Property Transactions: Treatment of Capital and Section 1231 Assets

advertisement

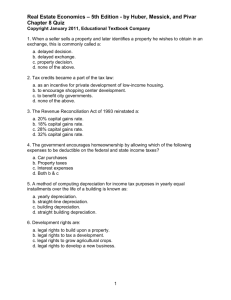

CCH Federal Taxation Basic Principles Chapter 12 Property Transactions: Treatment of Capital and Section 1231 Assets ©2003, CCH INCORPORATED 4025 W. Peterson Ave. Chicago, IL 60646-6085 800 248 3248 http://tax.cchgroup.com Chapter 12 Exhibits 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. Capital Assets—Definition of “Capital” Capital Assets—Other Definitions Determining the Capital/1231 Gains Rate “Basket” Computing Capital Gain Tax—10% Rate Computing Capital Gain Tax—20% Rate Tax Treatment for Ordinary Income Property and Capital Assets Patents Franchises, Trademarks, and Trade Names Lease Cancellation Payments Options—General Rules Options—Example Subdivided Real Estate Sold by Investors Worthless Securities Depreciation Recapture—Example 1 Depreciation Recapture—Example 2 Chapter 12, Exhibit Contents A CCH Federal Taxation Basic Principles 2 of 92 Chapter 12 Exhibits 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. Business Asset Dispositions—Template for Problem Solving Business Asset Dispositions—Example 1 Business Asset Dispositions—Example 2 The First Netting—Capital Gains and Losses The First Netting—Example 1 The First Netting—Example 2 The First Netting—Personal-Use Casualty/Theft Gains/Losses The First Netting—Business/Investment Use Casualty/Theft Gains/Losses The First Netting—Personal-Use Condemnation Gains/Losses The First Netting—Business/Investment-Use Condemnation Gains/Losses The First Netting—Long-Term Business Assets The First Netting—Recap The Second Netting—Examples The Second Netting—Recap of the Rules Applying the $3,000 Capital Loss Limitation Chapter 12, Exhibit Contents B CCH Federal Taxation Basic Principles 3 of 92 Capital Assets—Definition of “Capital” The term “capital” has different meanings among different professions. Here are some examples: Profession Definition of Capital Financial Accountant “Capital stock” generally refers to the owners equity of a corporation less its retained earnings. Banker “Capital” generally refers to the total assets of a company at book value. Investor A “cap” is a quick way of placing an approximate price tag on a company. “Cap” refers to the capitalization of a firm, which can be calculated by multiplying the stock price by the number of shares outstanding. For example, if DEF, Inc. has 10 million shares outstanding priced at $60 each, its capitalization is $600 million. Chapter 12, Exhibit 1a CCH Federal Taxation Basic Principles 4 of 92 Capital Assets—Definition of “Capital” Some general terms applied by investment brokers to companies with varying capitalization levels are listed below. Terms Capitalization Level Large Cap $5 billion or higher Mid Cap Between $500 million and $5 billion Small Cap $150 million to $500 million Micro Cap Less than $150 million Chapter 12, Exhibit 1b CCH Federal Taxation Basic Principles 5 of 92 Capital Assets—Definition of “Capital” Tax Accountant Chapter 12, Exhibit 1c “Capital assets” generally refer to any property other than: 1. Ordinary income property (e.g., inventory, receivables, creative works created by the taxpayer) 2. Depreciable business property (e.g., buildings, equipment) 3. Non-depreciable business property (e.g., land) Thus, capital assets would include land held for investment, cars used for personal travel, principal residences, household furnishings, stock, and jewelry. Paintings, manuscripts, and other creative works are capital assets if created by someone other than the taxpayer. CCH Federal Taxation Basic Principles 6 of 92 Capital Assets—Other Definitions Collectibles Collectibles are defined by the Internal Revenue Code as any of the following investments: works of art, rugs, antiques, gems, metals (e.g., gold, silver), stamps, coins, or alcoholic beverages (e.g., older vintages of wines held for investment). [Code Sec. 408(m)(2)] (Note that works of art, rugs, antiques, and the other items listed above, if held by dealers, are ordinary income property, not collectible investments. Why? Because dealers hold these assets as inventory, not as investments.) Chapter 12, Exhibit 2a CCH Federal Taxation Basic Principles 7 of 92 Capital Assets—Other Definitions Collectibles The pre-May 7, 1997 rates apply to the sale of collectibles. These old rates consist of: 1. 15% long-term capital gain rate (not the new 10% rate) for taxpayers within the 15% ordinary income tax bracket; 2. 28% long-term capital gain rate (not the new 20% rate) for taxpayers above the 15% ordinary income tax bracket. Chapter 12, Exhibit 2b CCH Federal Taxation Basic Principles 8 of 92 Capital Assets—Other Definitions Ordinary Income Property Ordinary income property includes any property that would result in the recognition of income taxed at the ordinary income rates if the property were sold. Thus, ordinary income property includes inventory, receivables, works of art or manuscripts created by the taxpayer, and capital assets that have been held for one year or less. Chapter 12, Exhibit 2c CCH Federal Taxation Basic Principles 9 of 92 Capital Assets—Other Definitions Code Sec. 1231 Assets. Generally, business assets held over 12 months fall under the category “Section 1231.” These assets include personal and real property, both depreciable and nondepreciable, that are used in a business. Examples include a fleet of delivery trucks, the portion of a car’s basis allocable to business transportation, the portion of a principal residence used for a home office, factory machinery, office computers, land held for future business expansion, warehouses, office buildings, apartment buildings, and rental houses. Chapter 12, Exhibit 2d CCH Federal Taxation Basic Principles 10 of 92 Capital Assets—Other Definitions Long-Term Holding Period Capital assets held for more than one year are long-term. Chapter 12, Exhibit 2e CCH Federal Taxation Basic Principles 11 of 92 Capital Assets—Other Definitions Two Categories of Long-Term Holding Period More than 12 Months. If a capital asset (other than a collectible) or a Code Sec. 1231 asset sold after May 6, 1997, had been held for more than 12 months, it is subject to the 20% capital gains rate (or the 10 % rate for taxpayers in the 15% bracket). More than 5 Years. (See following slide for explanation.) Chapter 12, Exhibit 2f CCH Federal Taxation Basic Principles 12 of 92 Capital Assets—Other Definitions Two Categories of Long-Term Holding Period More than 5 Years. For capital assets (other than collectibles) sold after 2006, and Code Sec. 1231 assets sold after 2006, the top long-term capital gain rate is 18% if the assets had been held for more than five years (or 8% for taxpayers in the 15% bracket). To get the special 18% rate, a taxpayer must either: 1. Acquire the capital asset after December 31, 2000, and hold it for over 5 years; or 2. Acquire the capital asset before January 1, 2001; “pretend” to sell it on January 1, 2001, by recognizing any realizable gain (commonly referred to as “marking to market,” the taxpayer pays a 20% capital gains tax on the difference between FMV on January 1, 2001, and adjusted basis); then hold the asset for over 5 years before actually selling it. [Note that 15%-bracket taxpayers who acquire property before January 1, 2001, need not mark-to-market the property on January 1, 2001, in order to get the special 8% rate. They need hold it only until after 2006 to get the favorable 8% rate.] Chapter 12, Exhibit 2g CCH Federal Taxation Basic Principles 13 of 92 Determining the Capital/1231 Gains Rate “Basket” Long-term capital gains and losses and Section 1231 gains and losses fall into one of five rate “baskets”: 10%, 15%, 20%, 25% and 28%. Two variables, (1) marginal ordinary tax rate, and (2) type of asset sold or exchanged, must be identified in order to determine the appropriate rate basket. Different combinations of these two variables result in different rate baskets. Chapter 12, Exhibit 3a CCH Federal Taxation Basic Principles 14 of 92 Determining The Capital/1231 Gains Rate “Basket” Two Variables Affecting Rate Baskets Rate Basket (1) Marginal Ordinary Rate (2) Type of Asset Sold 10% 15 % Non-Collectible Capital Assets; or Code Sec. 1231 Assets 15 % 15 % Collectibles Above 15 % Non-Collectible Capital Assets; or Code Sec. 1231 Assets (other than 1231 gain attributable to unrecaptured Code Sec. 1250 depreciation) 25 % Above 15 % Code Sec.1231 Assets (to the extent of gain attributable to unrecaptured Code Sec. 1250 depreciation) 28 % Above 15 % Collectible 20 % Chapter 12, Exhibit 3b CCH Federal Taxation Basic Principles 15 of 92 Computing Capital Gain Tax—10% Rate FACTS: Ben, a single individual, has 2003 taxable income in the amount of $29,000. This amount includes a $4,000 long-term capital gain on stock held over 12 months. QUESTION: What is Ben’s tax liability for 2003? SOLUTION: $3,910 as in the following calculations. Chapter 12, Exhibit 4a CCH Federal Taxation Basic Principles 16 of 92 Computing Capital Gain Tax—10% Rate SOLUTION: Description Taxable Income (a) Taxable income $29,000 (b) Long-term cap. gain $4,000 (c) = Lesser of: $28,400, or (a) – (b) Ordinary income subject to 10% and 15% rates $25,000 (d) = Lesser of: $40,400 (i.e., top 27% Ordinary income subject to 27% rate $0 bracket for single individuals, $68,800, less top 15% bracket, $28,400), or (a) – (b) – (c) $3,450.00 27% $0.00 10% $340.00 20% $120.00 (Lesser of: $40,400, or $0 = $29,000 – $4,000 – $25,000) Long-term capital gain subject to 10% rate $3,400 (f) = (b) – (e) Long-term cap. gain subject to 20% rate $600 Totals $29,000 Chapter 12, Exhibit 4b 10, 15% Tax (Lesser of: $28,400, or $25,000=$29,000 – $4,000) (e) = Lesser of: (b), or $28,400 – (c) (g) = (c) + (d) + (e) + (f) Tax Rate (Lesser of: $4,000, or $3,400 = $28,400 – $25,000) ($4,000 – $3,400) CCH Federal Taxation Basic Principles $3,910.00 17 of 92 Computing Capital Gain Tax—10% Rate Ben’s ordinary income is $25,000 ($29,000 – $4,000). According to the “single individual” rate table, the 10% and 15% tax rates apply to ordinary income up to $28,400. Since Ben’s ordinary income amount of $25,000 is below the $28,400 limit, a portion of his long-term capital gain gets taxed at the favorable 10% rate. The amount subject to the 10% rate is the difference between $28,400 (i.e., the 15% bracket’s upper limit), and $25,000 (i.e., Ben’s actual ordinary income). Any remaining long-term capital gain gets the favorable 20% long-term capital gain rate. Based on the computations above, Ben’s tax liability is $3,910. Chapter 12, Exhibit 4c CCH Federal Taxation Basic Principles 18 of 92 Computing Capital Gain Tax—20% Rate FACTS: Conor, a single individual, has 2003 taxable income in the amount of $29,000. This amount includes a $1,000 long-term capital gain on stock held over 12 months. QUESTION: What is Conor’s tax liability for 2003? SOLUTION: $4,060.00 as shown in the following calculation. Chapter 12, Exhibit 5a CCH Federal Taxation Basic Principles 19 of 92 Computing Capital Gain Tax—20% Rate SOLUTION: Description Taxable Income (a) Taxable income $29,000 (b) Long-term cap. gain $1,000 (c) = Lesser of: $28,400, or (a) – (b) Ordinary income subject to 15% rate $28,000 (d) = Lesser of: $40,400 (i.e., top 27% Ordinary income subject to 27% rate $0 bracket for single individuals, $68,800, less top 15% bracket, $28,400), or (a) – (b) – (c) (e) = Lesser of: (b), or $28,400 – (c) Tax Rate Tax 15% $3,900.00 27% $0 10% $40.00 20% $120.00 (Lesser of: $28,400, or $28,000 = $29,000 – $1,000) (Lesser of: $40,400, or $0 = $29,000 – $1,000 – $28,000) Long-term capital gain $400 subject to 10% rate (Lesser of: $1,000, or $400 = $28,400 – $28,000) (f) = (b) – (e) Long-term cap. gain subject to 20% rate (g) = (c) + (d) + (e) + (f) Totals Chapter 12, Exhibit 5b $600 ($7,000 – $400) $29,000 CCH Federal Taxation Basic Principles $4,060.00 20 of 92 Computing Capital Gain Tax—20% Rate Conor’s ordinary income is $28,000 ($29,000 – $1,000). According to the rate tables, all of this $28,000 of ordinary income is subject to 10% and 15% ordinary rates. $400.00 of his long-term capital gain is taxed at 10% and $600.00 is taxed at 20%. Based on the computations, Conor must pay $4,060.00 in taxes. Chapter 12, Exhibit 5c CCH Federal Taxation Basic Principles 21 of 92 Tax Treatment for Ordinary Income Property and Capital Assets Tax Treatment Always Ordinary Income Sometimes Ordinary Income, Sometimes Capital Always Capital Patents Franchises, trademarks, trade names Lease cancellation payments received by landlord Lease cancellation payments received by tenant Options Subdivided real estate sold by dealers Subdivided real estate sold by investors Business bad debts Non-business bad debts *(always shortterm, regardless of holding period.) Worthless securities held by dealers Worthless securities held by non-dealers. * (Holding period always ends on last day of tax year in which securities became worthless) Inventory Accounts receivable Chapter 12, Exhibit 6 CCH Federal Taxation Basic Principles 22 of 92 Patents Substantial Rights Gain or loss on sale of patents receives capital treatment if “all substantial rights” have been sold. Otherwise, gain or loss would get ordinary tax treatment. All substantial rights are deemed to have been sold if there are no restrictions regarding: Geographic areas within the country of issuance Time allowed to use the patent Markets or industries in which patent-related products may be sold Products or inventions related to the patent. Chapter 12, Exhibit 7a CCH Federal Taxation Basic Principles 23 of 92 Patents Holding Period Regardless of how brief a patent is held, if it receives capital treatment, the holding period is ALWAYS long-term. Chapter 12, Exhibit 7b CCH Federal Taxation Basic Principles 24 of 92 Patents Contingent Payments Are Ok Patents, unlike franchises, may receive capital treatment, even though the seller's receipt of patent royalties is contingent upon the patent's productivity, use, or disposition. Chapter 12, Exhibit 7c CCH Federal Taxation Basic Principles 25 of 92 Patents Ordinary Treatment for Certain Sellers Authors, composers, and artists who sell their creations ALWAYS must report ordinary income or loss. Code Sec. 1221(3). However, the inventor of a patent may get long-term capital gain treatment if “all substantial rights” have been sold. Chapter 12, Exhibit 7d CCH Federal Taxation Basic Principles 26 of 92 Franchises, Trademarks, and Trade Names To qualify for capital treatment, the seller must (1) transfer all significant rights; and (2) receive noncontingent payments. Chapter 12, Exhibit 8a CCH Federal Taxation Basic Principles 27 of 92 Franchises, Trademarks, and Trade Names Significant Rights “Significant rights” refers to the ability of the seller to make on-going decisions for the buyer, after the franchise, trademark, or trade name has been sold. Chapter 12, Exhibit 8b CCH Federal Taxation Basic Principles 28 of 92 Franchises, Trademarks, and Trade Names Contingent Payments Are Not Ok Franchises, trademarks, and trade names do not receive capital treatment if the seller's receipt of payments is contingent upon productivity, use, or disposition. Chapter 12, Exhibit 8c CCH Federal Taxation Basic Principles 29 of 92 Franchises, Trademarks, or Trade Names Special Rules for Buyers of Franchises, Trademarks, or Trade Names Contingent payments are deductible. Noncontingent payments must be amortized over 15 years. Chapter 12, Exhibit 8d CCH Federal Taxation Basic Principles 30 of 92 Lease Cancellation Payments Landlord. Lease cancellation payments are always ordinary income. Tenant. Lease cancellation payments are either ordinary or capital, depending upon the character of the leased asset. For example, a lease cancellation payment for retail space is ordinary income to the tenant; however, a lease cancellation payment for a principal residence is capital gain to the tenant. Chapter 12, Exhibit 9 CCH Federal Taxation Basic Principles 31 of 92 Options—General Rules Grantor = The maker of an option who receives value in exchange for a contractual obligation to sell or buy at a certain price Chapter 12, Exhibit 10a CCH Federal Taxation Basic Principles 32 of 92 Options—General Rules Grantor’s Tax Treatment If an option expires, the option money received by the grantor is either short-term capital gain or ordinary income, depending on the character of the property. Chapter 12, Exhibit 10b CCH Federal Taxation Basic Principles 33 of 92 Options—General Rules Grantor's tax treatment upon expiration of option to buy or sell Stock and Securities Tax treatment Examples Chapter 12, Exhibit 10c ALWAYS short-term capital gain, regardless of holding period Stock, commodity futures, calls, puts, etc. CCH Federal Taxation Basic Principles Other property ALWAYS ordinary income Land, warehouse, car, computer, etc. 34 of 92 Options—General Rules Grantee = The holder of an option who pays a price for the right to buy or sell at a certain price Chapter 12, Exhibit 10d CCH Federal Taxation Basic Principles 35 of 92 Options—General Rules Grantee’s Tax Treatment If the option is sold, or allowed to expire, the character of the property dictates the tax treatment. If the option is exercised, the option payment is added to the grantee's (if grantee is buyer and grantor is seller), or subtracted from the grantee's amount realized (if grantee is seller and grantor is buyer). Chapter 12, Exhibit 10e CCH Federal Taxation Basic Principles 36 of 92 Options—Example FACTS: On 6/30/x1, George grants Tina a $5,000, 2-year option to buy investment property for $100,000. QUESTION: Consider the tax treatment if the investment property were stocks or land under the 6 alternative assumptions below. Tax treatment Stock and Securities Other Property Alternate Assumptions Grantor Grantee Grantor Grantee 1. Two years later, Tina sells the option to Fred for $3,000. No effect ($2,000) Long-term capital loss No effect ($2,000) Long-term capital loss Chapter 12, Exhibit 11a ($3,000 – $5,000) CCH Federal Taxation Basic Principles ($3,000 – $5,000) 37 of 92 Options—Example Tax treatment Stock and Securities Other Property Alternate Assumptions Grantor Grantee Grantor Grantee 2. Two years later, Tina sells the option to Fred for $8,000. No effect $3,000 Long-term capital gain ($8,000 – $5,000) No effect $3,000 Long-term capital gain ($8,000 – $5,000) Chapter 12, Exhibit 11b CCH Federal Taxation Basic Principles 38 of 92 Options—Example Tax treatment Stock and Securities Other Property Alternate Assumptions Grantor Grantee Grantor Grantee 3. One year later, Tina sells the option to Fred for $8,000. No effect $3,000 Short-term capital gain ($8,000 – $5,000) No effect $3,000 Long-term capital gain ($8,000 – $5,000) Chapter 12, Exhibit 11c CCH Federal Taxation Basic Principles 39 of 92 Options—Example Tax treatment Stock and Securities Alternate Assumptions 4. The option expires on 6/30/x3. Chapter 12, Exhibit 11d Other Property Grantor Grantee Grantor Grantee $5,000 Short-term capital gain ($5,000) Long-term capital loss $5,000 Ordinary income ($5,000) Long-term capital loss CCH Federal Taxation Basic Principles 40 of 92 Options—Example Tax treatment Stock and Securities Other Property Alternate Assumptions Grantor Grantee Grantor Grantee 5. Tina exercises the option on 6/30/x1. $105,000 amount realized $105,000 basis $105,000 amount realized $105,000 basis Chapter 12, Exhibit 11e CCH Federal Taxation Basic Principles 41 of 92 Options—Example Tax treatment Stock and Securities Alternate Assumptions Grantor Grantee 6. Same facts as 5, $95,000 basis $95,000 except Tina is amount realized paying for the option to sell, not buy, the property. Chapter 12, Exhibit 11f Other Property Grantor Grantee $95,000 basis $95,000 amount realized CCH Federal Taxation Basic Principles 42 of 92 Subdivided Real Estate Sold by Investors Qualifying Property To qualify for capital gains treatment, three requirements must be met: 1. The subdivided lots must not have been previously held primarily for sale to customers in the ordinary course of business 2. The subdivided lots have not been “substantially improved” 3. The subdivided lots must be held for at least 5 years Chapter 12, Exhibit 12a CCH Federal Taxation Basic Principles 43 of 92 Subdivided Real Estate Sold by Investors Substantial Improvements Improvements such as infrastructure are substantial if they increase the value of the lots by over 10%. However, certain costs are deemed NEVER to be “substantial improvements.” Examples include: surveying, clearing drainage, and minimum all-weather access roads. Chapter 12, Exhibit 12b CCH Federal Taxation Basic Principles 44 of 92 Subdivided Real Estate Sold by Investors Tax Treatment for the First 5 Lot Sales. Gains on the first 5 lots sold receive capital treatment. Losses are ALWAYS ordinary. Tax Treatment for Gains on Subsequent Lot Sales. Gains receive BOTH capital and ordinary treatment, beginning in the year in which the 6th lot is sold, using the following formula: Tax treatment for GAINS after the fifth lot sale (a) Ordinary treatment (5% SP) – (100% selling exp.) (b) Capital treatment Total gain – (a) Chapter 12, Exhibit 12c CCH Federal Taxation Basic Principles 45 of 92 Worthless Securities Tax Treatment. Generally capital. However, if held by a dealer, then ordinary. Holding Period. The holding period for worthless securities begins on the day after the acquisition date and ends on the LAST DAY OF THE YEAR in which the securities are deemed to be worthless. Example Purchase date Worthless date Holding period beginning date? Holding period end. date? Long-term or Short-term? 12/31/x1 12/31/x2 1/1/x2 12/31/x2 Short-term 12/30/x1 1/1/x2 12/31/x1 12/31/x2 Long term Chapter 12, Exhibit 13 CCH Federal Taxation Basic Principles 46 of 92 Depreciation Recapture—Example 1 Example 1 FACTS: 1. A taxpayer has $2 million of gross income in year 1. 2. The taxpayer purchases a machine for $800,000 and depreciates it for $500,000 in year 1. 3. The machine is sold in year 2 for $1 million. 4. The taxpayer’s capital gains rate is 20%; the ordinary tax rate is 40%. (Actual tax brackets, actual MACRS depreciation computations, and deductions “from” AGI are ignored for purposes of simplifying this illustration.) QUESTION: Compare the results in years 1 and 2 with and without depreciation. Chapter 12, Exhibit 14a CCH Federal Taxation Basic Principles 47 of 92 Depreciation Recapture—Example 1 Year 1 Tax “Benefit” from Depreciation Deduction With Depreciation Gross Income Without Depreciation $2,000 $2,000 $500 $0 $1,500 $2,000 Ordinary Tax Rate 40% 40% Ordinary Income Tax $600 $800 Depreciation, Year 1 Taxable Income Tax Benefit from Depreciation Chapter 12, Exhibit 14b 200 ($800 – $600); or ($500 x 40%) CCH Federal Taxation Basic Principles 48 of 92 Depreciation Recapture—Example 1 Year 2 Tax “Burden” from Depreciation Adjustment to Basis With Without Depreciation Depreciation Sales Price Cost of Machine Less: Accumulated Depreciation Adjusted Basis Realized Gain Capital Gain Tax Rate Capital Gain Tax (Ignoring Depreciation Recapture) Tax Burden From Depreciation, Absent Any Depreciation Recapture Chapter 12, Exhibit 14c $1,000 $1,000 $800 $500 $300 $700 $800 $0 $800 $200 20% $140 20% $40 $100 ($140 – $40); or ($500 x 20%) CCH Federal Taxation Basic Principles 49 of 92 Depreciation Recapture—Example 1 Observation: Overall tax advantage from depreciation if depreciation is not recaptured: $100 ($200 benefit in year 1, minus $100 tax burden in year 2.) Chapter 12, Exhibit 14d CCH Federal Taxation Basic Principles 50 of 92 Depreciation Recapture—Example 2 Rationale for Recapture Rules The foregoing illustration demonstrates how unrecaptured depreciation would create an overall tax advantage—this, despite a reduced basis equivalent to the amount of accumulated depreciation deductions. The overall advantage was eliminated in the early 1960s with the enactment of the depreciation recapture rules. The depreciation recapture rules recharacterize capital gains as ordinary income to the extent of all or a portion of accumulated depreciation. Using the facts from Example 1, the following example shows how the recapture rules work. Chapter 12, Exhibit 15a CCH Federal Taxation Basic Principles 51 of 92 Depreciation Recapture—Example 2 Example 2 Year 2: Sale of the Machinery Sales Price $1,000 Cost of Machine $800 Less: Accumulated Depreciation $500 Adjusted Basis $300 Realized Gain $700 Chapter 12, Exhibit 15b CCH Federal Taxation Basic Principles 52 of 92 Depreciation Recapture—Example 2 With Depreciation Recapture Without Depreciation Recapture Code Sec. 1245 (Ordinary) Code Sec. 1231 (Capital) (Capital) Recharacterized Gain $500 $200 $700 Ordinary/Capital Tax Rates 40% 20% 20% Tax $200 $40 $140 Total Tax Additional taxes attributable to Depreciation Recapture Chapter 12, Exhibit 15c $240 $140 $100 ($240 – $140) CCH Federal Taxation Basic Principles 53 of 92 Depreciation Recapture—Example 2 Observation: The $100 additional taxes offsets the $100 tax advantage that would have resulted if depreciation had not been recaptured. Chapter 12, Exhibit 15d CCH Federal Taxation Basic Principles 54 of 92 Business Asset Dispositions— Template for Problem Solving Category #/Description (1) Gains on all depreciable personal property. Chapter 12, Exhibit 16a Code Sec. 1245 Depreciation Recapture (a) Code Sec. 1250 Depreciation Recapture 38.6% Basket (Always Ordinary Income) 38.6% Basket (Always Ordinary Income) Lesser of: 1. Accumulated depreciation, or 2. Realized gain. N/A Code Sec. 1231 Gain/Loss (Send to 2nd Netting) (b) (c) (d) 25% Basket 20% Basket (for (for any unrecaptured remaining gain or Code Sec. 1250 any loss) Gain) N/A [Realized gain – (a)] CCH Federal Taxation Basic Principles 55 of 92 Business Asset Dispositions— Template for Problem Solving Category #/Description Code Sec. 1245 Depreciation Recapture Code Sec. 1250 Depreciation Recapture (a) (b) 38.6% Basket (Always Ordinary Income) Code Sec. 1231 Gain/Loss (Send to 2nd Netting) (c) 38.6% Basket 25% Basket (For (Always Ordinary unrecaptured Income) Sec. 1250 Gain) (2) Gains on nonresidential real property acquired 1981-1986, with ACRS depreciation. Chapter 12, Exhibit 16b Lesser of: 1. Accumulated depreciation, or 2. Realized gain. N/A CCH Federal Taxation Basic Principles N/A (d) 20% Basket (For any remaining gain or any loss) [Realized gain – (a)] 56 of 92 Business Asset Dispositions— Template for Problem Solving Category #/Description (3) Gains on residential and nonresidential real property acquired after 1986. Code Sec. 1245 Depreciation Recapture (a) Code Sec. 1250 Depreciation Recapture Code Sec. 1231 Gain/Loss (Send to 2nd Netting) (b) (c) (d) 38.6% Basket (Always Ordinary Income) 38.6% Basket (Always Ordinary Income) 25% Basket (For unrecaptured Code Sec. 1250 Gain) 20% Basket (For any remaining gain or any loss) N/A Lesser of: 1. Actual accumulated depreciation – straightline accumulated depreciation,* or 2. Realized gain Lesser of: 1. Straight-line accumulated depreciation 2. Realized gain – (b) [Realized gain – (b) – (c)] [Note that (b) = 0] * (always 0 for individuals since actual accumulated depreciation = straight-line accumulated depreciation) Chapter 12, Exhibit 16c CCH Federal Taxation Basic Principles 57 of 92 Business Asset Dispositions— Template for Problem Solving Category #/Description (4) Gains on residential real property acquired 19811986, with ACRS depreciation. Chapter 12, Exhibit 16d Code Sec. 1245 Depreciation Recapture Code Sec. 1250 Depreciation Recapture (a) (b) 38.6% Basket (Always Ordinary Income) 38.6% Basket (Always Ordinary Income) N/A Lesser of: 1.Actual accumulated depreciation – straightline accumulated depreciation; or 2. Realized gain Code Sec. 1231 Gain/Loss (Send to 2nd Netting) (c) (d) 25% Basket 20% Basket (For (For any unrecaptured remaining gain or Code Sec. any loss) 1250 Gain) Lesser of: [Real gain – (b) – 1. Straight-line (c)] accumulated depreciation 2. Realized gain – (b) CCH Federal Taxation Basic Principles 58 of 92 Business Asset Dispositions— Template for Problem Solving Code Sec. 1245 Depreciation Recapture (a) Category #/Description (5) Gains on non-residential real property acquired 19811986, with straight-line depreciation. Chapter 12, Exhibit 16e 38.6% Basket (Always Ordinary Income) N/A Code Sec. 1250 Depreciation Recapture (b) Code Sec. 1231 Gain/Loss (Send to 2nd Netting) (c) (d) 25% Basket 20% Basket (For unrecaptured (For any remaining Code Sec. 1250 gain or any loss) Gain) Lesser of: Lesser of: [Real gain – (b) – 1. Actual accumulated 1. Straight-line (c)] depreciation – accumulated [Note that (b) = 0] straight-line depreciation accumulated 2. Realized gain – depreciation; or (b). 2. Realized gain 38.6% Basket (Always Ordinary Income) CCH Federal Taxation Basic Principles 59 of 92 Business Asset Dispositions— Template for Problem Solving Code Sec. 1245 Code Sec. 1250 Depreciation Depreciation Recapture Recapture (a) (b) Category #/Description (6) Gains on amortizable personal property used in business (e.g., patents, copyrights, leaseholds). Chapter 12, Exhibit 16f Code Sec. 1231 Gain/Loss (Send to 2nd Netting) (c) (d) 20% Basket (For any remaining gain or any loss) 38.6% Basket (Always Ordinary Income) 38.6% Basket (Always Ordinary Income) 25% Basket (For unrecaptured Code Sec. 1250 Gain) Lesser of: 1. Accumulated amortization or 2. Realized gain N/A N/A CCH Federal Taxation Basic Principles [Real gain – (a)] 60 of 92 Business Asset Dispositions— Template for Problem Solving Category #/Description (7) All losses on any longterm business assets. Chapter 12, Exhibit 16g Code Sec. 1245 Depreciation Recapture Code Sec. 1250 Depreciation Recapture (a) (b) 38.6% Basket (Always Ordinary Income) 38.6% Basket (Always Ordinary Income) N/A N/A Code Sec. 1231 Gain/Loss (Send to 2nd Netting) (c) (d) 25% Basket 20% Basket (For (For any unrecaptured remaining gain or Code Sec. 1250 any loss) Gain) CCH Federal Taxation Basic Principles N/A 100% losses are Code Sec. 1231. 61 of 92 Business Asset Dispositions— Template for Problem Solving Category #/Description (8) G/L on sale of shortterm business assets. Chapter 12, Exhibit 16h Code Sec. 1245 Depreciation Recapture Code Sec. 1250 Depreciation Recapture (a) (b) 38.6% Basket (Always Ordinary Income) 38.6% Basket (Always Ordinary Income) Code Sec. 1231 Gain/Loss (Send to 2nd Netting) (c) (d) 25% Basket 20% Basket (For (For any unrecaptured remaining gain or Code Sec. 1250 any loss) Gain) 100% ordinary. (Short-term gains or losses on business property are neither Code Sec. 1231, 1245, nor 1250.) CCH Federal Taxation Basic Principles 62 of 92 Business Asset Dispositions—Example 1 FACTS: David, a 38.6% taxpayer, purchases a building in 1988 for $390,000. He takes $90,000 of depreciation using the straight-line method. On October 15, 20x1, he sells the building for $440,000. QUESTION: How much taxes are attributable to the sale? Chapter 12, Exhibit 17a CCH Federal Taxation Basic Principles 63 of 92 Business Asset Dispositions—Example 1 Computation of Taxes on Code Sec. 1250 and Code Sec. 1231 Gains Code Sec. 1245 Depreciation Recapture Code Sec. 1250 Depreciation Recapture (a) (b) (c) 38.6% Basket (Always Ordinary Income) 25% Basket (for unrecaptured Code Sec. 1250 Gain) 20% Basket (for any remaining gain or any loss) Lesser of: 1. Actual accumulated depreciation – straightline accumulated depreciation,* or 2. Realized gain Lesser of: 1. Straight-line accumulated depreciation 2. Realized gain – [Realized gain – (b) – (c)] Category #/ Type of Gain # 3/Gains on residential and non-residential real property acquired after 1986. N/A Code Sec. 1231 Gain/Loss (Sent to 2nd Netting) (d) [Note that (b) = 0] (b). * (always 0 for individuals since actual accumulated depreciation = straight-line accumulated depreciation) Chapter 12, Exhibit 17b CCH Federal Taxation Basic Principles 64 of 92 Business Asset Dispositions—Example 1 Computation of Taxes on Code Sec. 1250 and Code Sec. 1231 Gains Category #/ Type of Gain Computation of realized gain: Sale Price…. ……...$440,000 Cost ……….………$390,000 Straight-line depr...... $90,000 Adjusted basis……..$300,000 Realized gain……...$140,000 Tax rates Tax amount ($32,500 total) Chapter 12, Exhibit 17c Code Sec. 1245 Depreciation Recapture Code Sec. 1250 Depreciation Recapture (a) (b) (c) (d) 38.6% Basket (Always Ordinary Income) 25% Basket (for unrecaptured Code Sec. 1250 Gain) 20% Basket (for any remaining gain or any loss) $0 The lesser of : 1. 0 = $90,000 – $90,000 2. $140,000 Code Sec. 1231 Gain/Loss (Sent to 2nd Netting) $90,000 Lesser of 1. $90,000, or 2. $140,000 – 0 $50,000 [$140,000 – 0 – $90,000] 38.6% 25% 20% 0 $22,500 $10,000 CCH Federal Taxation Basic Principles 65 of 92 Business Asset Dispositions—Example 2 FACTS: Conor, a 38.6% taxpayer, purchased an apartment building in 1986 for $390,000. He had taken $99,000 of ACRS depreciation. Straight-line depreciation would have been $90,000. On October 15, 19x1, he sells the building for $440,000. QUESTION: What are his taxes on the transaction? Chapter 12, Exhibit 18a CCH Federal Taxation Basic Principles 66 of 92 Business Asset Dispositions—Example 2 Computation of Taxes on Code Sec. 1250 and Code Sec. 1231 Gains Code Sec. 1245 Depreciation Recapture Code Sec. 1250 Depreciation Recapture (a) (b) Category #/ Type of Gain # 4 /Gains on residential real property acquired 1981-1986, with ACRS depreciation. Chapter 12, Exhibit 18b 38.6% Basket (Always Ordinary Income) N/A Lesser of: 1. Actual accumulated depreciation – straightline accumulated depreciation; or 2. Realized gain CCH Federal Taxation Basic Principles Code Sec. 1231 Gain/Loss (Send to 2nd Netting) (c) 25% Basket (For unrecaptured Code Sec. 1250 Gain) Lesser of: 1. Straight-line accumulated depreciation 2. Realized gain – (b). (d) 20% Basket (For any remaining gain or any loss) [Real gain – (b) – (c)] 67 of 92 Business Asset Dispositions—Example 2 Computation of Taxes on Code Sec. 1250 and Code Sec. 1231 Gains Code Sec. 1250 Code Sec. Depreciation 1245 Recapture Depreciation Recapture (a) Code Sec. 1231 Gain/Loss (Send to 2nd Netting) (b) (c) (d) Category #/ Type of Gain 38.6% Basket (Always Ordinary Income) Computation of realized gain: Sale Price…….....…$440,000 Cost ………….....…$390,000 ACRS depr................ $99,000 Adjusted basis .. ......$291,000 Realized gain …......$149,000 $9,000 The lesser of : 1. $9,000 = $99,000 – $90,000 2. $149,000 25% Basket (For unrecaptured Code Sec. 1250 Gain) $90,000 Lesser of 1. $90,000, or 2. $149,000 – $9,000 20% Basket (For any remaining gain or any loss) $50,000 [$149,000 – $9,000 – $90,000] Rate baskets 38.6% 25% 20% Tax amount ($36,064 total) $3,474 $22,500 $10,000 Chapter 12, Exhibit 18c CCH Federal Taxation Basic Principles 68 of 92 The First Netting—Capital Gains and Losses Offset Gains and Losses Within Each Basket Offset capital gains and losses within each basket (i.e., the 10%, 15%, 20%, and 28% baskets). (The 25% basket is not listed here because it holds only gains, never losses. Why no losses? Because the 25% basket applies only to that portion of Code Sec. 1231 gain attributable to unrecaptured Code Sec. 1250 depreciation.) Chapter 12, Exhibit 19a CCH Federal Taxation Basic Principles 69 of 92 The First Netting—Capital Gains and Losses Offset Gains and Losses from Separate Baskets If, after step 1, there are opposites (i.e., one or more baskets has a net gain and one or more a net loss), then the gains and losses must be further offset. The pecking order in selecting “net gain” and “net loss” baskets to offset is as follows. Chapter 12, Exhibit 19b CCH Federal Taxation Basic Principles 70 of 92 The First Netting—Capital Gains and Losses Pecking Order of Baskets Selected For The First Netting “Net gain baskets” to be offset against “net Start with short-term capital gains (might loss baskets” be as high as the 38.6% bracket), then long-term capital gains beginning with the highest-rate baskets holding net gains (i.e., 28%, then 20%, then 15%, then 10%). “Net loss baskets” to be offset against “net Start with short-term capital losses (might gain baskets” be as high as the 38.6% bracket), then long-term capital losses beginning with the highest-rate baskets holding net losses (i.e., 28%, then 20%, then 15%, then 10%). Chapter 12, Exhibit 19c CCH Federal Taxation Basic Principles 71 of 92 The First Netting—Example 1 FACTS: Fred reports the following gains and losses: Holding Period Basket Amount Long-Term 15% $2,000 gain Long-Term 20% $7,000 gain; ($4,000) loss Long-Term 28% $1,000 gain Short-Term 38.6% $4,000 gain; ($7,000) loss QUESTION: How is the first netting performed? Chapter 12, Exhibit 20a CCH Federal Taxation Basic Principles 72 of 92 The First Netting—Example 1 Two-Step Solution STEP 1: Offset Gains and Losses Within Each Basket Basket Result after 1st Netting 15% Net Amount Within Each Basket $2,000 gain $2,000 LTCG at 15%* 20% $3,000 net gain $1,000 LTCG at 20%* 28% $1,000 gain $0 38.6% ($3,000) net loss $0 * These rates are only relevant if the Long-Term Capital Gains survive the 2nd netting. Chapter 12, Exhibit 20b CCH Federal Taxation Basic Principles 73 of 92 The First Netting—Example 1 Two-Step Solution STEP 2: Offset Gains and Losses From Separate Baskets The $3,000 net loss from the 38.6% basket is first used to offset the $1,000 gain from the 28% basket; then $2,000 of the $3,000 net gain from the 20% basket. The result of the 1st netting is a $1,000 long-term capital gain subject to a 20% rate and a $2,000 long-term capital gain subject to a 15% rate (if they survive the second netting). Chapter 12, Exhibit 20c CCH Federal Taxation Basic Principles 74 of 92 The First Netting—Example 2 FACTS: Wilma reports the following gains and losses: Holding Period Basket Amount Long-Term 10% ($6,000) loss Long-Term 20% $4,000 gain; ($7,000) loss Long-Term 28% $4,000 gain Short-Term 38.6% $7,000 gain; ($3,000) loss QUESTION: How is the first netting performed? Chapter 12, Exhibit 21a CCH Federal Taxation Basic Principles 75 of 92 The First Netting—Example 2 Two-Step Solution STEP 1: Offset Gains and Losses Within Each Basket Basket Result after 1st Netting 10% Net Amount Within Each Basket ($6,000) loss 20% 28% ($3,000) net loss $4,000 gain ($1,000) long-term capital loss subject to ordinary loss treatment if it survives the second netting 0 net loss 0 net gain 38.6% $4,000 net gain 0 net gain Chapter 12, Exhibit 21b CCH Federal Taxation Basic Principles 76 of 92 The First Netting—Example 2 Two-Step Solution STEP 2: Offset Gains and Losses From Separate Baskets The $4,000 net gain from the 38.6% basket is first netted against the ($3,000) loss from the 20% basket, then against ($1,000) of the ($6,000) loss from the 10% basket. Next, the $4,000 gain from the 28% basket is netted against ($4,000) of the remaining ($5,000) loss from the 10% basket. The result of the 1st netting is a ($1,000) long-term capital loss within the 10% basket. This long-term capital loss, as with all long- and short-term capital losses not exceeding $3,000, is treated as an ordinary loss if it survives the 2nd netting. Chapter 12, Exhibit 21c CCH Federal Taxation Basic Principles 77 of 92 The First Netting—Personal-Use Casualty/Theft Gains/Losses Combine casualty/theft gains and losses less $100 per event, on personal-use property. If a net gain, both gains and losses are capital. Transfer the net gain to the second netting. Recall that the losses had been reduced by $100 per event but NOT by the 10% AGI floor. If a net loss, the net amount is treated as an ordinary itemized deduction, having been reduced by $100 per event AND to be further reduced by the 10% AGI floor. (No need to transfer to the second netting; rather, report on Schedule A.) Chapter 12, Exhibit 22 CCH Federal Taxation Basic Principles 78 of 92 The First Netting—Business/Investment Use Casualty/Theft Gains/Losses Combine casualty/theft gains and losses on business and PI property held long-term. (If the holding period is short-term, the gain or losses get ordinary treatment and are NOT part of the netting process.) If a net gain, then treat the net amount as a Code Sec. 1231 gain and transfer it to the second netting. If a net loss, then treat the net amount as an ordinary deduction for AGI. (No need to transfer to the second netting; rather, report on Schedule C.) Chapter 12, Exhibit 23 CCH Federal Taxation Basic Principles 79 of 92 The First Netting—Personal-Use Condemnation Gains/Losses Long-term gains receive capital treatment; short-term gains receive ordinary treatment; losses are not deductible. Transfer any personal-use condemnation long-term gains to the second netting. Chapter 12, Exhibit 24 CCH Federal Taxation Basic Principles 80 of 92 The First Netting—Business/Investment-Use Condemnation Gains/Losses Long-term gains and losses BOTH get Code Sec. 1231 treatment. (Code Sec. 1231 gains get capital tax rates; Code Sec. 1231 losses are deductible at ordinary tax rates. Also, note the difference in tax treatment for (1) business/investment casualty/theft net losses and (2) business/investment condemnation losses. Transfer the Code Sec. 1231 condemnation gains and losses to the second netting.) Chapter 12, Exhibit 25 CCH Federal Taxation Basic Principles 81 of 92 The First Netting—Long-Term Business Assets Upon the sale of a long-term business asset, any gain remaining after Code Sec. 1245 or Code Sec. 1250 depreciation recapture is a Code Sec. 1231 gain. Any loss is a Code Sec. 1231 loss. Transfer both Code Sec. 1231 gains and losses to the second netting. (Note that gains or losses on the sale of short-term business assets are always ordinary. No need to transfer to the second netting.) Chapter 12, Exhibit 26 CCH Federal Taxation Basic Principles 82 of 92 The First Netting—Recap Capital Gains and Losses Code Sec. 1231 Description 10% 20% 25% Capital gains & losses Personal casualty net gain 15% 20% 28% Net gain “38.6%” Gains or losses Net gain Net losses, from AGI, reduced $100 per event & 10% AGI (if net loss) Net losses, for AGI Net gain Personal-use condemnation gains & losses Net totals for 2nd Netting 10% Short-term Gains or losses Bus./inv. Casualty net gain Bus./inv. Condemnation G/L L-T business asset G/L Long-term (This column is not part of the netting process.) Always Ordinary Income Gains (losses not deductible) Gains (losses not deductible) Gains and losses Code Sec. 1245 and 1250 recaptured as ordinary income Gains, net of depr. Recap.; losses Net Gain or Loss 10% Chapter 12, Exhibit 27 20% 25% Net Gain or Loss 10% 15% 20% Net gain or loss “38.6%” 28% CCH Federal Taxation Basic Principles N/A for netting 83 of 92 The Second Netting—Examples QUESTION: For each independent set of gains and losses below, determine the tax treatment after the second netting. Rate Basket for Rate Basket for Capital Gains and Losses Code Sec. 1231 G/L’s Problem #1 Gains (Losses) Solution Long-Term Short-Term 20% 25% 20% 28% ($7,000) $3,000 $7,000 ($3,000) ($4,000), i.e., ($3,000) is offset against the “25% Code Sec. 1231 basket” (Code Sec. 1231 losses may not be offset against capital gains) Chapter 12, Exhibit 28a $4,000, i.e., $3,000 offsets the “28% LTCL basket” (Capital gains may not be offset against Code Sec. 1231 losses) CCH Federal Taxation Basic Principles 84 of 92 The Second Netting—Examples QUESTION: For each independent set of gains and losses below, determine the tax treatment after the second netting. Rate Basket for Rate Basket for Capital Gains and Losses Code Sec. 1231 G/L’s Long-Term Short-Term Problem #2 20% 25% 20% 28% Gains (Losses) ($7,000) $3,000 ($18,000) $3,000 Solution ($4,000) ordinary loss deduction 0 0 Chapter 12, Exhibit 28b CCH Federal Taxation Basic Principles $21,000 $6,000 net STCG, taxed at ordinary rate 85 of 92 The Second Netting—Examples QUESTION: For each independent set of gains and losses below, determine the tax treatment after the second netting. Rate Basket for Rate Basket for Capital Gains and Losses Code Sec. 1231 G/L’s Long-Term Short-Term Problem #3 20% 25% 20% 28% Gains (Losses) ($7,000) $3,000 $19,000 $3,000 Solution ($4,000) ordinary loss deduction 0 0 0 Chapter 12, Exhibit 28c CCH Federal Taxation Basic Principles ($27,000) ($3,000) ordin. loss deduction; ($2,000) STCL carryover 86 of 92 The Second Netting—Examples QUESTION: For each independent set of gains and losses below, determine the tax treatment after the second netting. Rate Basket for Rate Basket for Capital Gains and Losses Code Sec. 1231 G/L’s Long-Term Short-Term Problem #4 20% 25% 20% 28% Gains (Losses) $7,000 ($3,000) $18,000 ($3,000) ($21,000) Solution 0 (Code Sec. 1231 gains offset capital losses, first from the highest LTCL basket, then from STCLs!) 0 0 0 ($2,000) ordinary loss deduction ($21,000 - $19,000) ($19,000 = $18,000 + $4,000 - $3,000) Chapter 12, Exhibit 28d CCH Federal Taxation Basic Principles 87 of 92 The Second Netting—Recap of the Rules To complete the second netting, follow these steps: 1. Net each category by totaling the columns. 2. If the long-term capital column still shows a gain after offsetting any net shortterm capital losses (STCLs) treat the net amount as a net long-term capital gain (LTCG) subject to a maximum 10%, 15%, 20%, or 28% tax rate, depending on which basket survives the netting. 3. If the short-term capital column still shows a gain after offsetting any net LTCLs, treat the net amount as a net STCG subject to the ordinary marginal tax rate. 4. If the Code Sec. 1231 column total shows a net loss, treat the net amount as an ordinary loss, deductible for AGI, without the $3,000 limitation. Do not offset it against net long-term or short-term capital gains. 5. If the Code Sec. 1231 column total shows a net gain: Treat as ordinary income to the extent of Code Sec. 1231 net losses for the previous five years that have not been recaptured. (Refer to the example regarding 5-Year Look-Back Rules in the following slide.) Chapter 12, Exhibit 29a CCH Federal Taxation Basic Principles 88 of 92 The Second Netting—Recap of the Rules Example on the 5-Year Look-Back Rules QUESTION: Given the following facts, how much of the Code Sec. 1231 gains in 20x3 and 20x6 should be recharacterized as ordinary income? 20x1 20x2 20x3 20x4 20x5 20x6 Code Sec. 1231 G/L before (10,000) (20,000) 40,000 (10,000) (30,000) 50,000 look-back Recharacterized as ordinary income 10,000 20,000 30,000 10,000 30,000 40,000 Surviving Code Sec. 1231 10,000 10,000 gain treated as L-T capital gain (b) If any Code Sec. 1231 gain survives, offset it against any net LTCLs, starting with the highest baskets containing LTCLs. (c) If a Code Sec. 1231 gain still survives, offset it against any net STCLs. (d) If yet a Code Sec. 1231 gain survives, treat it as a long-term capital gain, subject to a maximum 25% tax rate. Chapter 12, Exhibit 29b CCH Federal Taxation Basic Principles 89 of 92 The Second Netting—Recap of the Rules If LTCLs or STCLs survive after netting with Code Sec. 1231 gains, first treat STCLs as ordinary losses, limited to $3,000. If any part of the $3,000 remains, treat any LTCLs as ordinary to the extent of the remainder (starting with the highest basket). Unused STCLs and LTCLs are carried forward indefinitely. Chapter 12, Exhibit 29c CCH Federal Taxation Basic Principles 90 of 92 Applying the $3,000 Capital Loss Limitation Only $3,000 may be deducted each year for the aggregate of “net” short-term and “net” long-term capital losses. Short-term capital losses (STCLs) are used up first, then long-term capital losses (LTCLs) beginning with the highest LTCL “baskets.” Note that STCLs and LTCLs get “ordinary” treatment to the extent of the $3,000 deduction noted above. Any remaining capital losses (i.e., in excess of $3,000) are carried over. However, also note that STCLs and LTCLs on the sale of personal use property such as a principal residence or a car used for commuting, are NEVER deductible, and NEVER carried forward! Chapter 12, Exhibit 30a CCH Federal Taxation Basic Principles 91 of 92 Applying the $3,000 Capital Loss Limitation Pecking Order of Loss “Baskets” Deductible against ordinary income, limited to: (a) Short-Term Capital Losses $3,000 (b) LTCLs, 28% Basket $3,000 – (a) (c) LTCLs, 20% Basket $3,000 – (a) – (b) (d) LTCLs, 15% Basket $3,000 – (a) – (b) – (c) (e) LTCLs, 10% Basket $3,000 – (a) – (b) – (c) – (d) Note that there is no 25% basket for losses since this basket applies only to the portion of Code Sec. 1231 gain attributable to unrecaptured Code Sec. 1250 depreciation. Chapter 12, Exhibit 30b CCH Federal Taxation Basic Principles 92 of 92