Corporate Tax Suite II

CCH

®

Intelli Connect

®

Faster Answers, Better Results ®

Corporate Tax Suite II

Get Comprehensive, Up-to-Date Tax Answers to Your

Most Complex Tax Compliance Questions

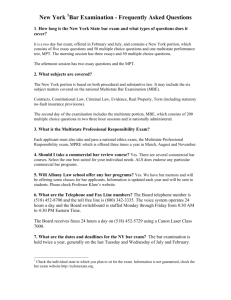

Wolters Kluwer’s premier Corporate Tax Suite II provides the world-class tools and solutions to help you find fast, accurate answers to your most complex federal and state tax compliance questions. This comprehensive library gives you expert guidance, authoritative content, news and productivity tools for all of your tax preparation and compliance needs.

Authoritative Content

z

Tax Legislation — Stay up to date on the latest tax legislation developments with our thorough and comprehensive coverage.

z

Primary Source Information — Includes IRC, IRS Rulings and

Documents, IRS Pubs, United States Tax Cases, Federal Tax

Regulations, Tax Court Memorandum, and much more.

Explanatory Material

z U.S. Master Tax Guide ® — Provides helpful and practical guidance on today’s federal tax law. It contains timely and precise explanations of federal income taxes for individuals, partnerships, corporations, estates and trusts, as well as new rules established by key court decisions and the IRS.

z

Tax Research Consultant — Supplies you with a practical, real-world focus on income, estate, gift, excise and Social

Security tax laws and the important issues you face every day.

z

Standard Federal Tax Reporter — Contains the most comprehensive, up-to-date federal income tax law content, including full text of federal administrative rulings and documents. z State Tax Reporters — Ties together detailed explanations, primary source materials and practical guidance to provide complete and definitive answers that help you plan tax strategies and resolve complex tax issues in every state.

z State Tax Guide — Gives you quick facts on the taxes levied in every state. This all-in-one guide provides summaries of various tax law topics, organized by tax type and by state, so you can quickly find answers to all of your everyday questions and assess the cost of doing business in each state. z

Multistate Corporate Tax Guide — Provides quick access to each state’s statement of its position on pertinent issues in corporate sales and use taxation, in an easy-to-ready chart format.

z Multistate Corporate Income Tax Guide — Includes the most comprehensive, timely and accurate income-based research available for the 47 states that have income-based taxes.

z Multistate Property Tax Guide — Offers comprehensive information on how to control real and personal state property taxes and make cost-effective planning decisions. It includes each state’s property tax guidelines — with all applicable statutes, regulations, cases, administrative rulings and releases.

z

Business Incentives Guide — Allows you to identify and track state tax incentives for businesses and credits, such as investment credits, job training, enterprise or revitalization zones, manufacturing-processing, agricultural, technology and pollution control, in all 50 states and the District of Columbia.

z

Accounting for Uncertain Tax Positions (FIN 48)

Manager — Provides guidance on the application of Financial

Accounting Standards Board (FASB) Accounting Standards

Codification Topic 740, Income Taxes. It also addresses income tax-related paragraphs in certain other Codification topics, including Topic 805, Business Combinations, and Topic 980,

Regulated Operations.

z Partnership Tax Planning and Practice — Contains all of the information you need to conduct federal tax planning and accounting for partnership and other pass-through entities, including up-to-date, comprehensive coverage of tax issues, with partnership tax planning and practice ideas integrated throughout the explanations.

Corporate Tax Suite II

Current News and Trends

z Tracker News — This customized daily news service is delivered to you via email or your own personalized news Web page.

z Federal Tax Weekly — Gives you timely insight on current federal tax developments.

z

Federal and State Tax Day z

TAXES — The Tax Magazine insightful analysis of current tax issues, trends and legislative developments.

® — Comprehensive and z Advance Release Documents z State Tax Review ® — Keeps you up to date on state tax news and state tax law developments for all 50 states.

z

Multistate Guide to Pass-Through Entities — An authoritative reference tool for corporate tax departments and other practitioners who need accurate, timely information concerning the operation of multistate or single-state S corporations, partnerships, LLCs, and more.

z

Distinctions Between Unitary and Nonunitary Business

A Practical Guide, by Jeffrey M. Vesely, JD, and Kerne H.O.

Matsubara, JD.

— z Equipment Leasing

Considerations , by John Amato, JD, and Donna

Fiammetta, CPA.

— State Income and Franchise Tax z Unclaimed Property — Laws, Compliance and Enforcement by Anthony L. Andreoli and J. Brooke Spotswood.

, z

Journal of Pass-Through Entities — Offers unparalleled expert analyses, proven strategies and practical insights that focus on issues affecting all forms of pass-through entities — partnerships, S corporations and LLCs — so you can dissect all the issues, compare and contrast alternatives, advantages and disadvantages, and make the best planning decisions.

z

Journal of State Taxation — The oldest and leading publication of its kind, providing guidance, information and creative tax planning strategies necessary for tackling problems involving state taxation, with comprehensive multistate taxation articles and charts and tables to simplify your research.

Productivity Tools and CCH

®

SmartCharts

z

Multistate Quick Answer SmartCharts — Gives you a fast way to check a rate, exemption, taxability or other state tax issue without having to navigate through laws, regulations, cases and rulings to get the information you need.

z State Tax SmartCharts — Provides quick links to in-depth state explanations, laws and regulations in a convenient, easy-to-read chart format. z Federal and State CCH ® IntelliForms ® — Includes over 20,000 forms and instructions, such as sales and use tax forms.

z

CCH ® Sales Tax RADAR Rates — Helps prevent costly errors in tax rate and calculation determinations. Search features for

Rates and Administration, Rate Changes and Rate Directory to ensure you are current and accurate.

z

Federal Sales Tax Deduction Toolkit tax deductions by the taxpayer’s state and compares them to the actual receipt method.

— Calculates new sales z Depreciation Toolkit schedule for any business asset and provides information on depreciation options.

— Helps you quickly create a depreciation z Business and Tax Prep Toolkit and tax computations.

— Provides common business z

Interactive Tax Calendar — Creates a customized calendar of federal and state tax due dates for specified tax types and jurisdictions, along with filing instructions.

Handbooks

z

U.S. Master ™ Depreciation Guide — Offers a one-stop resource for guidance in understanding and applying the complex depreciation rules to your fixed assets.

z

U.S. Master ™ GAAP Guide accounting and disclosure problems, with new insights into

U.S. GAAP standards.

— Helps you solve many complex z Social Security Benefits Explained — Provides a detailed explanation of the federal old-age, survivors and disability insurance programs under the Social Security Act.

For More Information

CCHGroup.com

888-CCH-REPS

(888-224-7377)

All trademarks and copyrights are property of their respective owners.

11/15 2014-0482-79

Join us on at CCHGroup.com/Social

© 2015 CCH Incorporated and its affiliates.

All rights reserved.