Nike Inc - Limitless Vision

advertisement

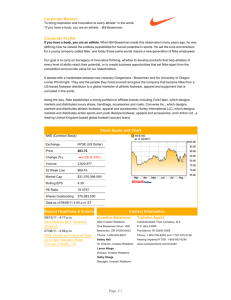

VOLUME 1 ISSUE 1 Nike Inc 19 Feb 2013 Business Overview Inside This Issue 1 Business Overview 2 Industry Overview 3 Competitive Landscape 4 Financial Highlights 5 Valuation 6 Recommendation 7 Appendix 8 References Incorporated in 1968, the principal business activity of the company is the design, development and worldwide marketing and selling of footwear, apparel, equipment and accessory products. NIKE is the largest seller of athletic footwear and athletic apparel in the world. The company sells its products to retail accounts, through NIKE-owned retail stores and internet sales in over 170 countries around the world. Virtually all of the company’s products are manufactured by independent contractors. Virtually all footwear and apparel products are produced outside the United States, while equipment products are produced both in the United States and abroad. Industry Overview The company belongs to the Consumer Cyclical sector and Apparel, Footwear and Accessories Industry. Companies in this industry manufacture and sell shoes and accessories. Apparel and footwear industries are often segregated however companies operating in this line often sell products to both categories. These industries serve two types of consumers: for the practical consumer, they provide sensible and affordable clothing whose styles will not change drastically from year to year, and for the fashion-conscious consumer. Because many of the goods that these companies produce are nonessential in nature, this industry's performance is highly correlated to the economy. During economic downturns, consumers have less discretionary income and will buy fewer goods from these companies The industry has witnessed a major downsizing in US in early 2000s right after the major market player shifted the production facilities abroad with cost reduction intentions. In the U.S., the annual footwear industry revenue was $48 billion in 2012. PAGE 2 NIKE INC Competitive Landscape Overall the industry is large with low growth and currently at maturity stage. The competition is intense in the industry because of low level of barriers to entry however marketing muscle and brand loyalty are critical success factors in the industry thus it is difficult for a new entrepreneur to sustain. Nike is the market leader in the industry especially in sportswear. Other major players in the market include V.F Corporation, Coach Inc, Polo and Adidas.. Financial Highlights FY2010 FY2011 ROE 20.67 21.77 21.98 NP % 10.03 10.22 9.21 1.93 2.2 2.37 EPS FY2012 Company Industry Sector Div Yield 1.53 0.79 0.88 Div Growth 14.38 3.76 2.16 Payout Ratio 30.72 6.98 10.74 The revenue of the company has been showing a positive trend over past couple of years. Despite of the recent economic downturn in US the company still managed to grow its revenue however it doesn’t put it at par with the industrial growth in apparel and footwear. The estimated revenue of around $26bn based on the recent growth rates estimated by the company in an analyst briefing nevertheless we have remained prudent while estimating the growth percentage by considering past and industrial growth. The NP Margin of the company is quite satisfactory if we look at historical financial highlights. The NP Margin is higher than the industry average which is around 7%. ROE of the company is showing a positive trend however it is still lower than the industry. The reason of lower ROE is the constantly increasing paid in capital in the balance sheet of NIKE. The EPS of the company is also increasing y/y and we estimate EPS of 2.7-2.8 based on the expected growth rate of industry however we have made certain cut due to historical lower growth shown by NIKE. The company’s operating cash flows have remained positive in previous years however the management didn’t invest the sum in business projects which is because of the maturity stage of company. The company repurchased the common equity shares since it had major idle cash. Despite of the massive cash drain the cash balance stood at $2bn by the end of FY2012. The cash flow and satisfactory performance by management show the company isn’t growing with significant pace and currently at the maturity level. Although some sources believe that the e-commerce sales window still has growth potential for the company we expect the growth in long-term with not greater pace. Consequently the most important aspect in the company is its dividend payments. NIKE INC PAGE 3 Valuation The level of dividends paid by the company has remained quite stable on Payout ratio basis. We expect the dividends to grow at historic growth rates and payout ratio. The DPS would be around .8$ in FY 2013 (any dividend payments made in the recent quarters of 2013 should be subtracted from the figure). The valuation of the NIKE shares for the FY 2013 has been estimated by using dividend discount model due to appropriateness of the model to company cash flows. The intrinsic value estimated is sensitive to the inputs of the model. Slight changes in growth rates and investor required rate of return may alter the price. The intrinsic value estimated by the end of FY 2013 is $61.38. (Spread sheet shown in appendix) Recommendation Based upon the value estimated, in the valuation section, the share gives upside margin of 12% by the end of FY13 thus we recommend BUY. The investment in the company should be long-term and certain price fluctuations can be witnessed in short-term. PAGE 4 NIKE INC Appendix Year Value DPS or TV Calculation PV at 11.44% 0 DPS01 0.67 1 DPS1 0.77 = 0.67 × (1 + 15.11%) 0.69 2 DPS2 0.88 = 0.77 × (1 + 13.86%) 0.71 3 DPS3 0.99 = 0.88 × (1 + 12.61%) 0.71 4 DPS4 1.1 = 0.99 × (1 + 11.35%) 0.71 5 DPS5 1.21 = 1.10 × (1 + 10.10%) Terminal value = 1.21 × (1 + 10.10%) ÷ (11.44% – 5 99.43 (TV5) 10.10%) Intrinsic value of 's common stock (per share) 0.71 $61.38 Current share price $54.95 57.85 References 1. 2. 3. 4. 5. 6. 7. 8. SECP 10-K filing.2012.Retreived from: http://www.sec.gov/Archives/edgar/data/320187/000119312511194791/d10k.htm Wikiinvest.n.d. Retrieved from: http://www.wikinvest.com/industry/Footwear_and_Accessories Wikipedia. Footwear Industry. Retrieved from: http://en.wikipedia.org/wiki/Footwear#Footwear_industry Dr. Stephen Brokaw. Analysis of the Luxury Goods & Apparel and Footwear Industries. Retrieved from: http://www.uwlax.edu/urc/jur-online/PDF/2004/nguyen.pdf CSI Market. Retrieved from: http://csimarket.com/stocks/competitionSEG2.php?code=NKE Stock Analysis. Retrieved from: http://www.stock-analysis-on.net/NYSE/Company/Nike-Inc/DCF/DDM#r Reuters. Retrieved from: http://www.reuters.com/finance/stocks/financialHighlights?symbol=NKE.N Morningstar financials. http://financials.morningstar.com/incomestatement/is.html?t=NKE&region=USA&culture=en-us