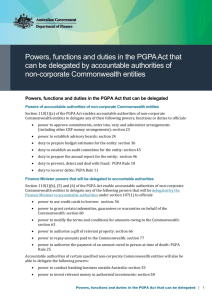

managing risk and internal accountability

advertisement