out (LIFO) Newest units assumed sold Oldest units assumed still on hand 50 Last-in, First-out (LIFO) illustrated The computations are: 51 Practice Problem: LIFO - Periodic system Beginning Inventory 20 @ $ 9.00 Purchase 1/10 40 @ 10.00 Purchase 1/22 30 @ 11.00 Sales on 1/13: 55 Units Ending Inventory: 20+40+30-55 = 35 units $180 $400 $330 LIFO of cost of ending inventory (top down) : 20 @ $9 = $180 Alternatively 15 @ $10 = $150 (recommended), Total = $330 COGS = beg. Inv. + net pur. FIFO for COGS (bottom up) – end. Inv. 55 units 30 @ $11 = $330 = $180 + (400+330) 25 @ $10 = $250 – 330 = $580. Total = $580 35 units 52 Practice Problem: LIFO -Perpetual system Beginning Inventory 20 @ $ 9.00 $180 Purchase 1/10 40 @ 10.00 $400 Purchase 1/22 30 @ 11.00 $330 Sales on 1/13: 55 Units Ending Inventory: 20 + 40+ 30 - 55 = 35 units LIFO COGS for 1/13 Sale LIFO Inventory on 1/13 55 units 40 @ $10 = $400 5 @ $9 = $40 15 @ $9 = $135 Total = $535 Inventory on 1/22 (same as inventory on 1/31 due to no other transactions after 1/22 in January) 35 units 5 @ $9 = $ 45 30 @ $11 = $330 Total = $375 53 Learning Objective LIFO Reserve and LIFO Effect 54 LIFO Reserve Many companies use LIFO for external reporting and income tax purposes but maintain internal records using FIFO or average cost. The difference in the value of inventory between the inventory method used for internal reporting purposes (i.e., FIFO) and LIFO is reported in an account referred to as LIFO Reserve or the Allowance to Reduce Inventory to LIFO . 55 55 LIFO Reserve The change in the balance of LIFO Reserve account from one period to another is referred as the LIFO Effect, which reflects the impact on income from using LIFO vs. FIFO. The SEC required the LIFO reserve disclosure since 1974 for firms adopting LIFO costing. 56 56 Cost flow assumptions: The LIFO reserve disclosure Amount actually shown on balance sheet Amount shown on balance sheet if FIFO had been used 9-57 LIFO Reserve (contd.) The LIFO Reserve decreased by $655,000 in 2005. This difference is the same as the 2005 COGS difference between LIFO and FIFO. A decreased LIFO Reserve indicates a smaller LIFO COGS than FIFO COGS, an indication of either deflation or a LIFO liquidation (discussed later). When LIFO Reserve increases, it indicates a greater LIFO COGS than FIFO COGS, an indication of inflation. 58 58 LIFO Reserve (contd.) The proof of LIFO effect equals the COGS impact of FIFO vs. LIFO: COGS = BI + Pur –EI COGS FIFO – COGS LIFO (BI=beg. Inv; EI=ending Inv.) =(BI FIFO – BI LIFO) – (EI FIFO – EI LIFO) =LIFO Reserve of BI – LIFO Reserve of EI Thus, a positive LIFO effect indicates COGS FIFO > COGS LIFO (see the example in Exhibit 9.6 on p57) Conversely, a negative LIFO effect indicates COGS FIFO < COGS LIFO 59 59 LIFO and inflation: LIFO reserve Figure 9.4 Magnitude of Inventory and LIFO Reserve relative to CPI and Oil Prices 9-60 LIFO Reserve and Inflation (contd.) When inflation heats up, the disparity between LIFO inventory and FIFO inventory increases. Why did the LIFO reserve increase through 2007 and then decrease? Firms reduce inventory levels as they downsize, restructure, or adopt just-in-time inventory management. Oil price was $16.75 per barrel at the end of 2001. It was $85.52 per barrel at the end of 2007 before dropped to $31.84 by the end of 2008. 61 61 Learning Objective: Understand supplemental LIFO disclosures and the effect of LIFO liquidations on net income. 62 LIFO Liquidation When prices rise . . . LIFO inventory costs on the balance sheet are “out of date” because they reflect old purchase transactions. If inventory declines, these “out of date” costs may be charged to current COGS, and earnings. This LIFO liquidation results in “paper profits.” 63 LIFO liquidation LIFO Liquidation occurs when a firm experiences significant inventory shortage, and therefore, liquidate some layers in beginning inventory. This results in costs from preceding periods being matched against current year’s revenues. This leads to a distortion in net income and a substantial increase in tax payment in the current period. 64 LIFO liquidation: Illustration Old LIFO layers If recent inventory purchase is sufficient, gross margin will be $32,000 65 LIFO liquidation: Calculation of LIFO liquidation profits The LIFO Reserve on 12/31/2005= 10 x $100+15x $200 = $6000. LIFO effect of 2005 is (6,00010,000= -4,000) What the per unit COGS would have been without the liquidation 66 LIFO liquidation disclosures Income tax effect ($910,000) was the difference. From footnote The buildup of the LIFO inventory creates the reserve, 67 and the decline in inventory--known as LIFO dipping--is a liquidation of the reserve. LIFO liquidation Disclosures (contd.) Aral’s 2005 LIFO effect ($655,000 decrease) is attributable to LIFO liquidation profit in the amount of $2,600,000, reducing LIFO Reserve, and an inflation effect in 2005 in the amount of $1,945,000, increasing LIFO Reserve. Reconciliation of Changes in LIFO Reserve: Rising input costs increased LIFO cost of goods sold by $1,945,000 LIFO dipping undercharged expense and thus, reduced COGS by (2,600,000) Result: LIFO COGS is less than LIFO by $ 655,000 (=Changes in LIFO Reserve) 68 The Frequency of LIFO liquidation and Its Contribution to Pre-Tax Earnings LIFO liquidation is not uncommon: Figure 9.5 of the textbook indicates that during the period of 1985 to 2001, on average, about 10% to 20% of firms using LIFO experiencing LIFO liquidation. The contribution of LIFO liquidation to pre-tax earnings ranges from 10.4% in 1991 to 2% in 2000. To avoid being misled by transitory LIFO liquidation profit, LIFO inventory footnote should be studied to see whether LIFO liquidation occurred and its impact to profits. 69 Learning Objective: Remove LIFO dipping, a non-sustainable factor from gross margin analysis. 70 LIFO liquidation: Gross profit distortion Improving gross margin was reported But the improvement was due to LIFO liquidation 71 Current ratio example Eliminating LIFO ratio distortions : Current Ratio Understated because of LIFO LIFO reserve adjustment restates inventory to approximate current cost. 72 Eliminating LIFO Distortion: Inventory Turnover Rate Distorted by LIFO liquidation 73 Partial LIFO use Most companies use a combination of Inventory cost flow assumptions. The LIFO to FIFO adjustment is identical to the method used in Exhibit 9.8. Ending LIFO reserve Beginning LIFO reserve So, the LIFO reserve decreased $4,538 during the year. COGS LIFO $4,538 COGS FIFO 74 Tax implications of LIFO U.S. tax rules specify that if LIFO is used for tax purposes, LIFO must also be used in external financial statements. This LIFO conformity rule explains why so many firms use LIFO for financial reporting purposes. 9-75 Tax implications of LIFO 9-76 Eliminating realized holding gains for FIFO firms Reported income for FIFO firms always includes some realized holding gains during periods of rising inventory costs. The size of the FIFO realized holding gain depends on: How fast input costs are changing. How fast inventory turns over during the period. x 10% cost increase Replacement COGS = 7,900,000 + = 8,000,000 100,000 Realized FIFO holding gain 9-77 Reasons why some companies do not use LIFO The estimated tax savings is too small (academic research confirms that LIFO firms have higher tax savings) . Business cycles may cause extreme fluctuations in physical inventory levels. The rate of inventory obsolescence is high. 9-78 Reasons why some companies do not use LIFO Managers may want to avoid reporting lower profits because they believe doing so will lead to: Lower stock price Lower compensation from earnings-based bonuses Loan covenant violations Small firms may not find LIFO economical because of high recordkeeping costs. 9-79 Summary Absorption costing can lead to potentially misleading trend comparisons. GAAP allows firms latitude in selecting a cost flow assumption. Some firms use FIFO, others use LIFO, and still others use weighted-average. This diversity can hinder comparisons across firms, thus its often useful to convert LIFO firms to a FIFO basis. Reported FIFO income includes potentially unsustainable realized holding gains. 9-80 Summary (contd.) Similarly, LIFO liquidations produce potentially unsustainable realized holding gains. Old, out-of-date LIFO layers can distort various ratio comparisons. Users must understand these inventory accounting differences and know how to adjust for them. Only then can valid comparisons be made across firms and over time. 9-81 Learning Objective: Discuss the factors affecting a company’s choice of inventory method. 82 Decision Makers’ Perspective What factors motivate companies to select one inventory method over another? How closely do reported costs reflect actual flow of inventory? How well are costs matched against related revenues? How accurate is the timing of reported income and income taxes? 83 FIFO vs. LIFO: Comparison of FIFO and LIFO 84 Comparison of FIFO and LIFO When Prices Are Rising . . . FIFO Matches low (older) costs with current (higher) sales. Inventory is valued at approximate replacement cost. Results in higher taxable income and lower COGS. LIFO Matches high (newer) costs with current (higher) sales. Inventory is valued based on low (older) cost basis. Results in lower taxable income and higher COGS. Is not allowed by the IASC. 85 Advantage and Disadvantage of FIFO Advantage a. Less likely to be subject to management manipulation; b. Produce higher income during an inflation period; c. Inventory cost reported on the B/S is close to the replacement cost. Disadvantage a. Bad matches of sales revenue and CGS; match current sales revenue with old cost (earnings contains the holding gains and therefore, have lower quality than LIFO earnings) b. Producing higher income during an inflation period results in paying more income tax. . 86 Advantage and Disadvantage of LIFO Advantage a. Good match of sales revenue with CGS(thus, higher earnings quality than FIFO earnings). b. Produce lower income during an inflation period; result in tax savings. . Disadvantage a. Inventory cost presented on the B/S is not fair. b. Subject to management manipulation. 87 Earnings Quality Manipulating income reduces earnings quality because it can mask permanent earnings. Inventory write-downs and changes in inventory method are two additional inventory-related techniques a company could use to manipulate earnings. 88 Analytical insights: LIFO dangers LIFO makes it possible to “manage” earnings when inventory costs are rising! How? Accelerate inventory purchases toward the end of a “good” earnings year so that COGS increases. Delay inventory purchases toward the end of a “bad” earnings year so that COGS decreases when old LIFO layers are liquidated. 89 Inventory Errors 90 Inventory Errors Inventory errors are unique in financial reporting because they involve multiple accounts and multiple periods. Due to the ending inventory will be the beginning inventory of next year, the errors will be corrected by the end of the second year. 91 The Impact of Valuation of Ending Inventory on The CGS & Income Year 1 Income COGS = Beg. Inv. + Net . - End. Inv. under over under a over b over under Year 2 over under under over under over a. either understating the units or the value b. either overstating the units or the value Inventories: Measurement 92 Inventory Errors: An Example Due to a miscount in 2008, ending inventory is overstated by $1 million. Here’s the effect: If not corrected, here’s how the 2008 error will affect 2009 results: 9-93 Class Practice Problem Assume that, at the end of 2001, Xeron Corporation neglected to include $1,000 of goods in transit to the company when it performed the annual inventory count. This error went undetected through 2002. How would this inventory error affect the financial statements for 2001 and 2002? Assume the cost flow assumption is FIFO. 94 Class Practice Problem To analyze, use the inventory formula and the balance sheet formula. Note that the asset account in inventory error analysis is ending inventory, and the equity effect is retained earnings, specifically the effect on net income. 95 Class Practice Problem Analysis : BI: Beginning Inventory P: Net Purchase EI: Ending Inventory COGS: Cost of goods sold NI: Net income A: Assets L: Liabilities SE: Stockholder’s equity BI + P - EI 01: 02: U U = COGS | NI O U U O | A = L + SE U X U X Why is there no effect on 2002 ending stockholder’s equity? NI 2001 understated by $1,000 NI 2002 overstated by $1,000 Both closed to RE, so no net effect at the end. SE in last year is understated, but SE balance is offset by overstated of year 2002. Thus, no effect on 2002 ending Stockholder’s Equity. 96 LCM Understand and apply the lower-of-costor-market rule used to value inventories. 97 Lower of cost or market Inventory is presumed to be impaired when its replacement cost falls below its carrying value. When this occurs, GAAP requires inventory to be carried on the balance sheet at the lower of its cost or “market” value. 98 Lower of cost or market example Net realizable value: The amount that would be received if the assets were sold in the (used) asset market. 99 LCM and inventory aggregates The lower of cost or market LCM method can be applied to: Individual inventory items Classes of inventory—say, fertilizers versus weed-killers The inventory as a whole Three different answers 100 Criticisms of the LCM method Write-downs may initially be conservative, but the resulting higher margin in the period following the write-down can lead to earnings management. Because LCM is conservative, it violates the neutrality posture that financial reporting rules are designed to achieve. LCM relies on an implicit relationship between input and output prices that may not prevail. But selling price and profit potential hasn’t changed LCM rule would require write-down 101 Global Vantage Point Comparison of IFRS and GAAP Inventory Accounting IFRS guidelines for inventory are similar to U.S. GAAP Two important differences LIFO is not permitted under IAS 2 Lower of cost or market is applied differently. Market is net realisable value (no ceiling or floor). IAS 2 allows inventory reductions to be reversed if the market recovers, but the inventory carrying amount cannot exceed the original cost. 9-102 Estimate ending inventory and cost of goods sold Estimate ending inventory and cost of goods sold using the gross profit method. 103 Inventory Estimation Techniques Estimate instead of taking physical inventory Less costly Less time consuming Two popular methods are . . . 1. 2. Gross Profit Method Retail Inventory Method 104 Gross Profit Method Auditors are testing the overall reasonableness of client inventories. Estimating inventory & COGS for interim reports. Useful when . . . Determining the cost of inventory lost, destroyed, or stolen. Preparing budgets and forecasts. NOTE: The Gross Profit Method is not acceptable for use in annual financial statements. 105 Gross Profit Method This method assumes that the historical gross margin rate is reasonably constant in the short run. We need to know: 1. Net sales for the period. 2. Cost of beginning inventory. 3. Historical gross margin rate. 4. Net purchases for the period. 106 Steps to the Gross Profit Method 1. Estimate Historical Gross Margin %. 2. Sales x (1 - Estimated Gross Margin %) = Estimated COGS 3. Beg. Inventory + Net Purchases = Cost of Goods Available for Sale (COGAS) 4. The above information needs to be available COGAS - Estimated COGS = Estimated Cost of Ending Inventory 107 Gross Profit Method Matrix, Inc. uses the gross profit method to estimate end of month inventory. At the end of May, the controller has the following data: •Net sales for May = $1,213,000 •Net purchases for May = $728,300 •Inventory at May 1 = $237,400 •Gross margin = 43% of sales Estimate Inventory at May 31. 108 Gross Profit Method Beginning Inventory Plus: Net Purchases = Goods Available for Sale Less: Estimated COGS* = Estimated Ending Inventory $ $ * COGS = Sales x (1 - GM%) = $ = $ 237,400 728,300 965,700 (691,410) 274,290 1,213,000 x ( 1 - 43% ) 691,410 NOTE: The key to successfully applying this method is a reliable Gross Margin Percentage. 109 Class Practice Problem - Inventory Estimation Given the following information from the general ledger: Sales, January-March $600,000 Inventory, January 1 50,000 Purchases, January-March 450,000 If the gross margin has historically been 30 percent of sales, calculate the estimated ending inventory at March 31. 110 Solution First, estimate COGS: If GM% = 30%, then COGS = 70% So Sales x 70% = COGS Then, estimate EI: BI + P (net) - EI = COGS 600,000 x .7 = COGS = 420,000 50,000 + 450,000 - EI = 420,000 80,000 = EI 111 Summary Absorption costing is required by GAAP but can lead to potentially misleading trend comparisons. GAAP allows firms latitude in selecting a cost flow assumption. Some firms use FIFO, others use LIFO, and still others use weighted-average. This diversity can hinder comparisons across firms, thus it’s often useful to convert LIFO firms to a FIFO basis. 9-112 Summary Reported FIFO income includes potentially unsustainable realized holding gains. Similarly, LIFO liquidations distort reported margins and produce unsustainable realized holding gains. Old, out-of-date LIFO layers can distort various ratio comparisons. 9-113 Summary concluded To address inventory obsolescence, GAAP requires inventory to be carried at lower of cost or market (LCM). IFRS accounting for inventory is very similar to GAAP, but LIFO is not allowed. The LIFO conformity rules requires firms to use LIFO for financial reporting if they use it for tax reporting. Most LIFO firms use some form of dollar-value LIFO. 9-114 Summary concluded Users must understand these inventory accounting differences and know how to adjust for them. Valid comparisons can only be made across firms and over time after adequate adjustments. 9-115