Learning Objectives

LO7

Record an entry to receive cash on deferred

revenue.

LO8

Calculate the amount and record the entry

for deferred revenue when earned.

LO9

Record an entry to pay cash on a deferred

expense.

LO10 Calculate the amount and record the entry

for a deferred expense when incurred.

© 2014 Cengage Learning. All Rights Reserved.

Lesson 21-2

Recording Revenue Received in Advance

LO7

● Cash received for goods or services which

have not yet been provided is called deferred

revenue.

● Deferred revenue is sometimes called unearned

revenue.

© 2014 Cengage Learning. All Rights Reserved.

SLIDE 2

Lesson 21-2

Recording Revenue Received in Advance

Unearned Rent Income

November 1. Received cash for

three months’ rent in advance,

$4,500.00. Receipt No. 905.

Debit

Decreases

Nov. 1

Credit

Increases

Cash

4,500.00

Unearned Rent Income

Nov. 1

Credit Unearned Rent Income

LO7

2

© 2014 Cengage Learning. All Rights Reserved.

4,500.00

Debit Cash 1

SLIDE 3

Lesson 21-2

Recording Adjusting Entry for Deferred

Revenue Earned

LO8

Rent Income

Total Rent

Number of

÷

=

Received

Months

$4,500.00 ÷

Rent per

Month

3

Rent per

Month

= $1,500.00

Number of

Amount of

×

=

Months

Adjustment

$1,500.00 ×

2

Debit

Decreases

Unearned Rent Income

3,000.00 Nov. 1

(New Bal.

Dec. 31 Adj.

= $3,000.00

Debit Unearned Rent Income

Credit

Increases

Rent Income

Dec. 31 Adj.

1

© 2014 Cengage Learning. All Rights Reserved.

4,500.00

1,500.00)

3,000.00

2 Credit Rent Income

SLIDE 4

Lesson 21-2

Recording an Expense Paid in Advance

LO9

● Payments for goods or services which have

not yet been received are called deferred

expenses.

© 2014 Cengage Learning. All Rights Reserved.

SLIDE 5

Lesson 21-2

Recording an Expense Paid in Advance

Prepaid Rent

November 1. Paid cash for

three months’ rent in advance,

$4,500.00. Check No. 231.

Credit

Decreases

Debit

Increases

Nov. 1

Prepaid Rent

4,500.00

Cash

Nov. 1

Debit Prepaid Rent

LO9

1

© 2014 Cengage Learning. All Rights Reserved.

Credit Cash

4,500.00

2

SLIDE 6

Lesson 21-2

Recording Adjusting Entry for Deferred

Expenses Incurred

Total Rent

Number of

÷

=

Paid

Months

$4,500.00 ÷

Rent per

Month

×

$1,500.00 ×

3

Dec. 31 Adj.

Rent Expense

3,000.00

= $1,500.00

Months

Incurred

2

Rent per

Month

LO10

Amount of

=

Nov. 1

Adjustment

(New Bal.

Prepaid Rent

Dec. 31 Adj.

4,500.00

1,500.00)

3,000.00

= $3,000.00

Debit Rent Expense 1

Credit Prepaid Rent 2

© 2014 Cengage Learning. All Rights Reserved.

SLIDE 7

Lesson 21-2

Analyzing Deferrals

LO10

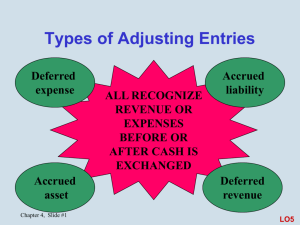

● The adjusting entries for deferred revenue and

deferred expenses must be recorded at the end

of a fiscal period in order for the financial

statements to be accurate.

● Each entry for a deferral affects a balance sheet

account and an income statement account.

● If a deferral entry is not recorded, both the

balance sheet and the income statement will be

incorrect.

© 2014 Cengage Learning. All Rights Reserved.

SLIDE 8

Lesson 21-2

Lesson 21-2 Audit Your Understanding

1. When a business receives cash for services

that will be performed in the future, what

type of account is credited?

ANSWER

A liability account

© 2014 Cengage Learning. All Rights Reserved.

SLIDE 9

Lesson 21-2

Lesson 21-2 Audit Your Understanding

2. The adjusting entry for deferred expenses

that have now been incurred includes a debit

to what type of account?

ANSWER

An expense account

© 2014 Cengage Learning. All Rights Reserved.

SLIDE 10