1A – Basic Tax Computation [142]

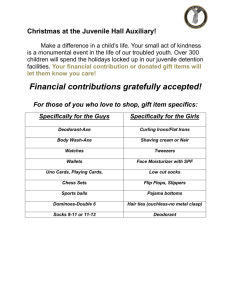

advertisement

![1A – Basic Tax Computation [142]](http://s3.studylib.net/store/data/009465958_1-21f906b2c3bed3b4df963f8eed9753a9-768x994.png)

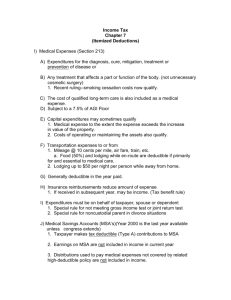

EA Exam Lite Part 1 Individuals 1 Topic 1 Overview: The Individual Tax Computation Format 2 1A Sorting Those Deductions Basic Components of Individual Formula: Gross Receipts (Statutory Exclusions) Gross Income (Deductions for Adjusted Gross Income) Adjusted Gross Income (Personal Exemption Deductions) (Larger of Itemized or Standard Deduction) Taxable Income Figure 1 – A helpful guide for deductions 3 1B Format Example With AMT Figure 2 – A comprehensive example with both regular tax and AMT computations Note impact of: AGI floors on itemized deductions Phaseouts of exemption and itemized deductions AMT computation starts with regular taxable income and adjusts for differences The “permanent” column is used to compute the AMT credit (which is only for timing differences) 4 Topic 2 Itemized Deductions: A Broad Brush 5 2A Medical Expenses - Family Deduction – Those of TP, spouse, dependent (7.5%) Dependent – Ignore gross income & filing status tests Expense – Must be for specific disease/illness Nonqualified – Over the counter drugs, cosmetic surgery (unless deformity), health club dues, meals Capital Expenditures Increasing Value of Property – Deduct only to extent of not increasing the value of the property (e.g., elevator, swimming pool, etc.) Question 1 6 2B State, Local & Foreign Taxes Personal Property Taxes – Deduct if based on value Taxes on Realty – Deductible only by owner, always based on actual period of ownership (not payment; allocate deduction, adjust selling price and basis) Assessments – Not deductible if add to value (e.g., sidewalks) Sales Tax Option – May elect to deduct state & local sales taxes rather than state & local income taxes (increase table amount by taxes on large purchaes) Question 2 7 2C Interest Expense Interest Expense on Investments – Deduction is limited to net investment income; excess is carryover Qualified Acquisition Indebtedness – Interest on 1st $1M loans secured by home (two homes) and spent on home; pre-10/14/87 debt qualifies, reduces $1M Home Equity Indebtedness – Interest on 1st $100,000 of loans secured by home (two homes qualify) but NOT spent on home; no limit on pre-10/14/87 debt Points – On a primary residence are deductible Question 3 8 2D Charitable Deductions Deductible – Cash, property, & credit card to listed orgs. (not needy ind’s); services not deductible Out-of-Pocket Exp – Deduct ($.14 per mile) Overall Limit – 50% of AGI for both (5 yr c/o) Public Limit – 50% of AGI (deduct first) Private Limit – 30% of AGI (deduct last) Special Rules – Property (30% or 50% rules), and stringent $ limit documentation rules Question 4 9 2E Casualty & Theft Losses Casualty – Fire, storm, shipwreck or other sudden destruction Temporary Living Expenses – Taxable, reduce by excess cost Initial Deduction – Lesser of (1) cost or (2) decrease in FMV of property (could be repairs); reduce by insurance Personal Loss Floors - $100 per casualty/theft, and 10% AGI on total net personal C&T loss Business Losses – No floors, and if completely destroyed, deduct adjusted basis of property Casualty in Federally Declared Disaster Area – May elect to deduct on prior-year return Question 5 10 2F Miscellaneous Itemized Deduct. Miscellaneous Itemized Not Subject to 2% Floor– Miscellaneous Itemized Subject to 2% Floor: Impairment-related work expense Deductions against Income in Respect of a Decedent Unrecovered annuity or pension costs of decedent Gambling losses of amateur, to extent of winnings Limited expenses of certain performing artists Investment expenses for other than rent or royalty income Allocated investment fees of nonpublic mutual funds (public funds net these on Form 1099-DIV) Tax return preparation and litigation fees Legal fees related specifically to tax advice Certain hobby expenses Question 6 11 Topic 3 Travel & Entertainment Expenses 12 3A Meals and Entertainment Deductible Entertainment – Either directly related (bus. discussion during entertain) or associated with (before or after) Tickets - Entertainment if TP present, either as gift or entertainment if TP is not present) 50% Disallowance – On M&E to ultimate payor Entertainment Facilities – Maintenance cost not ded. Country Club Memberships – Not deductible, but any direct costs incurred at facility (e.g., lunch) may be Gifts - $25 limit per donee per year ($400/$600 for service awards); related party rules apply Question 7 13 3B Transportation and Auto Exp. Deductible Commuting Costs – Office to client, or between two jobs, incremental costs for tools/equip. Auto – Deduct larger of actual or standard mileage Actual Costs – All actual operating costs (gas, oil, insurance, depreciation), prorate for business usage Std. Mileage Rate - $.485 per business mile Parking & Fees – If business, add to either method Actual Costs & Accelerated Depreciation – May not switch to Standard Mileage Method 14 3C Travel Expenses Travel Expenses – Includes transportation, meals, lodging, incidentals while “away from home” on bus. Tax Home – Workplace, determined by time spent, activity, & total income; may be personal residence Temporary Location – In travel status unless (1) more than one year, or (2) indefinite; in both cases, tax home has moved to new location Transportation Costs – For domestic travel, deductible if trip is “primarily business” (bus. days > personal days); travel days are business days 15 Topic 4 Tax Credits for Individuals: A Broad Brush 16 4A Child & Dependent Care Credit Credit – Qualified amount x Qualified percentage Qualified Amount – Smallest of: Qualified Percentage – Actual qualifying child care expenses $3,000 (one dependent), $6,000 (two or more) Earned income of lesser earning spouse (impute at $250/ $500 mo. for each month spouse is disabled or f/t student) 35% if AGI <= $15,000 decreases 1% for each additional $2,000 AGI constant at 20% once AGI > $43,000 Question 8 17 4B Credit for Elderly & Disabled Credit – For (1) taxpayers age 65 or older with limited social security, or (2) permanently disabled individuals of any age Formula for Credit – 15% of: • Initial Amount*=$5,000 S, $7,500 MJ, $3,750 MS Less any social security payments received Less ½ AGI > $7,500 S, $10,000 MJ, $5,000 MS * Disabled substitute disability pay, if smaller Question 9 18 4C Earned Income Tax Credit E/I Credit – Refundable if no tax due (up to 60% adv) Married – Must file MJ; if divorced, custody parent Claimant – May not be a “qualifying child” Investment Income Limit for Credit - $2,900 Qualifying Child –Natural/step/ foster/ adopted, if < age 19 or F/T student < age 24, lived with TP > ½ yr Qualifying Earned Income – Deferred comp, meals & lodging, excluded fringes (but not alimony, unemp) Computation – Max for >1; phaseouts apply Question 10 19 4D Child Tax Credit Child Tax Credit - $1,000 for qualifying child < age 17 (natural/step/foster, brother/sister & step, or direct descendant of any of these); limited to tax liability Phaseout of Credit - $.50 for each $1,000 AGI > $110,000 (MJ), $75,000 (S or HH), $55,000 (MS) Refundable Portion – 15% of taxpayer’s earned income (+ combat pay) > $11,750 20 4E Hope Scholarship & Lifelong Learning Credits Credits – For higher education expenses other than room & board; claimed by person eligible to take exemption (even if paid by dependent) Hope Scholarship Credit – Up to $1,650 per student for first 2 years of post-secondary education expenses (100% of first $1,100, 50% of next $1,100) Lifelong Learning Credit – 20% per TP for first $10,000 of expenses for all other courses AGI Phaseout – $94,000-$114,000 MJ ($47,000$57,000 other) Question 11 21 4F Other Individual Credits Adoption Credit – Credit for qualified adoption expenses up to $11,390 per child under age 19 or incapacitated, AGI phase out, maximum if special needs, regardless of actual costs Elective Deferrals Credit – 50% for up to $2,000 to IRA or 403(b); phaseouts of % begin at $30,000 Residential Energy Credits – $500 – For nonbusiness energy property, with specified maximums of $200 (windows), $50 (circulating fans), $150 (boilers), $300 (energy-efficient building property) 30% of up to $2,000 Cost – Alternative home solar equip. 22 Topic 5 Determining the Adjusted Basis of Property 23 5A Basis of Purchased Property Adjusted Basis = Cost + Installation + Capital Improvements – Depreciation/Cost Recovery Taxes & Closing Costs – Add to basis Above-Mkt. Price – If bus., excess is goodwill Liabilities Assumed – Always in basis Property as Compensation – FMV of property received is taxable, and that becomes basis Securities – Use specific ID; otherwise, FIFO flow; if stock split, reallocate cost to all 24 5B Basis of Stock Dividends and Securities Stock Dividends – Nontaxable; spread original cost over old & new shares (tack holding periods); if blocks of securities, allocate within each block Fractional Shares – Allocate basis (relative FMVs) Stock Dividends – Different Class – if nontaxable, allocate old cost by relative FMVs of both stocks Proportionate Stock Rights – If nontaxable, allocation if FMV rights > 15% FMV of stock Question 12 25 5C Basis – Gift Property Gift Basis – Gain – Always use donor’s basis Gift Basis – Loss – Use lesser of (1) donor’s basis or (2) FMV of gift at date of gift If FMV < Donor’s Basis – And amount realized is between the two possible bases, no gain or loss Gift-Tax Add-On – To donor’s basis, portion of gift tax related to appreciation in value (100% for pre-77) Donor Holding Period – Tacks if donor basis used Figure 3 Questions 13 and 14 26 5D Basis – Inherited Property General Rule – FMV at date of death (state valuation if no federal estate tax return) Jointly –Held – FMV on inherited portion Alternate Valuation Date (AVD) – 6 months after date of death; elect only if (1) value of adjusted gross estate decreases, and (2) estate tax decreases Distributed Prior to AVD – Use FMV @ distribution Holding Period – Automatically long-term for all Question 15 27 5E Basis of Personal Property Converted to Business Use Basis for Gain – Always cost of property Basis for Loss – Lesser of (1) cost or (2) FMV of property on date of conversion Loss Basis – Is always the depreciation basis Date of Conversion – Determines the cost recovery method (e.g., ACRS, MACRS, etc.) Question 16 28 Topic 6 Netting Capital Gains & Losses of Individuals 29 6A Capital Asset Definition Capital Asset Definition – NEVER includes: Property held for resale (e.g., inventory) Property used productively in a trade or business Copy, literary or artistic composition (c/o basis) Ordinary accounts or notes receivable U.S. Government. publications issued at a discount Commodities and derivatives, hedges, business supplies What is a Capital Asset? – Personal assets and Investment properties Question 17 30 6B Capital Gain and Loss Netting Process 3-Step Process – (1) Net all S/Ts, (2) Net all L/Ts (> 1 yr.), (3) if same sign, add separately to income; if opposite signs, add net difference to income Final Result – 4 Basic Rules (for final net result): S/T Capital Gain – Treat as ordinary income S/T Capital Loss - $3,000 offset against ordinary income L/T Capital Gain – 15% max. rate (5% if 10/15 bracket) L/T Capital Loss - $3,000 offset against ordinary income Figures 4 and 5 31 6C Preferential Tax Rates for Longterm Capital Gains If Net L/T Gain – Determine appropriate rates 15% (or 5%) - Basic rate for most L/T capital gains 25% - For “unrecaptured Sec. 1250 gain” on realty 28% - For collectibles, Sec. 1202 stock gain, all c/o’s Netting Process – Four columns for 4 rates: If 15% Nets to a Loss – Net against 28% result first If S/Ts Net to a Loss – Net against 28% result first If 28% Nets to a Loss – Net against 25% result first If 25% Nets to a Loss – Net against any 15% gain result Figures 6 and 7 Question 18 32 6D Tax Treatment of Net Capital Losses $3,000 – Maximum combined ordinary income offset for net S/T and net L/T losses each yr. (use S/T first) $1,500 – Married – filing separately limit If Taxable Income < Capital Loss – Full limit (up to $3,000) still assumed utilized in computing carryover Capital Loss Carryover – Indefinite (retain character) Decedent’s Return – No carryovers possible Question 19 33 Topic 7 Vacation Home Rentals Under Sec. 280A 34 7A Sec. 280A Basic Classifications Sec. 280A – 3 Basic Vacation Home Rules: De Minimis – Ignore income and expenses if rental days < 15 Insignificant Personal Usage – If <= larger of 14 days or 10% days rented, deduct loss (passive?) Significant Personal Use – If > larger of 14 days or 10% days rented, deductions limited to income (carryover any unused losses to future years) 35 7B Sec. 280A Loss Limitations If Limit Applies – Deduct (1) interest/taxes/casualty & theft losses first, then (2) non-depreciation expense, then (3) depreciation Allocations of Expenses to Rental & /Personal – IRS (days actually used), Bolton (365 days for int./taxes) Co-owner Use & Swaps – Count as personal days Repair Days (substantial) – Not personal days Figure 8 Questions 20 and 21 36 Topic 8 Individual Retirement Accounts 37 8A IRAs – Qualification Requirements Required – Earned comp., < age 70½ at year end Spouses – Each has account (total comp. limit) Contributions – Up to due date (no extension); owner cannot be trustee (bank or fiduciary is OK) Investments in IRA – Not allowed in saving bonds or collectibles (except U.S. gold or silver coins OK) Rollovers – If w/d, redeposit w/i 60 days; no loans Death – IRA included in estate, can only be rolled over by spouse, can combine with spouse, basis c/o 38 8B IRAs – Earned Compensation “Earned” – Limit on IRA contribution/deduction Does Not Include - Deferred comp, unearned sources (int, div, etc.), or a limited partner’s share of income Includes – Wages/salary/commissions, S/E income (less ½ SE tax & other retirement contributions), taxable alimony & separate maintenance payments S/E Loss – Does not offset salary for limit Question 22 39 8C IRAs – Prohibited Transactions Prohibited Transactions – Plan and D/Q Person: Transfer income/assets to “disqualified” person Fiduciary acting in its own self-interest Consideration to fiduciary from plan party Any acts between plan/disqualified Person (sell, lending) IRA Rule – If prohibited transaction, lose IRA status as of 1st day of year, treated as distribution of cash (FMV of account) as of first of year 40 8D IRAs –Maximum Contribution & Deduction Maximum Contribution – Lesser of $4,000 per spouse ($5,000 if 50 or older), or taxpayers’ combined earned income Maximum Deduction – Dependent on other plan participation: Neither Spouse Participates – Maximum $4,000/$5,000 each Both Spouses Participates – Reduce $4,000/$5,000 by $.40 (or $.50) for each $1 AGI > $52,000 (S), $83,000 (MJ), $0 (MS) One Spouse Participates – If covered, same as both; if not covered, AGI phaseout over $156,000-$166,000 [$200 min.] Figure 9 Question 23 41 8E Roth IRAs [R] Roth IRA – No age limit, contribute up to $4,000/$5,000; nondeductible, but no tax on withdrawals after 5-year period; reduce $4,000/$5,000 by contributions to regular IRA Phaseout – MJ($156,000-$166,000), S($99,000-$114,000) Tax-Free Distributions – After 5 yrs if age 59½, disabled, or first-time home buying Regular IRA – May be converted to Roth if AGI < $100,000; recognize deferred income at conversion Recharacterizations – Possible if trustee to trustee Question 24 42 8F Educational (Coverdell) IRA Educational IRA – Designate as such, for education expenses of beneficiary (child < 18) Contributions - $2,000 maximum total per child, nondeductible; AGI phaseouts @$95,000/$190,000 Amounts Spent – Nontax. if for qualified education exp; any excess taxed @ regular rate + 10% Req. Withdrawal – Within 30 days of beneficiary reaching age 30, or date of death if before Exceptions – Special needs, military adv. Question 25 43 8G Sec. 401(k) Plans – Basic Requirements CODA – Employee choice - cash or deferred annuity Contributions – Excluded, 100% vested, deferred taxes, tax-free accumulations Nondiscrimination - Tests for highly comp. Sec. 403(b) Plan – Similar plan for educators Maximum Contribution - $15,500 per year ($20,500 if age 50 or older) – not excluded from payroll tax Overall Limit on Contribution – Lesser of 25% comp or $45,000, less all contributions to qualified plans 44 Topic 9 Federal Gift Tax – A Quick and Dirty Overview 45 9A Requirements to File a Gift Tax Return Certain “Gifts” Are Not Gifts for Gift Tax Purposes: Tuition paid for someone else Medical expense paid for someone else Political contributions Gifts to spouse or charity rd Gifts to 3 party < $12,000 (if present interest) Spouses – No “joint return,” but may elect to split gifts Generation-Skipping Transfer Tax – Any gift to “skip” (2 generations younger), tax at maximum rate, $2,000,000 exemption Question 26 46 9B Types of Gifts Types of Gifts – Include bargain sales, release of general power of appointment, forgiveness of debt (family), below-market loans, beneficiary assignment, property settlements in divorce, exchanging single annuity for joint annuity Donee Disclaimer – Donor must receive from donee within 9 months of gift; if so, no gift has been made Due Date – By April 15th after year end (penalties exist for late filing and/or payment) Deceased Donor – Due date is earlier of (1) gift tax due date (2) estate tax due date (plus extensions) 47 9C Computing Taxable Gifts Gift-Splitting – By married couple, splits gifts in half; (must file 709) Annual Exclusion - $12,000 per donee per year for gifts of present interest (currently enjoy) Marital Deduction – Unlimited for any gift to (U.S. citizen) spouse that is not a terminable interest Charitable Deduction – Unlimited for gifts of present interests to recognized charities Credits - $345,800 unified credit, prior gift taxes paid Figures 10, 11, and 12 Question 27 48 Topic 10 Federal Estate Tax – A Quick and Dirty Overview 49 10A Estate Tax – Minimum Requirements to File Form 706 – Due 9 months after date of death Gross Estate – FMV of all properties owned by decedent at death Required Filing – If sum of gross estate and lifetime gifts > $2,000,000 (the exemption equivalent of unified credit for the estate tax) Unified Credit – Different for gifts & estates Questions 28 and 29 50 10B Gross Estate – Inclusion Rules Gross Estate – FMV of all property at death, including any outstanding loans and notes Incomplete Transfer Inclusions Life insurance proceeds (if payable to estate or retained incidents of ownership, e.g., loans, etc.) Life insurance proceeds (if transfer within 3 years) Any transfers within 3 yrs. with reversionary int. Gift taxes paid on gifts within 3 yrs. of death 51 10C Deductions From the Gross Estate Marital Deduction – Unlimited deduction for bequests of nonterminable interest prop. (also for QTIP election terminable interest property) Charitable Deduction – Unlimited for contributions to recognized charities Administrative Exp. – Legal & Acct’g. fees Others – Liabilities against property, casualty or theft loss funeral costs,, last illness expenses (latter two may be on 1040 or 1041 instead) 52 10D Computation of the Estate Tax Estate Tax – Computed on a cumulative basis: Add lifetime gifts to gross estate, Compute tax on total, then offset total tax with any gift taxes paid and unified credit Extensions to File/Pay – Are available Some Credits – Are available (see next slide) 53 10E Credits Against the Estate Tax $780,800 Unified Credit - Available to each estate to offset tax; equivalent of a $2,000,000 exclusion Prior Gift Taxes Paid Credit – Allowed because total tax includes lifetime gifts in base Prior Transfer Taxes Credit – Mitigates multiple estate inclusions within 10 years; sliding % inclusion depending on interval between the two deaths(100% within 2 yrs, 20% drop for each 2 years, 0% for 10) Foreign Death Tax Credit – For amounts paid Figure 13 54 Questions? As Time Permits Contact: John Everett Professor of Accounting Virginia Commonwealth University jeverett@vcu.edu 55